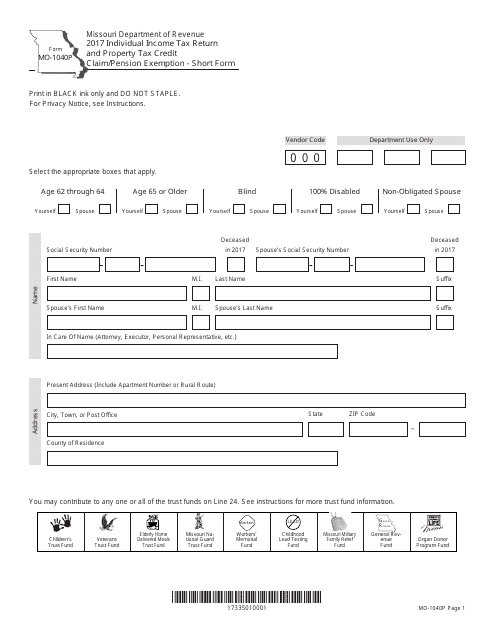

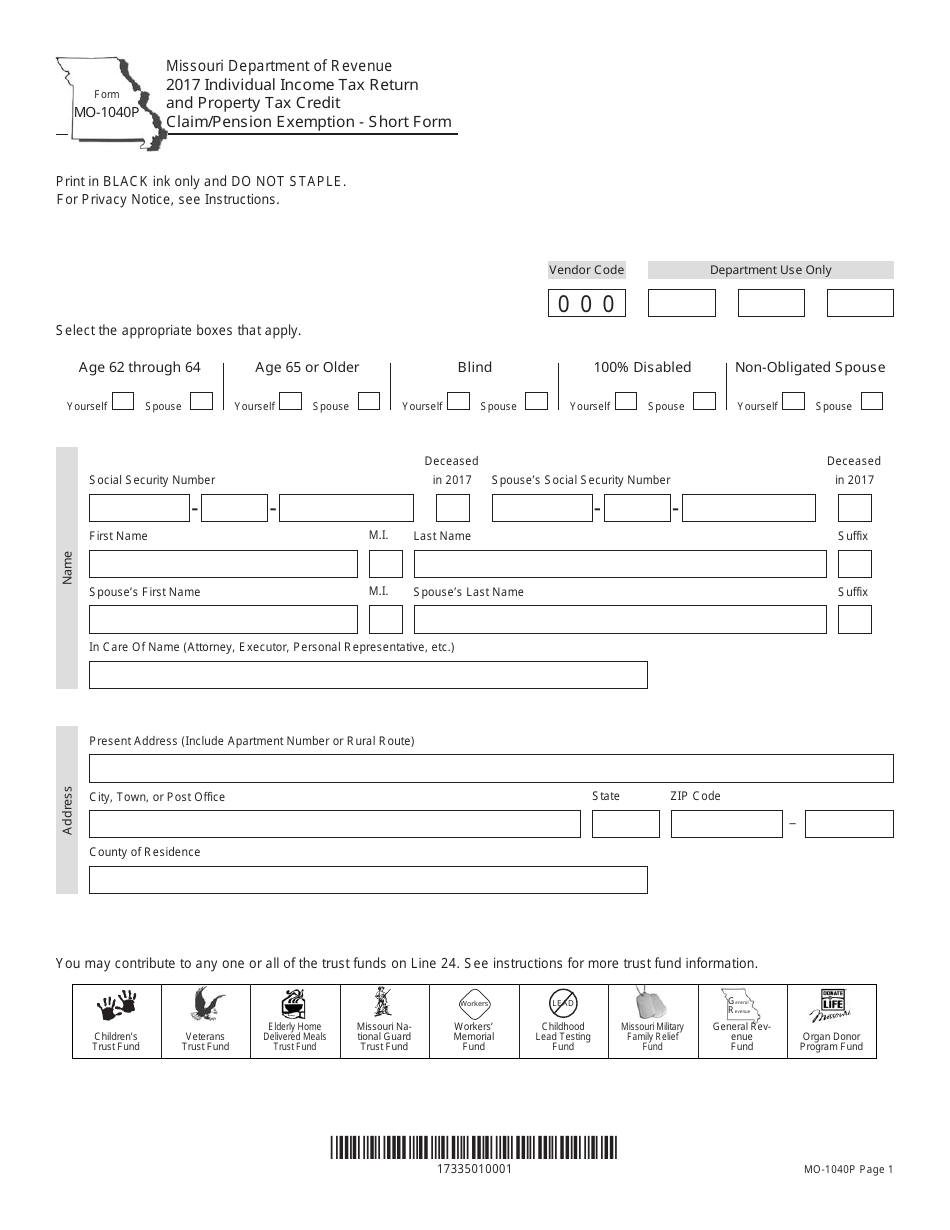

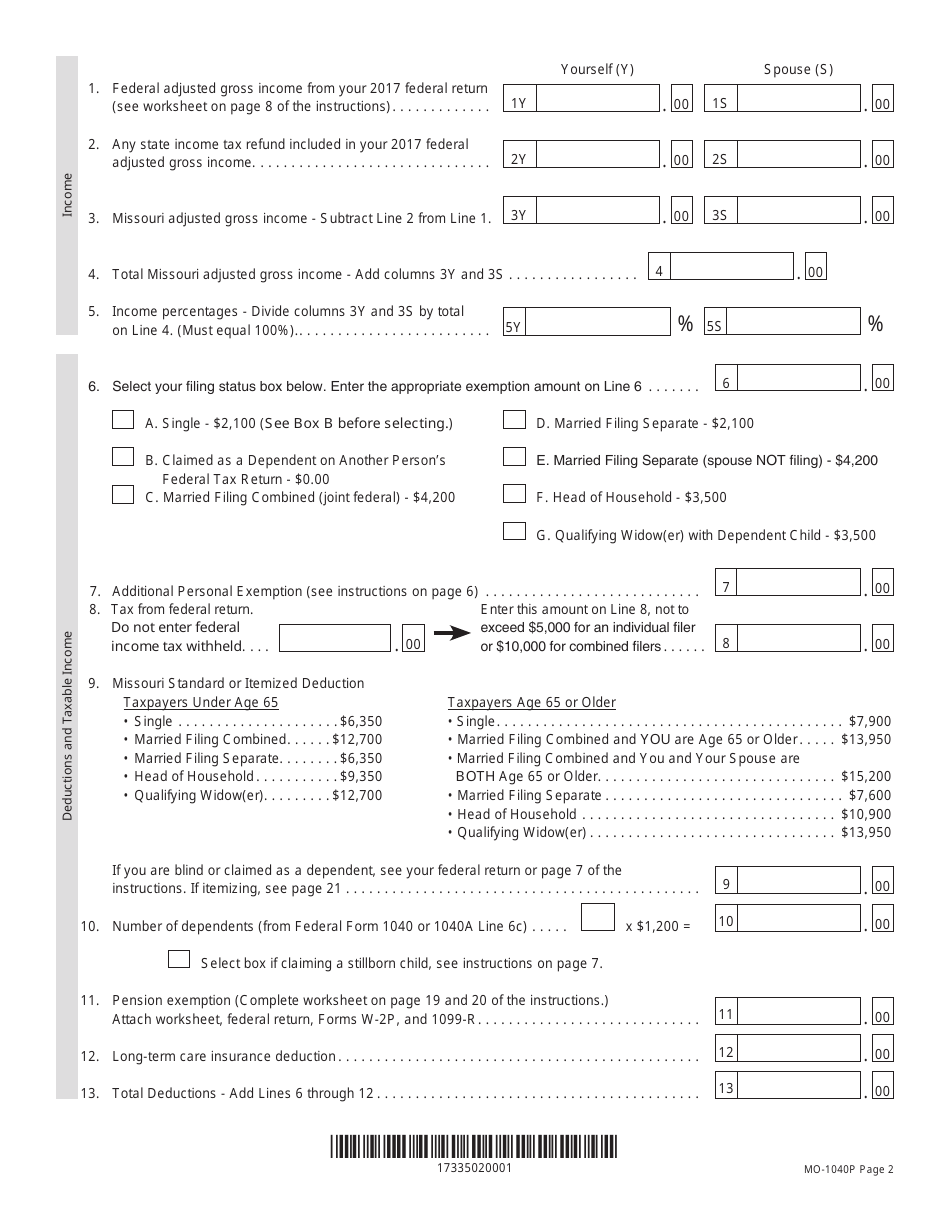

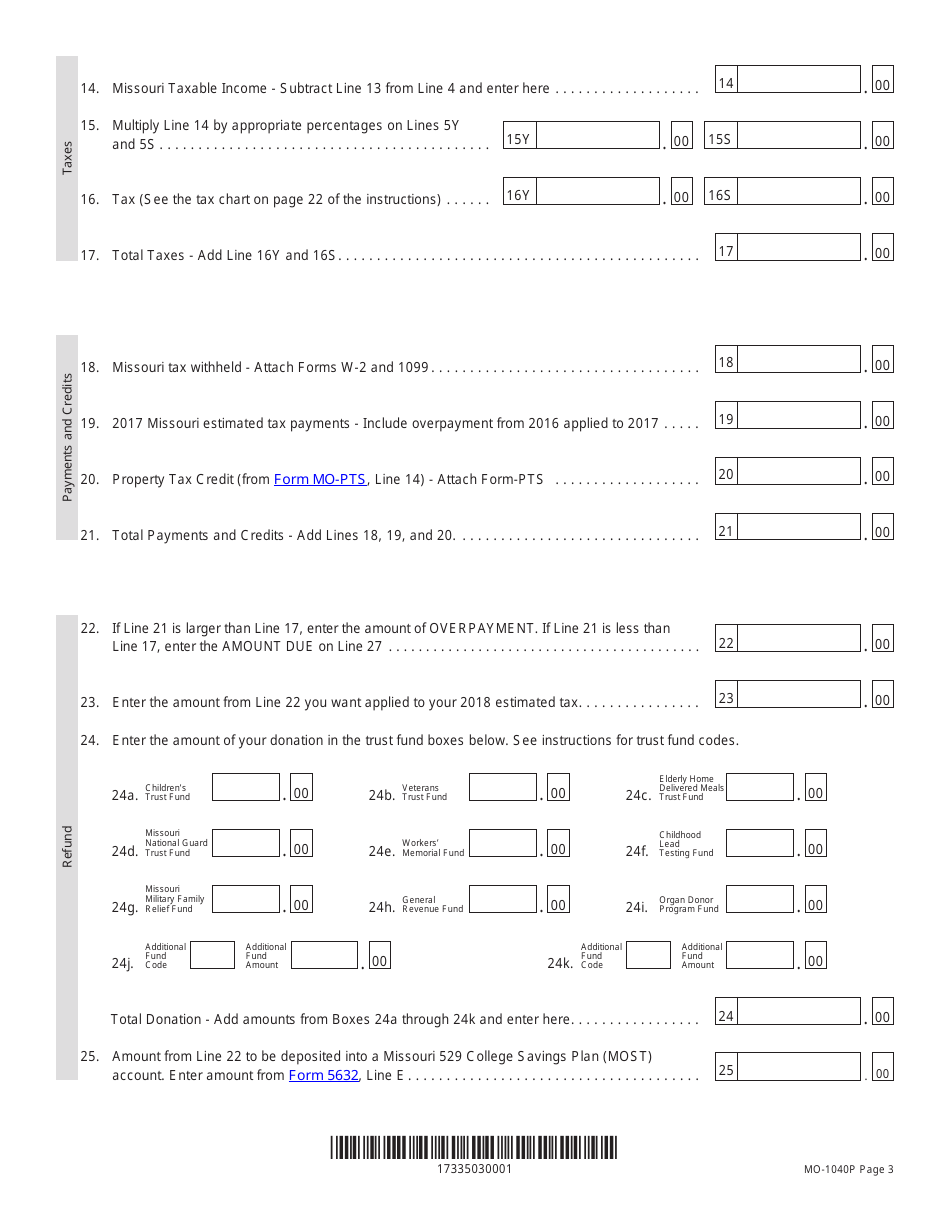

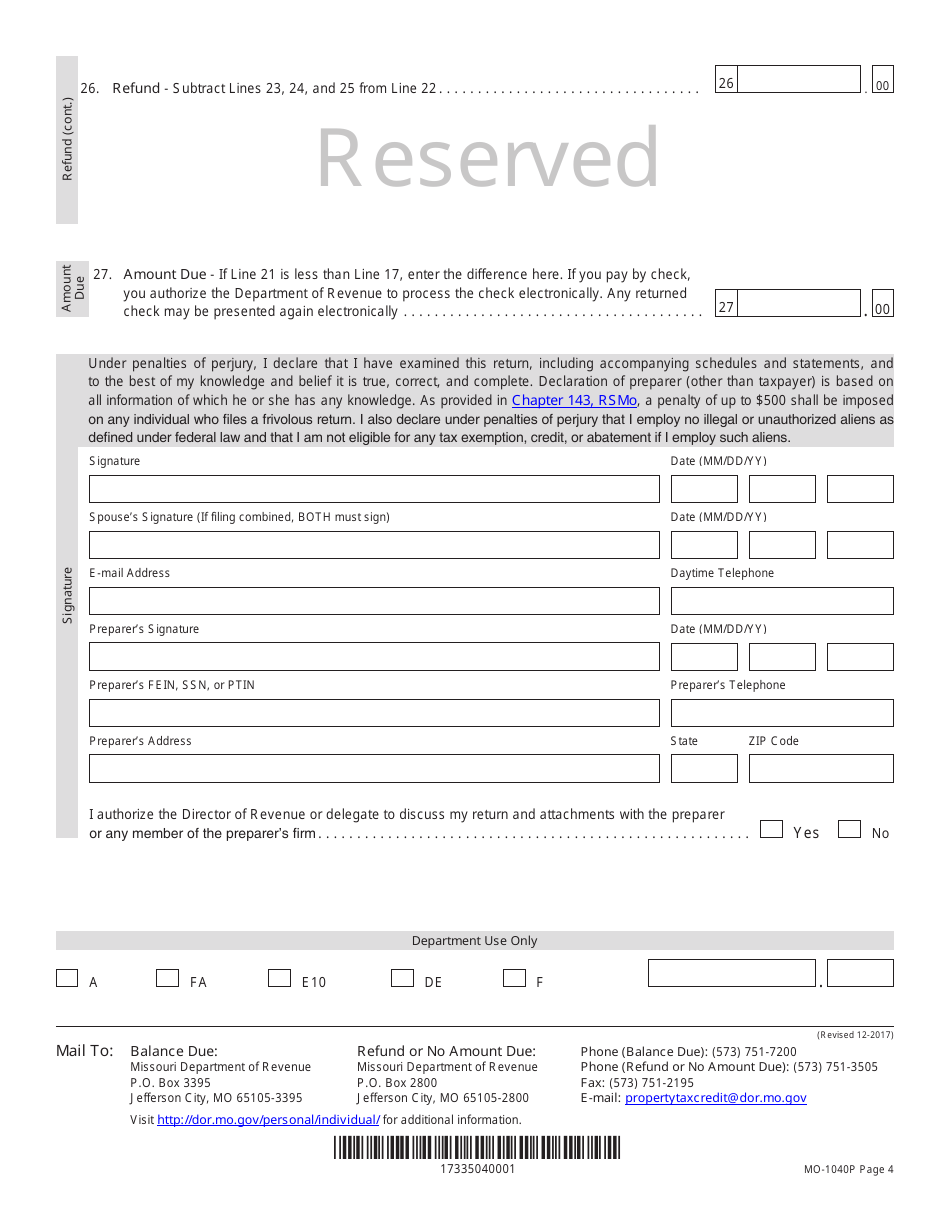

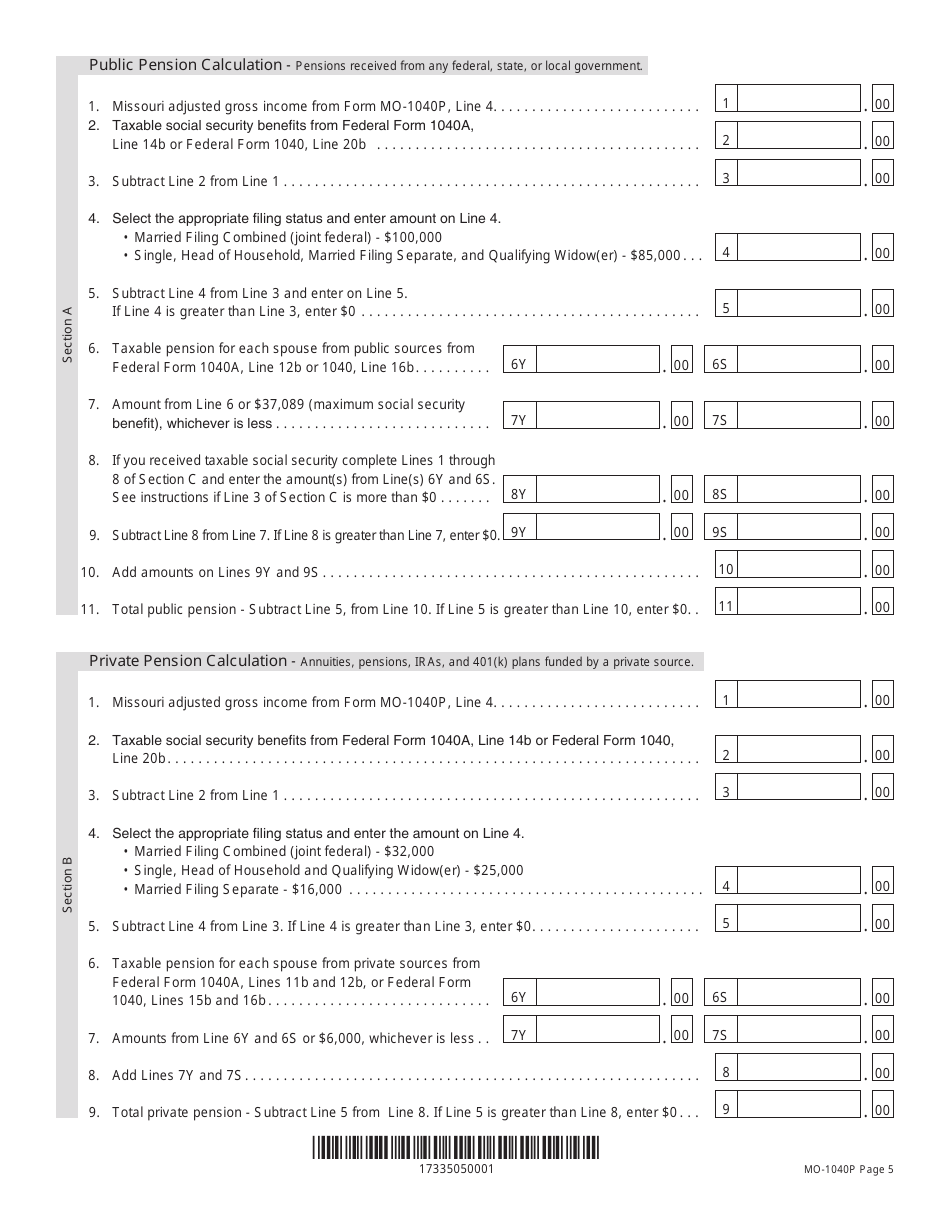

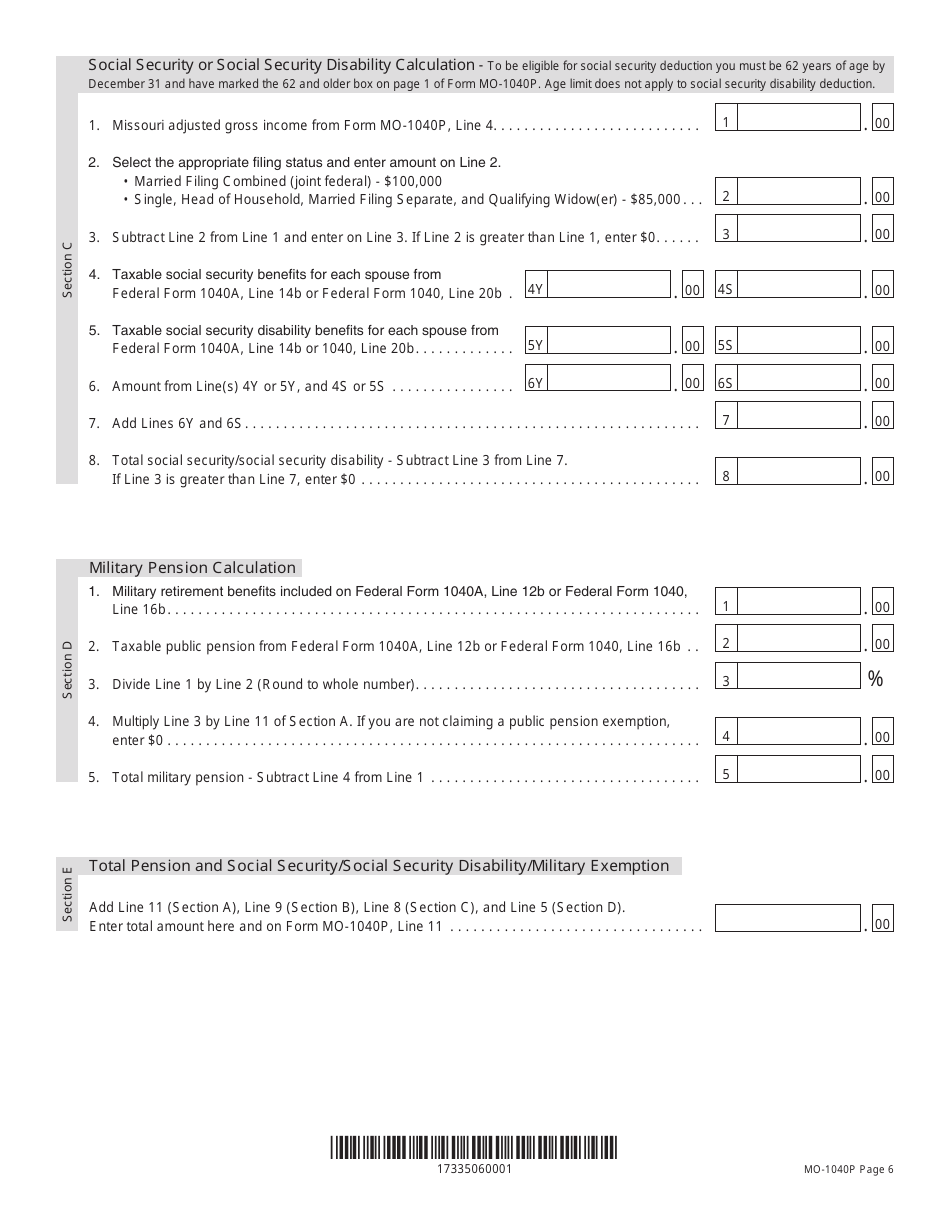

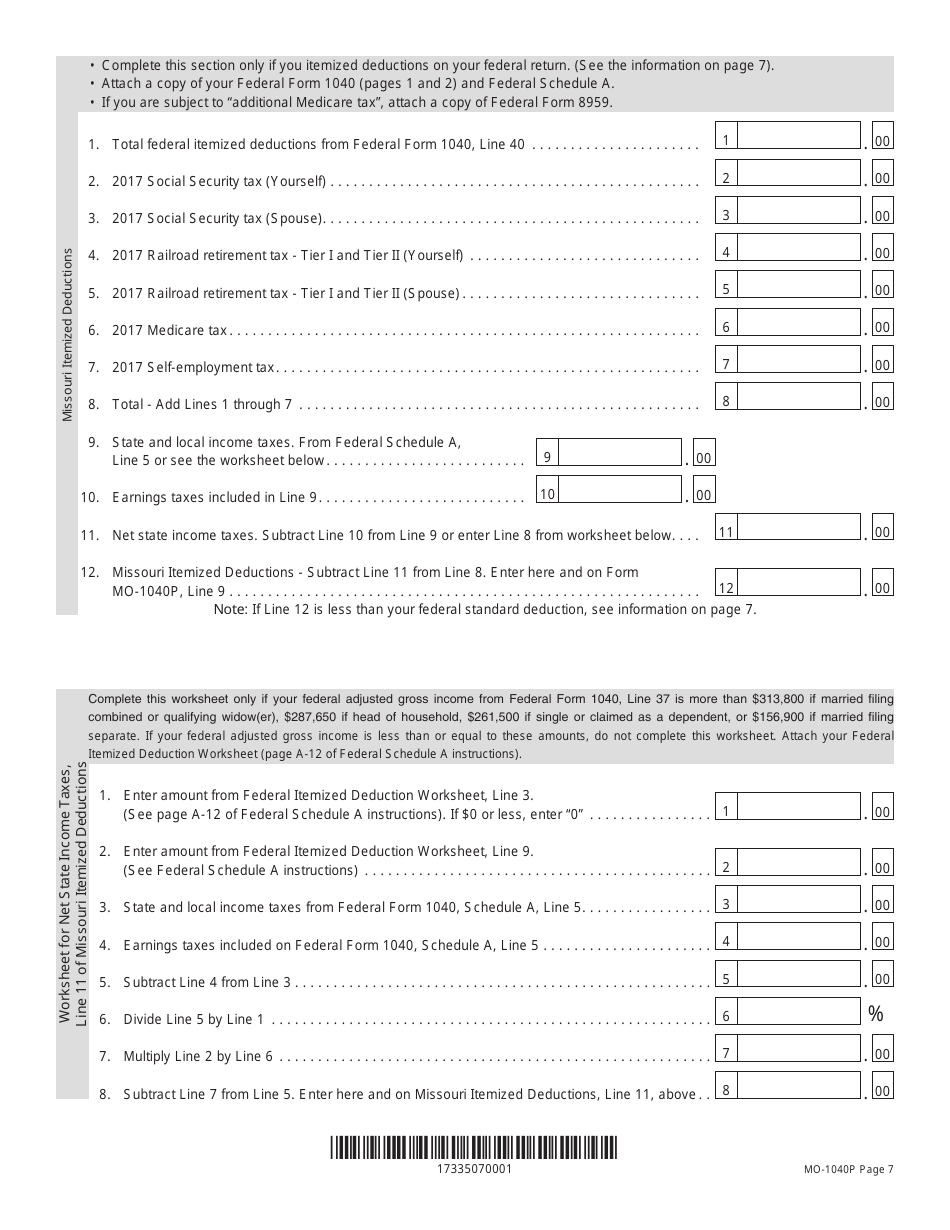

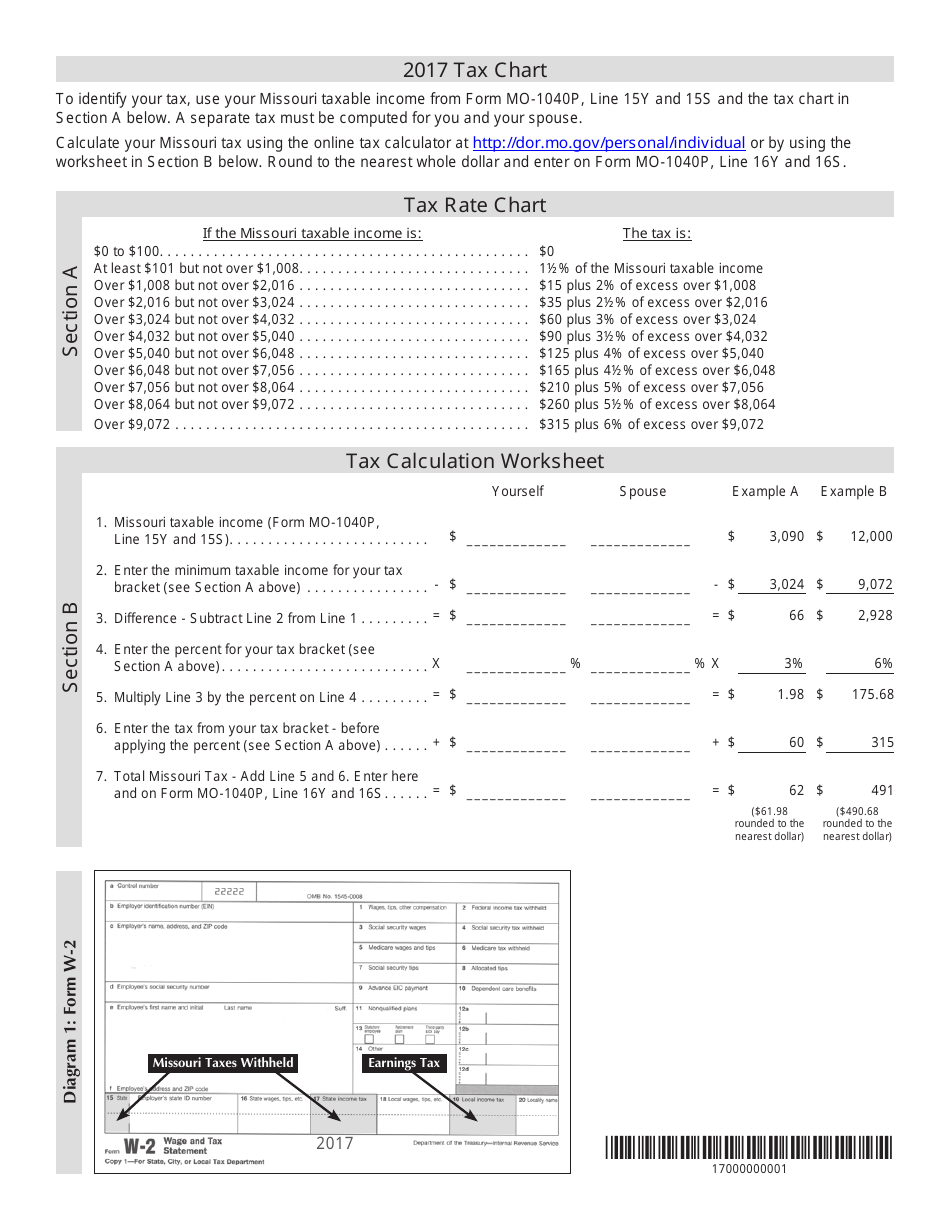

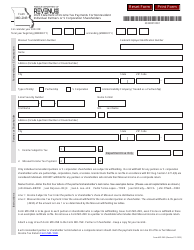

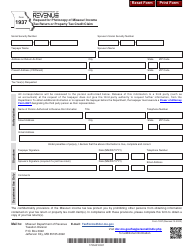

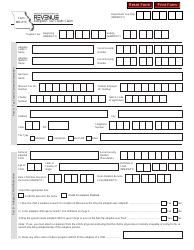

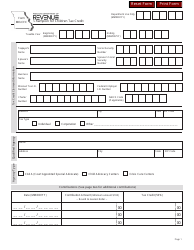

Form MO-1040P Individual Income Tax Return and Property Tax Credit Claim / Pension Exemption - Short Form - Missouri

What Is Form MO-1040P?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-1040P form?

A: The MO-1040P form is the Individual Income Tax Return and Property Tax Credit Claim/Pension Exemption - Short Form for Missouri residents.

Q: What is the purpose of the MO-1040P form?

A: The purpose of the MO-1040P form is to report your individual income tax and claim a property tax credit or pension exemption in Missouri.

Q: Who should use the MO-1040P form?

A: Missouri residents who meet the eligibility requirements for the property tax credit or pension exemption can use the MO-1040P form.

Q: What can you claim on the MO-1040P form?

A: On the MO-1040P form, you can claim the property tax credit or pension exemption if you meet the eligibility criteria.

Q: When is the deadline to file the MO-1040P form?

A: The deadline to file the MO-1040P form is typically April 15th, but it may vary depending on the tax year. Check the instructions for the specific year you are filing for.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MO-1040P by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.