This version of the form is not currently in use and is provided for reference only. Download this version of

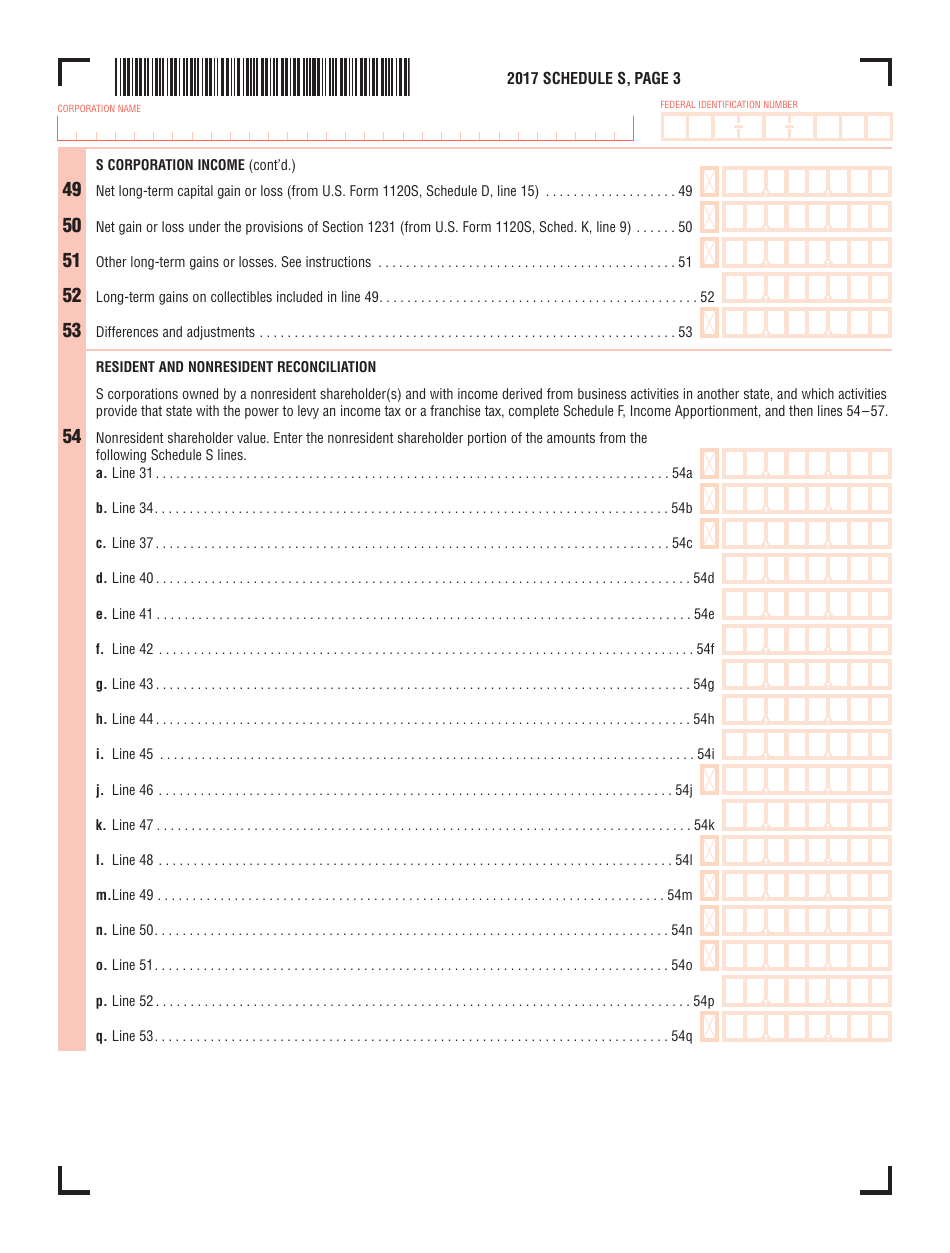

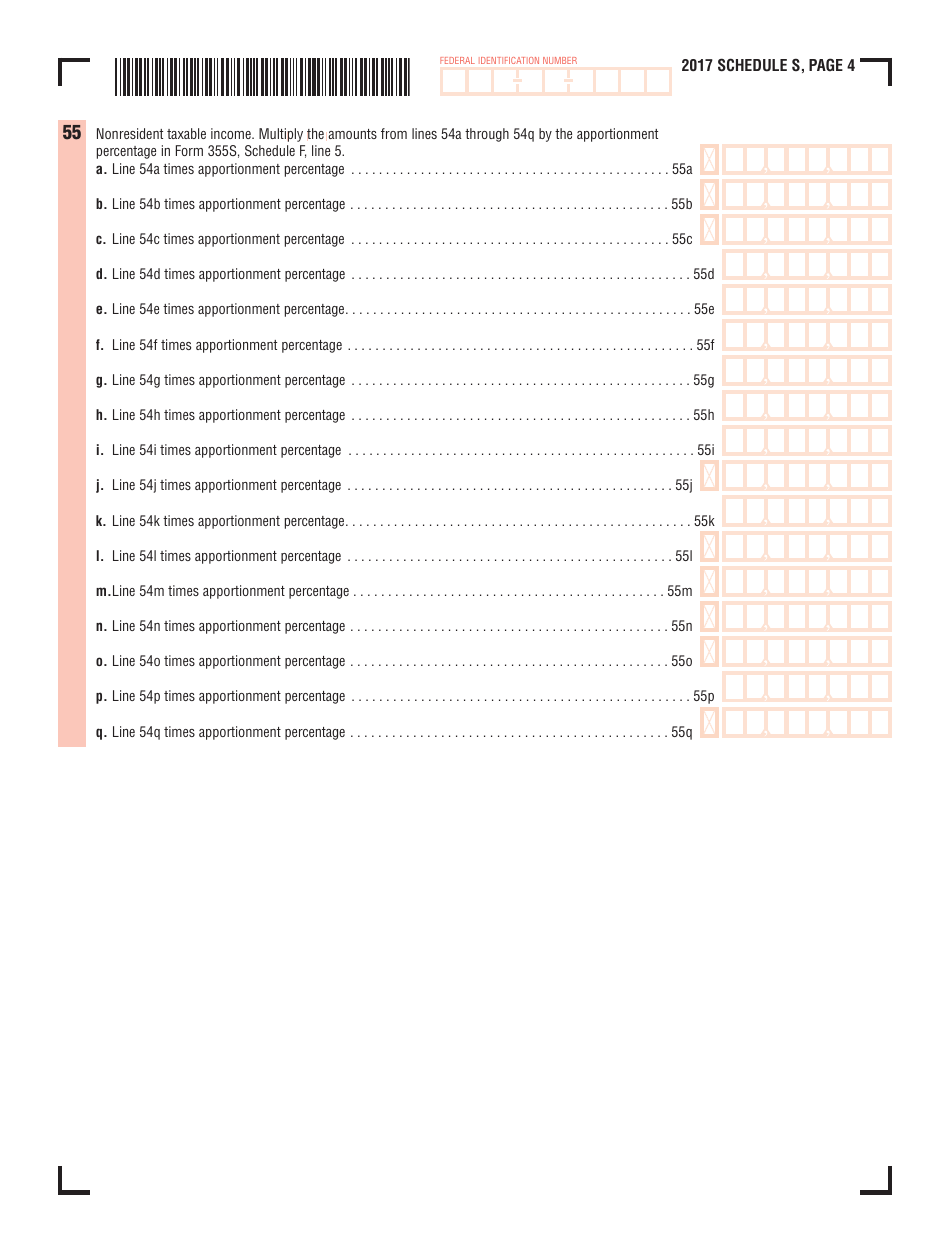

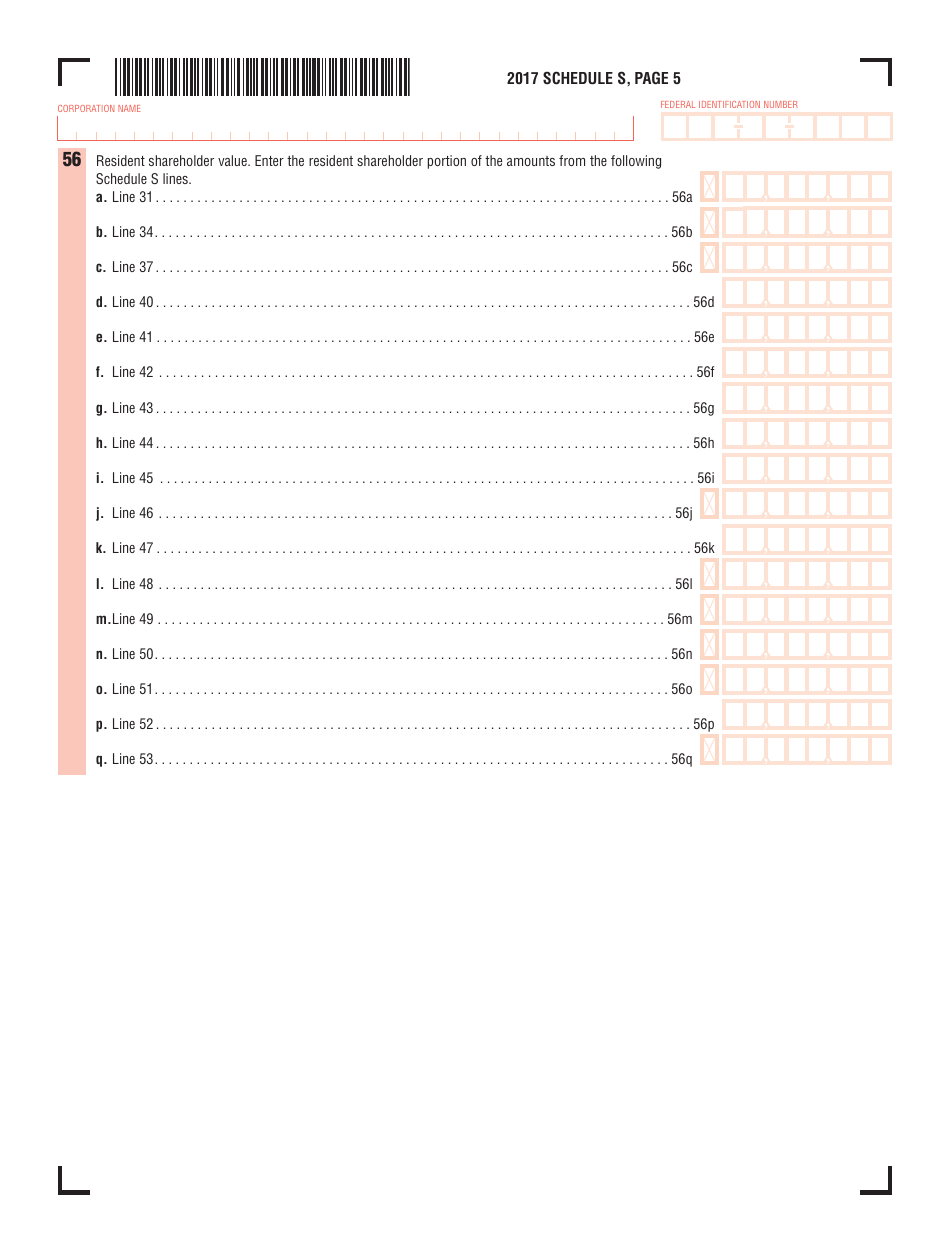

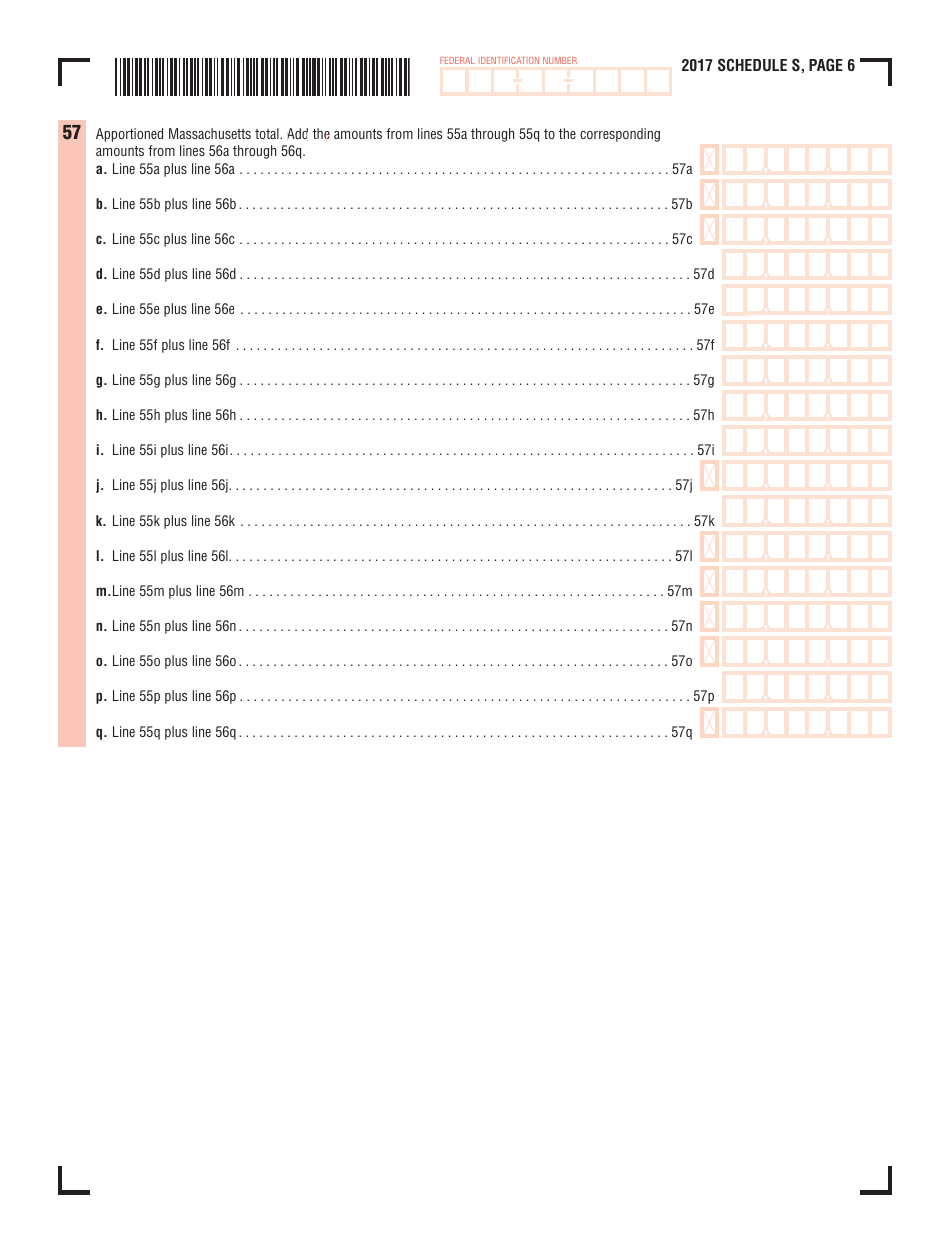

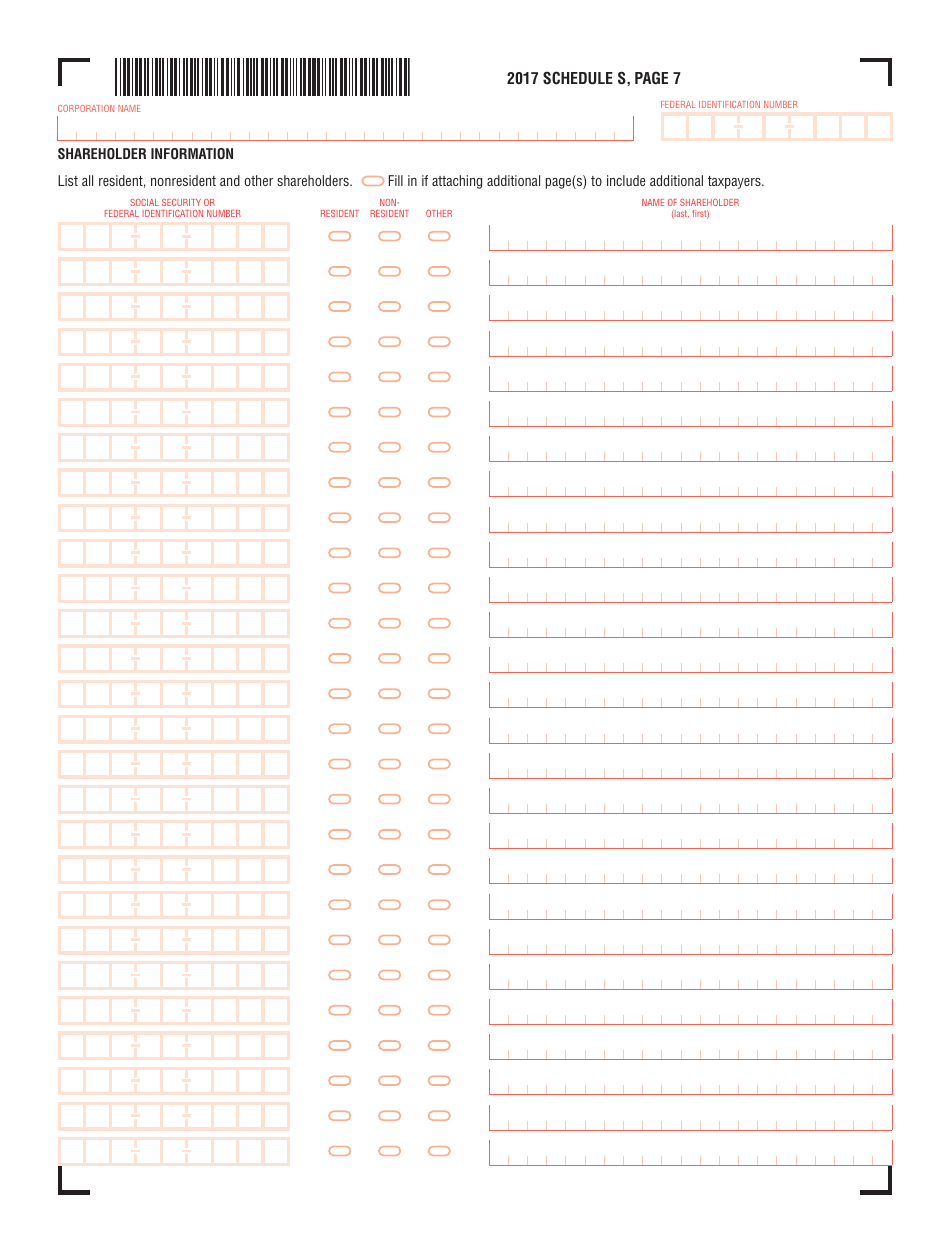

Schedule S

for the current year.

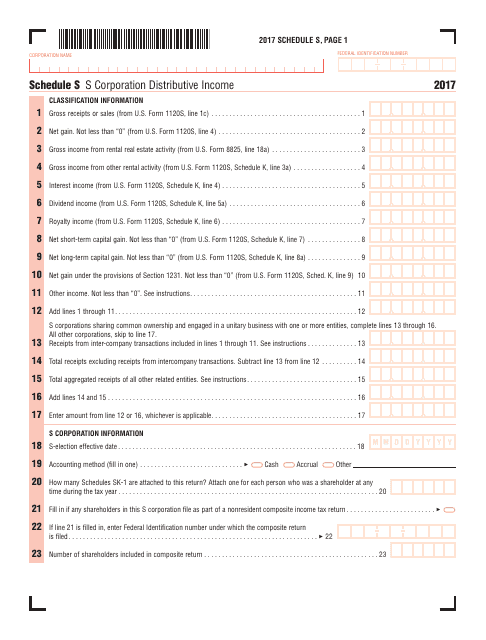

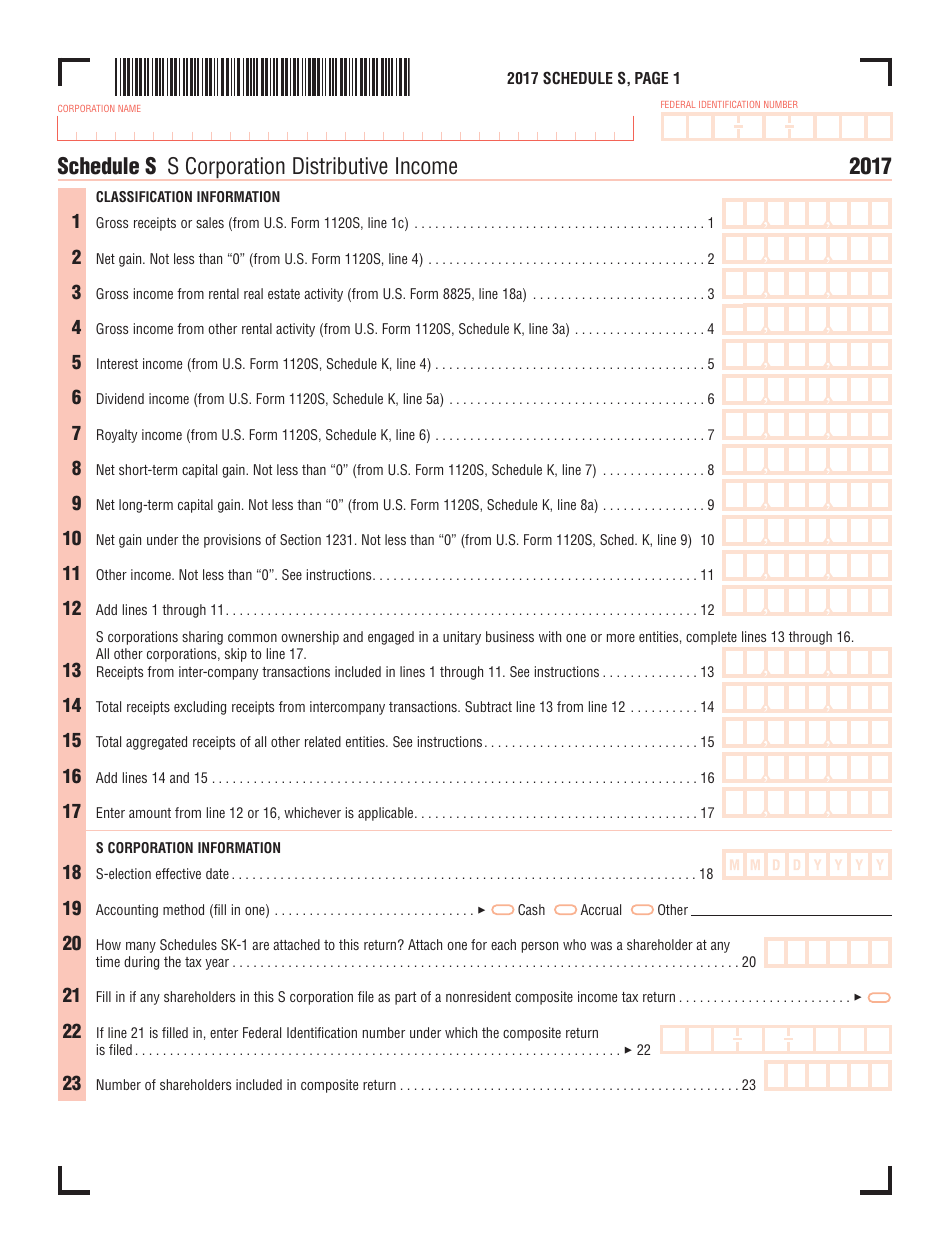

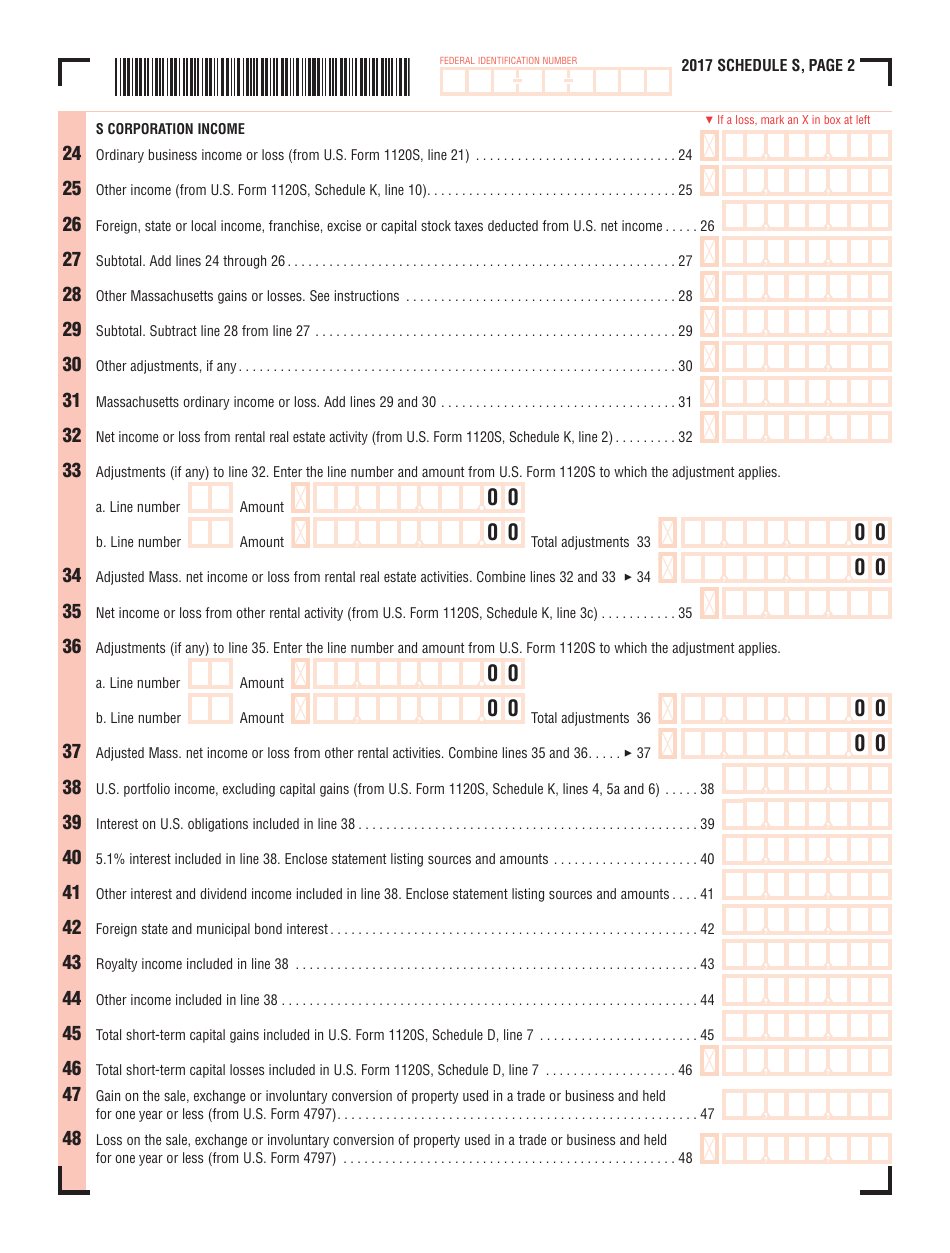

Schedule S S Corporation Distributive Income - Massachusetts

What Is Schedule S?

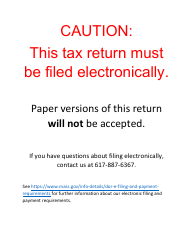

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule S?

A: Schedule S is a form used to report the S Corporation's distributive income in Massachusetts.

Q: What is an S Corporation?

A: An S Corporation is a type of business entity that passes its income, losses, deductions, and credits to its shareholders for federal tax purposes.

Q: What is distributive income?

A: Distributive income is the portion of the S Corporation's income that is allocated to each shareholder based on their ownership percentage.

Q: Why is Schedule S important?

A: Schedule S is important because it determines the amount of distributive income that each shareholder must report on their individual tax returns.

Q: Who needs to file Schedule S?

A: S Corporations that operate in Massachusetts and have shareholders who are residents of Massachusetts or have Massachusetts source income must file Schedule S.

Q: When is Schedule S due?

A: Schedule S is typically due on the same date as the S Corporation's federal tax return, which is usually March 15th.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule S by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.