This version of the form is not currently in use and is provided for reference only. Download this version of

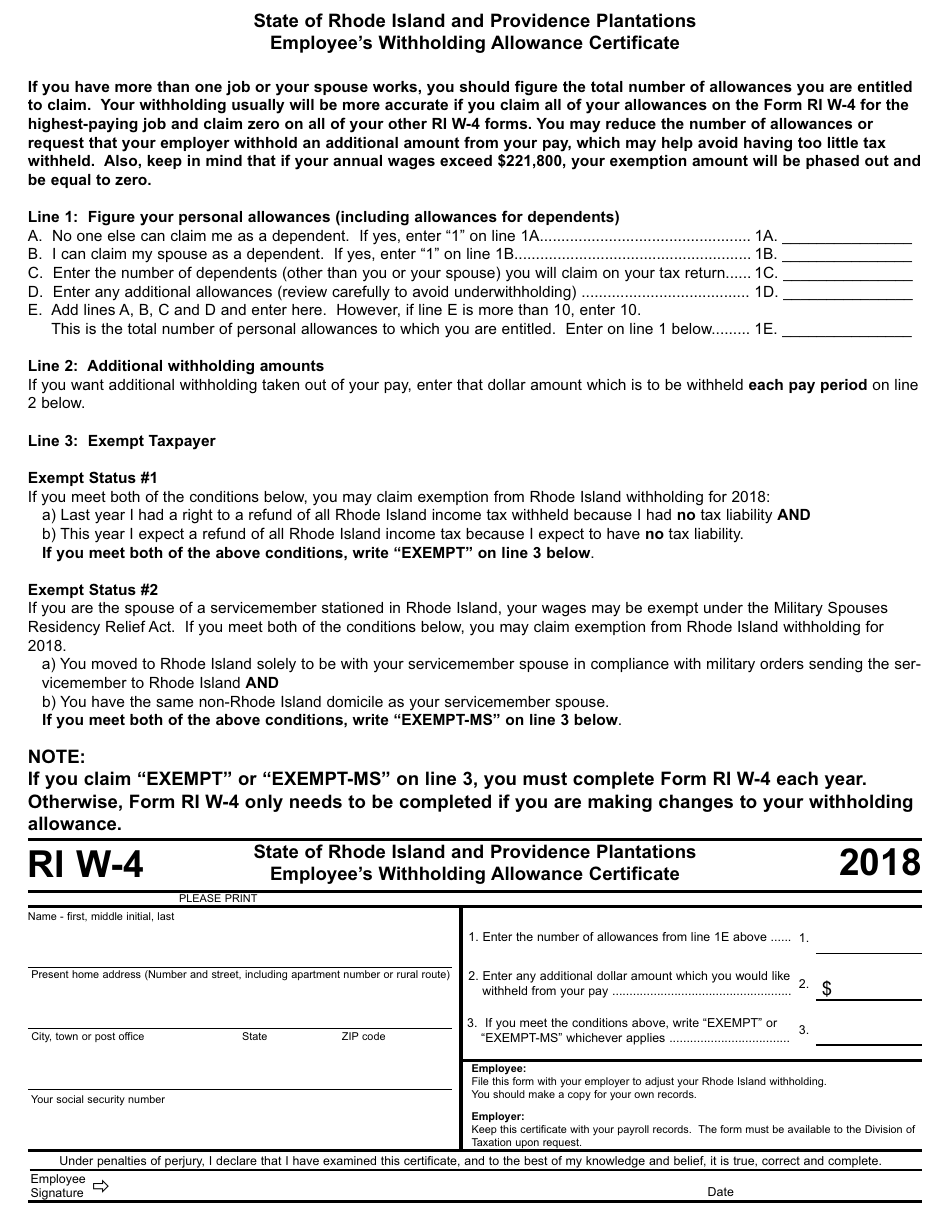

Form RI W-4

for the current year.

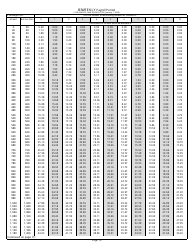

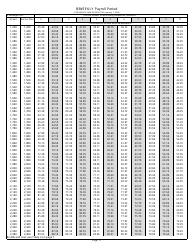

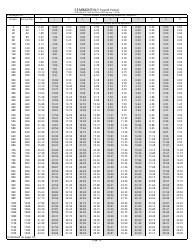

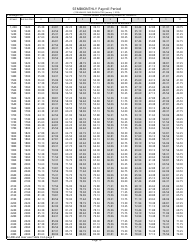

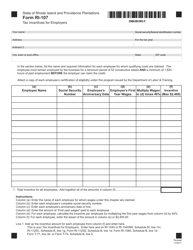

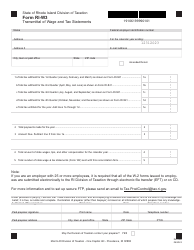

Form RI W-4 Rhode Island Employer's Income Tax Withholding Tables - Rhode Island

What Is Form RI W-4?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

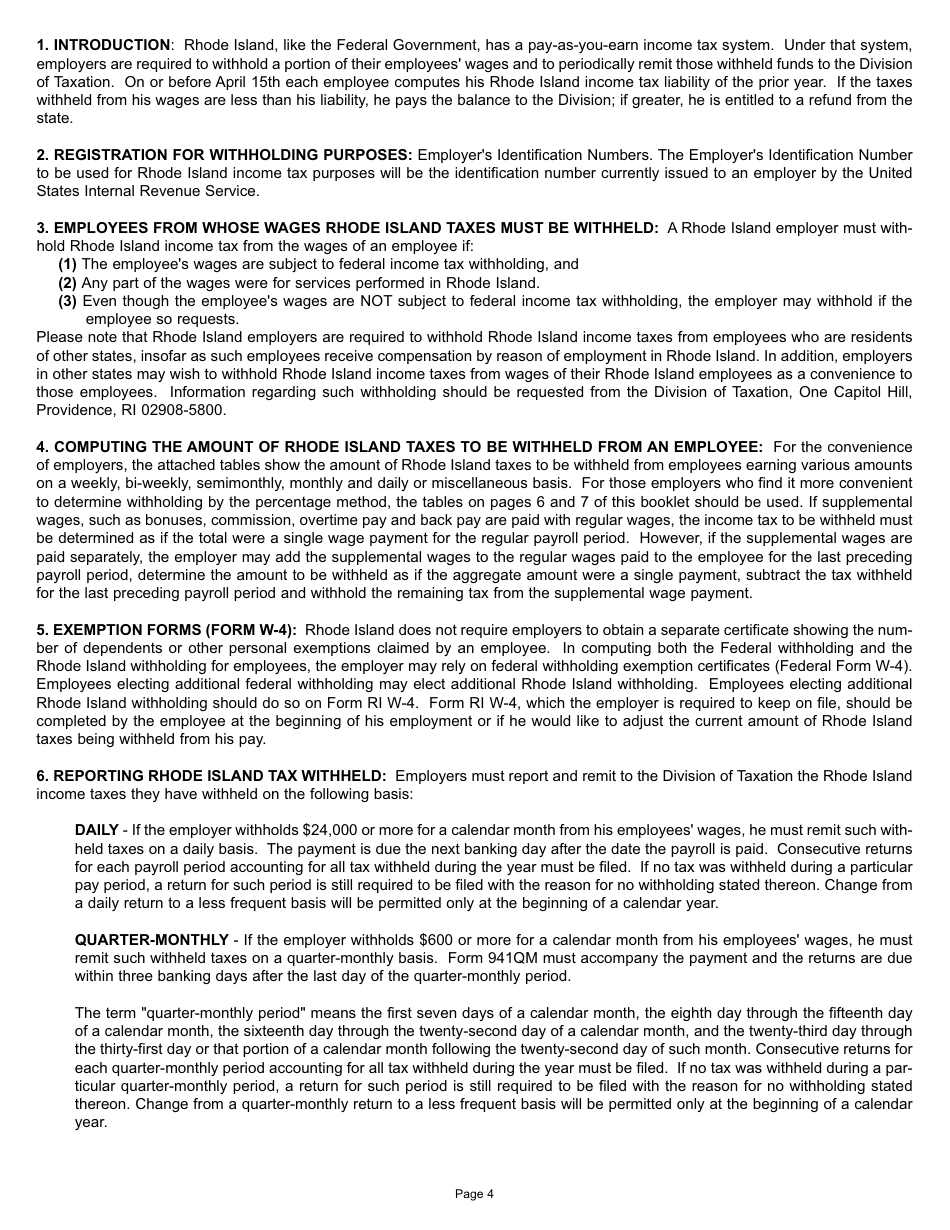

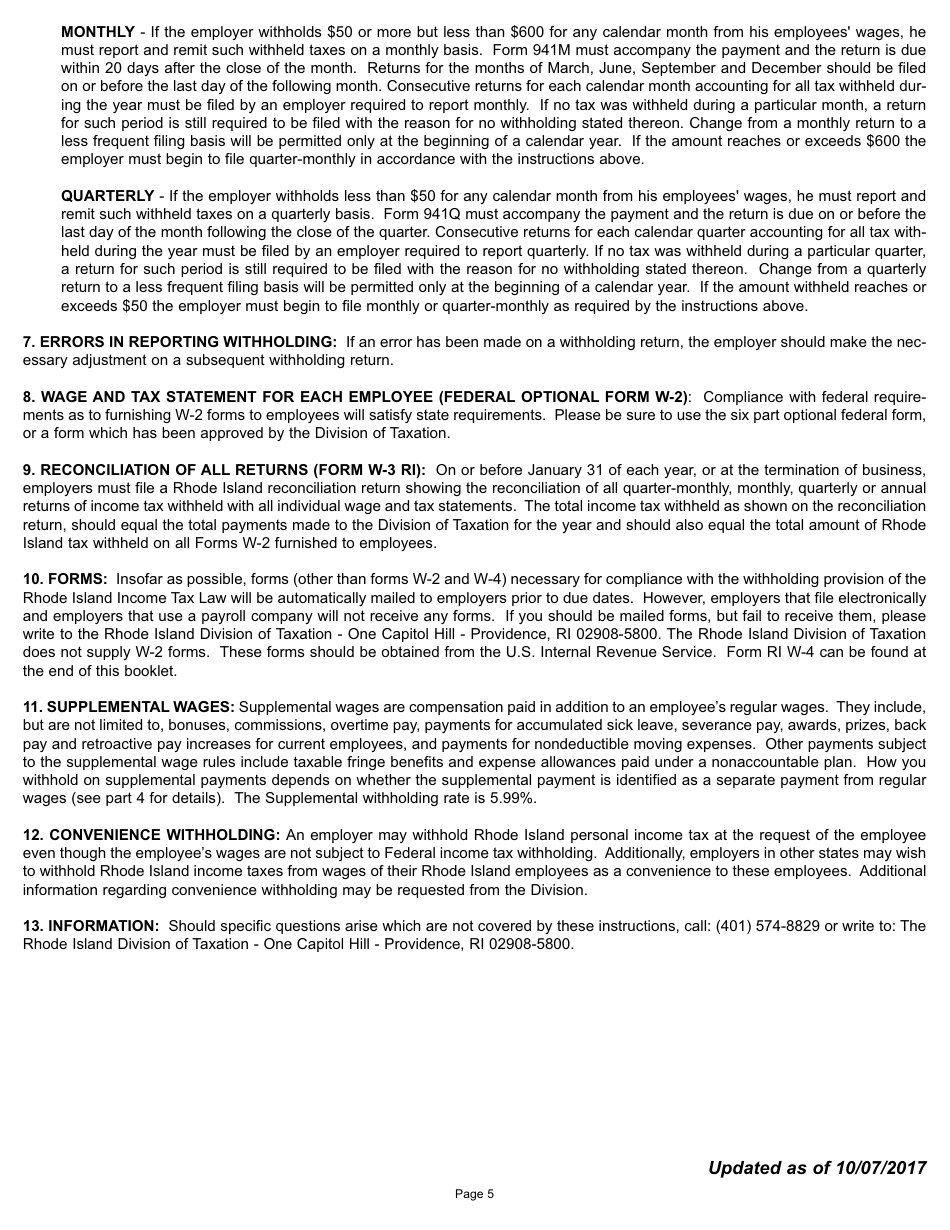

Q: What is the Form RI W-4?

A: The Form RI W-4 is a document used to determine how much Rhode Island income tax should be withheld from an employee's wages.

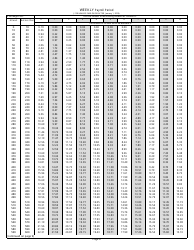

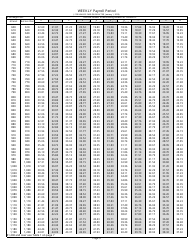

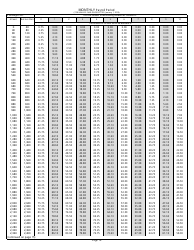

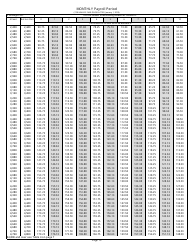

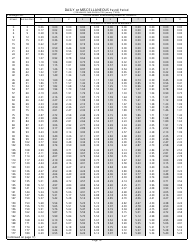

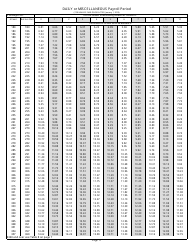

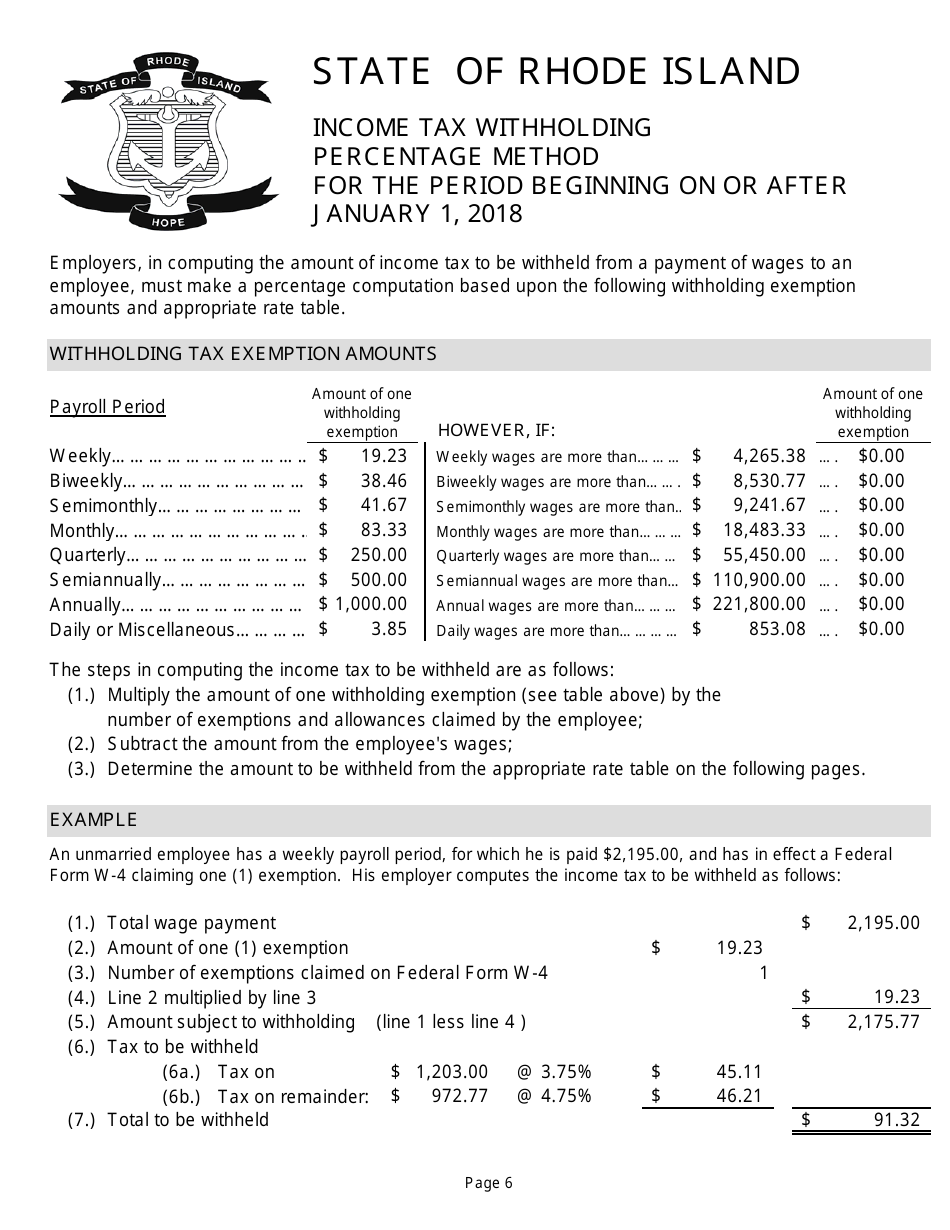

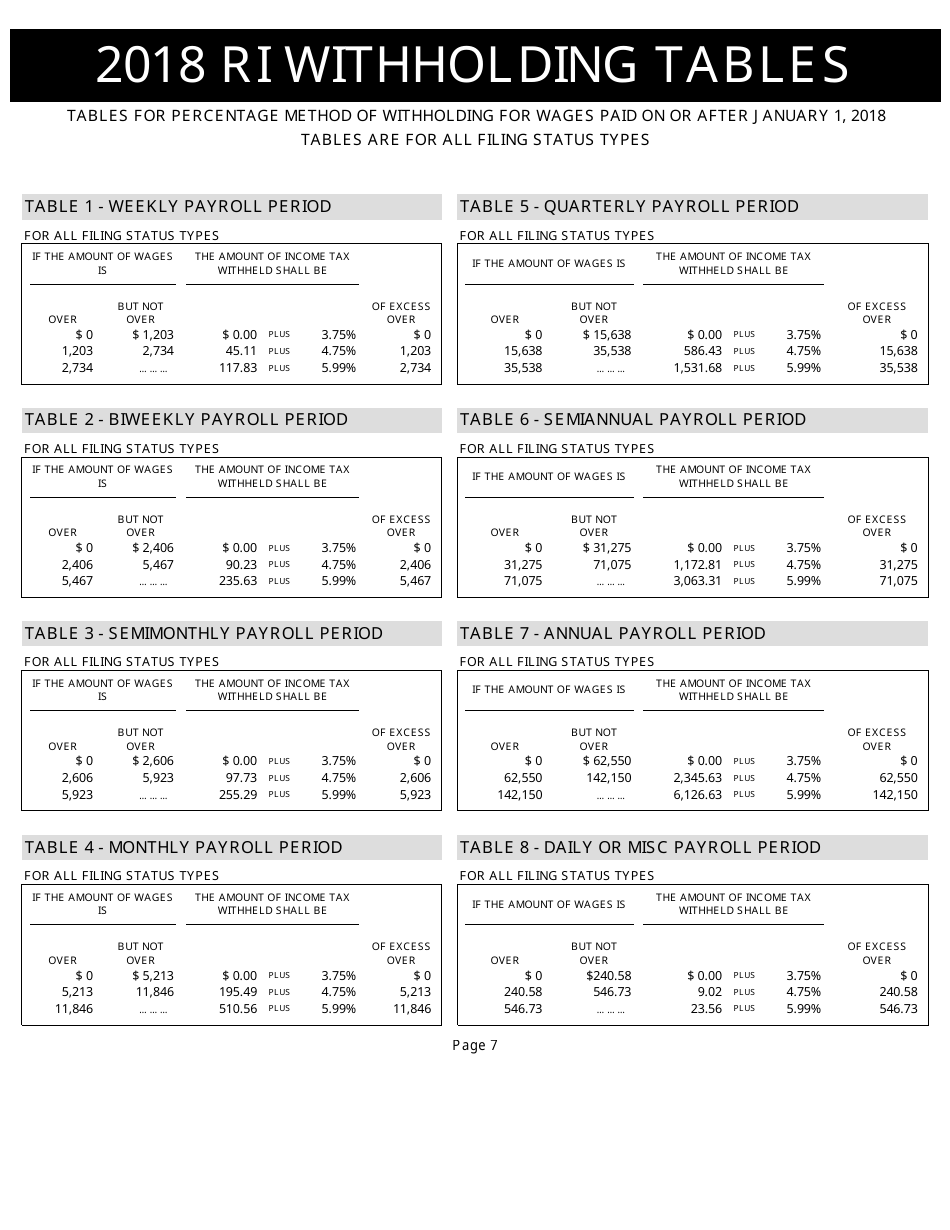

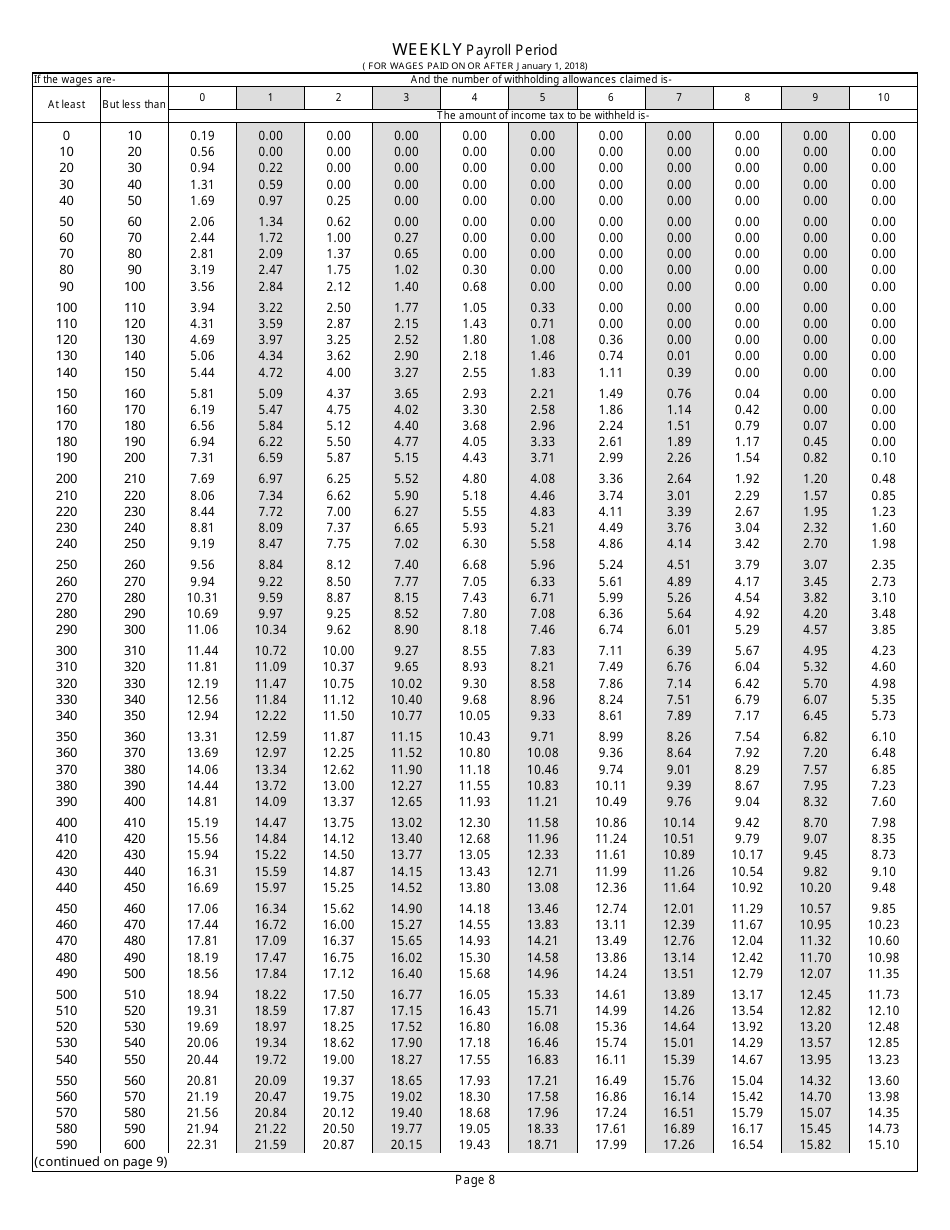

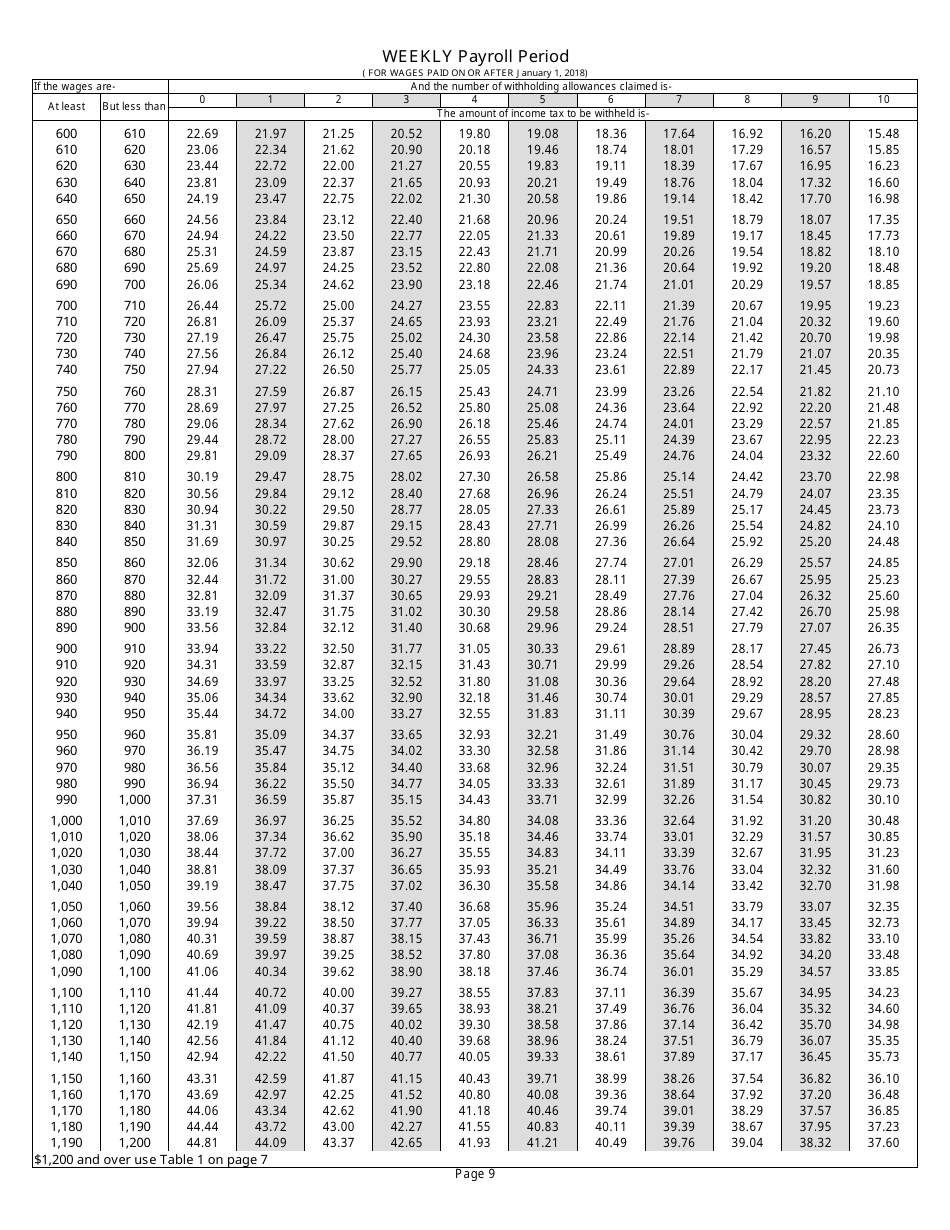

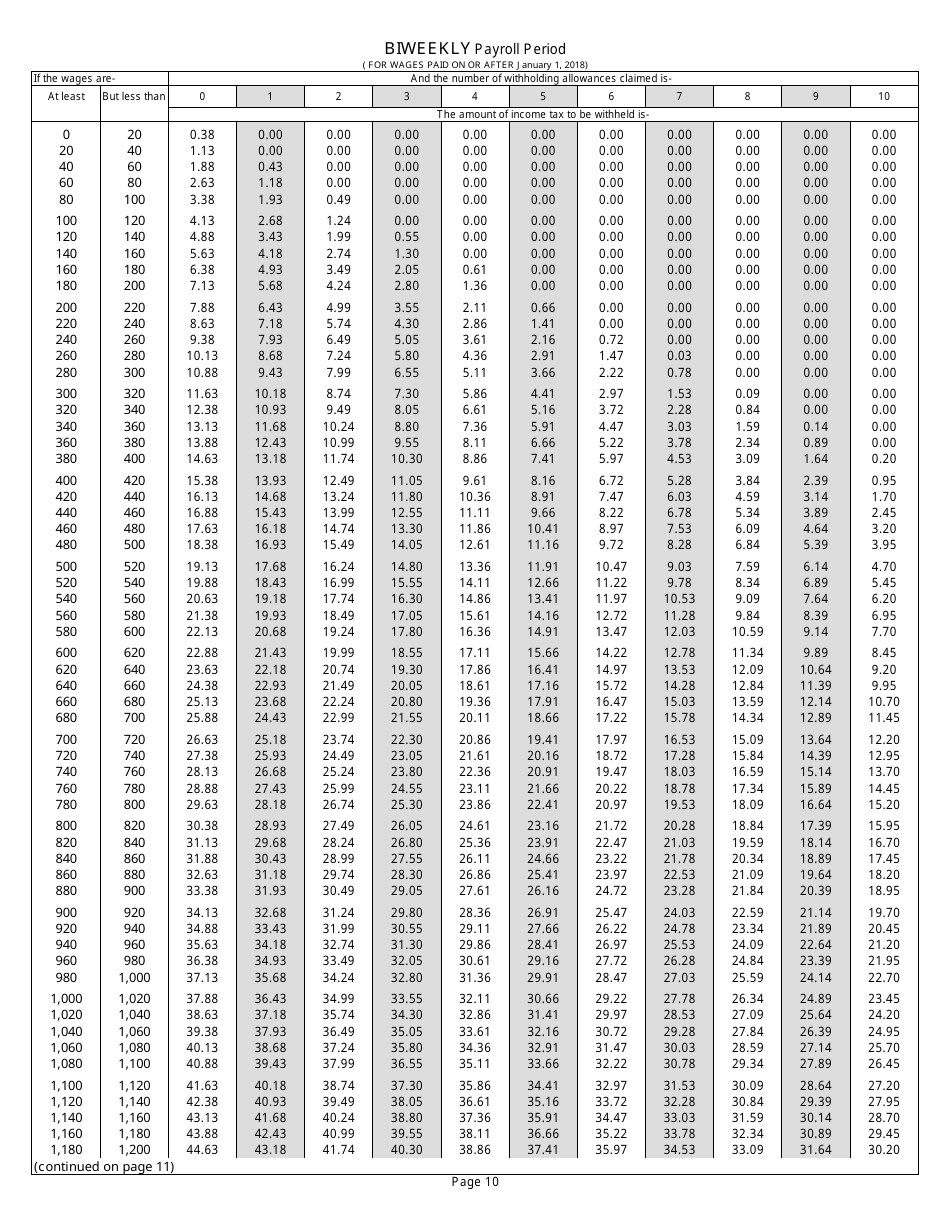

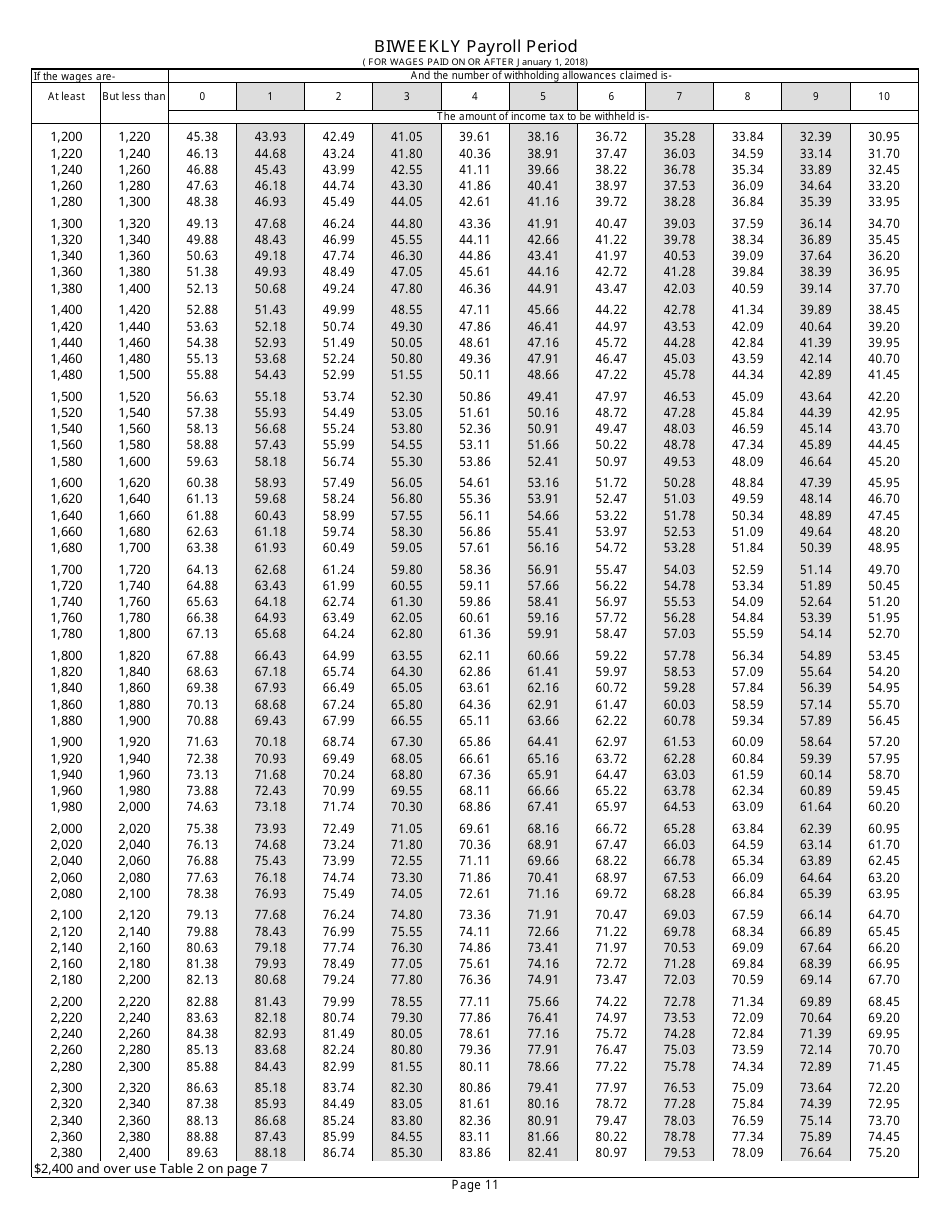

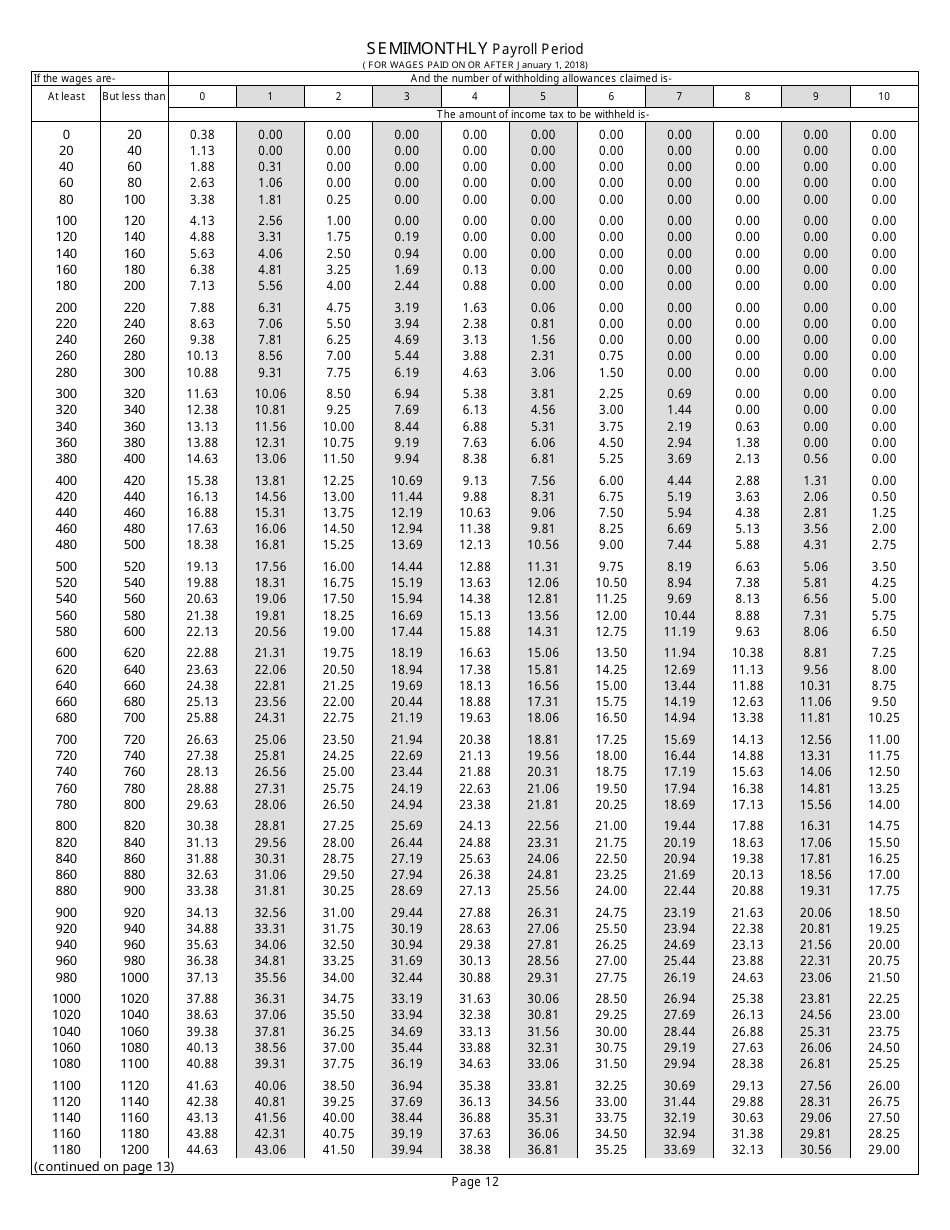

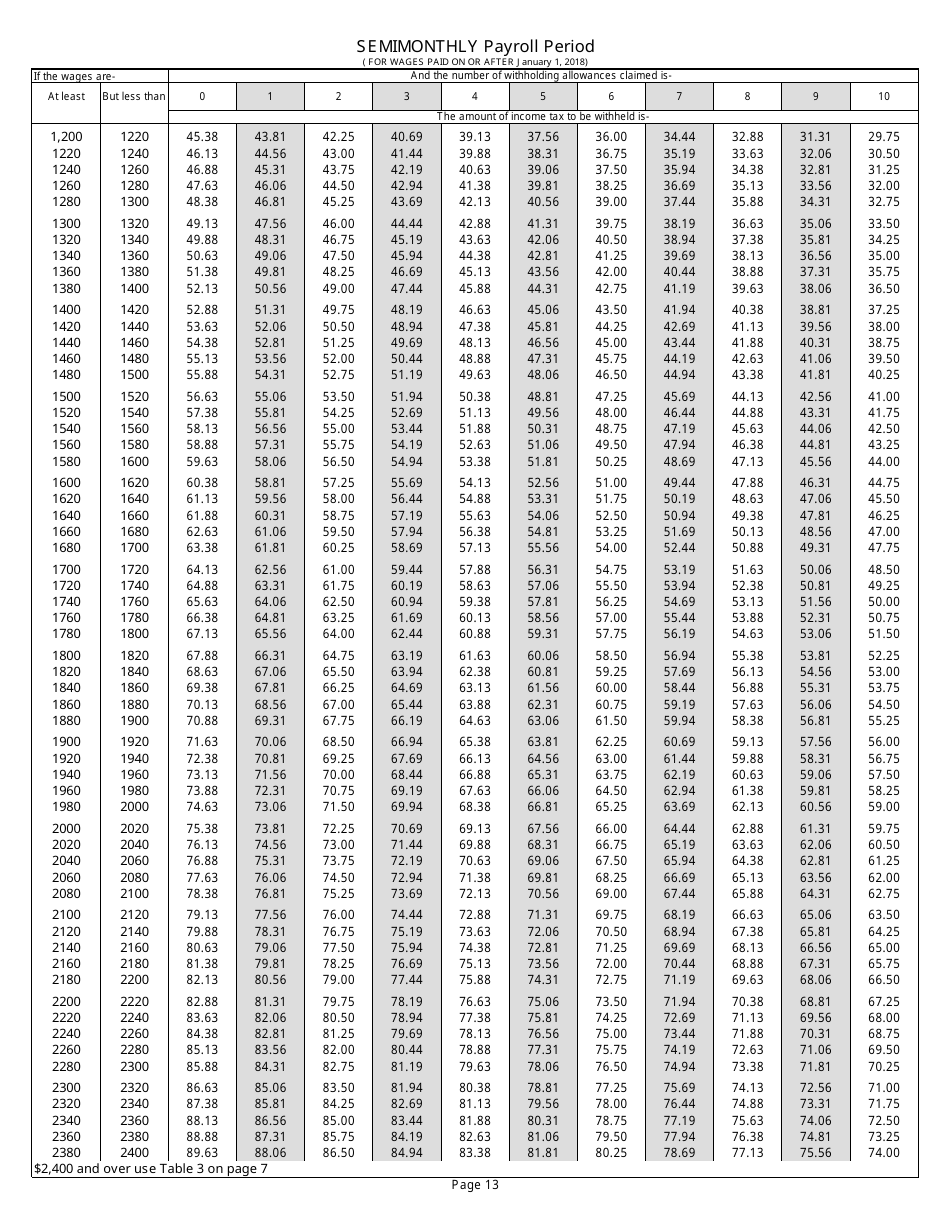

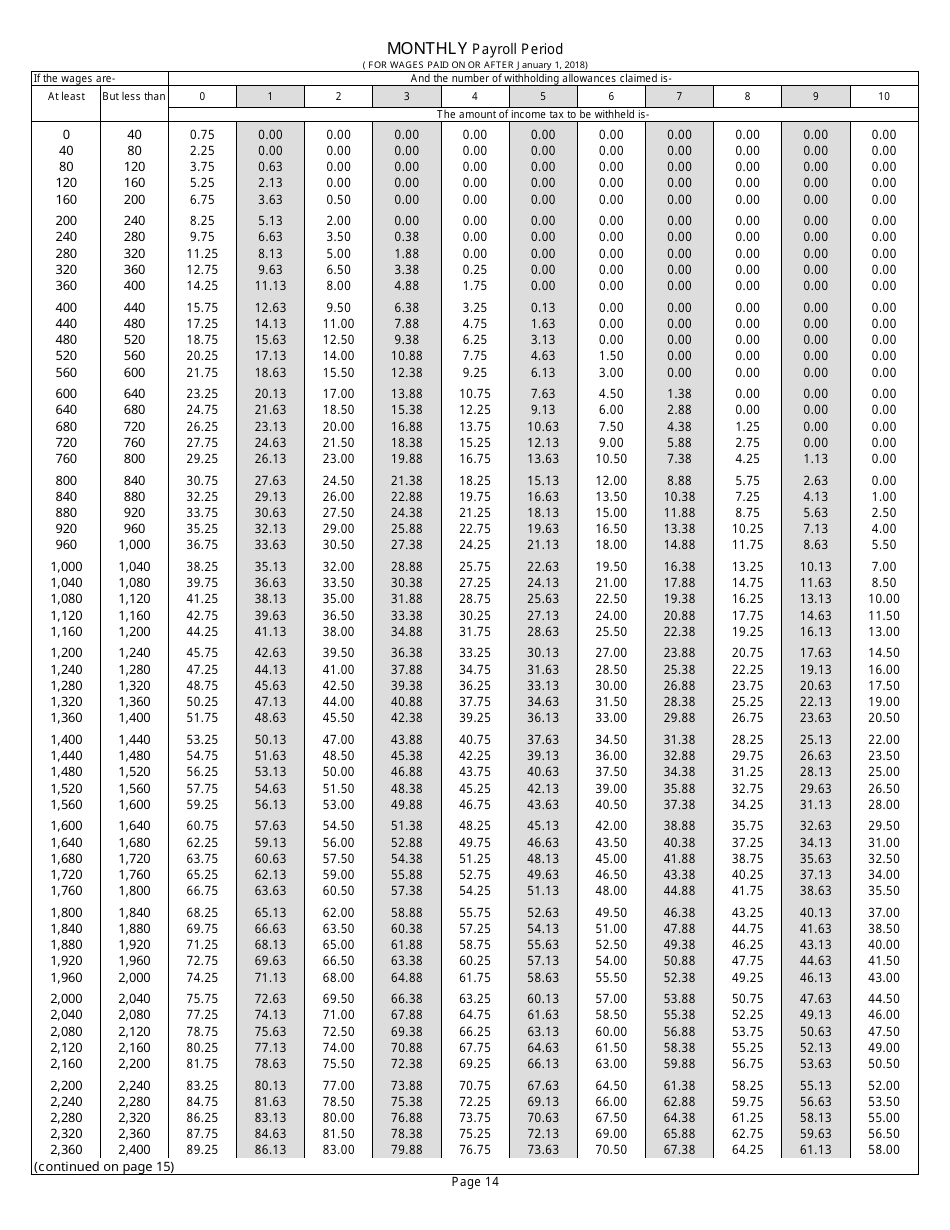

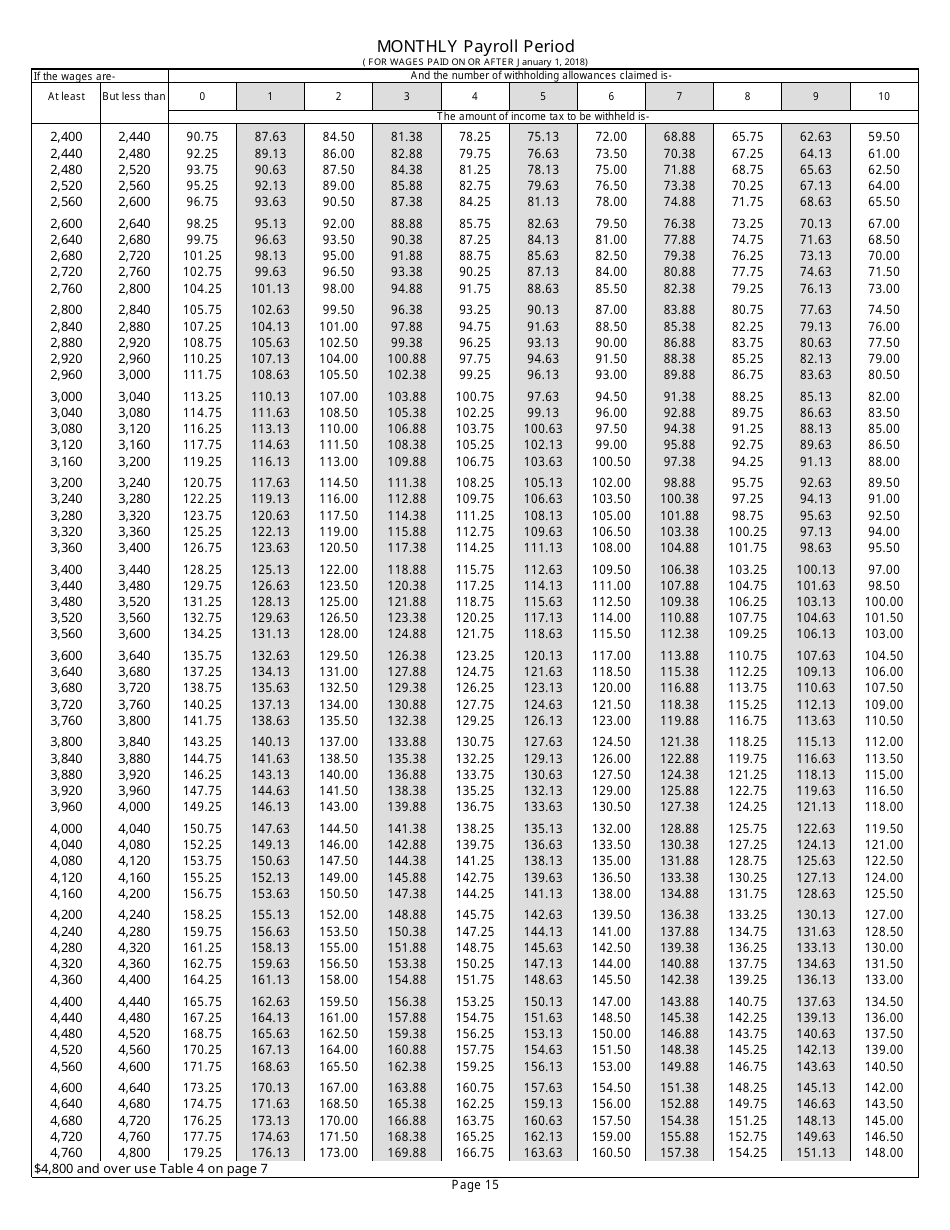

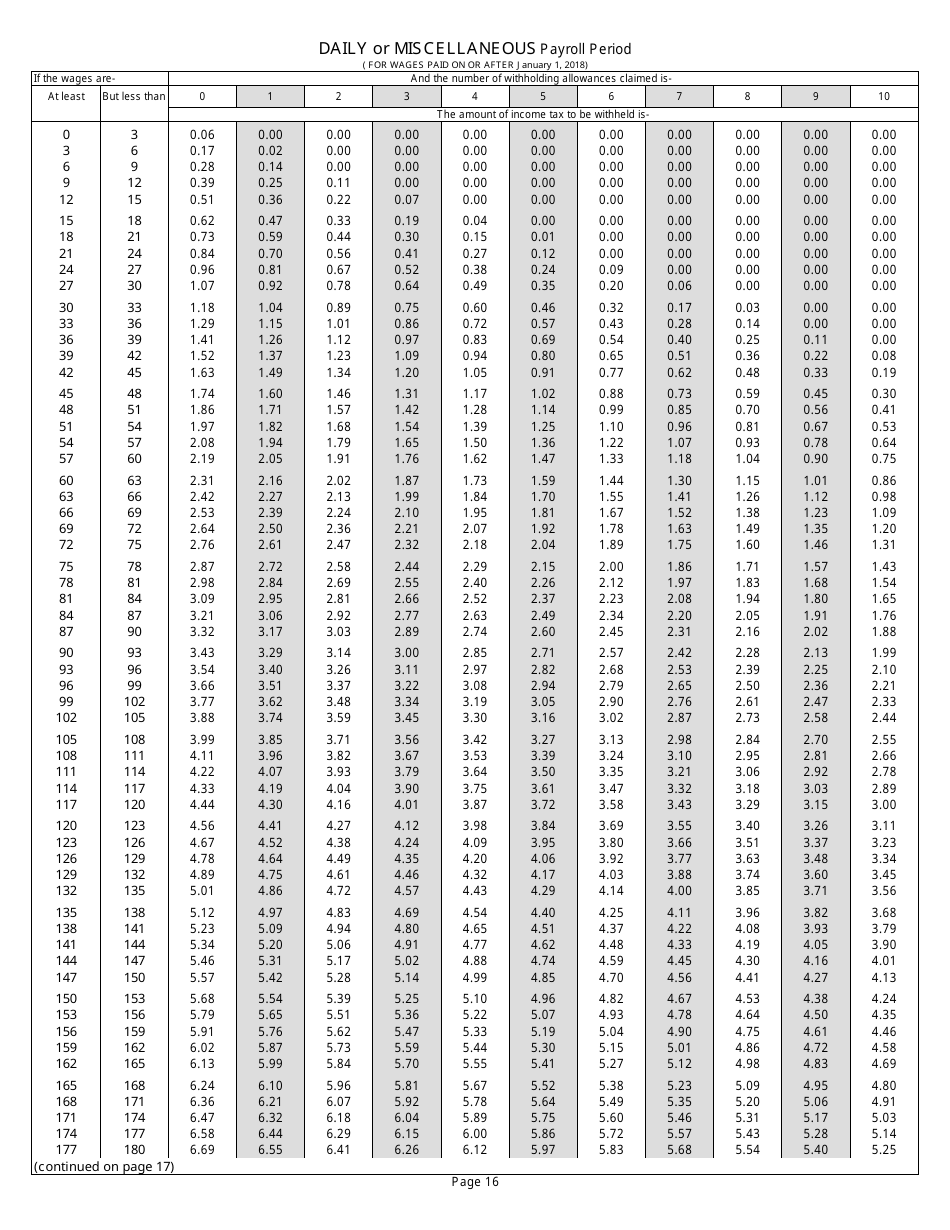

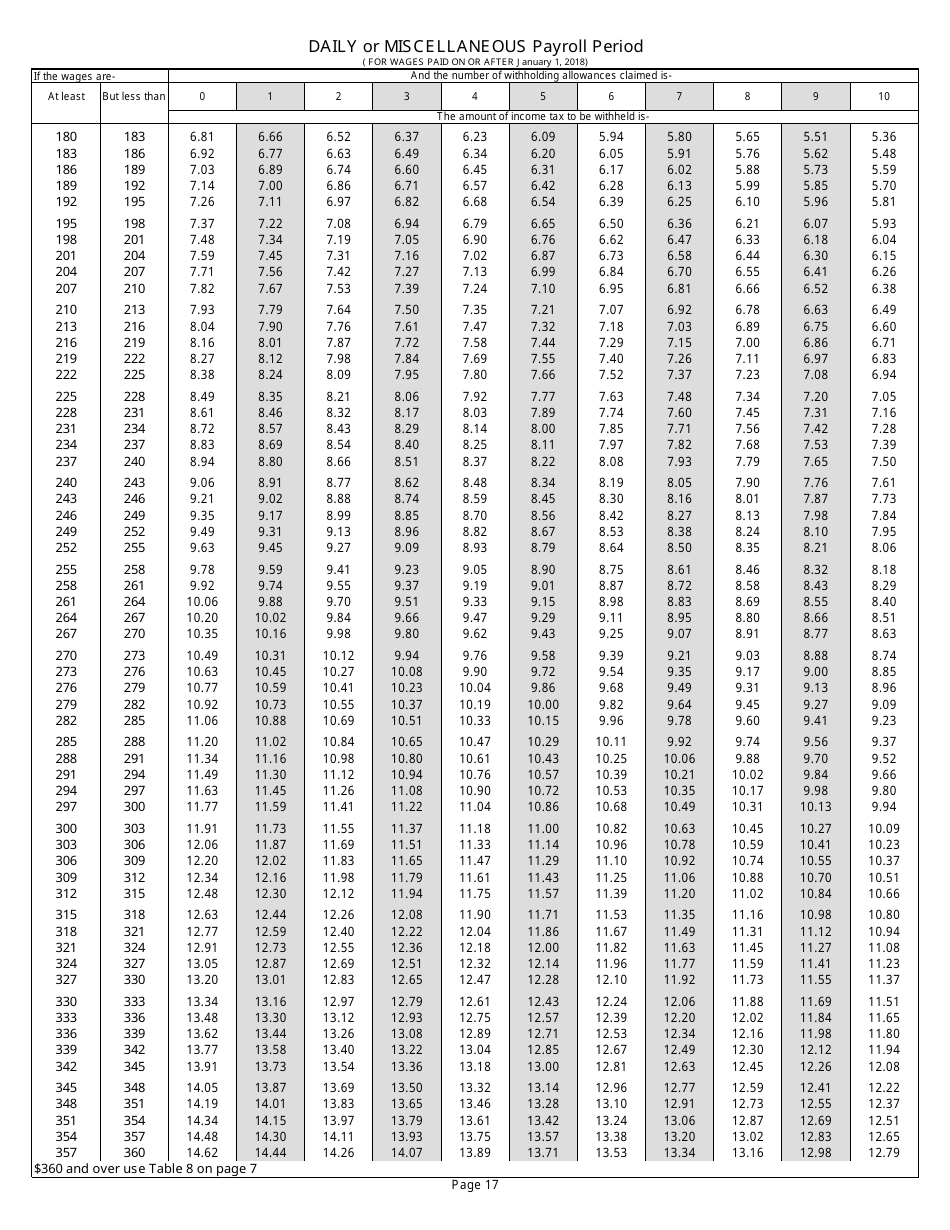

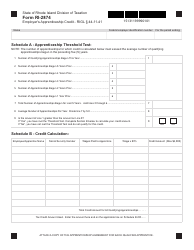

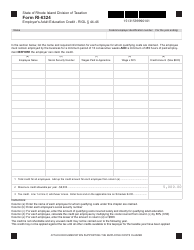

Q: What are Rhode Island Employer's Income Tax Withholding Tables?

A: Rhode Island Employer's Income Tax Withholding Tables are tables that provide guidance on how much income tax to withhold from an employee's wages based on their filing status and allowance claimed.

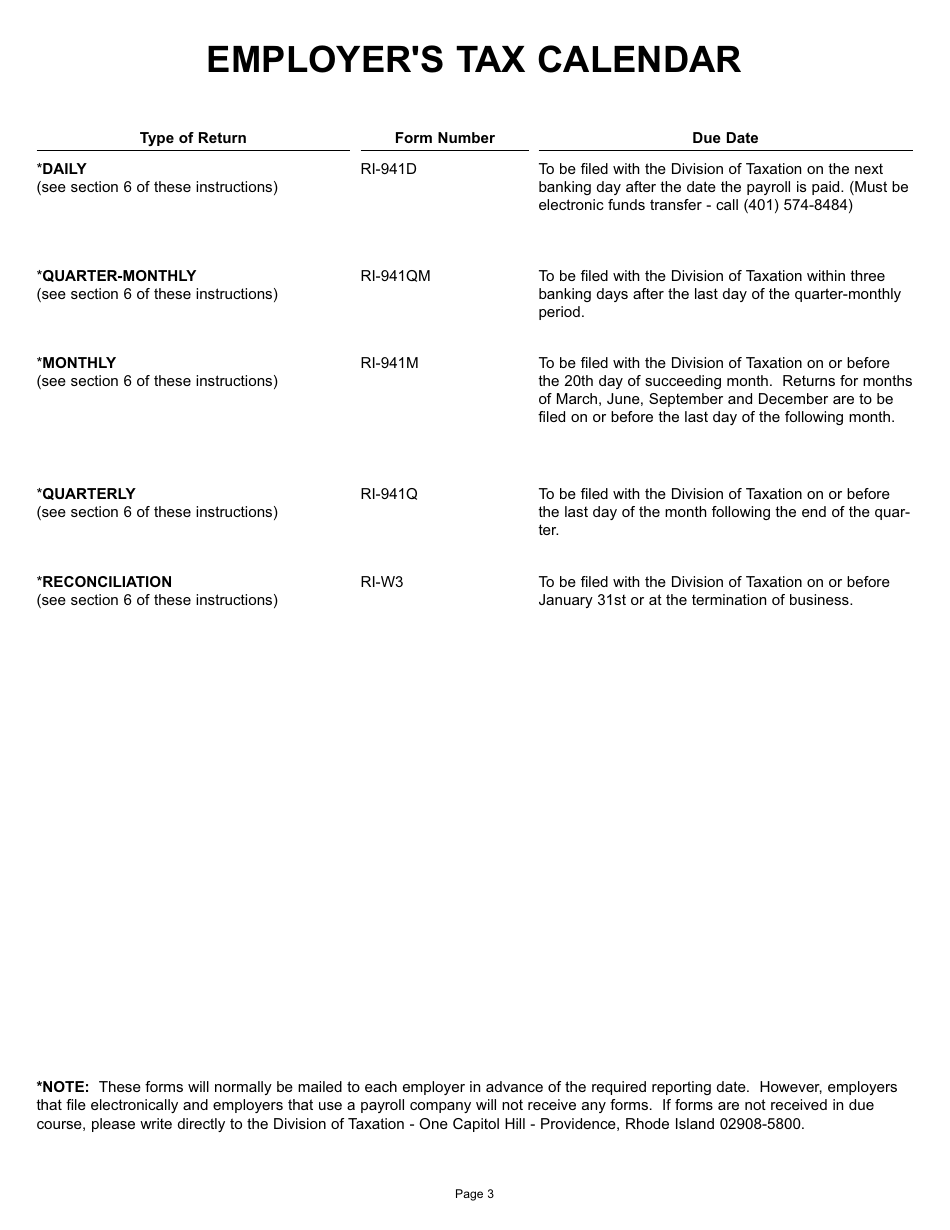

Q: Why do employers need to use Form RI W-4 and the withholding tables?

A: Employers need to use Form RI W-4 and the withholding tables to ensure that the correct amount of Rhode Island income tax is withheld from their employees' wages.

Q: Who should use Form RI W-4?

A: Both employers and employees should use Form RI W-4. Employers use it to determine how much tax to withhold from employees' wages, and employees use it to specify their filing status and allowances.

Q: What happens if I don't fill out Form RI W-4?

A: If you don't fill out Form RI W-4, your employer will generally withhold Rhode Island income tax based on the default status of single with no allowances.

Q: Can I change my withholding during the year?

A: Yes, you can change your withholding during the year by submitting a new Form RI W-4 to your employer.

Q: What factors are considered when determining the amount of income tax to withhold?

A: The amount of income tax to withhold is based on factors such as your filing status, number of allowances claimed, and the income tax rate applicable to your income bracket.

Q: Do I need to file Form RI W-4 every year?

A: No, you do not need to file Form RI W-4 every year. However, it is a good practice to review it annually and make any necessary updates.

Q: Is there a penalty for not having enough tax withheld?

A: There may be a penalty if you do not have enough tax withheld throughout the year. It is important to ensure that the correct amount of tax is being withheld to avoid penalties and interest.

Form Details:

- Released on July 10, 2017;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI W-4 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.