This version of the form is not currently in use and is provided for reference only. Download this version of

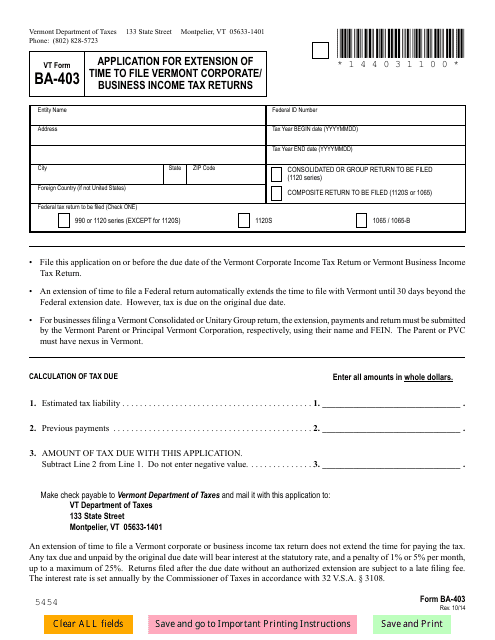

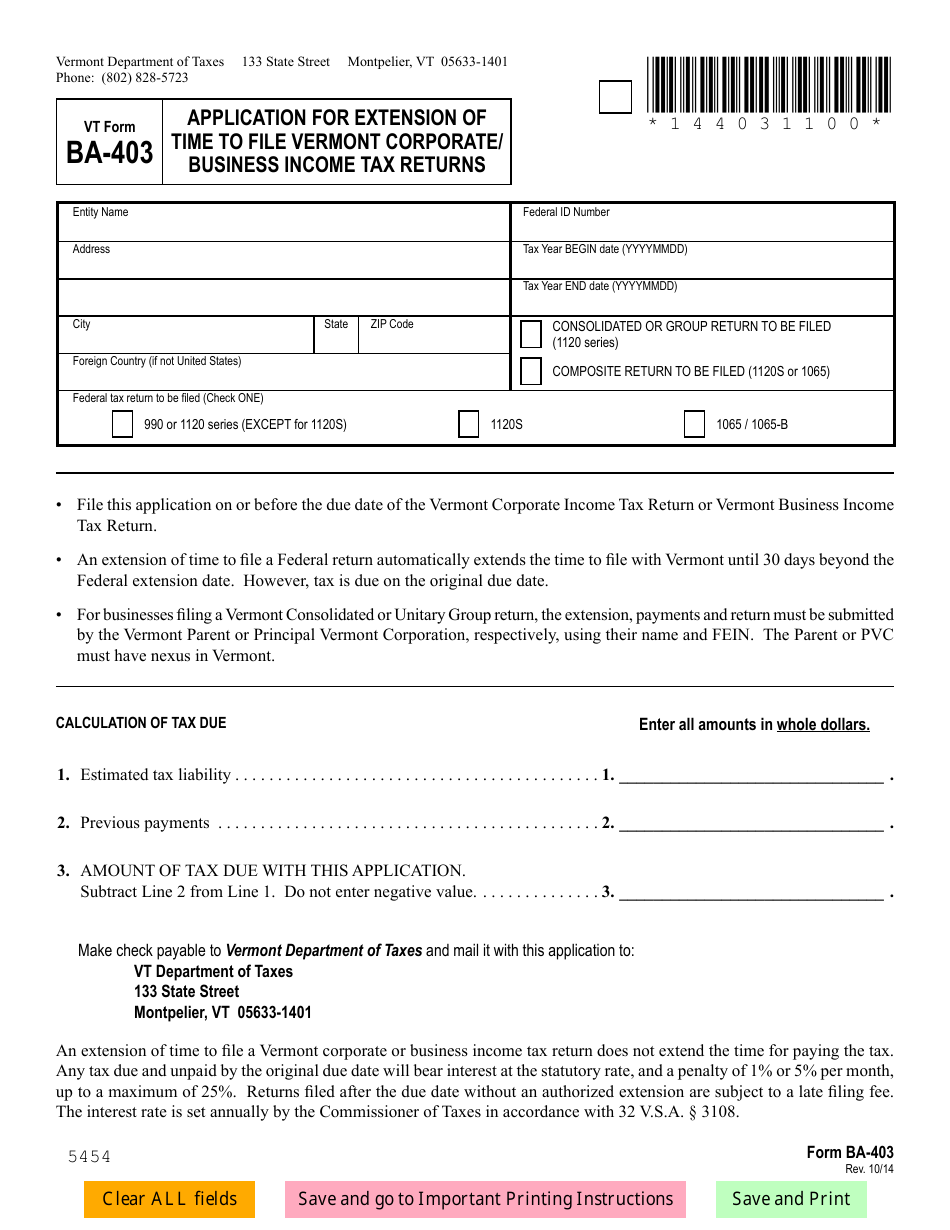

VT Form BA-403

for the current year.

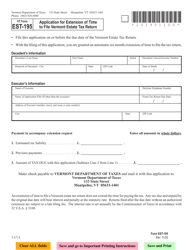

VT Form BA-403 Application for Extension of Time to File Vermont Corporate / Business Income Tax Returns - Vermont

What Is VT Form BA-403?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form BA-403?

A: The VT Form BA-403 is the Application for Extension of Time to File Vermont Corporate/Business Income Tax Returns.

Q: Who needs to file the VT Form BA-403?

A: Those who need more time to file their Vermont Corporate/Business Income Tax Returns.

Q: What is the purpose of the VT Form BA-403?

A: The purpose of the form is to request an extension of time to file Vermont Corporate/Business Income Tax Returns.

Q: When is the deadline to file the VT Form BA-403?

A: The deadline to file the form is the same as the deadline for filing Vermont Corporate/Business Income Tax Returns.

Q: Is there a fee for filing the VT Form BA-403?

A: No, there is no fee for filing the form.

Q: How long is the extension granted by the VT Form BA-403?

A: The extension granted by the form is typically 6 months.

Q: Is the VT Form BA-403 available for both corporations and businesses?

A: Yes, the form is available for both corporations and businesses.

Q: What information is required on the VT Form BA-403?

A: The form requires basic information about the taxpayer, such as name, address, and taxpayer identification number.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form BA-403 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.