This version of the form is not currently in use and is provided for reference only. Download this version of

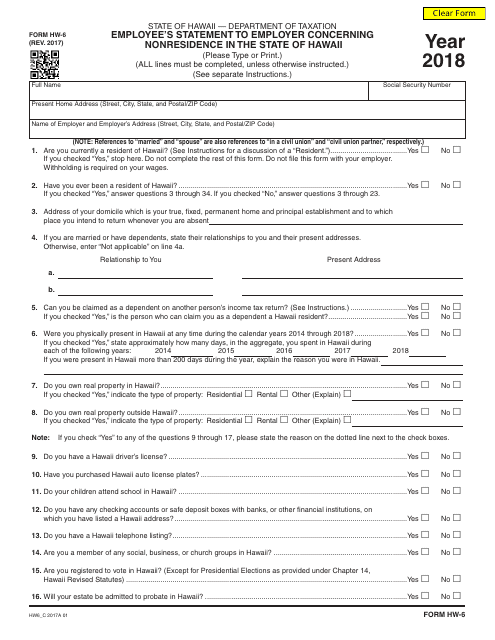

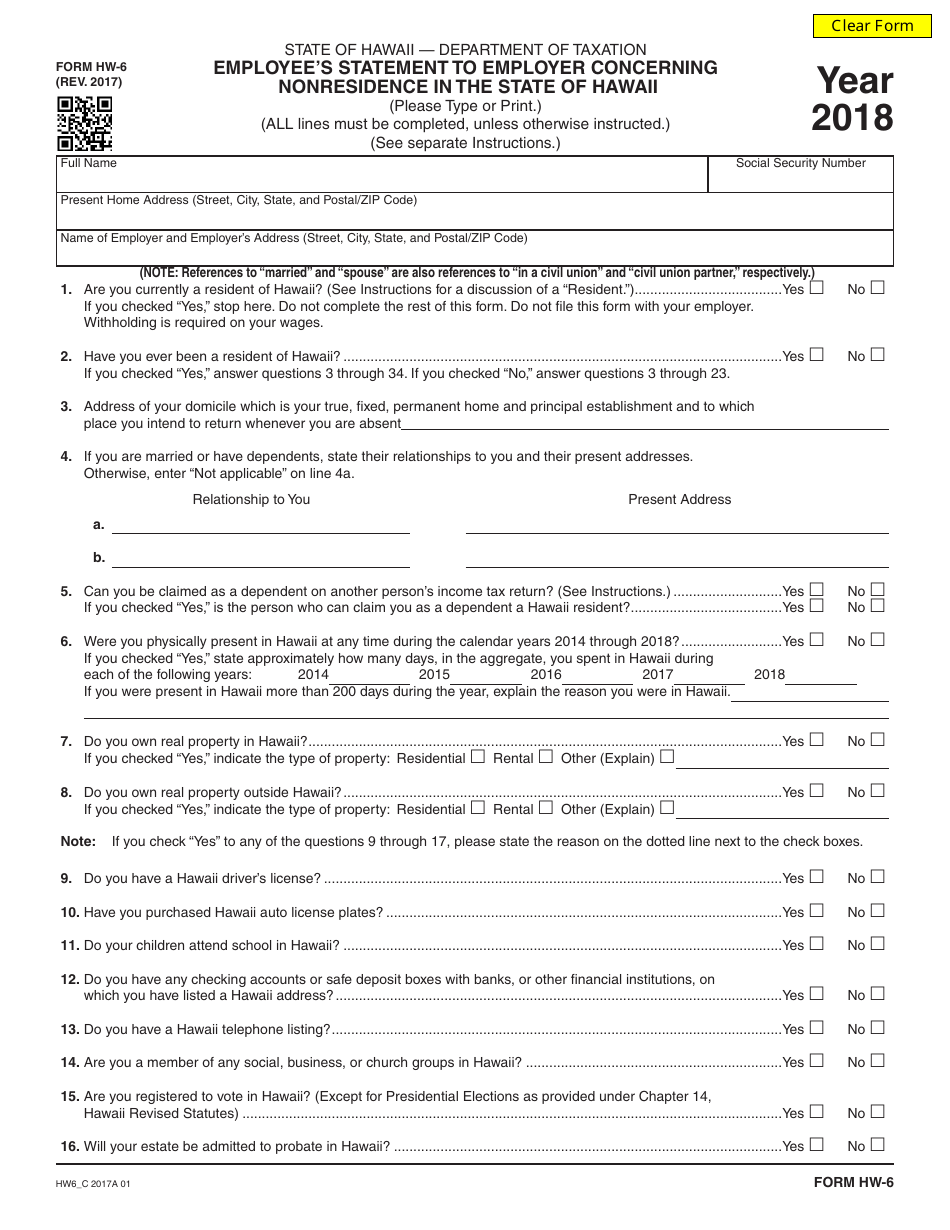

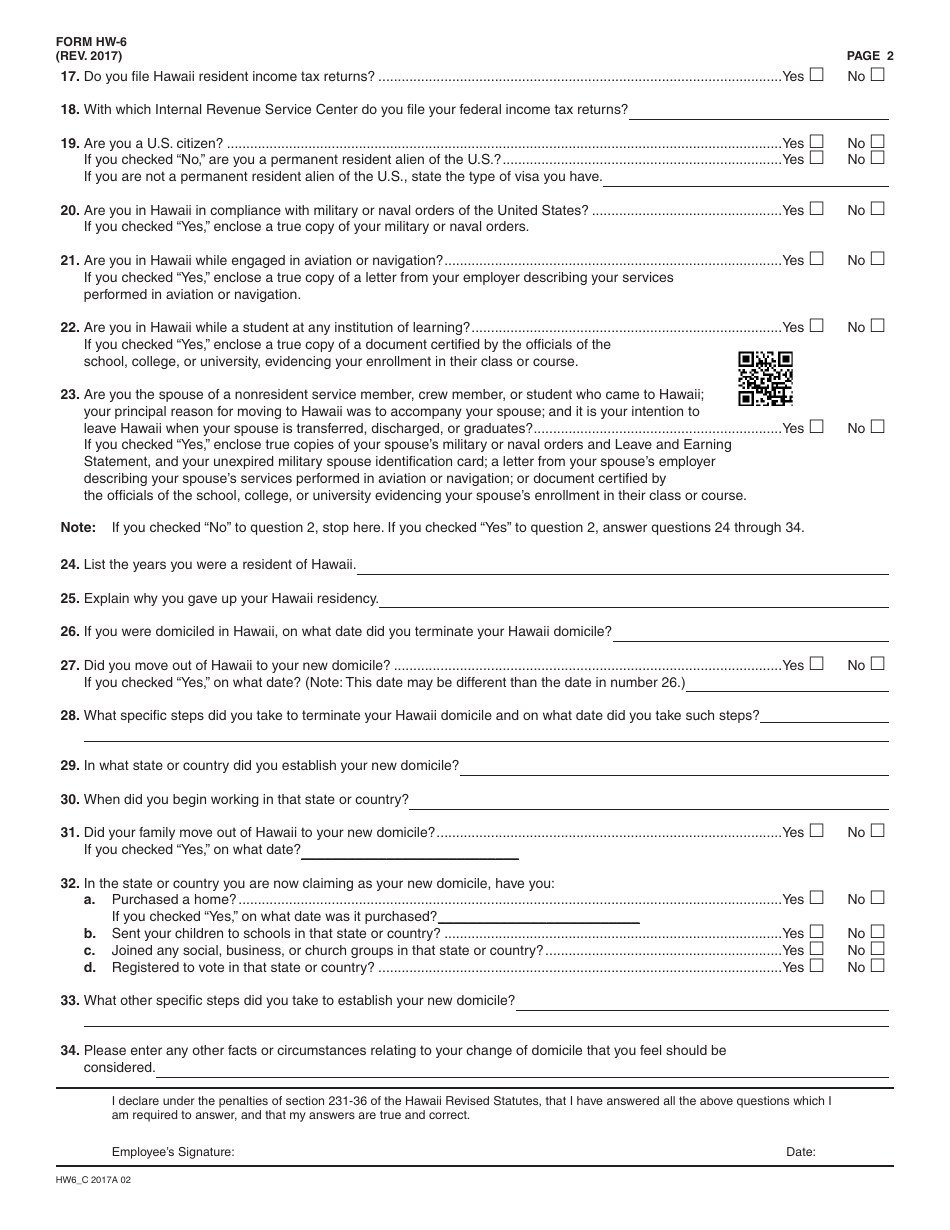

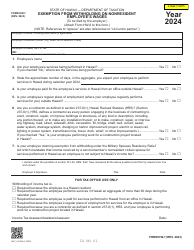

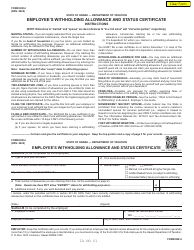

Form HW-6

for the current year.

Form HW-6 Employee's Statement to Employer Concerning Nonresidence in the State of Hawaii - Hawaii

What Is Form HW-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is HW-6?

A: HW-6 is the Employee's Statement to Employer Concerning Nonresidence in the State of Hawaii.

Q: Who needs to fill out the HW-6 form?

A: Employees who are claiming nonresidence in the State of Hawaii need to fill out the HW-6 form.

Q: What is the purpose of the HW-6 form?

A: The HW-6 form is used to inform employers of an employee's nonresidence in the State of Hawaii for tax purposes.

Q: Is the HW-6 form mandatory?

A: The HW-6 form is mandatory for employees claiming nonresidence in the State of Hawaii.

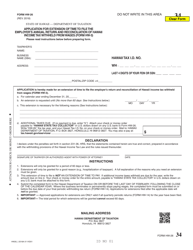

Q: What information is required on the HW-6 form?

A: The HW-6 form requires employees to provide their personal information, including name, address, social security number, and employer information.

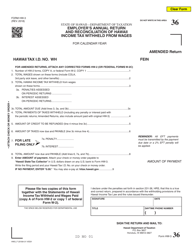

Q: How often do I need to fill out the HW-6 form?

A: The HW-6 form needs to be filled out annually or whenever there is a change in the employee's residency status.

Q: Are there any penalties for not completing the HW-6 form?

A: Yes, failure to complete the HW-6 form may result in penalties imposed by the Hawaii Department of Taxation.

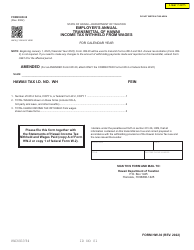

Q: Can I claim nonresidence in the State of Hawaii if I live in Hawaii?

A: No, only individuals who are physically present outside of Hawaii for the entire year can claim nonresidence.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.