This version of the form is not currently in use and is provided for reference only. Download this version of

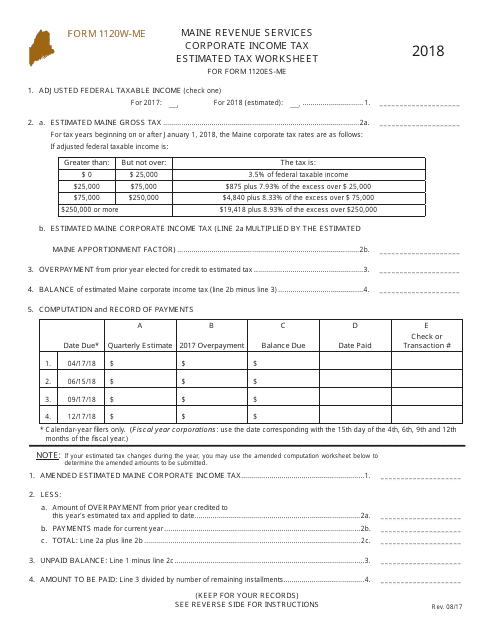

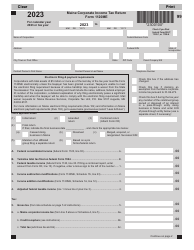

Form 1120W-ME

for the current year.

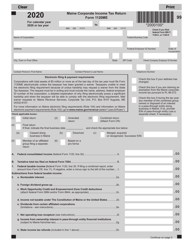

Form 1120W-ME Corporate Income Tax Estimated Tax Worksheet - Maine

What Is Form 1120W-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120W-ME?

A: Form 1120W-ME is a worksheet used to calculate estimated tax payments for corporate income tax in the state of Maine.

Q: Who should use Form 1120W-ME?

A: This form should be used by corporations that are required to make estimated tax payments in Maine.

Q: What is the purpose of Form 1120W-ME?

A: The purpose of this form is to help corporations calculate and determine their estimated tax payments for the state of Maine.

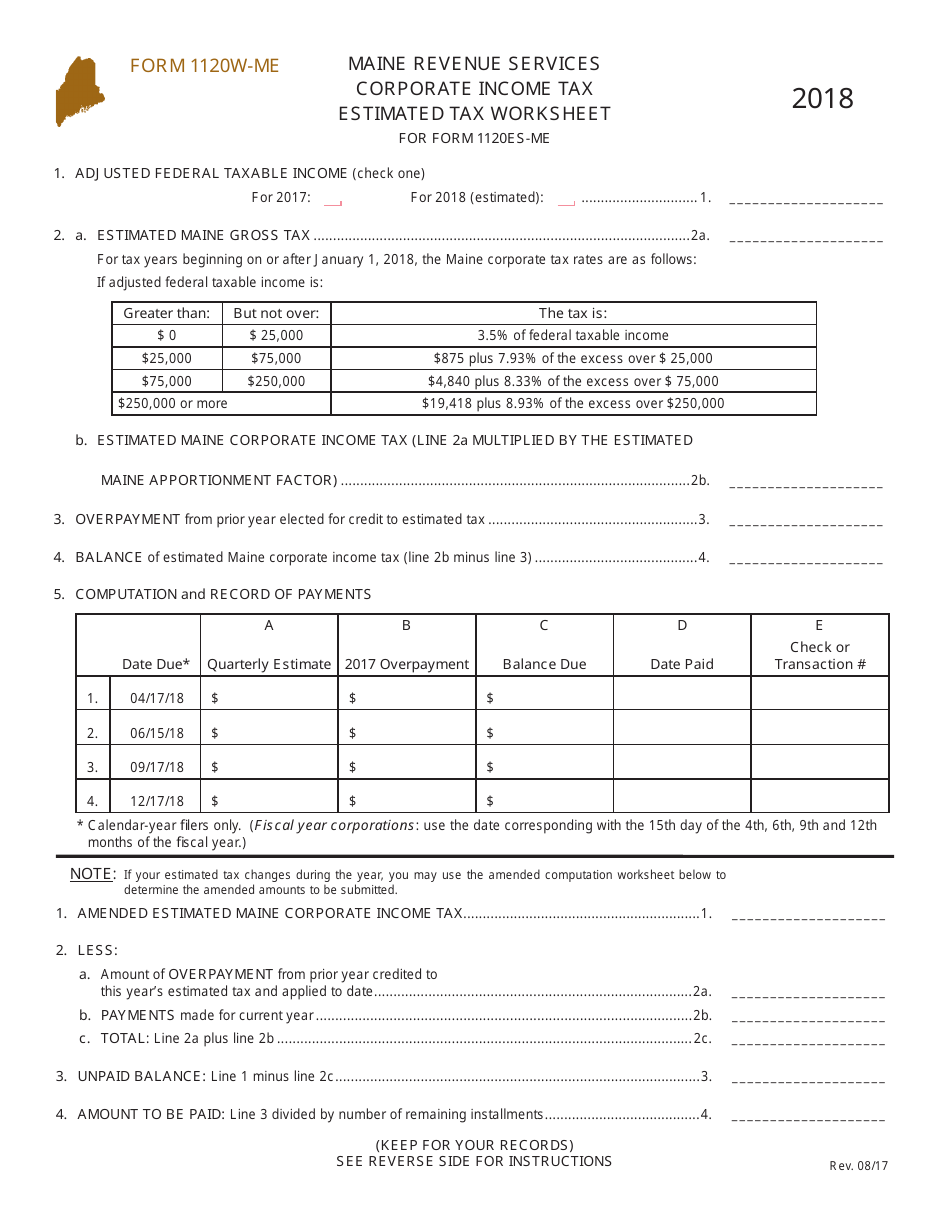

Q: How often do corporations need to make estimated tax payments?

A: Corporations generally need to make estimated tax payments on a quarterly basis, unless they meet certain exceptions.

Q: What information is required on Form 1120W-ME?

A: This form requires information regarding the corporation's income, deductions, credits, and the amount of estimated tax payments made.

Q: What are the consequences of not making estimated tax payments?

A: Failure to make estimated tax payments or underpayment of estimated tax may result in penalties and interest.

Q: Are there any special rules or provisions for Form 1120W-ME?

A: Yes, there may be special rules or provisions that apply to certain types of corporations or specific situations. Consult the form instructions or a tax professional for guidance.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120W-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.