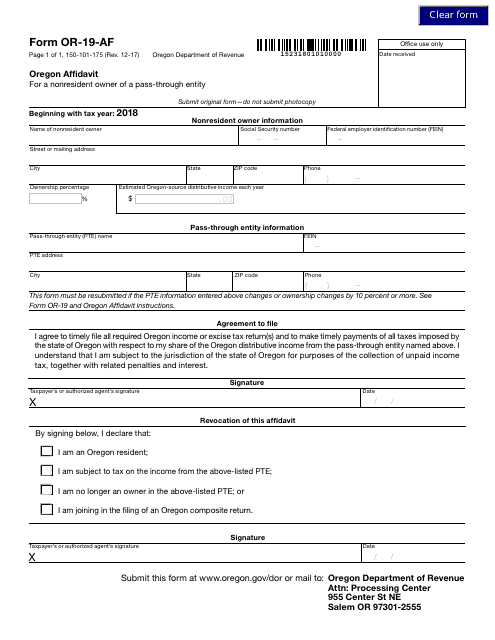

Form OR-19-AF Oregon Affidavit - Oregon

What Is Form OR-19-AF?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form OR-19-AF?

A: The Form OR-19-AF is the Oregon Affidavit form.

Q: What is the purpose of the Form OR-19-AF?

A: The purpose of the Form OR-19-AF is to provide information about the estate of a deceased person in Oregon.

Q: Is the Form OR-19-AF required for all estates in Oregon?

A: No, the Form OR-19-AF is only required for estates that meet certain criteria, such as having a gross estate value above a certain threshold.

Q: Do I need to file the Form OR-19-AF if I am not the executor of the estate?

A: No, the Form OR-19-AF should be filed by the executor of the estate or their authorized representative.

Q: When should I file the Form OR-19-AF?

A: The Form OR-19-AF should be filed within nine months after the date of death or within nine months after the decedent's last day of residency in Oregon, whichever is later.

Q: Are there any fees associated with filing the Form OR-19-AF?

A: There is no filing fee for the Form OR-19-AF.

Q: What information do I need to provide on the Form OR-19-AF?

A: You will need to provide information about the decedent, the estate assets and liabilities, and any beneficiaries or heirs.

Q: What happens after I file the Form OR-19-AF?

A: After you file the Form OR-19-AF, the Oregon Department of Revenue will review the information and may contact you if they need additional documentation or have further questions.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-19-AF by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.