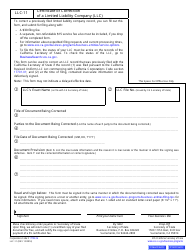

This version of the form is not currently in use and is provided for reference only. Download this version of

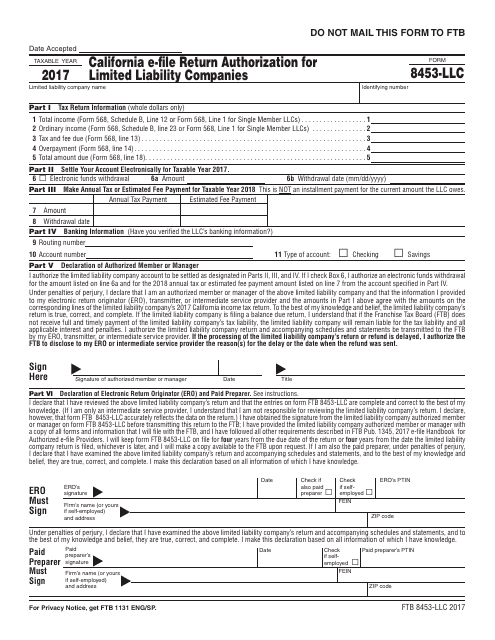

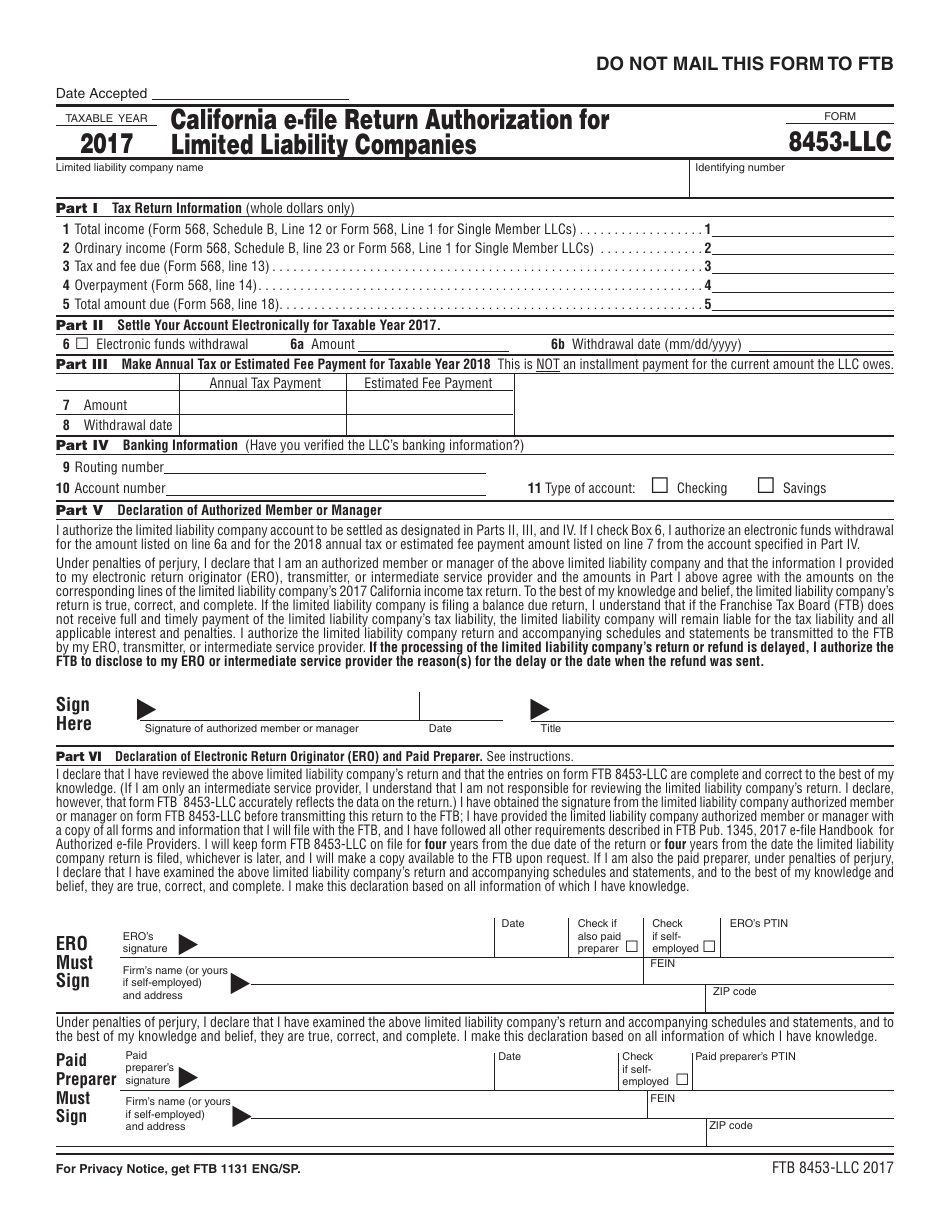

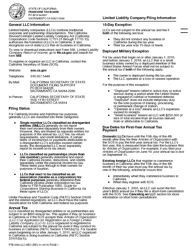

Form FTB8453-LLC

for the current year.

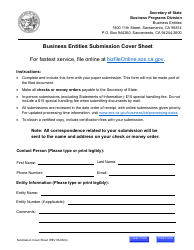

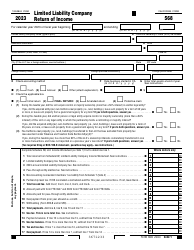

Form FTB8453-LLC California E-File Return Authorization for Limited Liability Companies - California

What Is Form FTB8453-LLC?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB8453-LLC?

A: Form FTB8453-LLC is the California E-File Return Authorization for Limited Liability Companies.

Q: Who files Form FTB8453-LLC?

A: Limited Liability Companies (LLCs) in California file Form FTB8453-LLC.

Q: What is the purpose of Form FTB8453-LLC?

A: Form FTB8453-LLC is used to authorize the electronic filing of LLC tax returns in California.

Q: Is Form FTB8453-LLC mandatory for LLCs in California?

A: Yes, LLCs in California are required to file Form FTB8453-LLC if they choose to e-file their tax returns.

Q: Are there any fees associated with filing Form FTB8453-LLC?

A: No, there are no fees associated with filing Form FTB8453-LLC.

Q: Can I file Form FTB8453-LLC electronically?

A: Yes, Form FTB8453-LLC is specifically for authorizing the electronic filing of LLC tax returns.

Q: When is Form FTB8453-LLC due?

A: The due date for Form FTB8453-LLC is the same as the due date for the LLC tax return, which is typically April 15th.

Q: What should I do after filing Form FTB8453-LLC?

A: After filing Form FTB8453-LLC, you should retain a copy for your records and proceed with e-filing your LLC tax return.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB8453-LLC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.