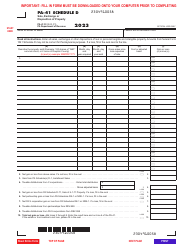

This version of the form is not currently in use and is provided for reference only. Download this version of

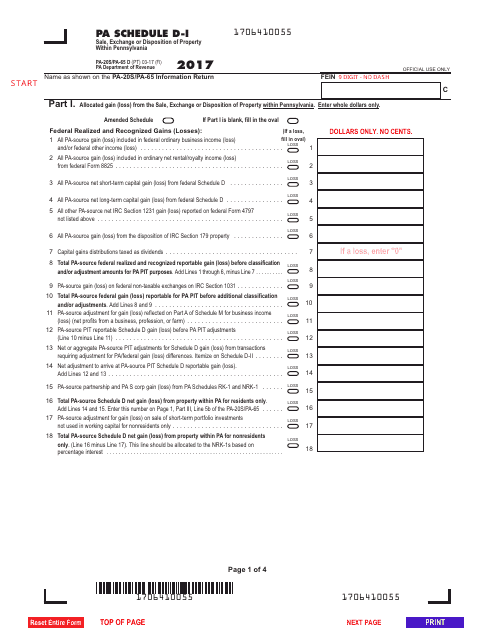

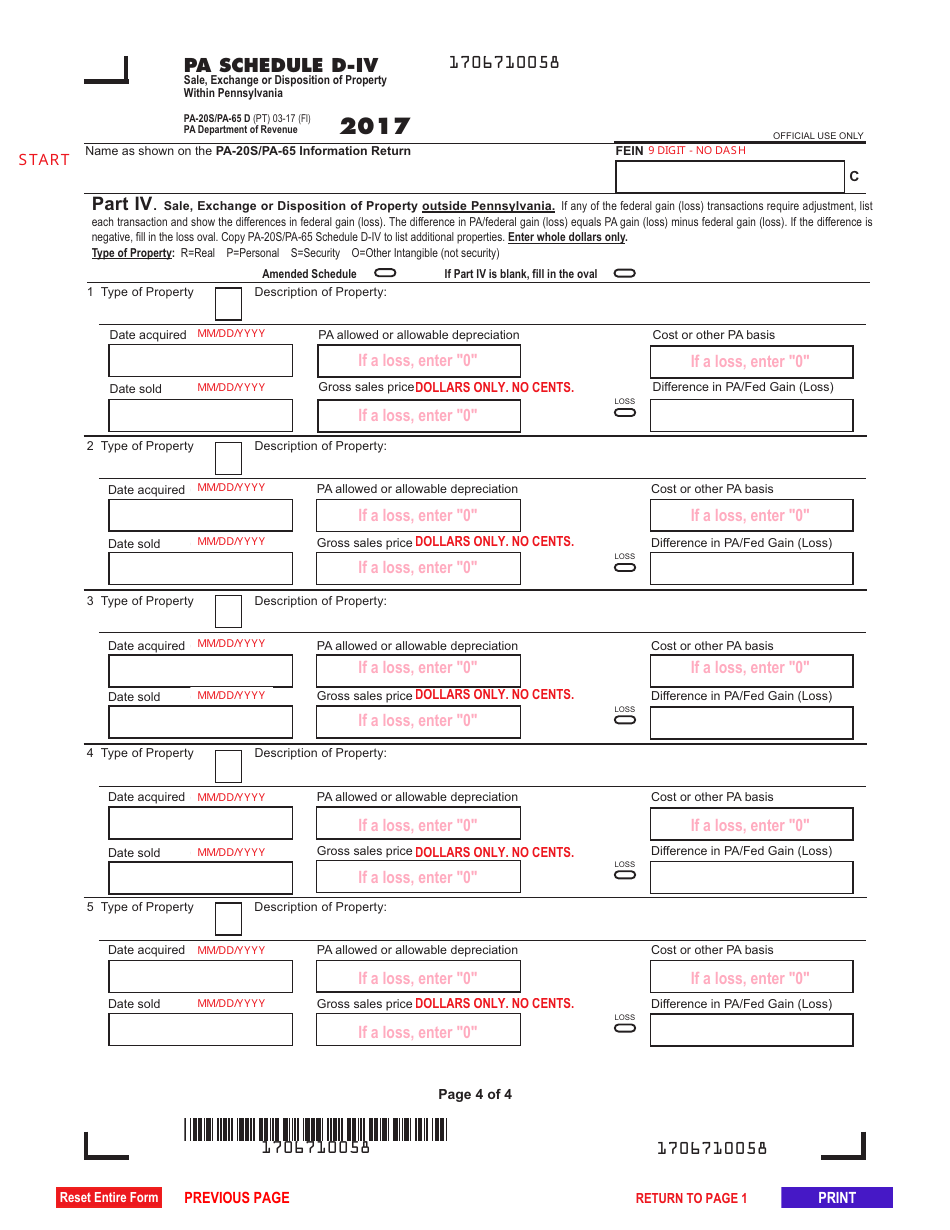

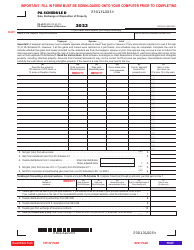

Form PA-20S (PA-65 D) Schedule D

for the current year.

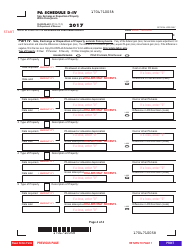

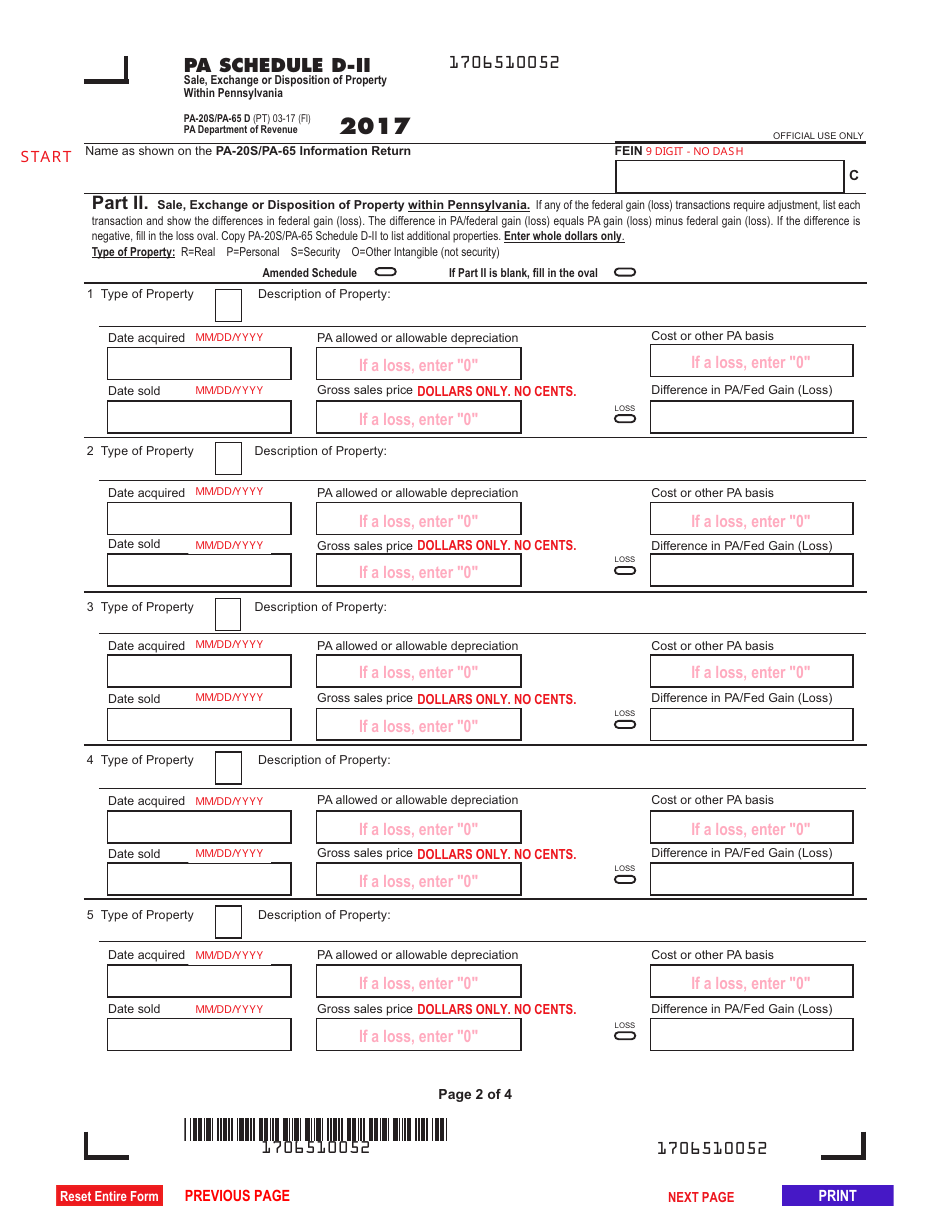

Form PA-20S (PA-65 D) Schedule D Sale, Exchange or Disposition of Property Within Pennsylvania - Pennsylvania

What Is Form PA-20S (PA-65 D) Schedule D?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

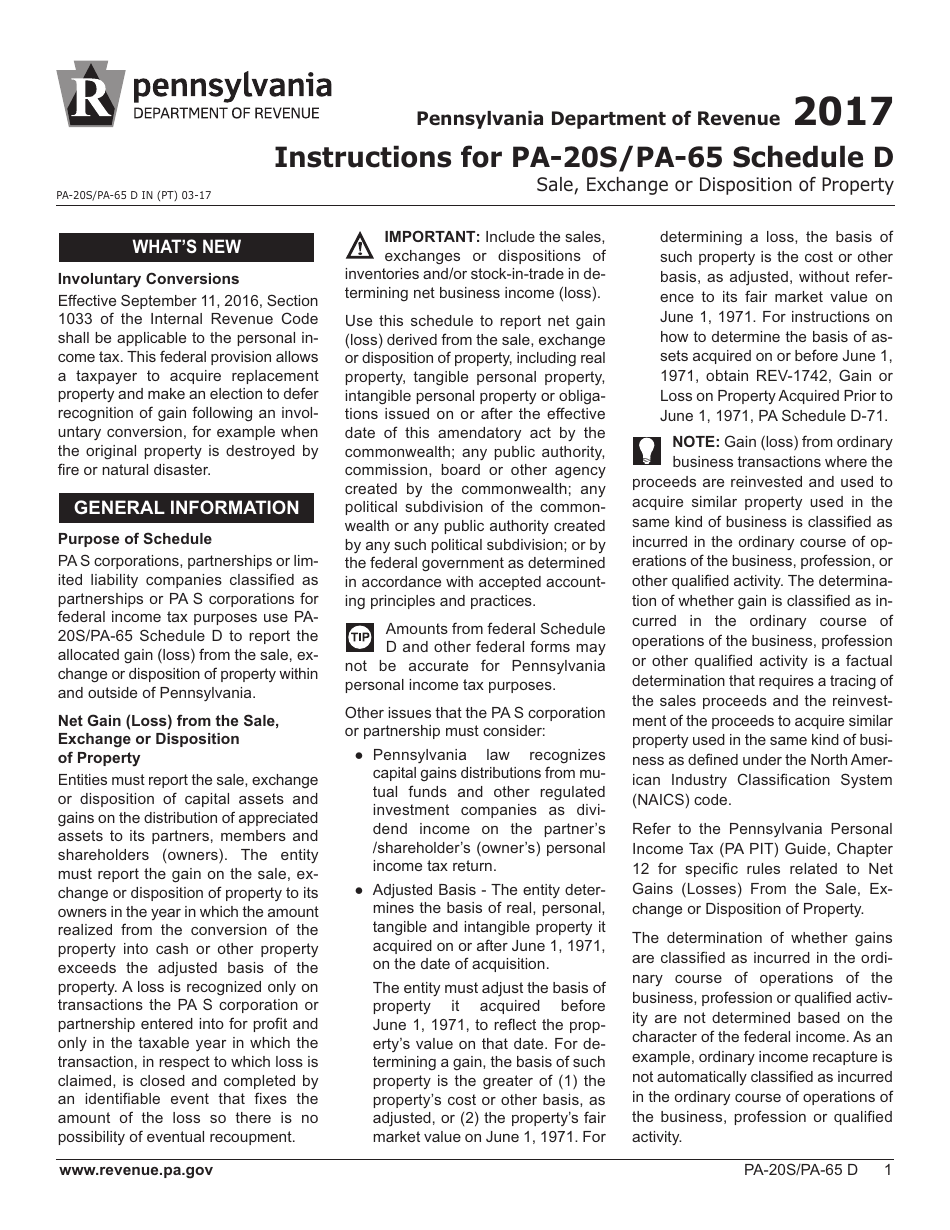

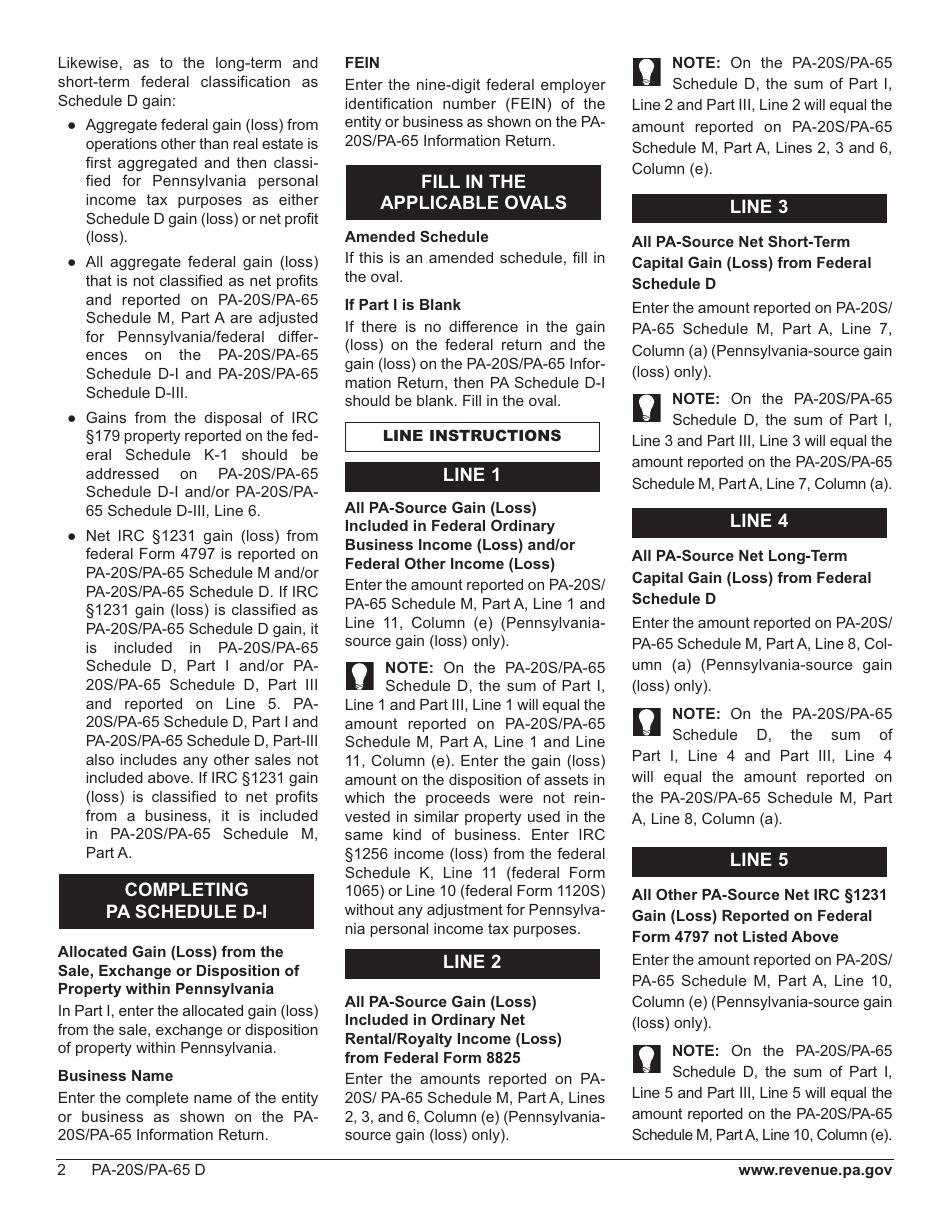

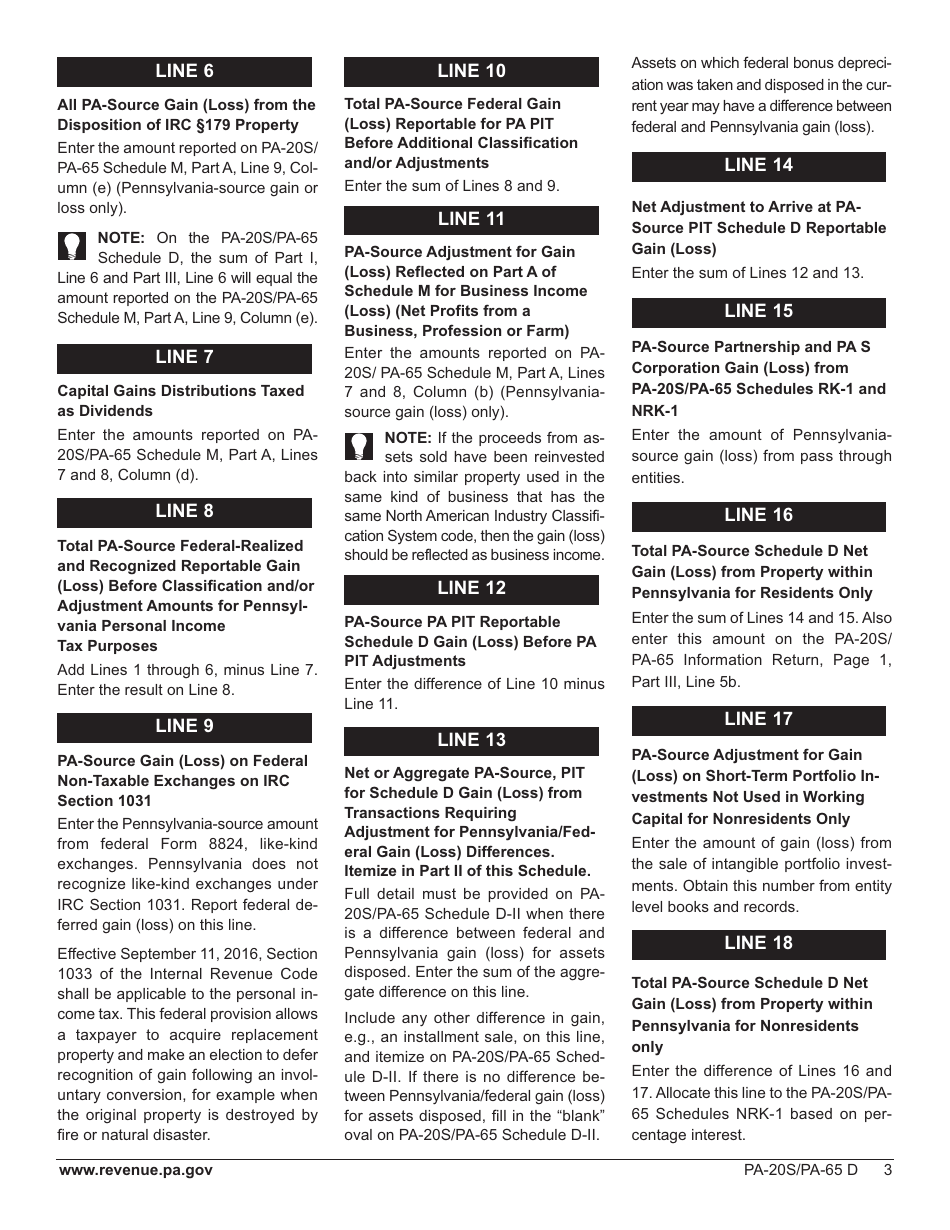

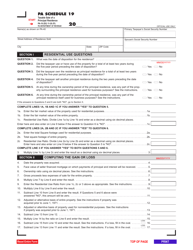

Q: What is Form PA-20S (PA-65 D) Schedule D?

A: Form PA-20S (PA-65 D) Schedule D is a form used in Pennsylvania to report the sale, exchange, or disposition of property within the state.

Q: Who needs to fill out Form PA-20S (PA-65 D) Schedule D?

A: Partnerships and S corporations in Pennsylvania need to fill out Form PA-20S (PA-65 D) Schedule D.

Q: What is the purpose of Form PA-20S (PA-65 D) Schedule D?

A: The purpose of Form PA-20S (PA-65 D) Schedule D is to report the details of any property sales, exchanges, or dispositions that occurred within Pennsylvania.

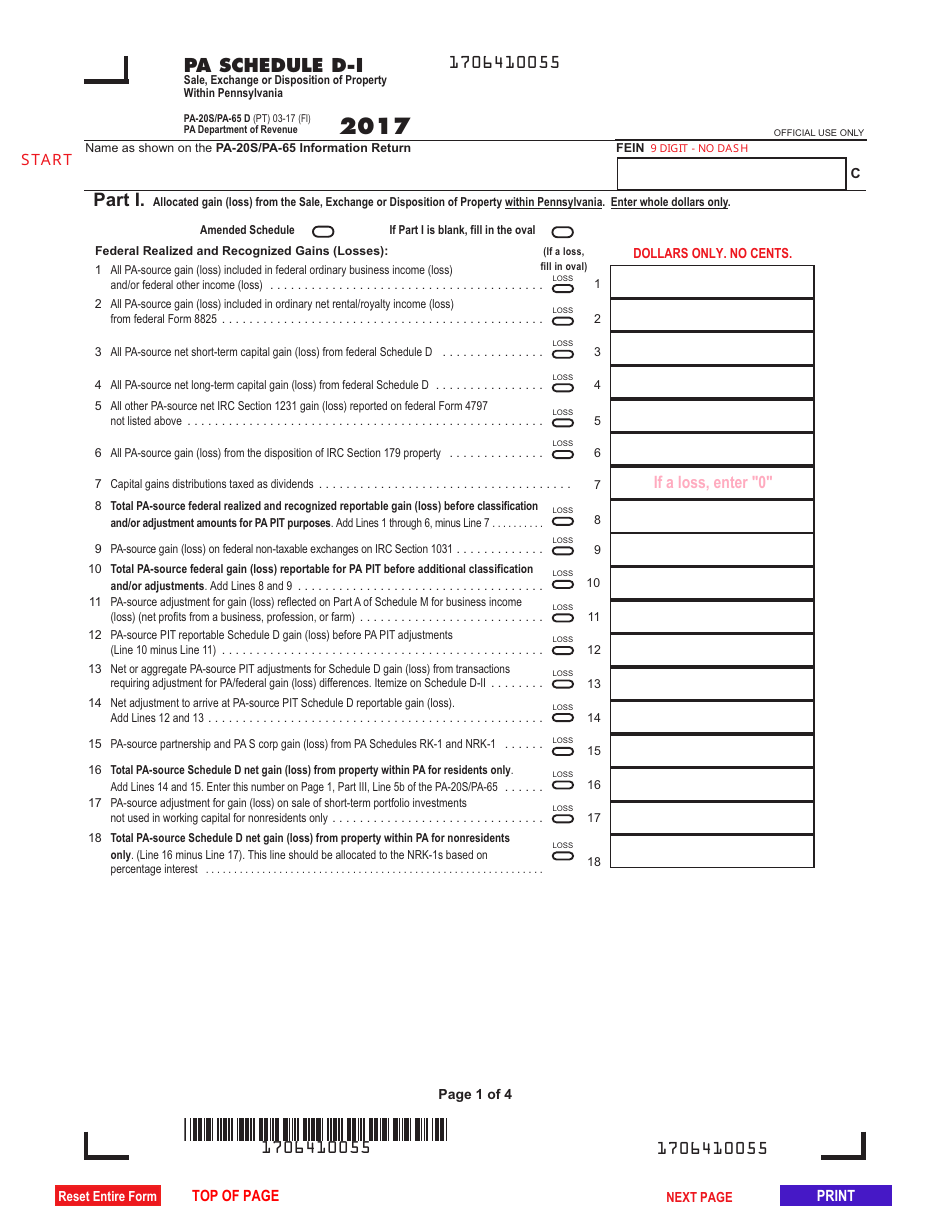

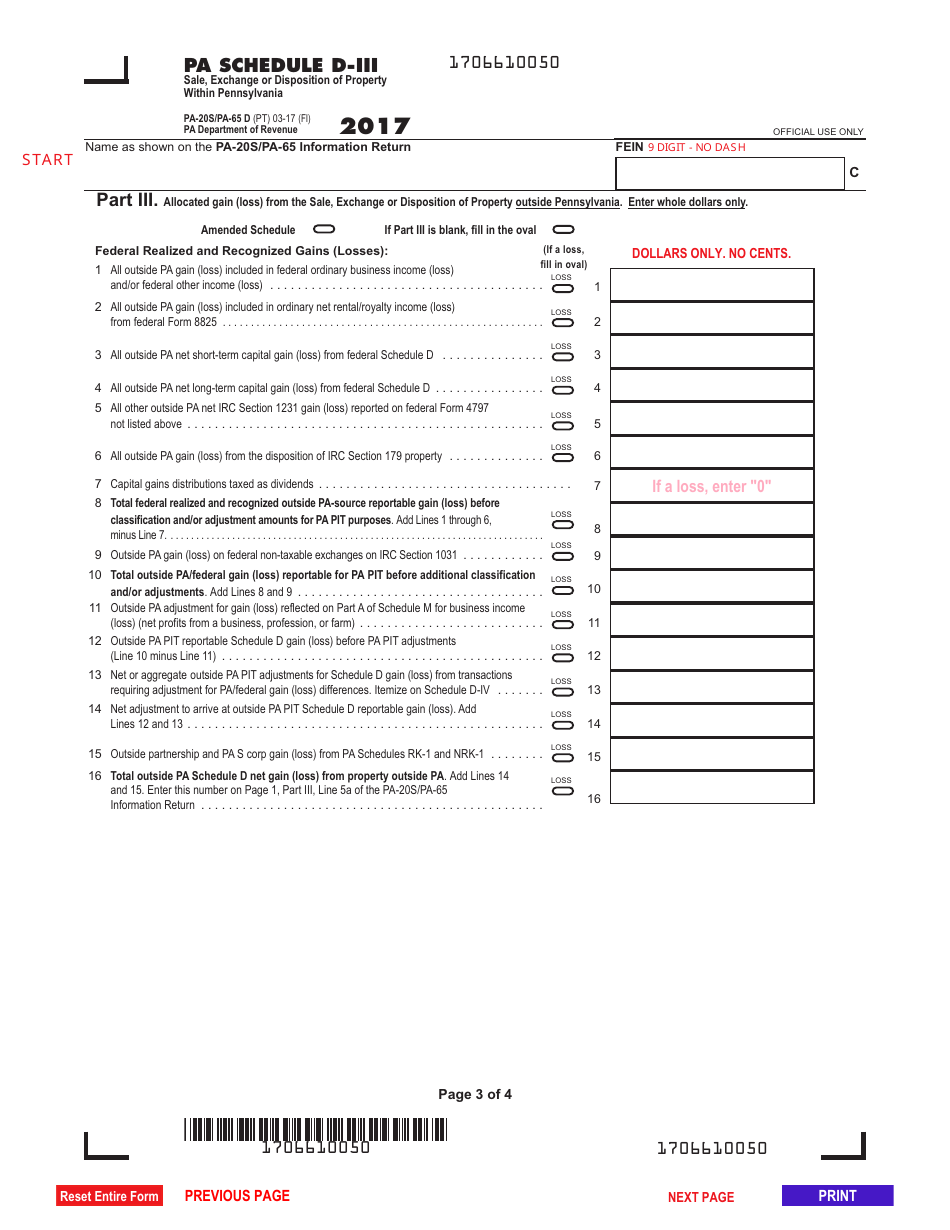

Q: What information is required on Form PA-20S (PA-65 D) Schedule D?

A: Form PA-20S (PA-65 D) Schedule D requires information such as the date of the sale, description of the property, and the amount of gain or loss.

Q: Can Form PA-20S (PA-65 D) Schedule D be filed electronically?

A: Yes, Form PA-20S (PA-65 D) Schedule D can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 D) Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.