This version of the form is not currently in use and is provided for reference only. Download this version of

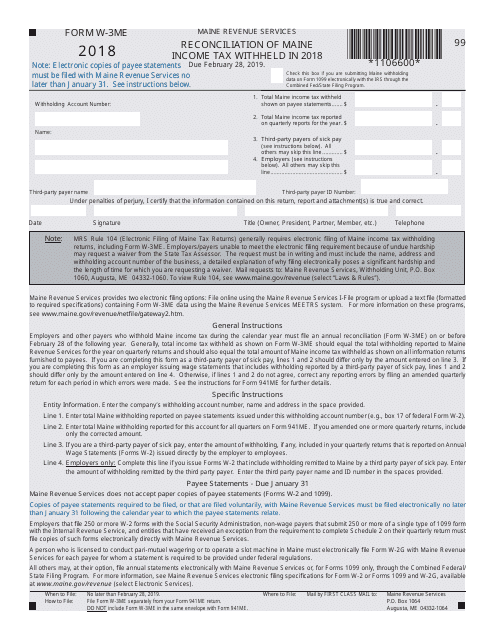

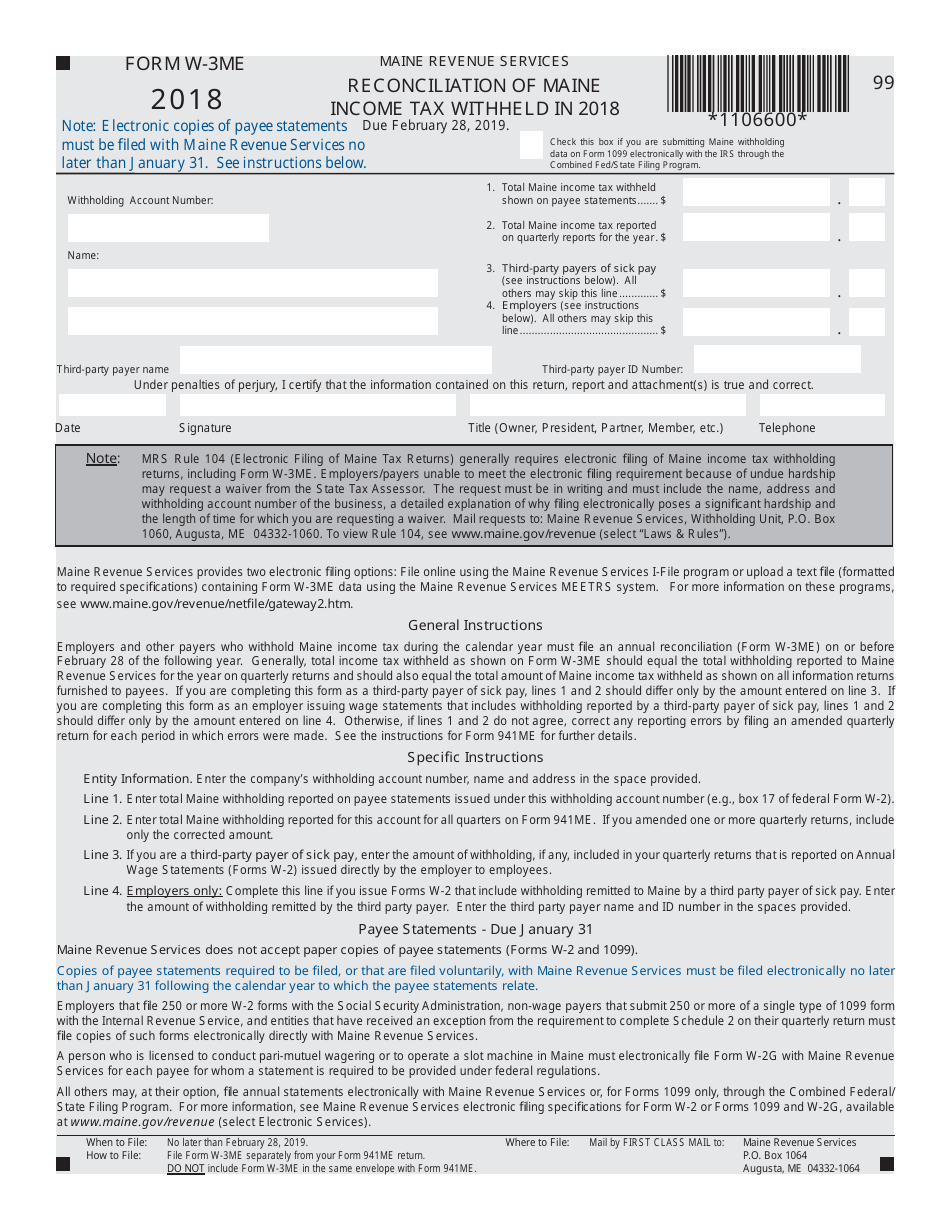

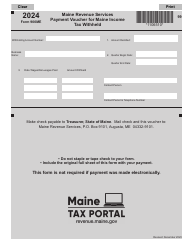

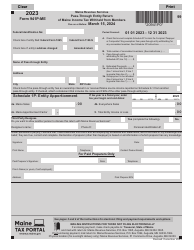

Form W-3ME

for the current year.

Form W-3ME Reconciliation of Maine Income Tax Withheld in 2018 - Maine

What Is Form W-3ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-3ME?

A: Form W-3ME is a document used for the reconciliation of Maine income tax withheld in 2018.

Q: Who needs to file Form W-3ME?

A: Employers in Maine who withheld income tax during 2018 need to file Form W-3ME.

Q: When is the deadline to file Form W-3ME?

A: The deadline to file Form W-3ME is January 31st of the following year.

Q: What is the purpose of filing Form W-3ME?

A: Form W-3ME is used to reconcile the amount of Maine income tax withheld by an employer with the total amount reported on employees' W-2 forms.

Q: What information is required on Form W-3ME?

A: Form W-3ME requires the employer's information, total wages subject to Maine income tax, total tax withheld, and other relevant details.

Q: Are there any penalties for not filing Form W-3ME?

A: Yes, failure to file Form W-3ME may result in penalties and interest charges.

Q: Can Form W-3ME be filed electronically?

A: Yes, employers have the option to file Form W-3ME electronically instead of mailing a paper copy.

Q: Is Form W-3ME only for Maine income tax withholding?

A: Yes, Form W-3ME is specific to reconciling Maine income tax withheld and does not cover federal taxes or taxes from other states.

Q: Can I file Form W-3ME if I didn't withhold any income tax?

A: No, if you did not withhold any Maine income tax during 2018, you do not need to file Form W-3ME.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form W-3ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.