This version of the form is not currently in use and is provided for reference only. Download this version of

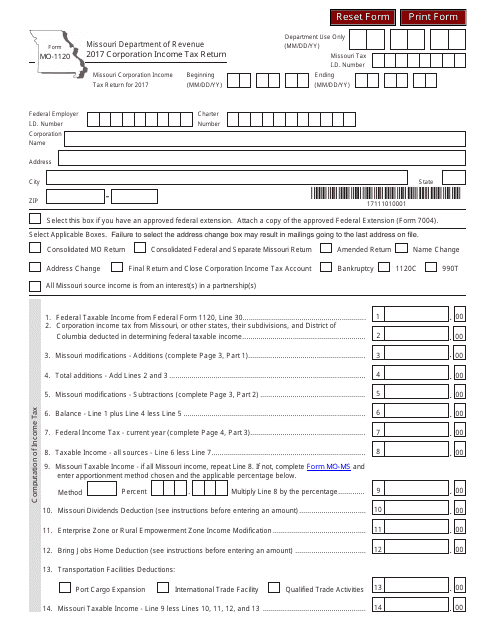

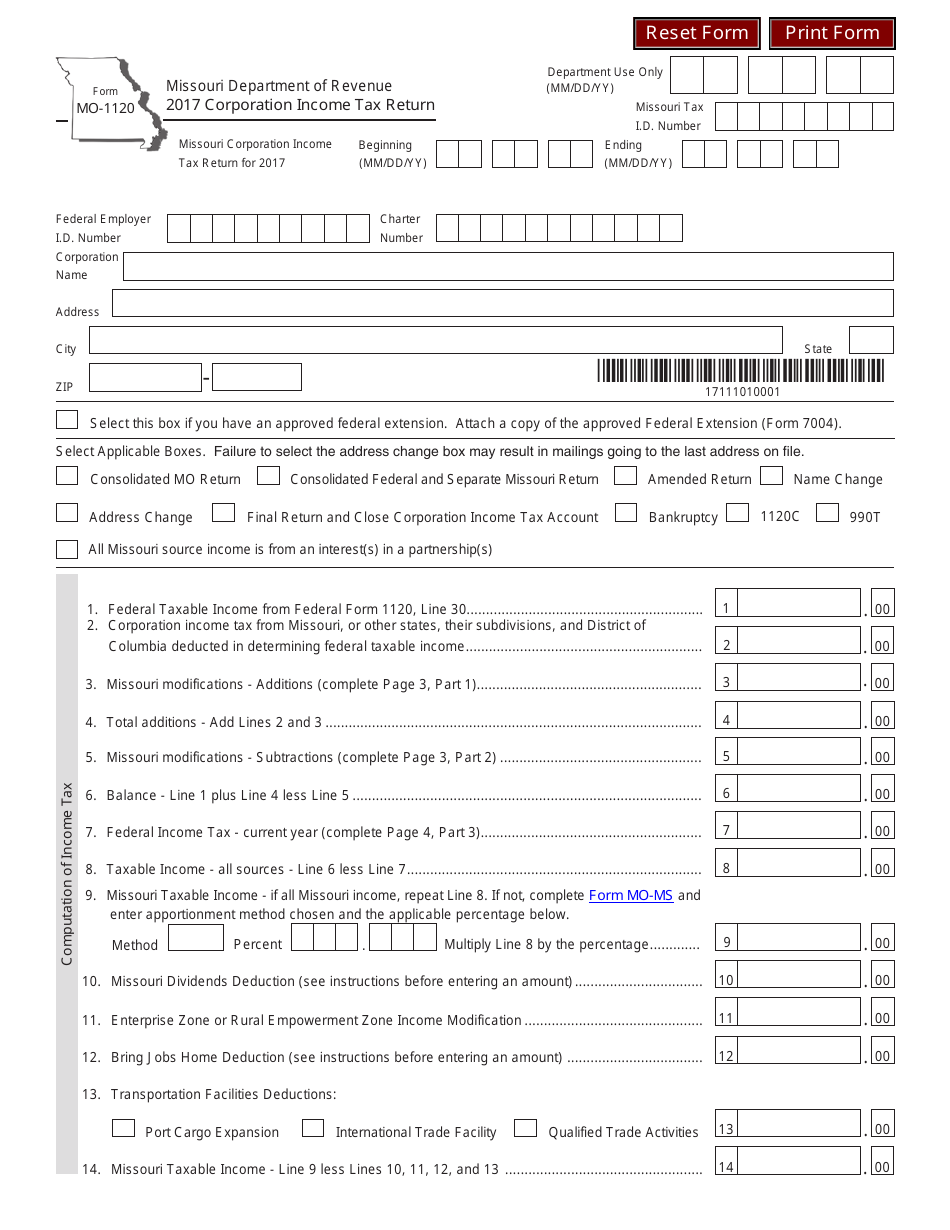

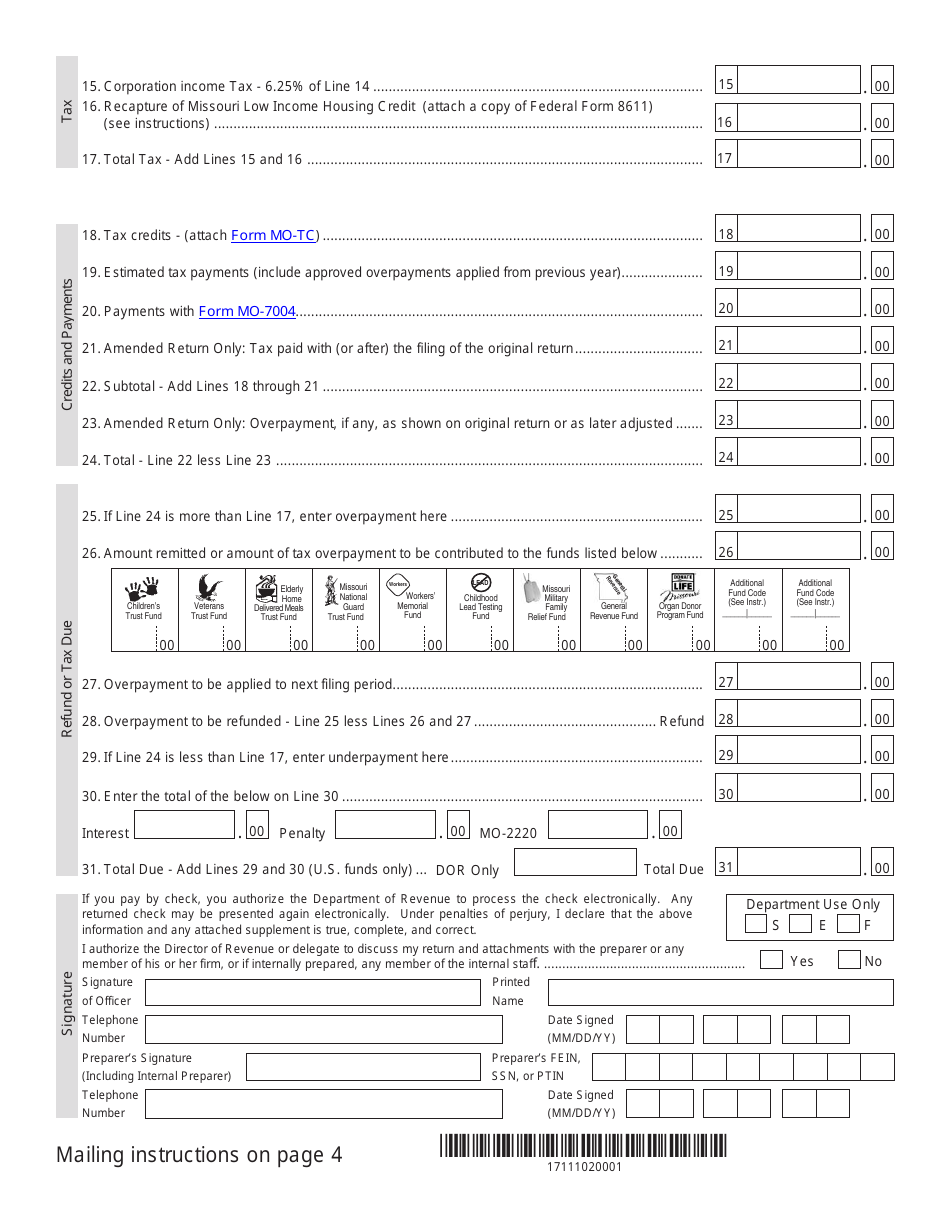

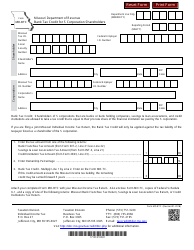

Form MO-1120

for the current year.

Form MO-1120 Corporation Income Tax Return - Missouri

What Is Form MO-1120?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1120?

A: Form MO-1120 is the Corporation Income Tax Return for the state of Missouri.

Q: Who needs to file Form MO-1120?

A: Corporations doing business in Missouri need to file Form MO-1120.

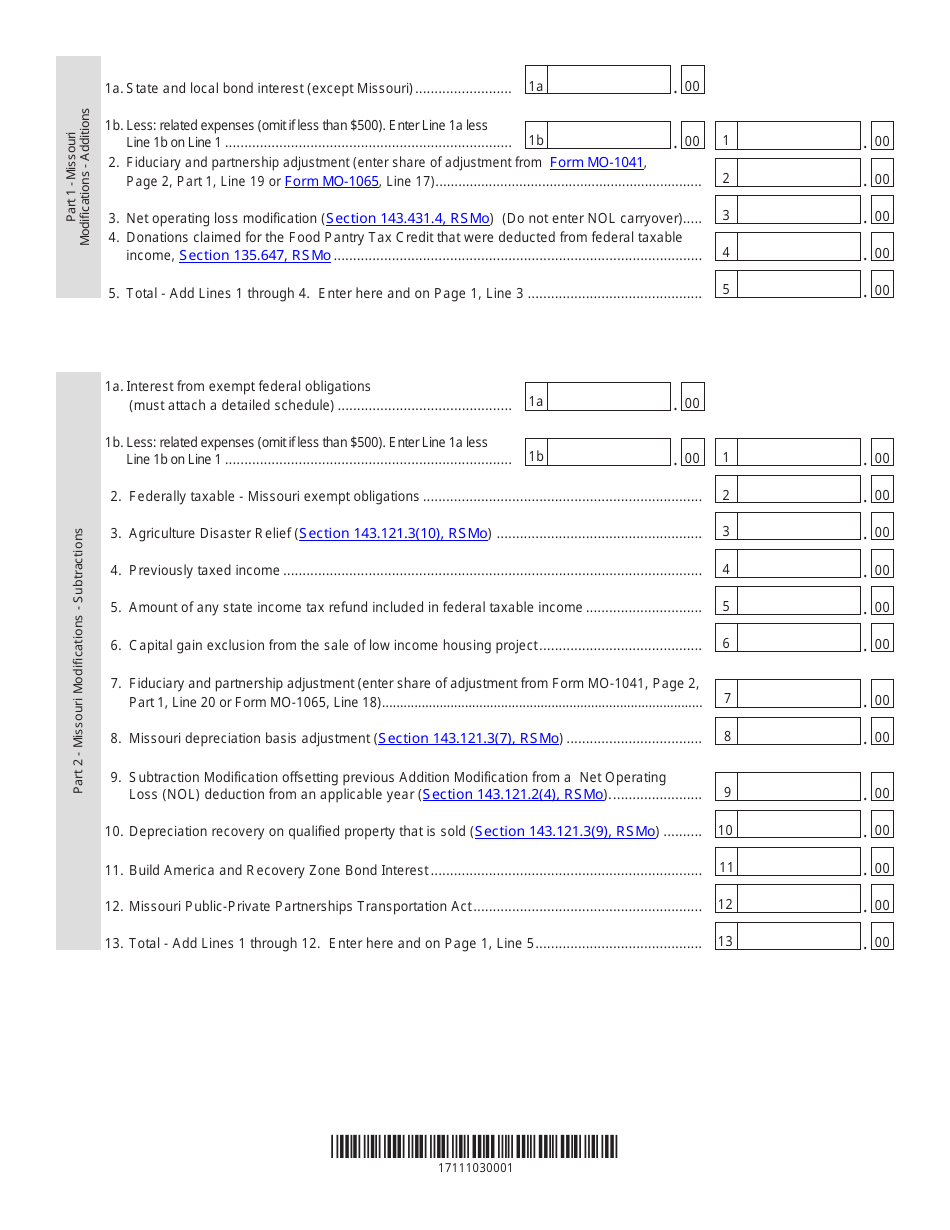

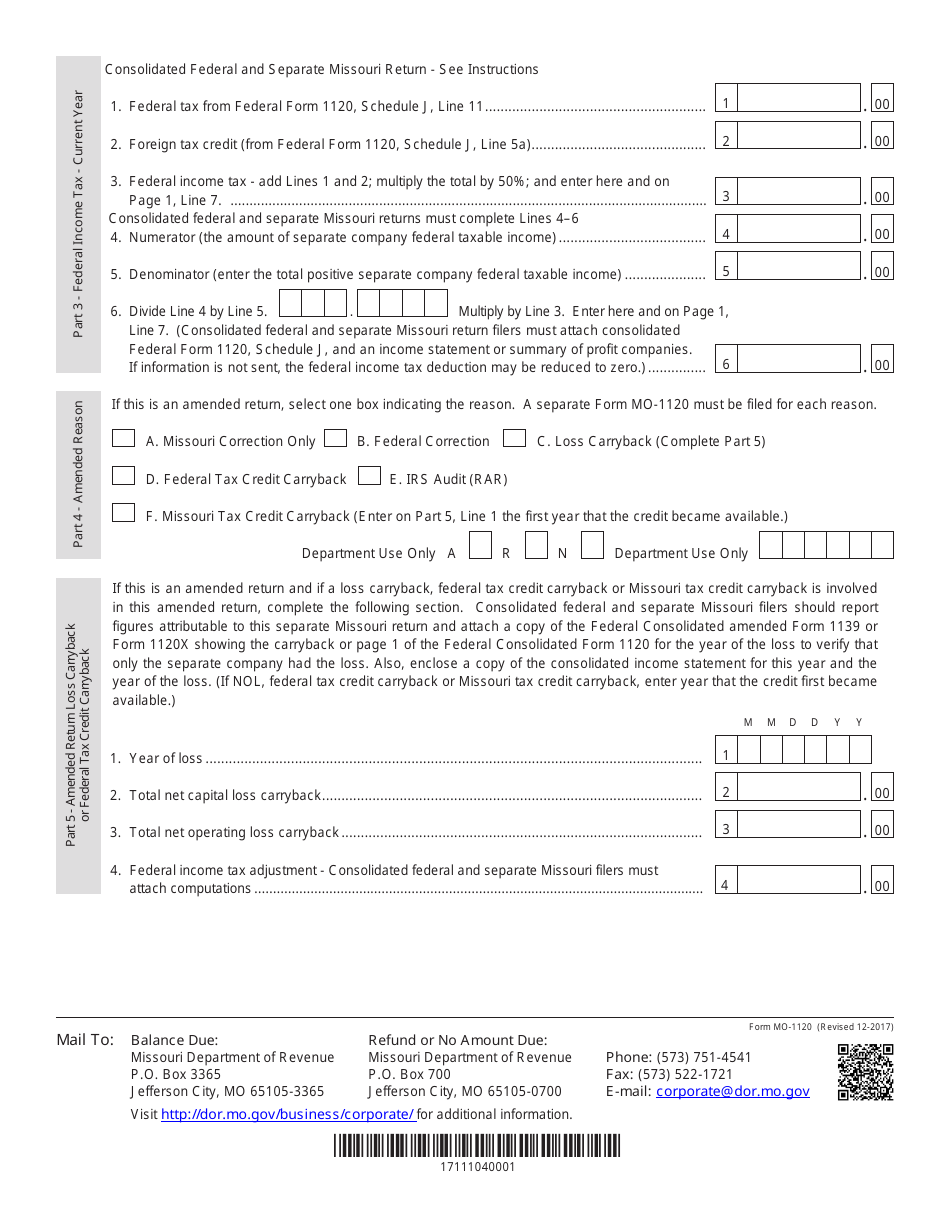

Q: What information is required on Form MO-1120?

A: Form MO-1120 requires information about the corporation's income, deductions, credits, and tax liability.

Q: When is the deadline to file Form MO-1120?

A: Form MO-1120 is due on the 15th day of the 3rd month following the end of the corporation's tax year.

Q: Are there any penalties for late filing of Form MO-1120?

A: Yes, there are penalties for late filing, including a 5% penalty per month of the tax due.

Q: Can I file Form MO-1120 electronically?

A: Yes, Missouri allows electronic filing of Form MO-1120.

Q: Are there any additional forms or schedules that need to be filed with Form MO-1120?

A: Depending on the circumstances, corporations may need to include additional forms or schedules with Form MO-1120, such as Schedule N or Schedule M.

Q: Can I request an extension to file Form MO-1120?

A: Yes, you can request an extension by filing Form MO-7004 with the Missouri Department of Revenue.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.