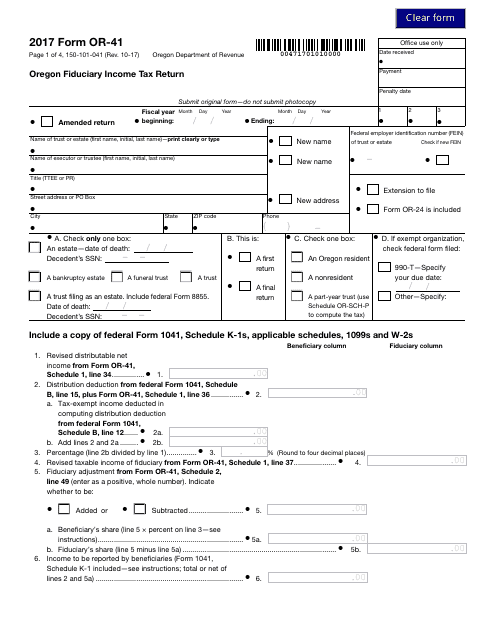

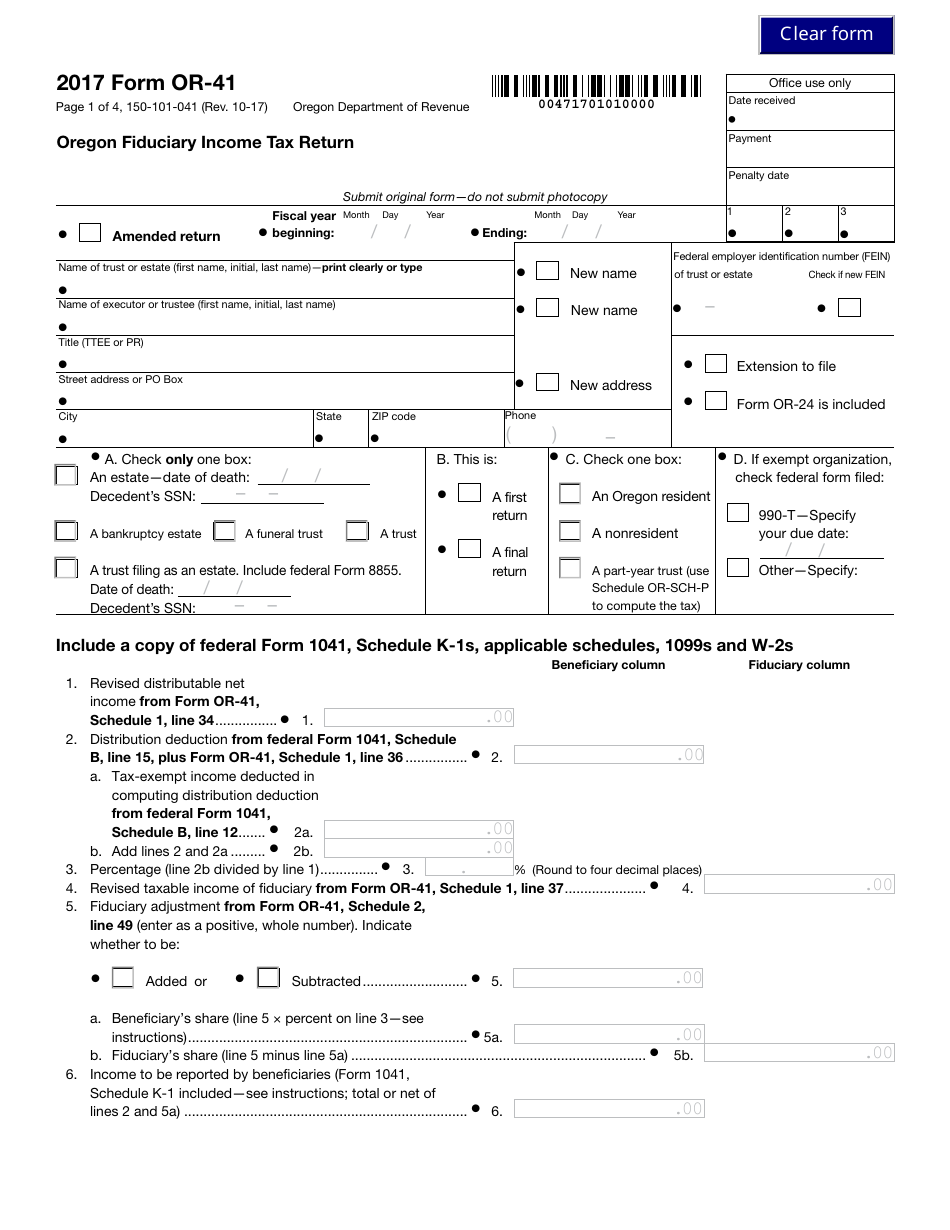

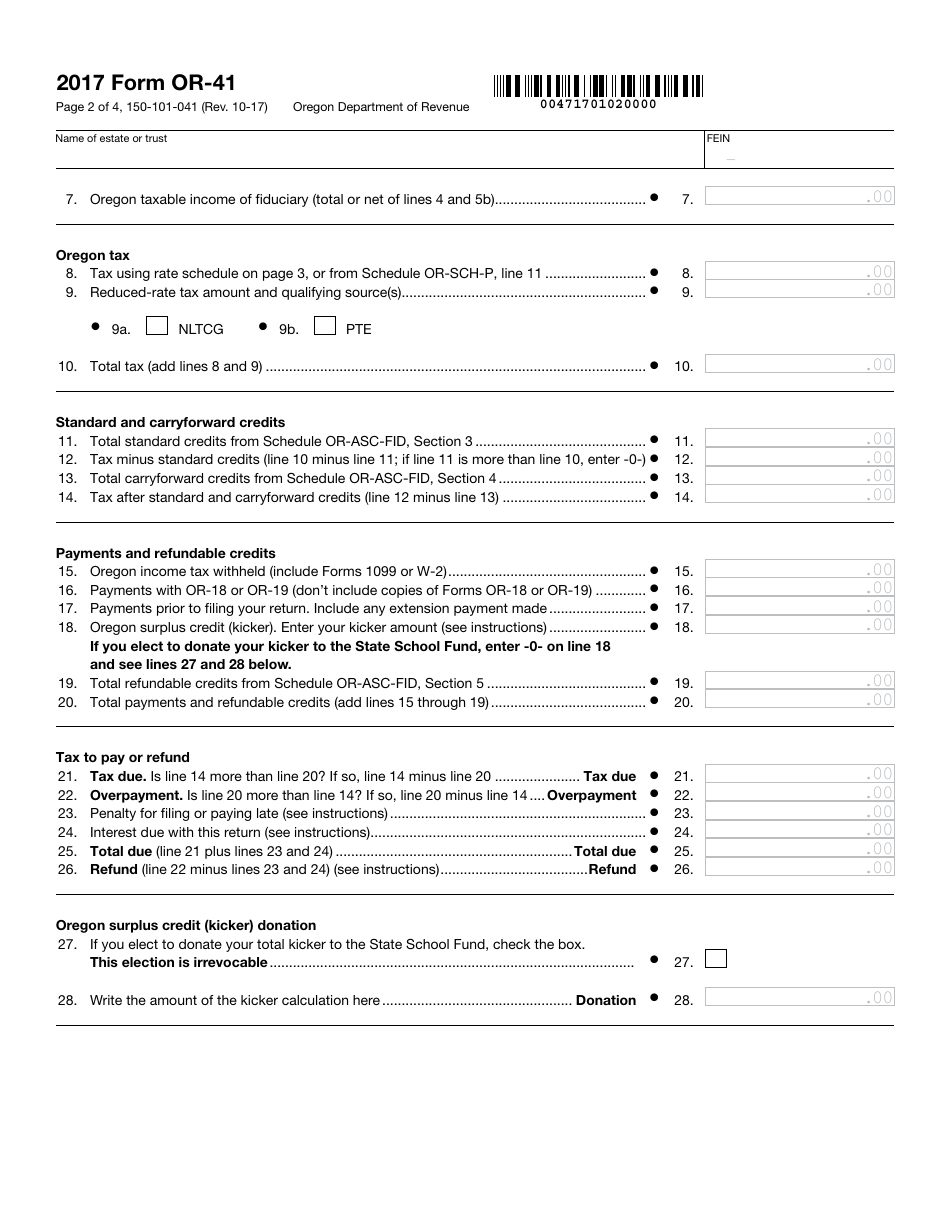

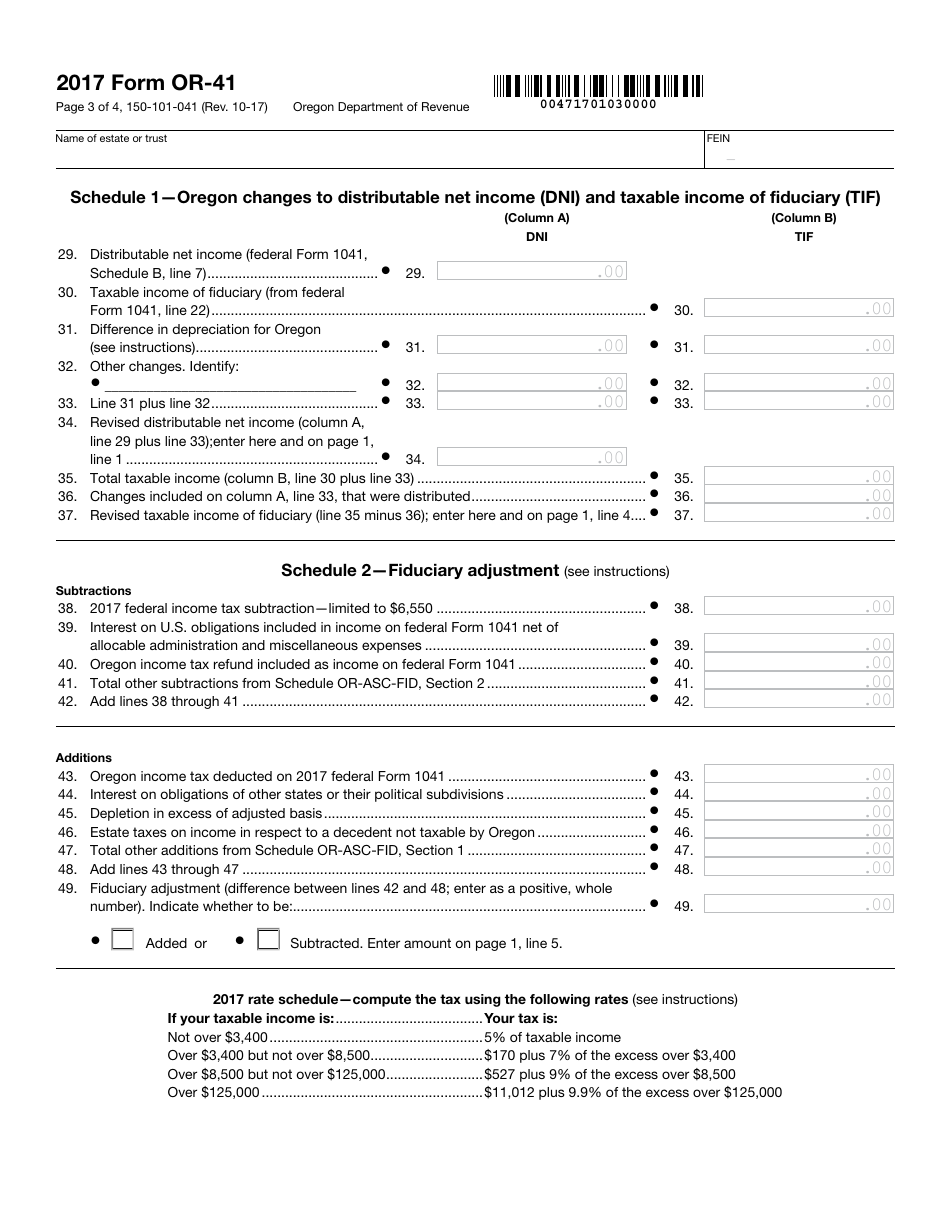

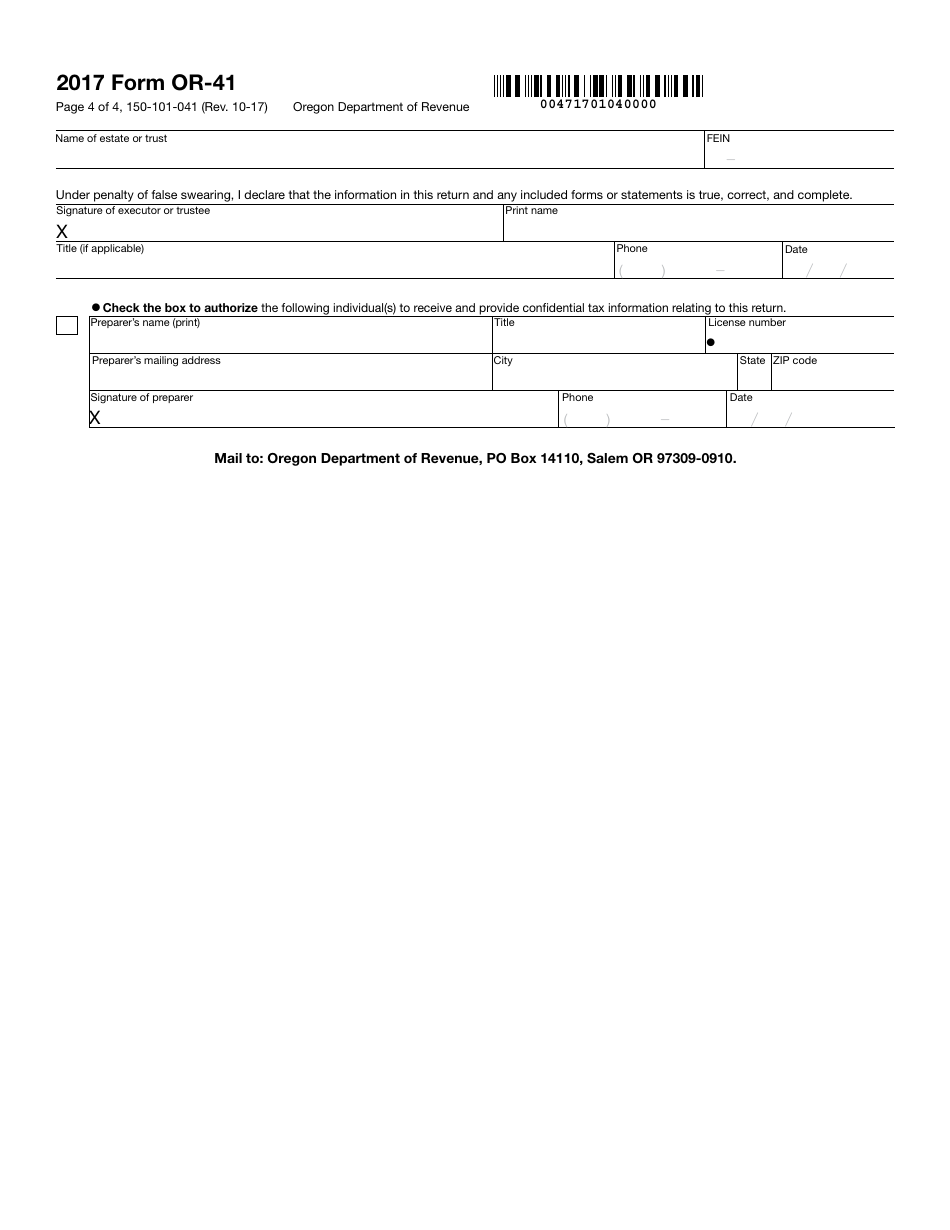

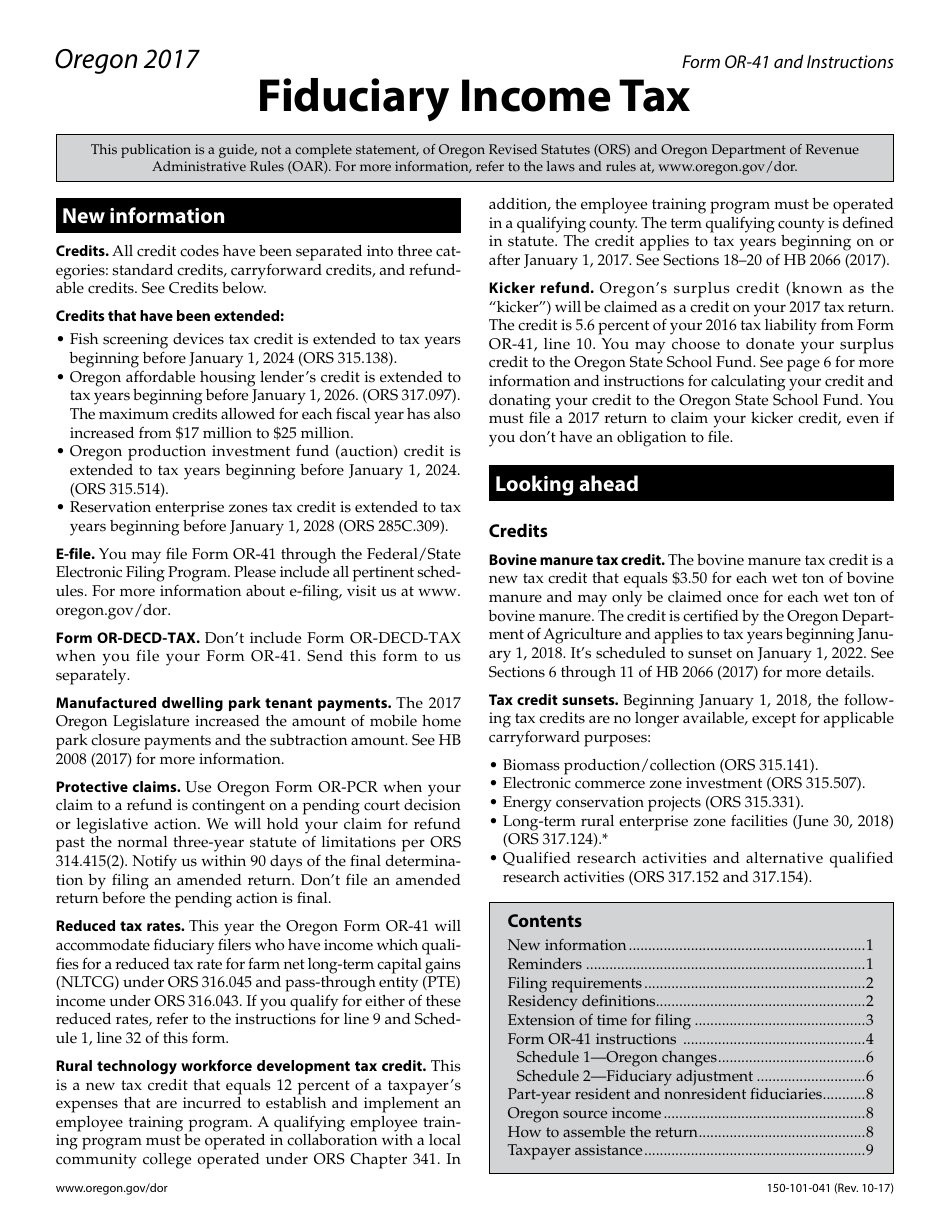

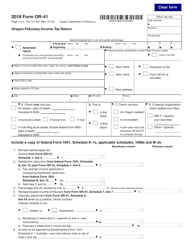

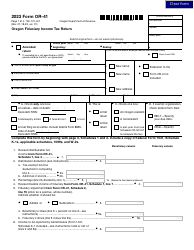

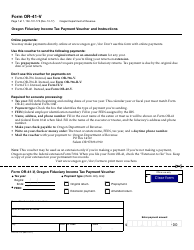

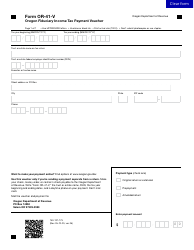

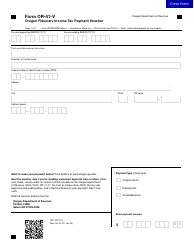

Form OR-41 Oregon Fiduciary Income Tax Return - Oregon

What Is Form OR-41?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-41?

A: Form OR-41 is the Oregon Fiduciary Income Tax Return.

Q: Who needs to file Form OR-41?

A: Form OR-41 must be filed by fiduciaries of estates or trusts that have income derived from Oregon sources.

Q: What is the purpose of Form OR-41?

A: Form OR-41 is used to report and pay income taxes on behalf of estates or trusts in Oregon.

Q: When is Form OR-41 due?

A: Form OR-41 is due on the 15th day of the fourth month following the close of the taxable year.

Q: Are there any special requirements for Form OR-41?

A: Yes, fiduciaries need to attach a copy of the federal Form 1041, U.S. Income Tax Return for Estates and Trusts, to Form OR-41.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-41 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.