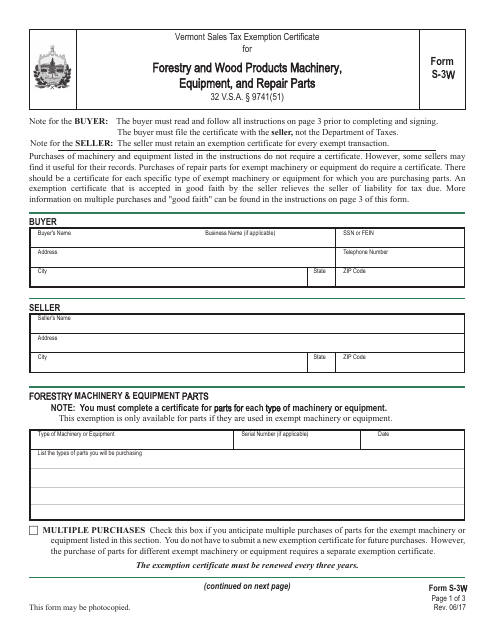

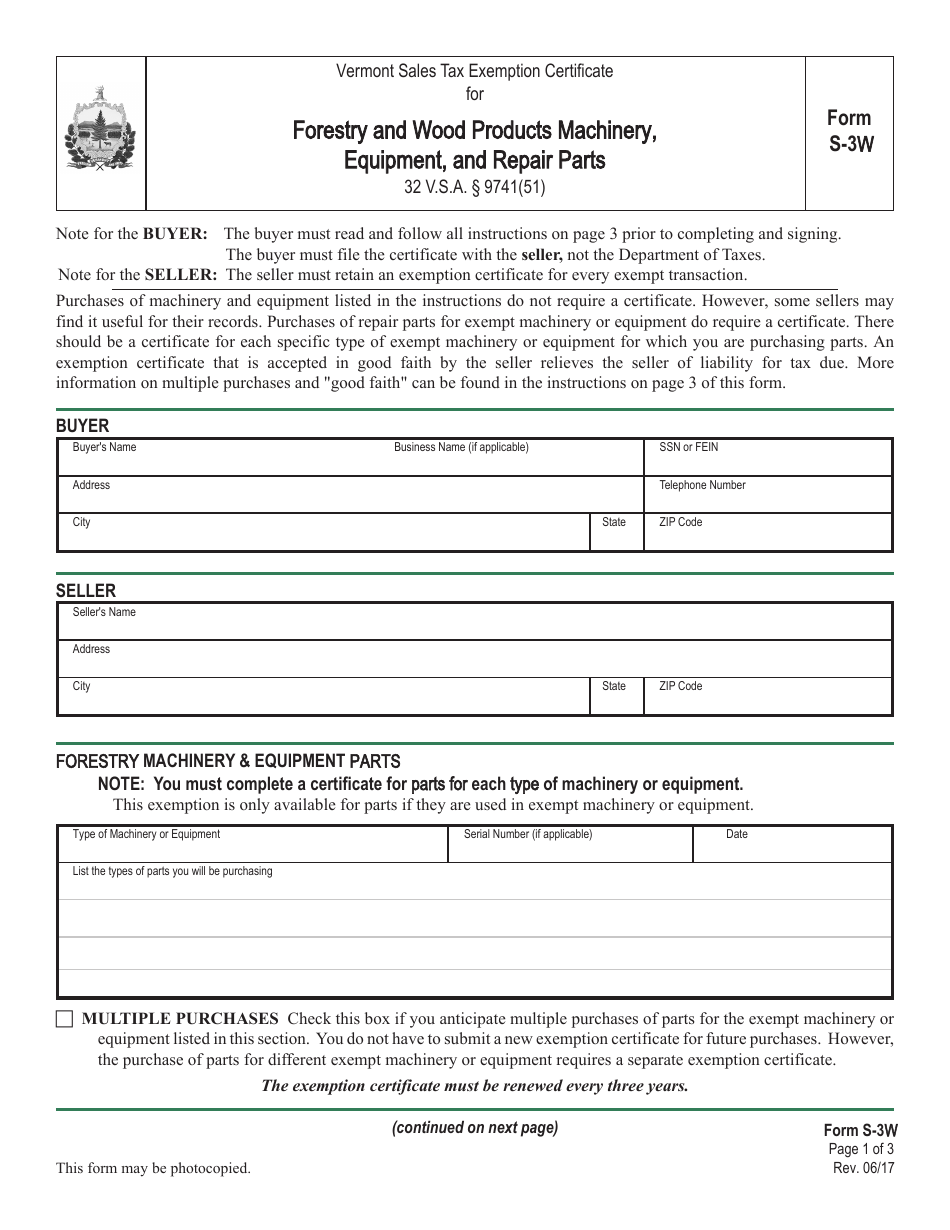

VT Form S-3W Forestry and Wood Products Machinery, Equipment, and Repair Parts - Vermont

What Is VT Form S-3W?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form S-3W?

A: VT Form S-3W refers to a specific tax form in Vermont.

Q: What does VT Form S-3W cover?

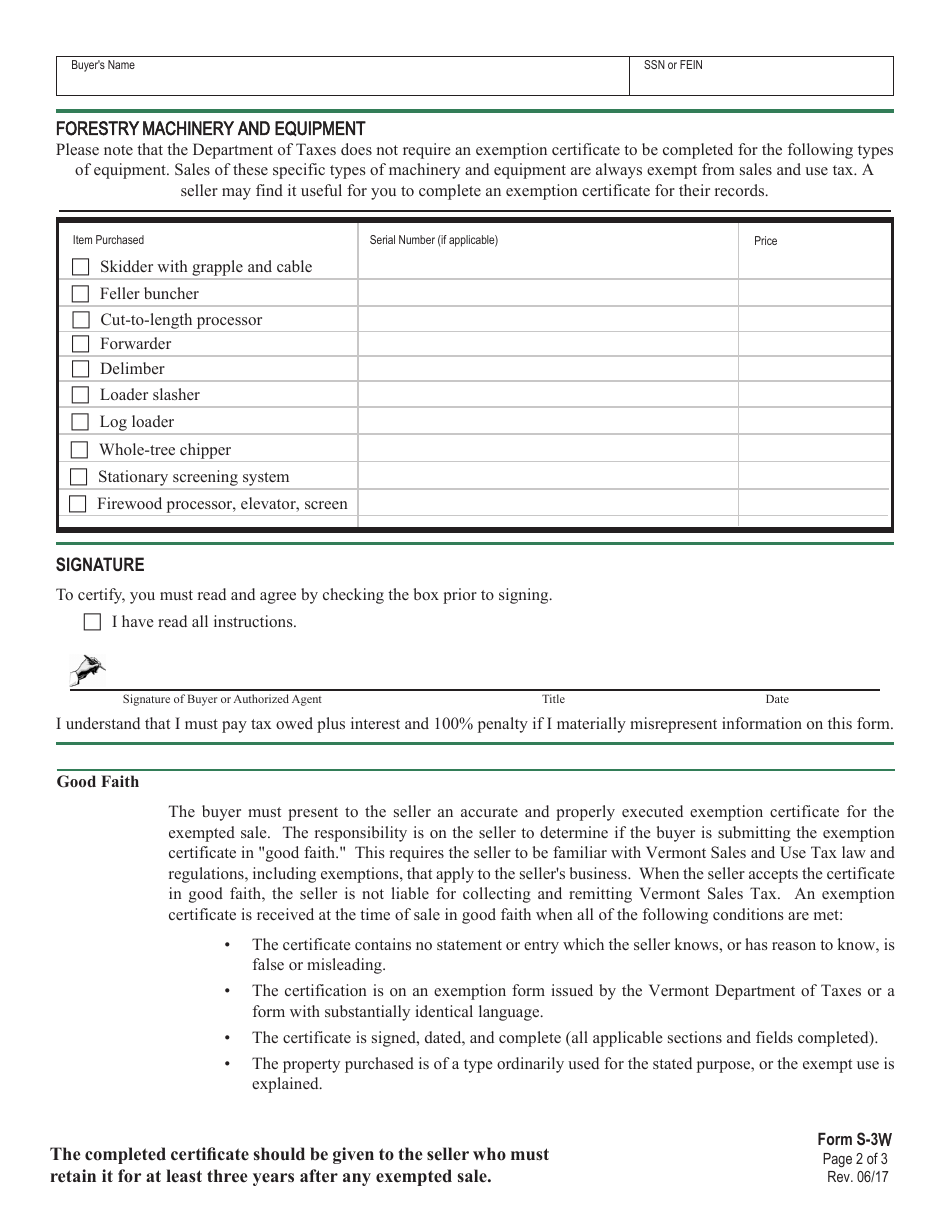

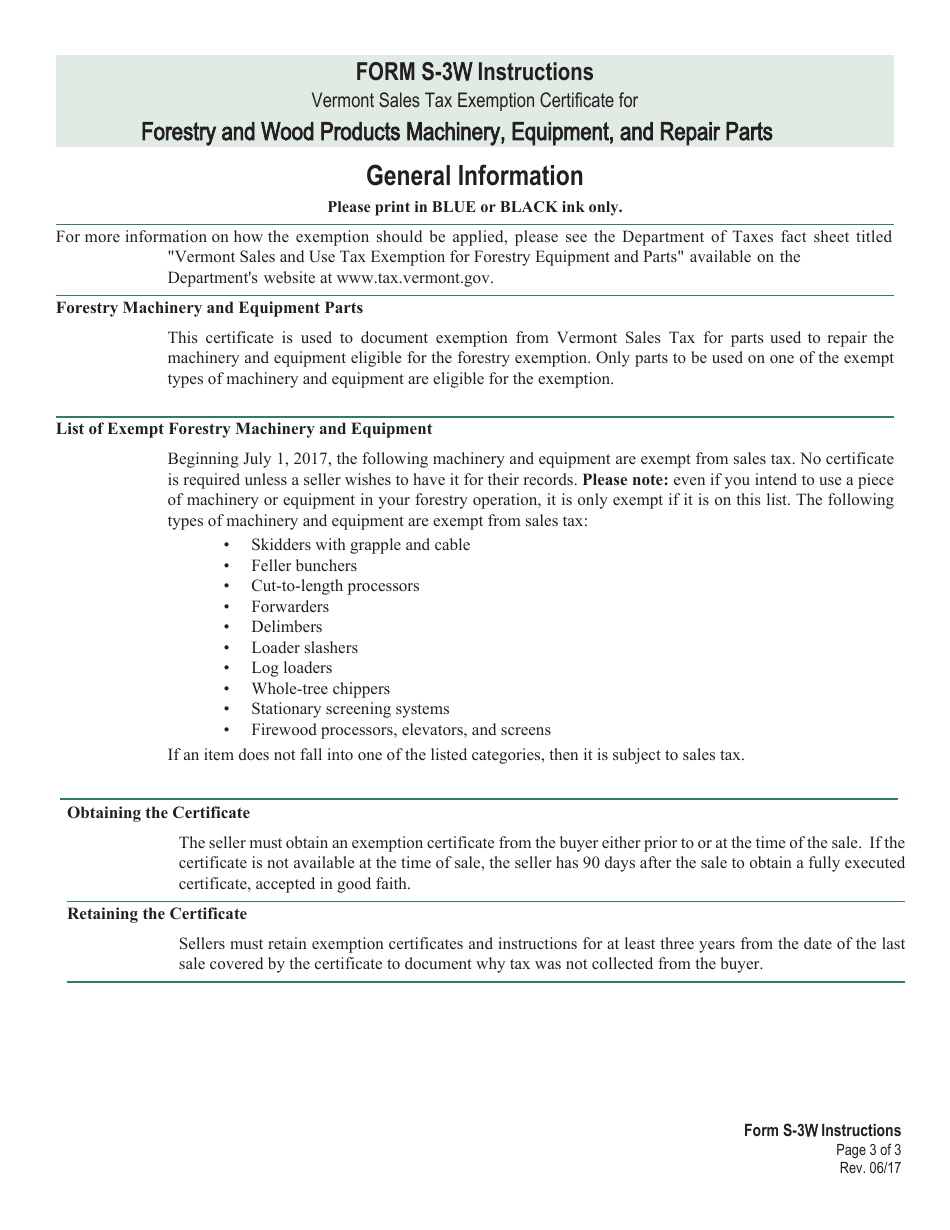

A: VT Form S-3W is used for reporting sales of forestry and wood products machinery, equipment, and repair parts.

Q: Who needs to file VT Form S-3W?

A: Anyone who sells forestry and wood products machinery, equipment, or repair parts in Vermont may need to file VT Form S-3W.

Q: When should VT Form S-3W be filed?

A: VT Form S-3W should be filed on a quarterly basis.

Q: Is there a deadline for filing VT Form S-3W?

A: Yes, VT Form S-3W must be filed by the last day of the month following the end of the quarter.

Q: What if I don't file VT Form S-3W?

A: Failure to file VT Form S-3W may result in penalties and interest.

Q: Are there any exemptions or deductions available for VT Form S-3W?

A: Yes, there may be exemptions and deductions available for certain sales. It is recommended to consult the instructions for VT Form S-3W or a tax professional for more information.

Q: Is VT Form S-3W only applicable to Vermont residents?

A: No, VT Form S-3W is applicable to anyone who sells forestry and wood products machinery, equipment, or repair parts in Vermont, regardless of residency.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3W by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.