This version of the form is not currently in use and is provided for reference only. Download this version of

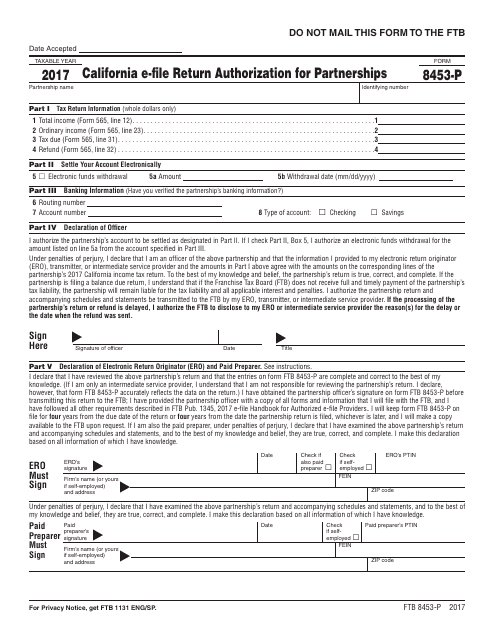

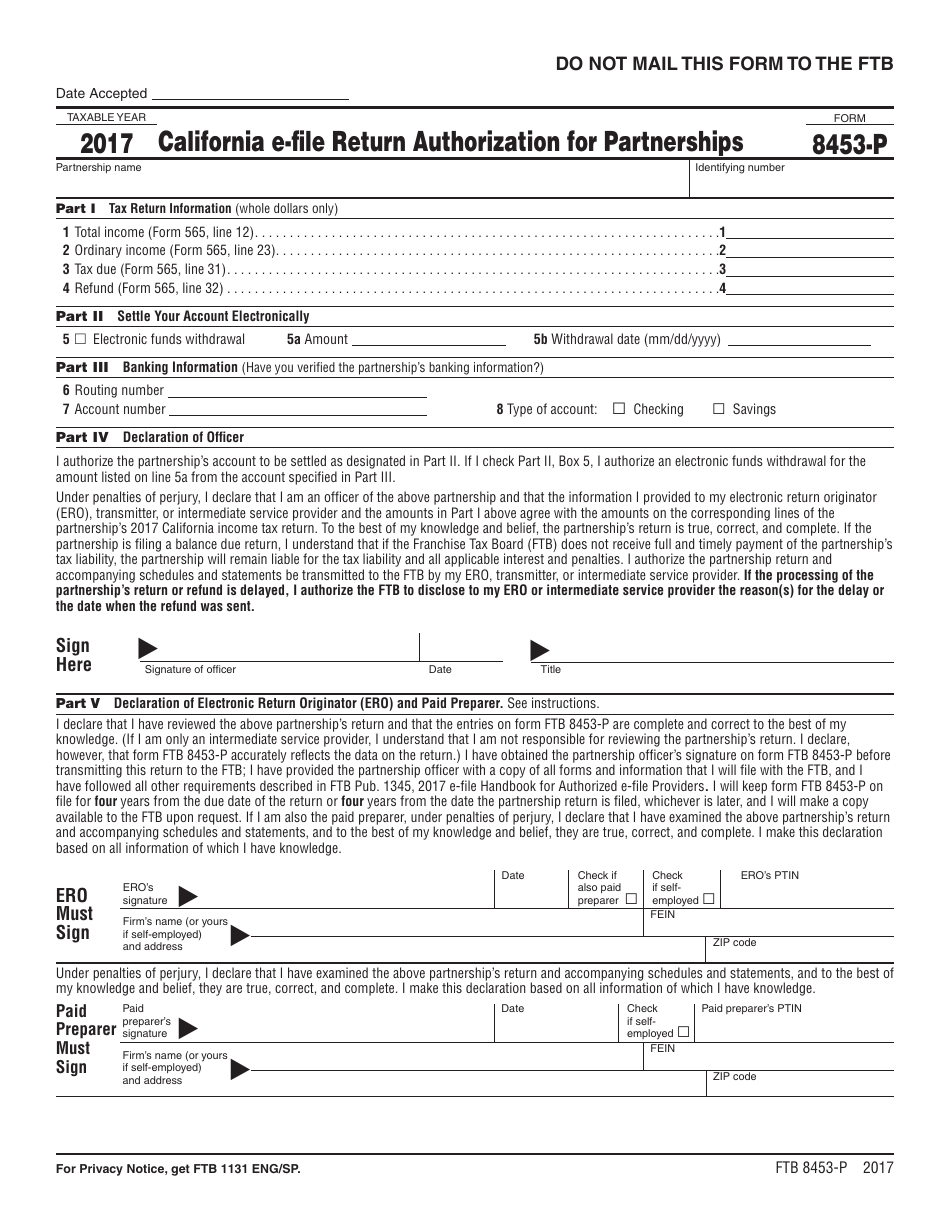

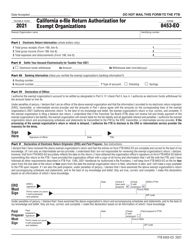

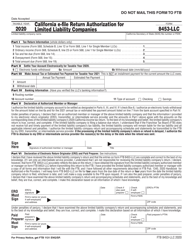

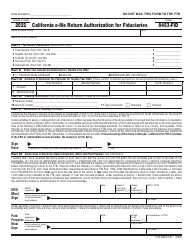

Form FTB8453-P

for the current year.

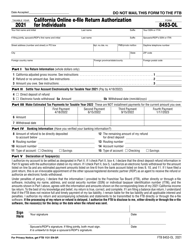

Form FTB8453-P California E-File Return Authorization for Partnerships - California

What Is Form FTB8453-P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB8453-P?

A: Form FTB8453-P is the California E-File Return Authorization for Partnerships. It is used to authorize the electronic filing of partnership tax returns in California.

Q: When is Form FTB8453-P required?

A: Form FTB8453-P is required when a partnership chooses to electronically file their tax return in California.

Q: How do I fill out Form FTB8453-P?

A: Form FTB8453-P requires basic information about the partnership, including the partnership's name, address, and EIN (Employer Identification Number). It also requires a signature from one of the partners.

Q: Can I electronically file my partnership tax return in California?

A: Yes, California allows partnerships to electronically file their tax returns. Form FTB8453-P is required to authorize electronic filing.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB8453-P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.