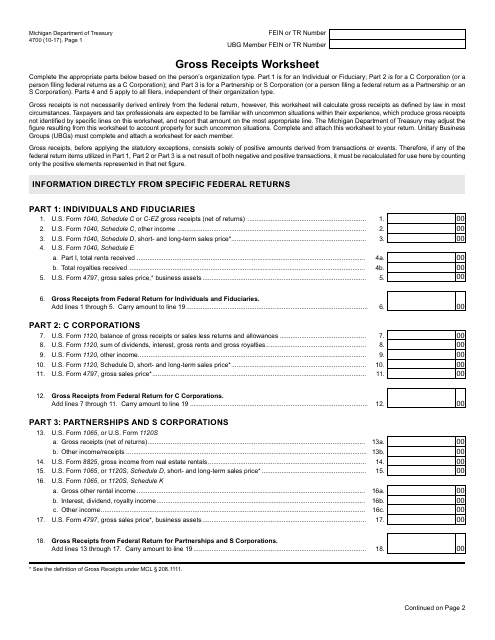

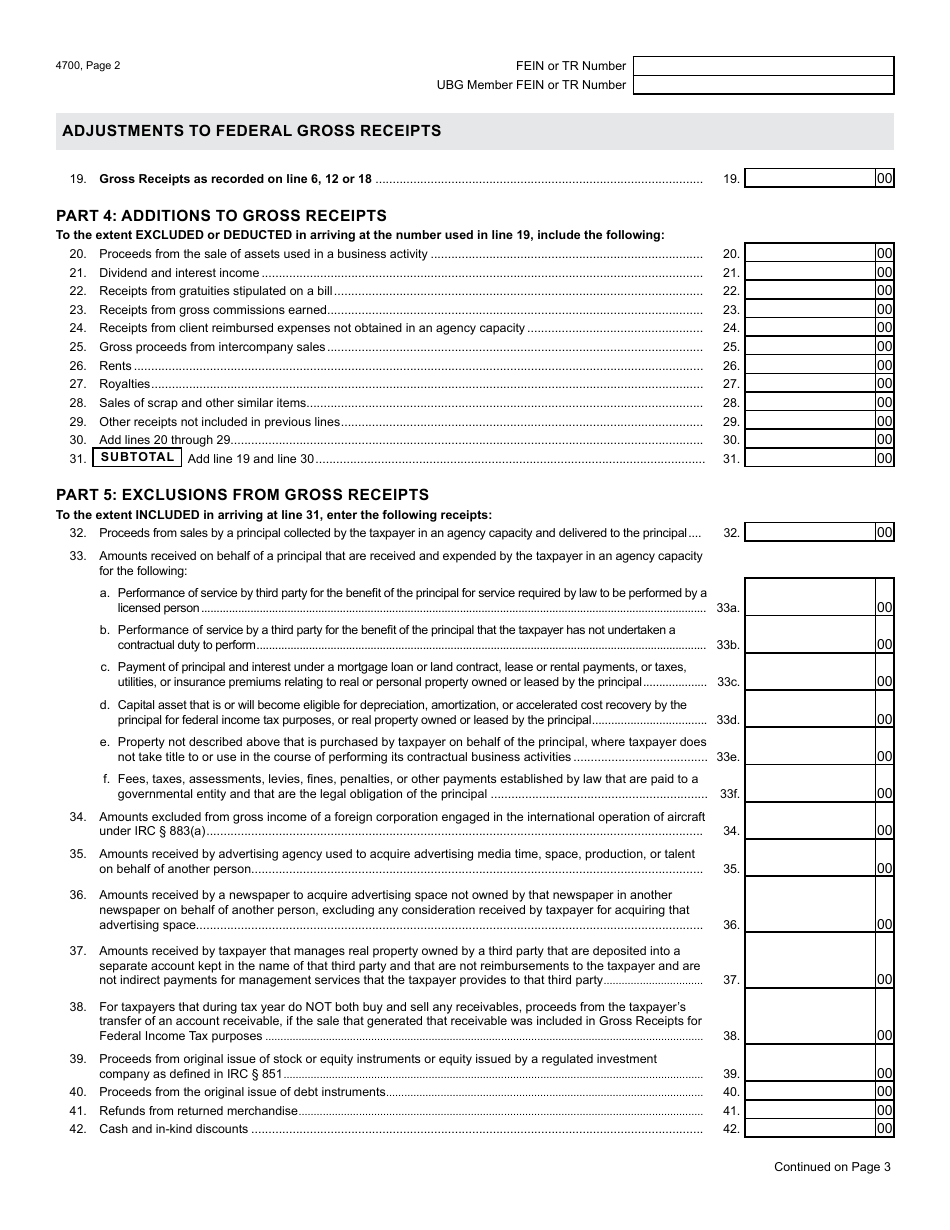

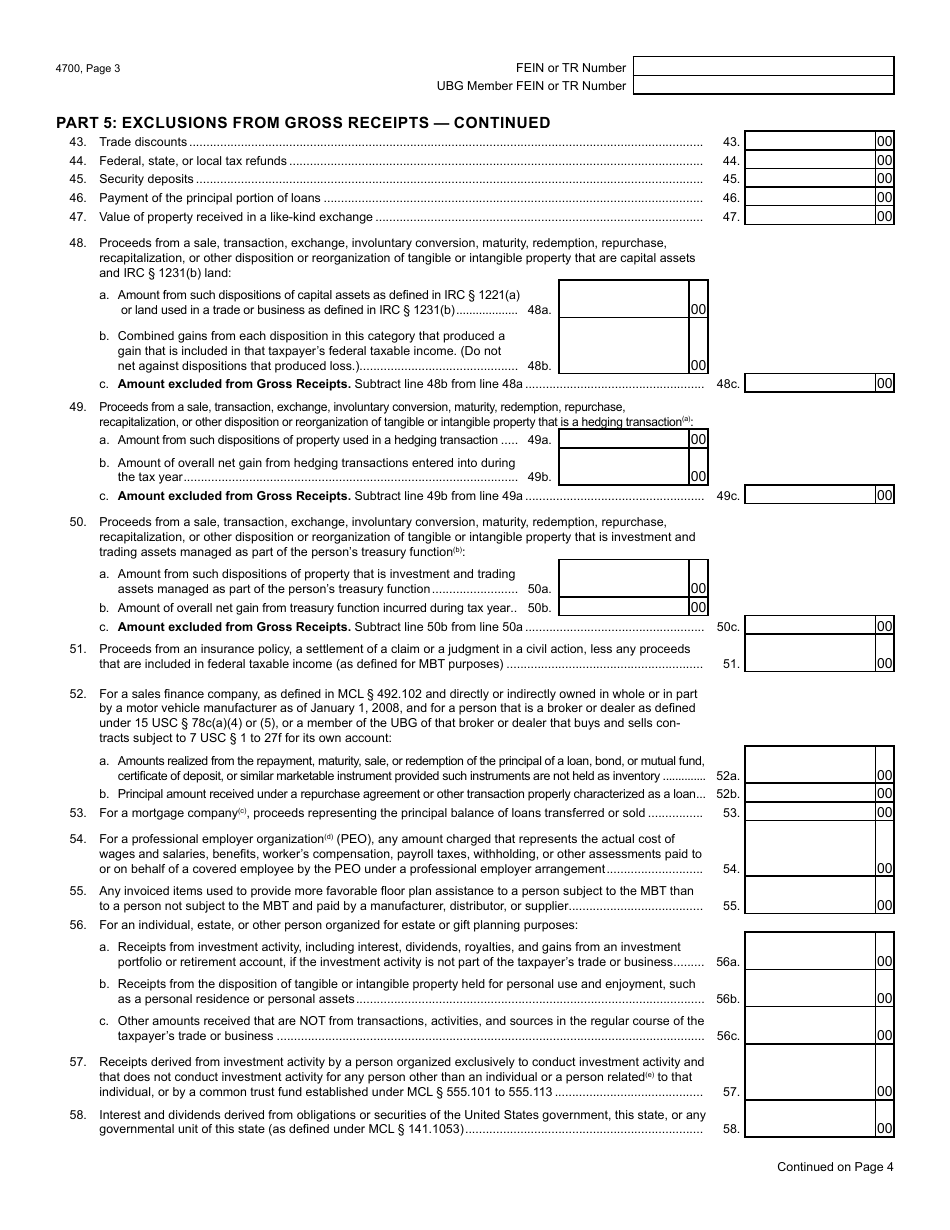

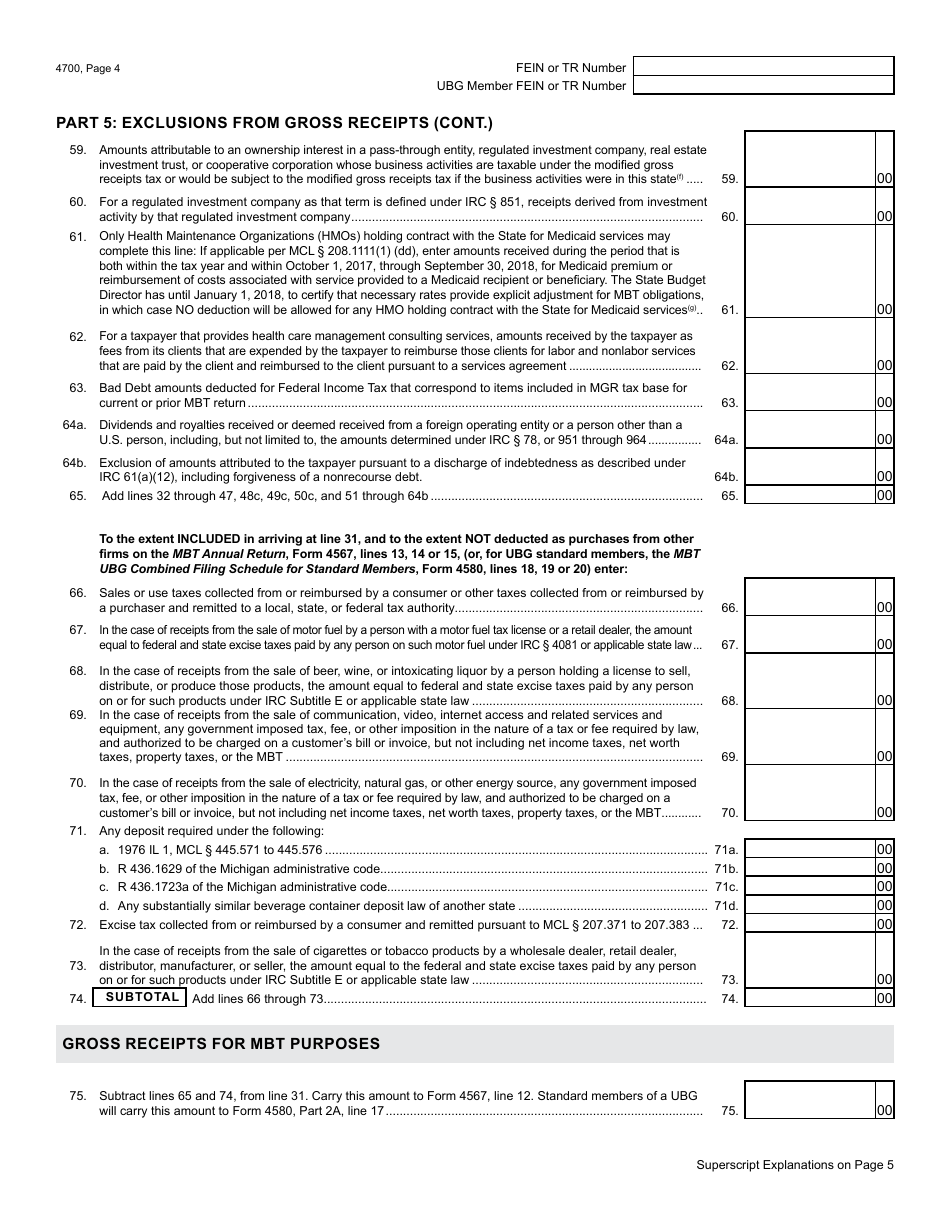

Form 4700 Gross Receipts Worksheet - Michigan

What Is Form 4700?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4700?

A: Form 4700 is the Gross Receipts Worksheet.

Q: What is the purpose of Form 4700?

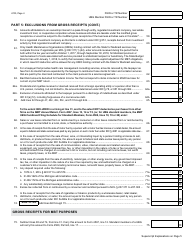

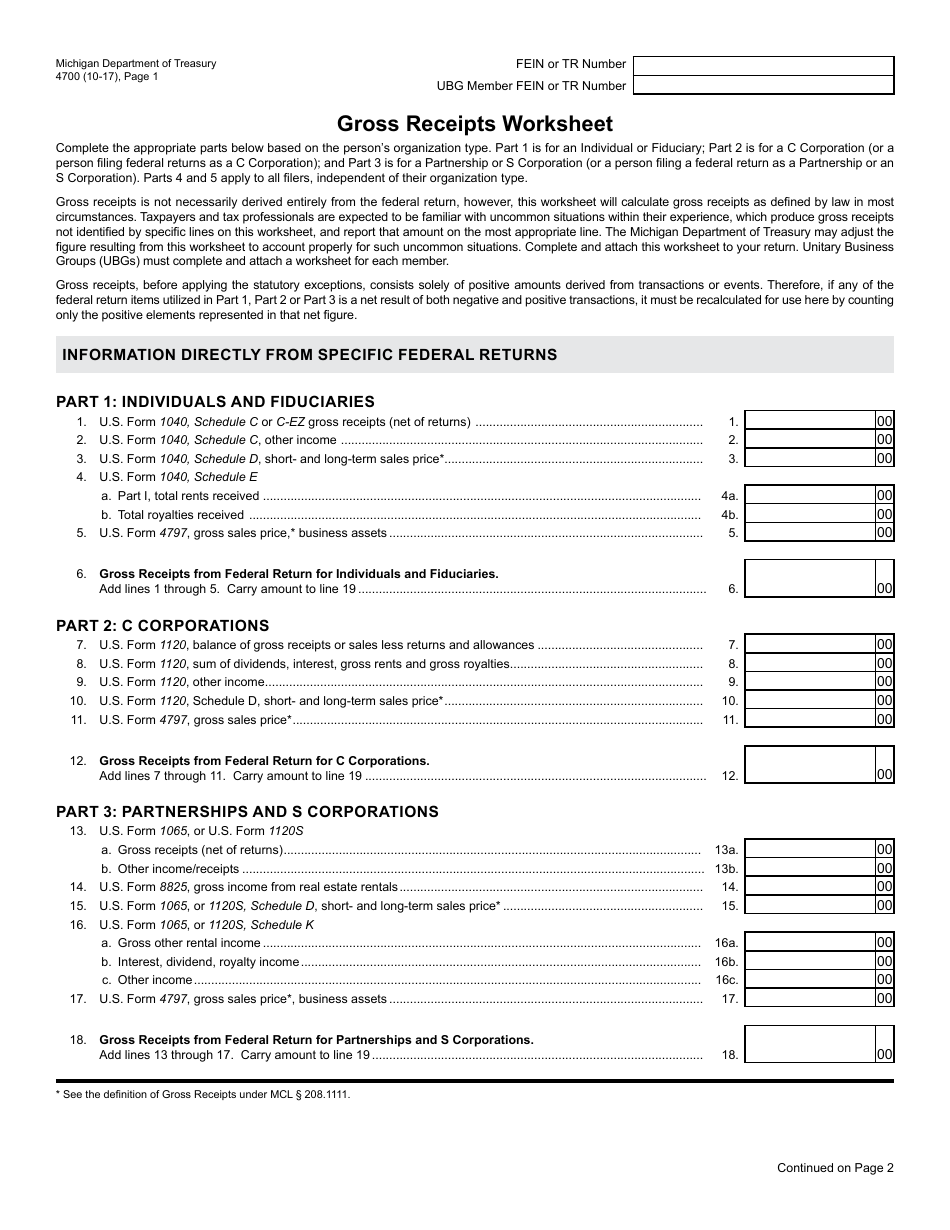

A: The purpose of Form 4700 is to calculate gross receipts for business taxation in Michigan.

Q: Who needs to file Form 4700?

A: Businesses operating in Michigan need to file Form 4700.

Q: What is meant by gross receipts?

A: Gross receipts refer to the total income received by a business before deducting any expenses.

Q: How do I fill out Form 4700?

A: You need to enter the appropriate information regarding your business income and expenses to calculate the gross receipts.

Q: Are there any important deadlines for filing Form 4700?

A: The form should be filed by the due date of your annual tax return in Michigan, usually April 15th.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4700 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.