This version of the form is not currently in use and is provided for reference only. Download this version of

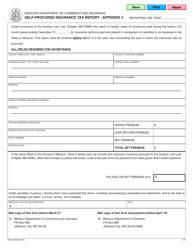

Form MO-SHC

for the current year.

Form MO-SHC Self-employed Health Insurance Tax Credit - Missouri

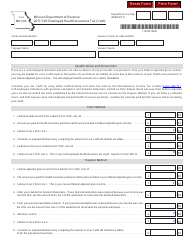

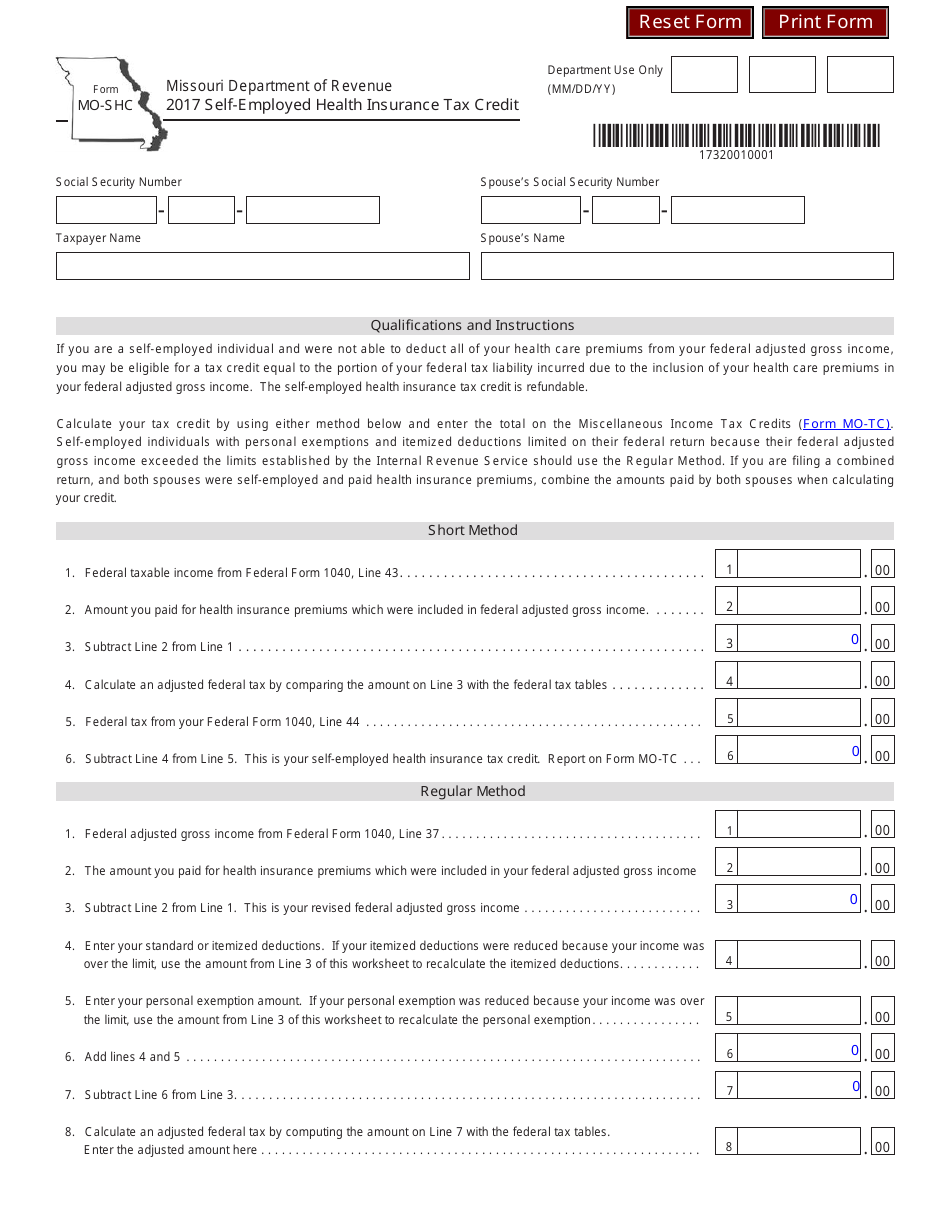

What Is Form MO-SHC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-SHC Self-employed Health Insurance Tax Credit?

A: MO-SHC is a tax credit available to self-employed individuals in Missouri who pay for their own health insurance.

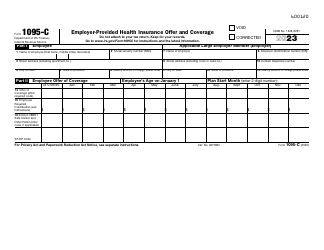

Q: Who is eligible for the MO-SHC Self-employed Health Insurance Tax Credit?

A: To be eligible, you must be a self-employed individual who pays for your own health insurance and meets certain income requirements.

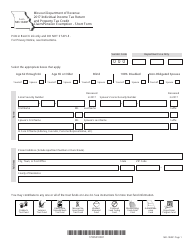

Q: How do I apply for the MO-SHC Self-employed Health Insurance Tax Credit?

A: You can apply for the MO-SHC tax credit by filling out the necessary forms and submitting them to the Missouri Department of Revenue.

Q: What expenses can be claimed for the MO-SHC Self-employed Health Insurance Tax Credit?

A: You can claim expenses for health insurance premiums that you paid for yourself and your dependents.

Q: What is the maximum amount of the MO-SHC Self-employed Health Insurance Tax Credit?

A: The maximum annual credit amount is $3500 per individual or $7000 per household.

Q: Is the MO-SHC Self-employed Health Insurance Tax Credit refundable?

A: No, the MO-SHC tax credit is non-refundable, meaning it can only reduce your Missouri state income tax liability to zero, but any excess credit cannot be refunded.

Q: Can I claim the MO-SHC Self-employed Health Insurance Tax Credit if I receive health insurance coverage through my spouse's employer?

A: No, you are not eligible for the MO-SHC tax credit if you have access to health insurance coverage through your spouse's employer.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-SHC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.