This version of the form is not currently in use and is provided for reference only. Download this version of

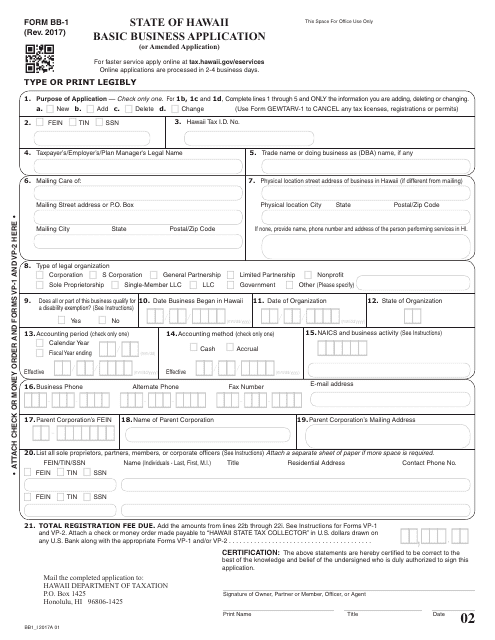

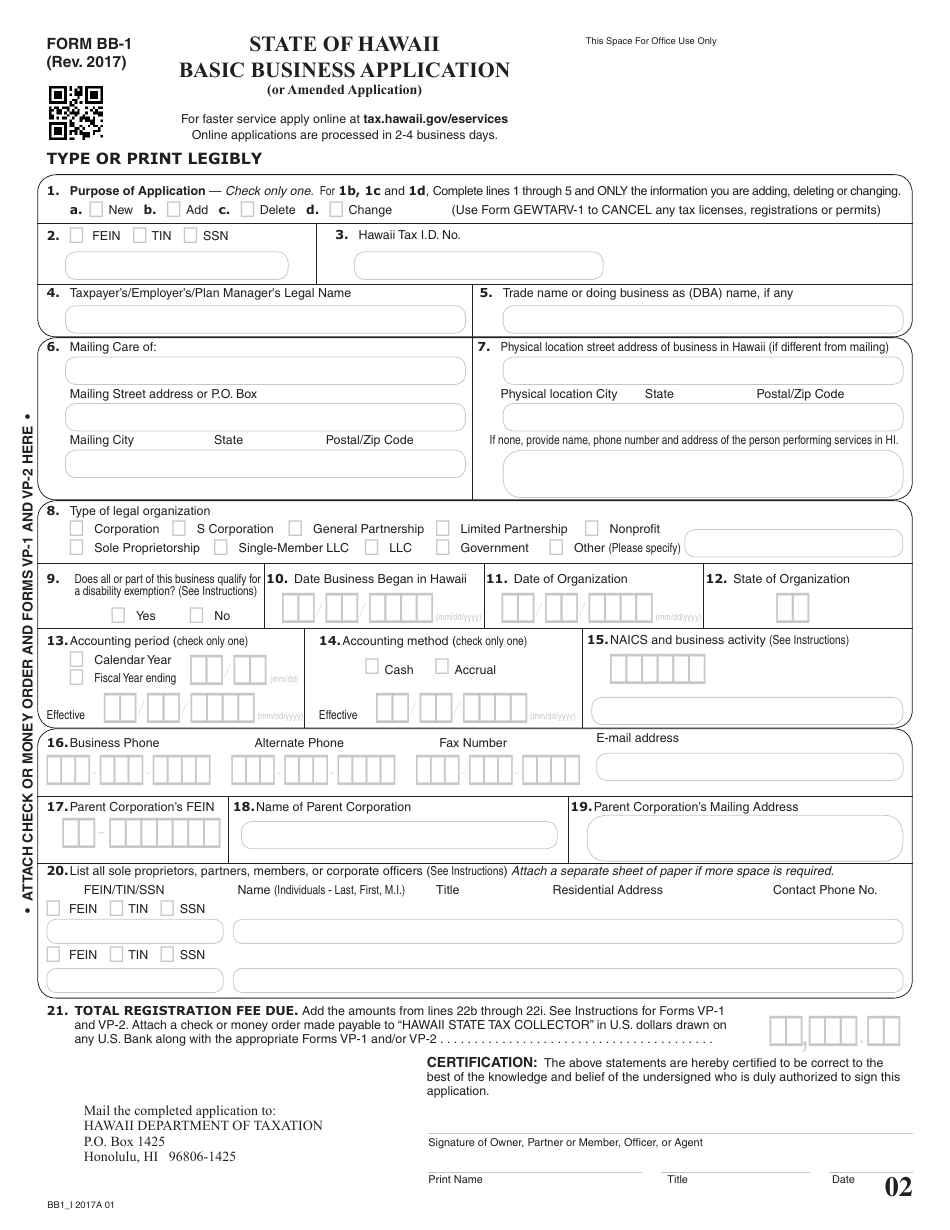

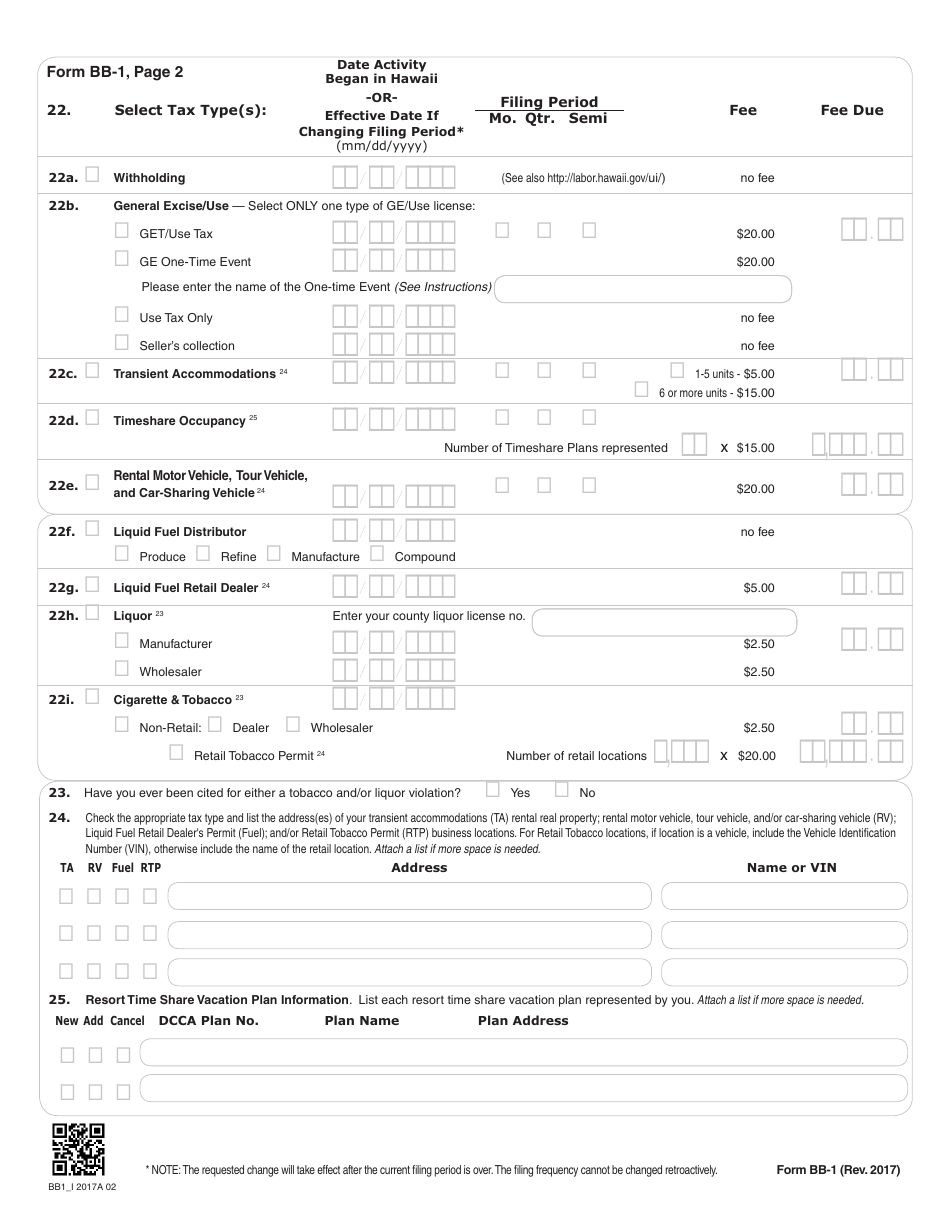

Form BB-1

for the current year.

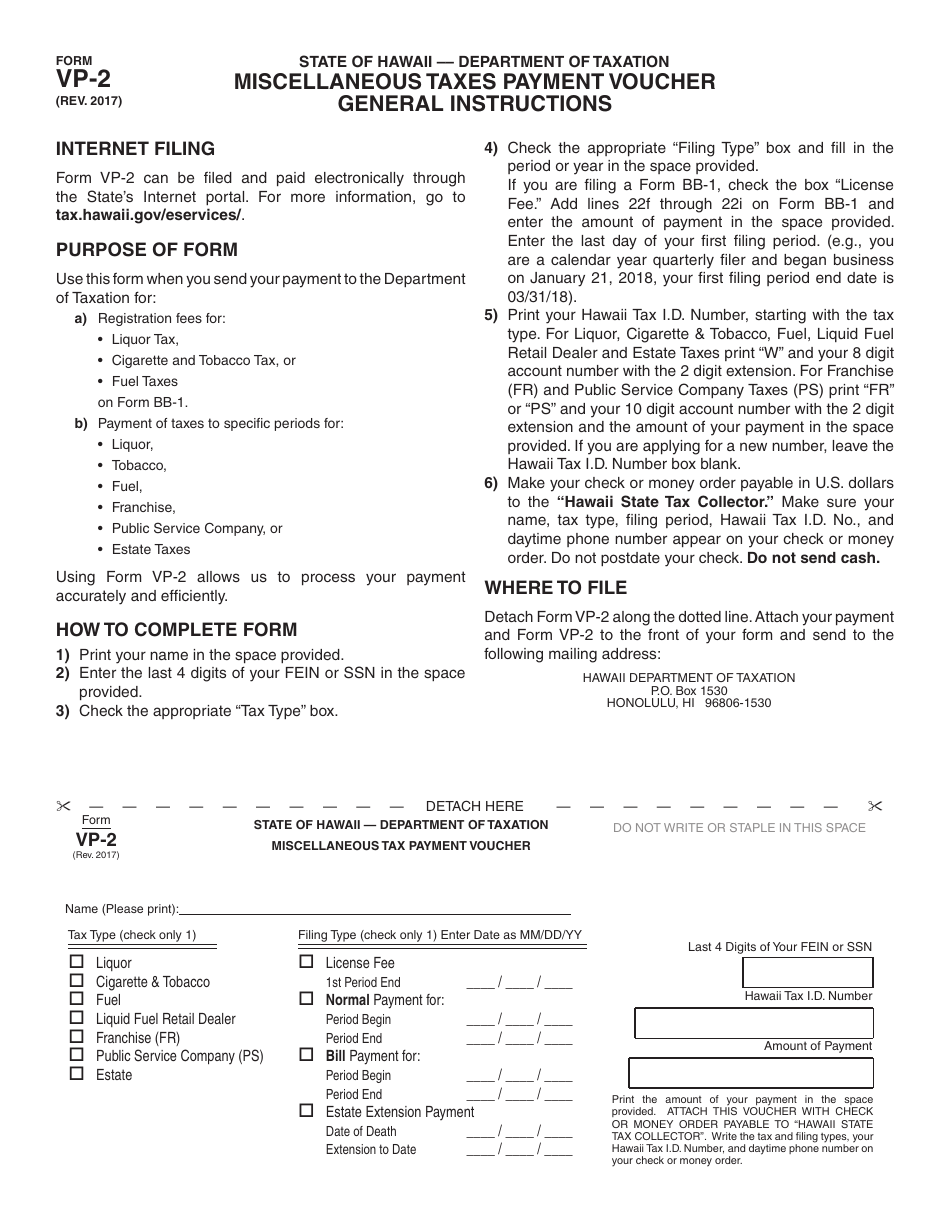

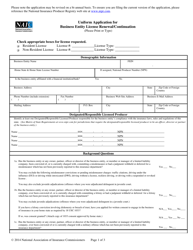

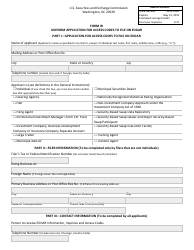

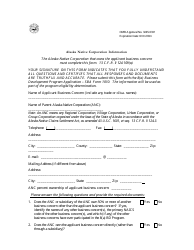

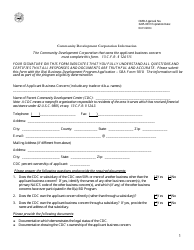

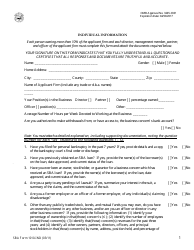

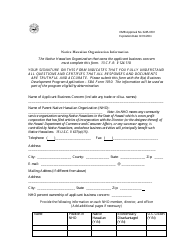

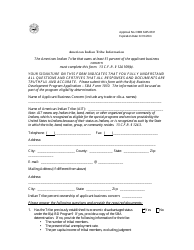

Form BB-1 Basic Business Application (Or Amended Application) - Hawaii

What Is Form BB-1?

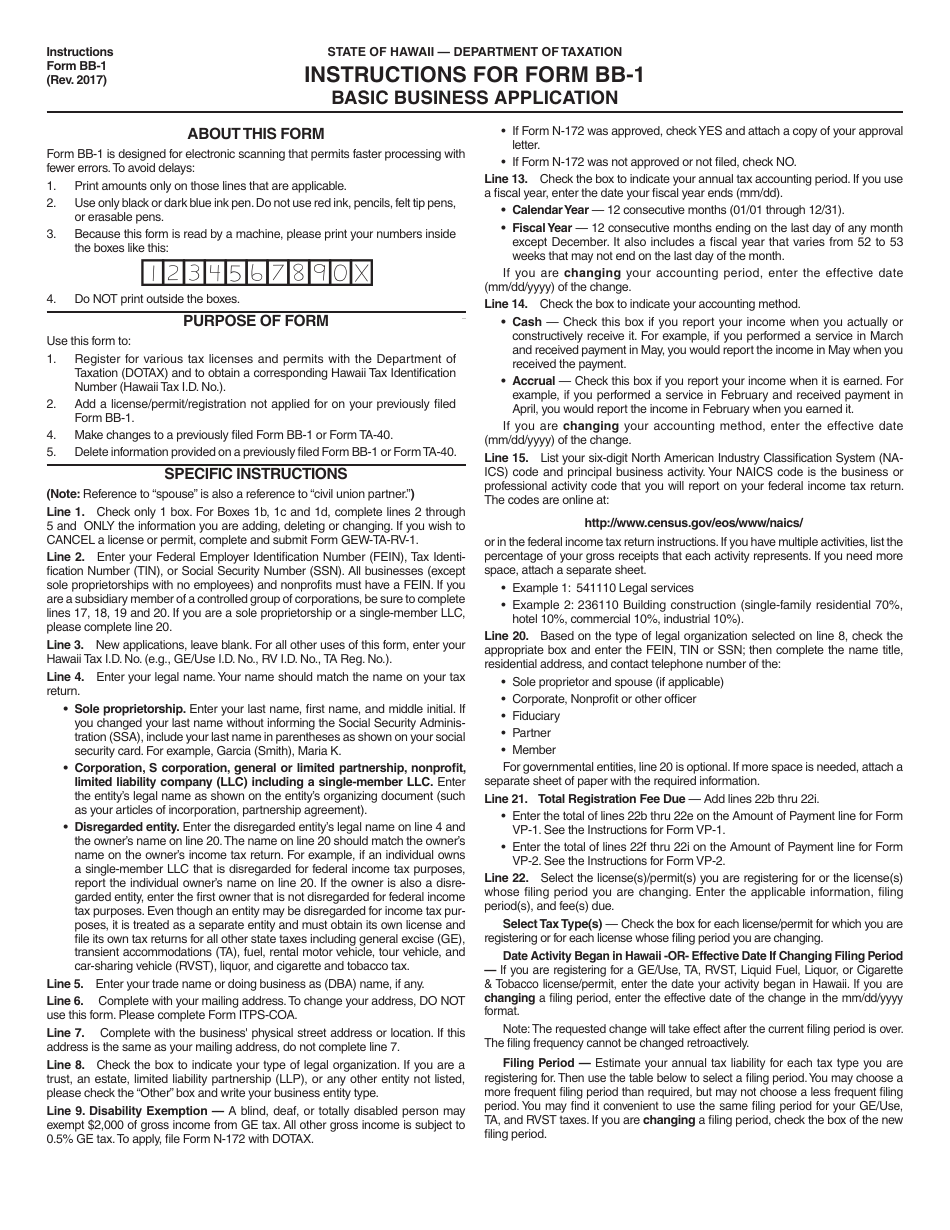

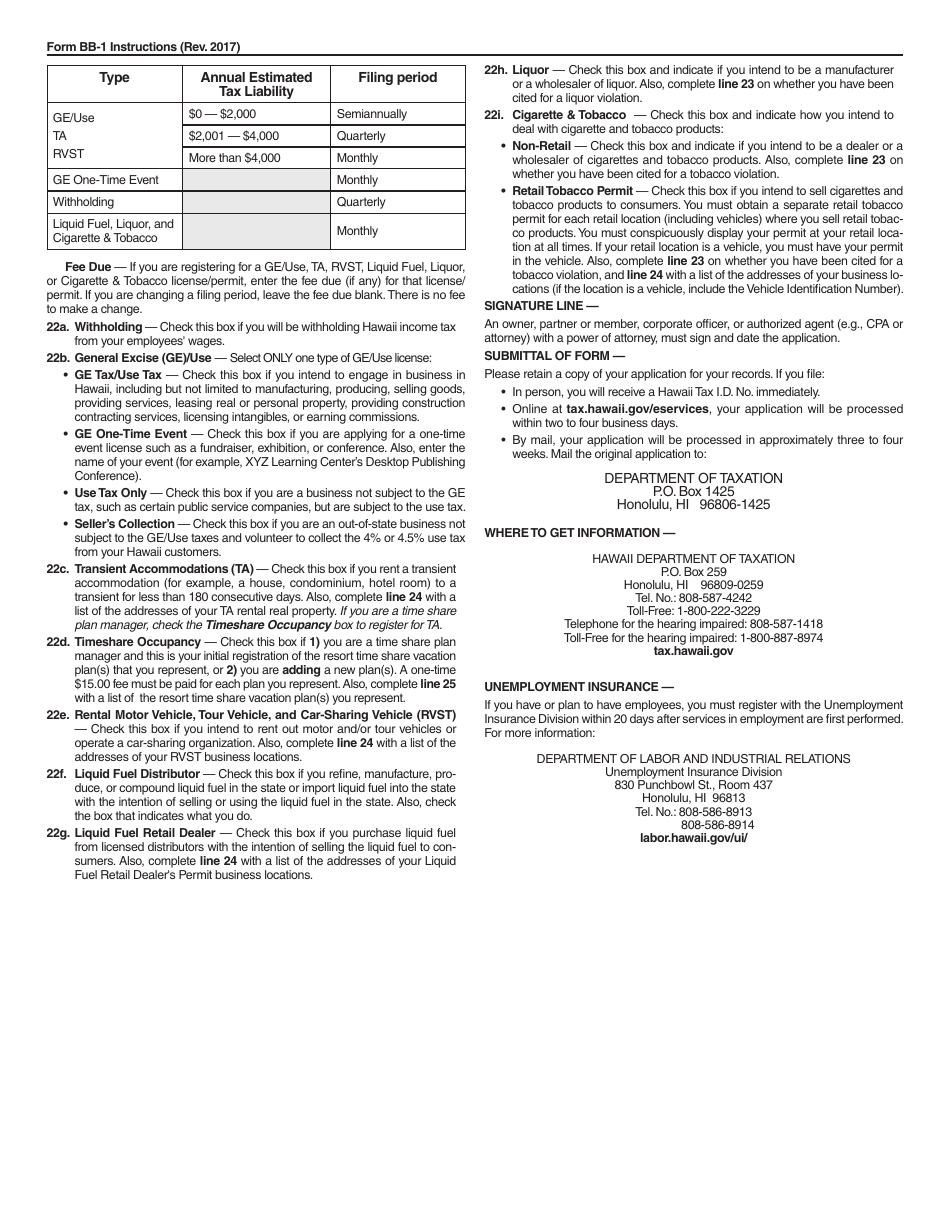

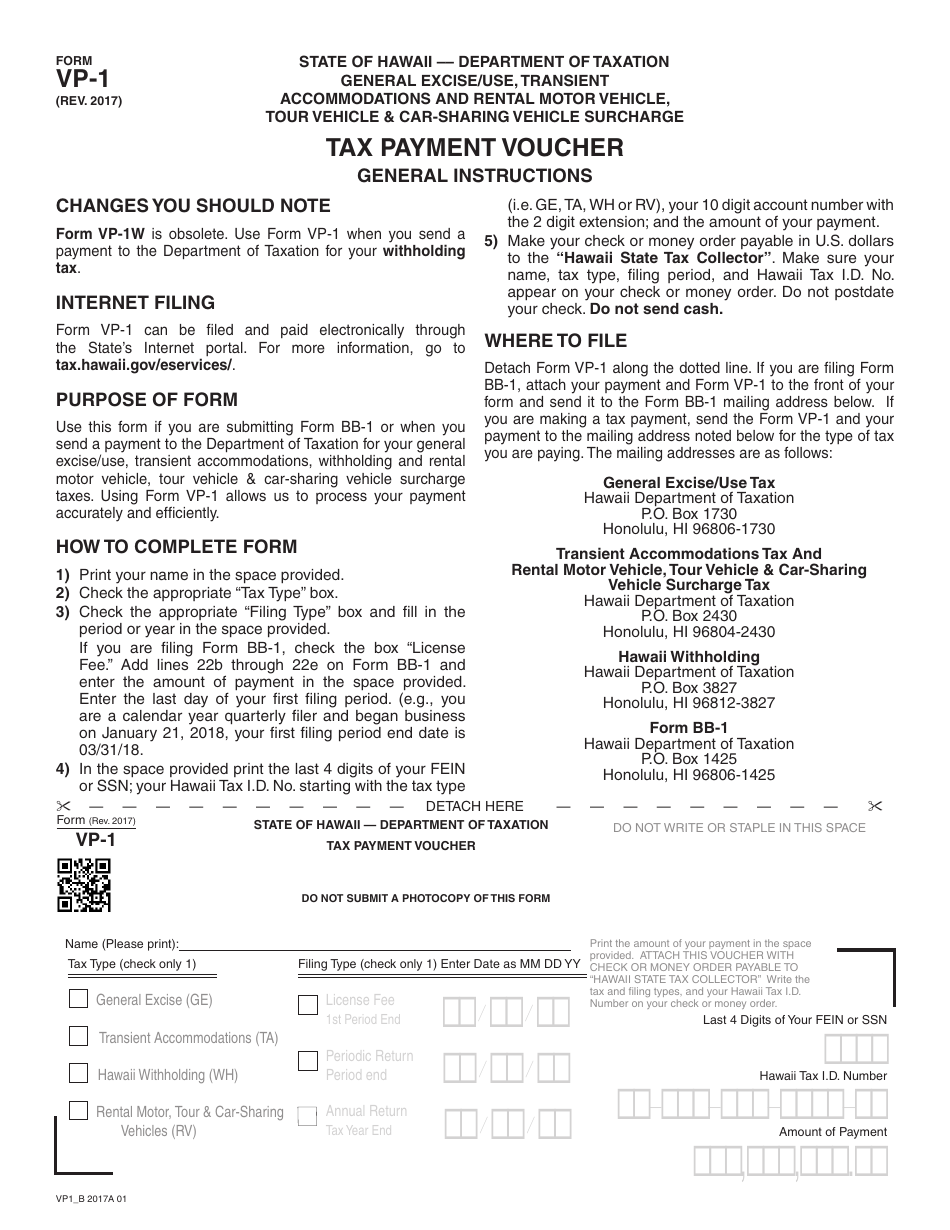

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BB-1?

A: Form BB-1 is the Basic Business Application (or Amended Application) in Hawaii.

Q: What is the purpose of Form BB-1?

A: The purpose of Form BB-1 is to apply for or amend a business registration in Hawaii.

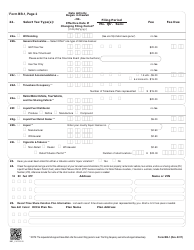

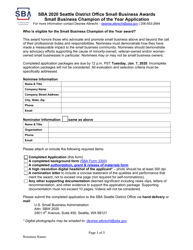

Q: Is there a fee to submit Form BB-1?

A: Yes, there is a fee to submit Form BB-1. The fee amount depends on the type of registration or amendment being applied for.

Q: What information is required on Form BB-1?

A: Form BB-1 requires information such as the legal name of the business, business activity description, responsible party information, and other relevant details.

Q: What is the deadline for filing Form BB-1?

A: The deadline for filing Form BB-1 depends on the type of registration or amendment being applied for. It is recommended to submit the form as soon as possible to ensure timely processing.

Q: Are there any penalties for late filing of Form BB-1?

A: Yes, there may be penalties for late filing of Form BB-1. It is important to adhere to the applicable deadlines to avoid any penalties.

Q: Can I make changes to my business information after filing Form BB-1?

A: Yes, you can make changes to your business information after filing Form BB-1 by submitting an amended application.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BB-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.