This version of the form is not currently in use and is provided for reference only. Download this version of

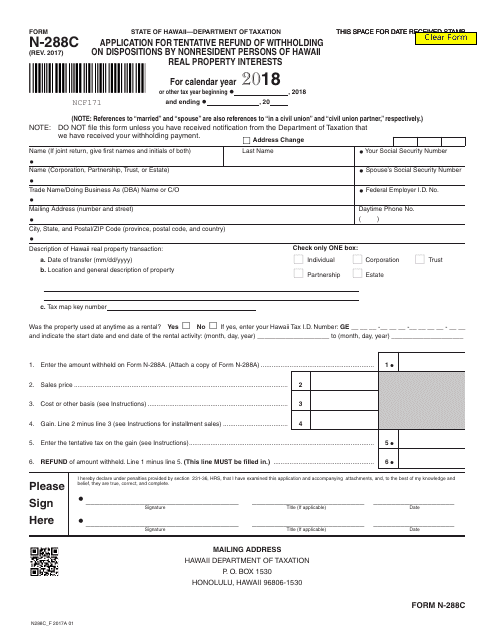

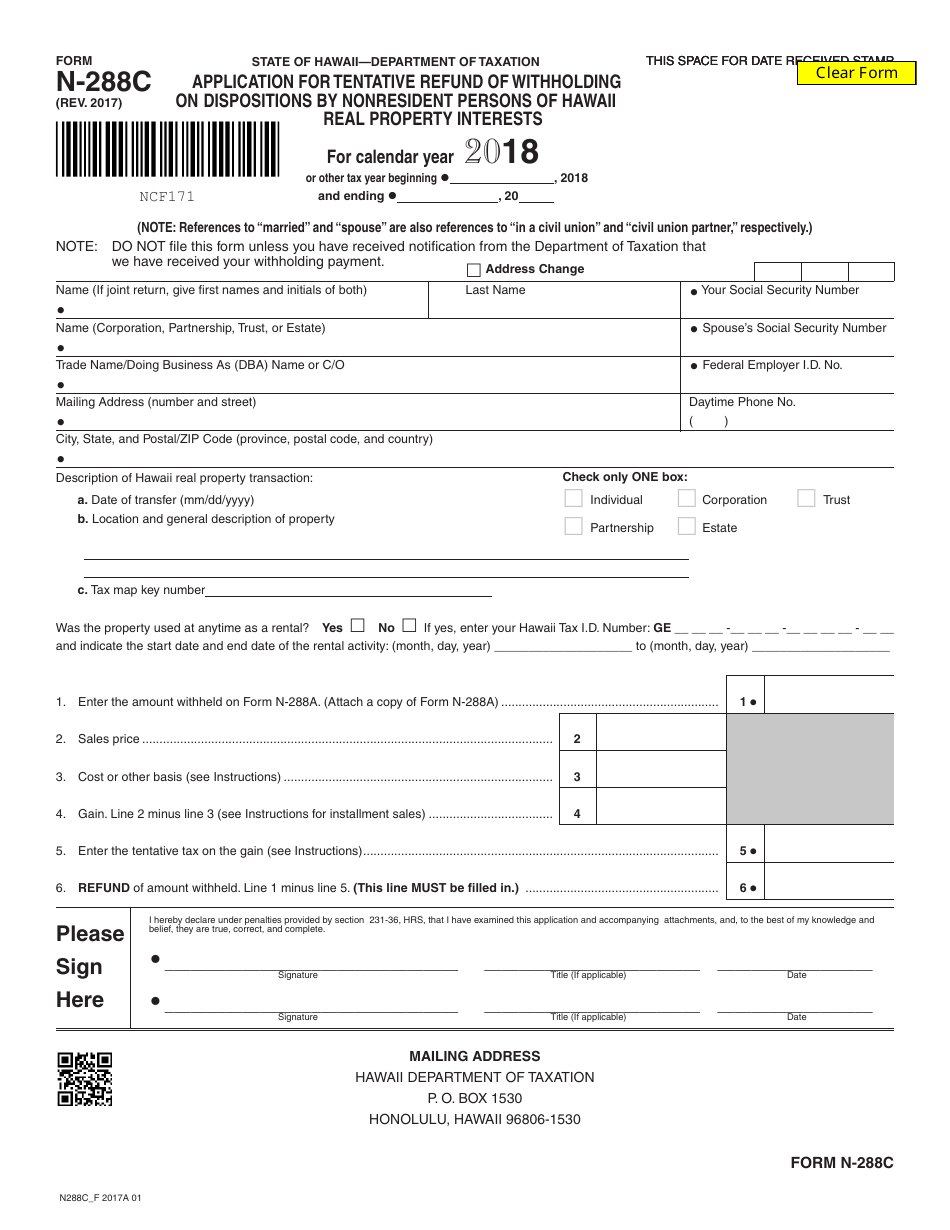

Form N-288C

for the current year.

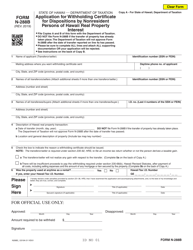

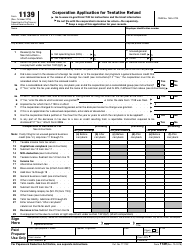

Form N-288C Application for Tentative Refund of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests - Hawaii

What Is Form N-288C?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288C?

A: Form N-288C is the application for tentative refund of withholding on dispositions by nonresident persons of Hawaii real property interests.

Q: Who needs to file Form N-288C?

A: Nonresident persons who have disposed of Hawaii real property interests and had withholding tax withheld need to file Form N-288C.

Q: What is the purpose of Form N-288C?

A: The purpose of Form N-288C is to apply for a tentative refund of withholding tax on the disposition of Hawaii real property interests.

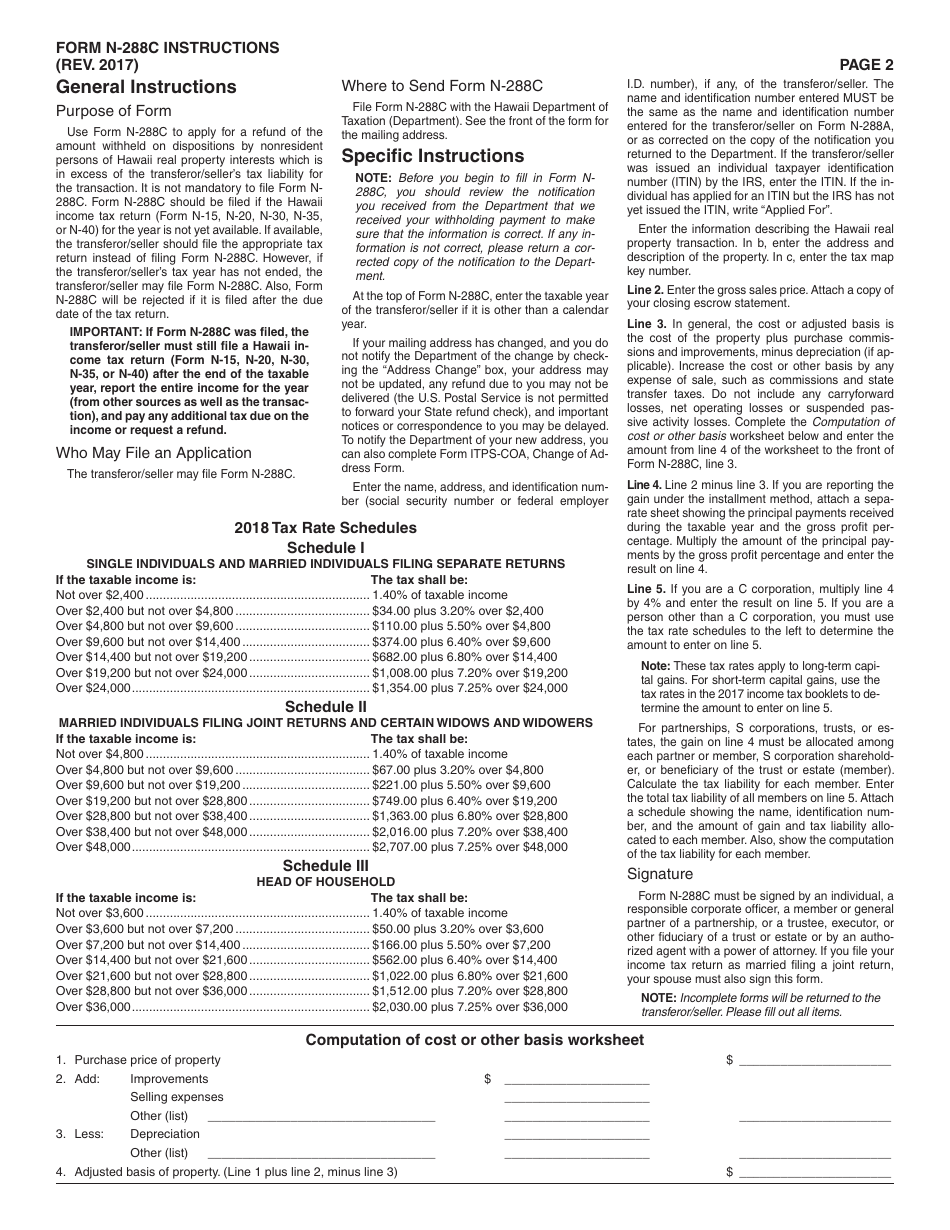

Q: What information is required on Form N-288C?

A: Form N-288C requires information about the nonresident person, the Hawaii real property interest, the withholding tax withheld, and the reason for the refund application.

Q: When is Form N-288C due?

A: Form N-288C is due within 12 months from the date of the disposition of the Hawaii real property interest.

Q: What happens after filing Form N-288C?

A: After filing Form N-288C, the Hawaii Department of Taxation will review the application and determine if a refund will be issued.

Q: How long does it take to receive a refund after filing Form N-288C?

A: The processing time for a refund after filing Form N-288C can vary, but it usually takes several weeks to several months.

Q: Are there any fees associated with filing Form N-288C?

A: No, there are no fees associated with filing Form N-288C.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288C by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.