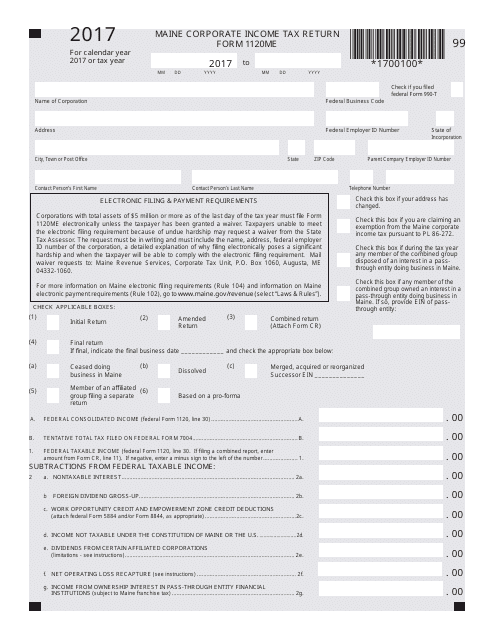

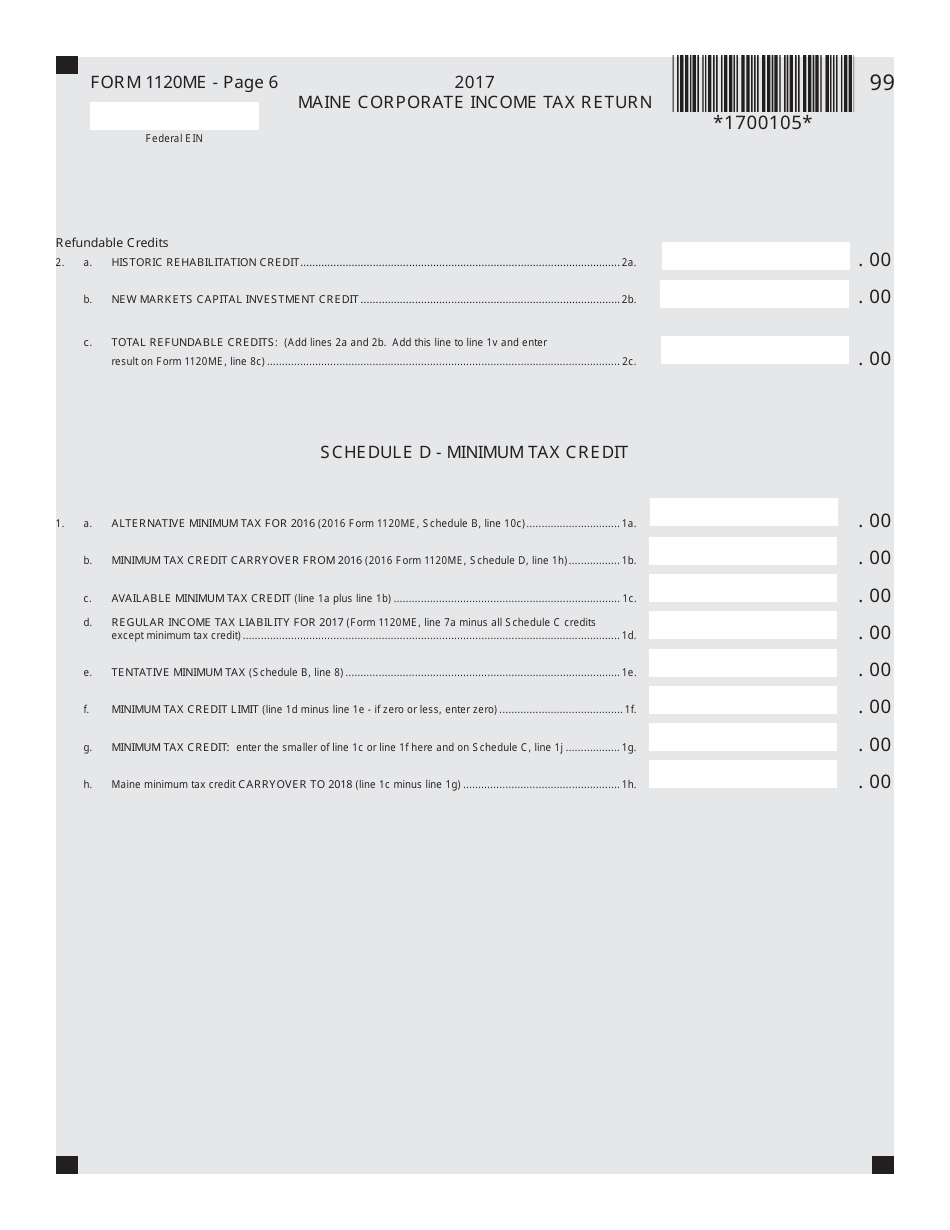

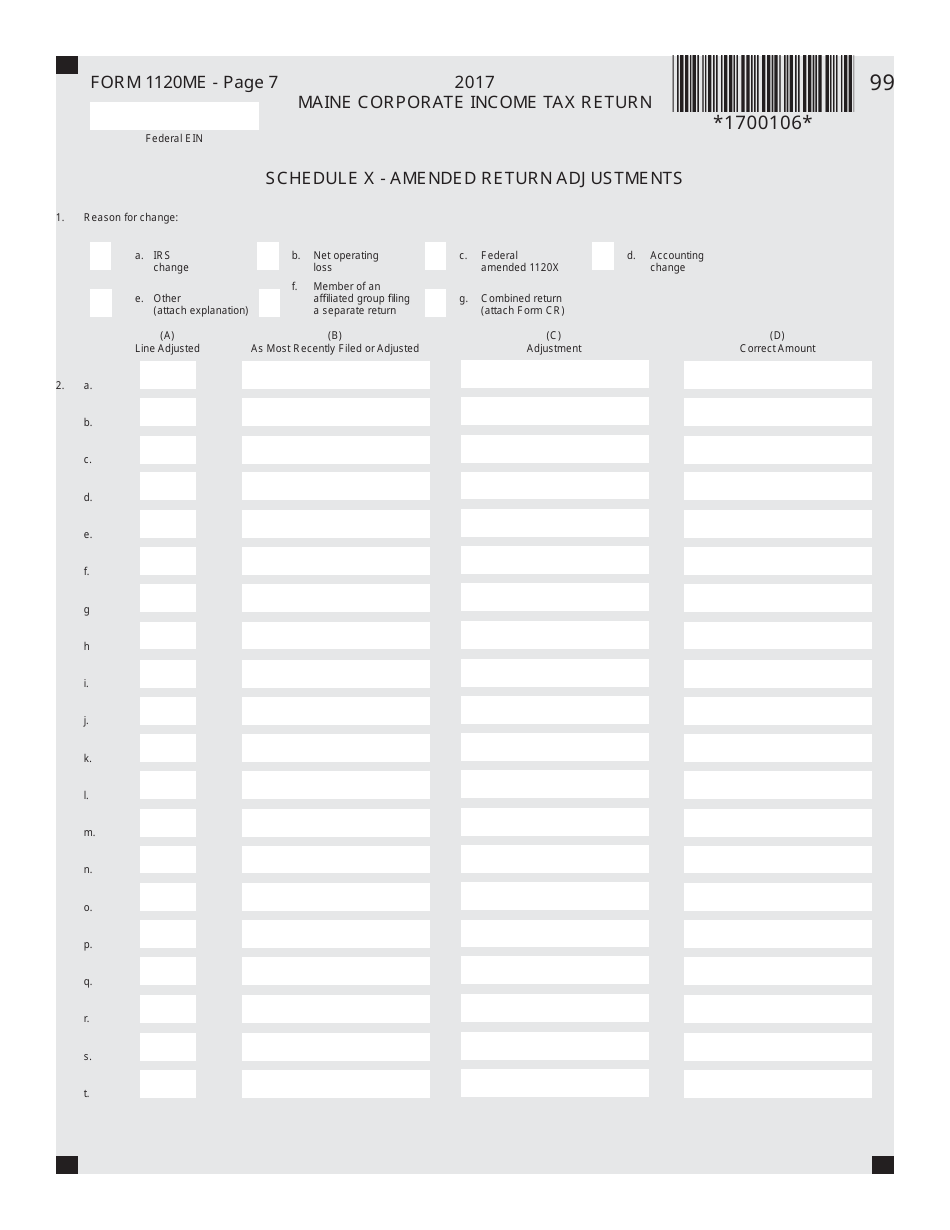

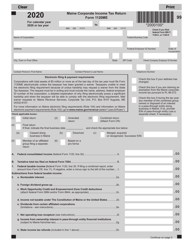

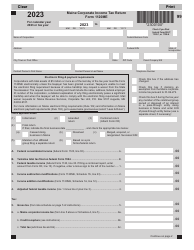

Form 1120ME Maine Corporate Income Tax Return - Maine

What Is Form 1120ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ME?

A: Form 1120ME is the Maine Corporate Income Tax Return.

Q: Who needs to file Form 1120ME?

A: Any corporation doing business or deriving income in the state of Maine needs to file Form 1120ME.

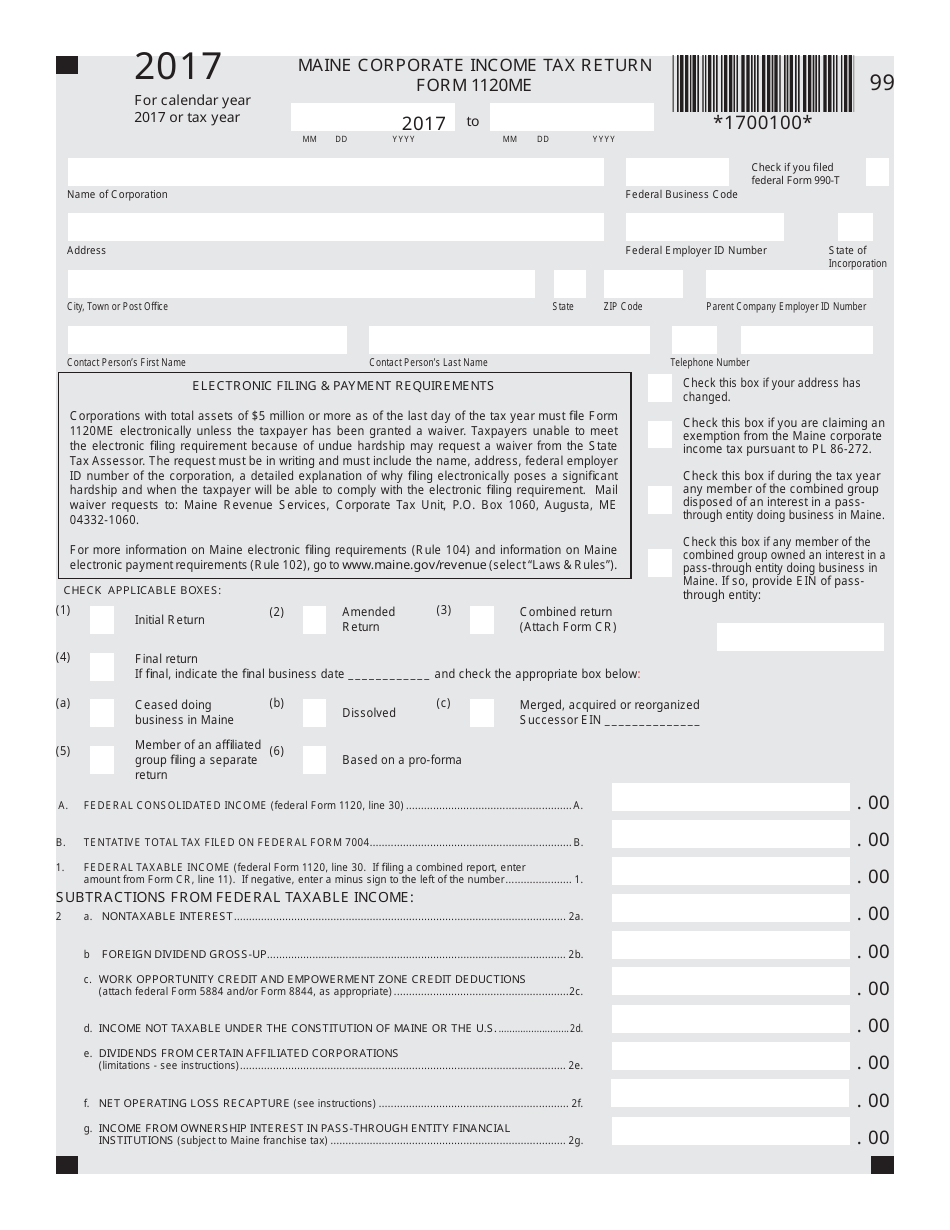

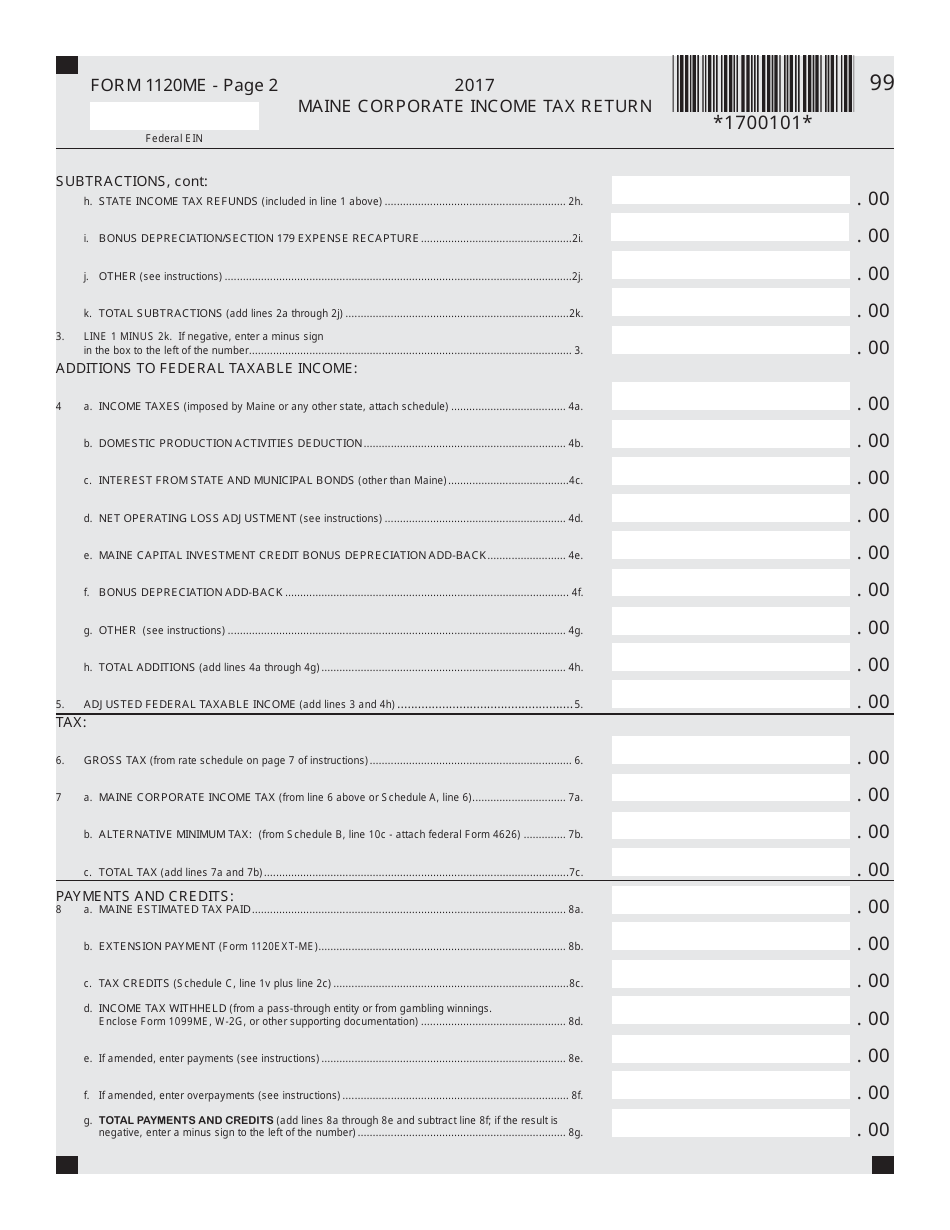

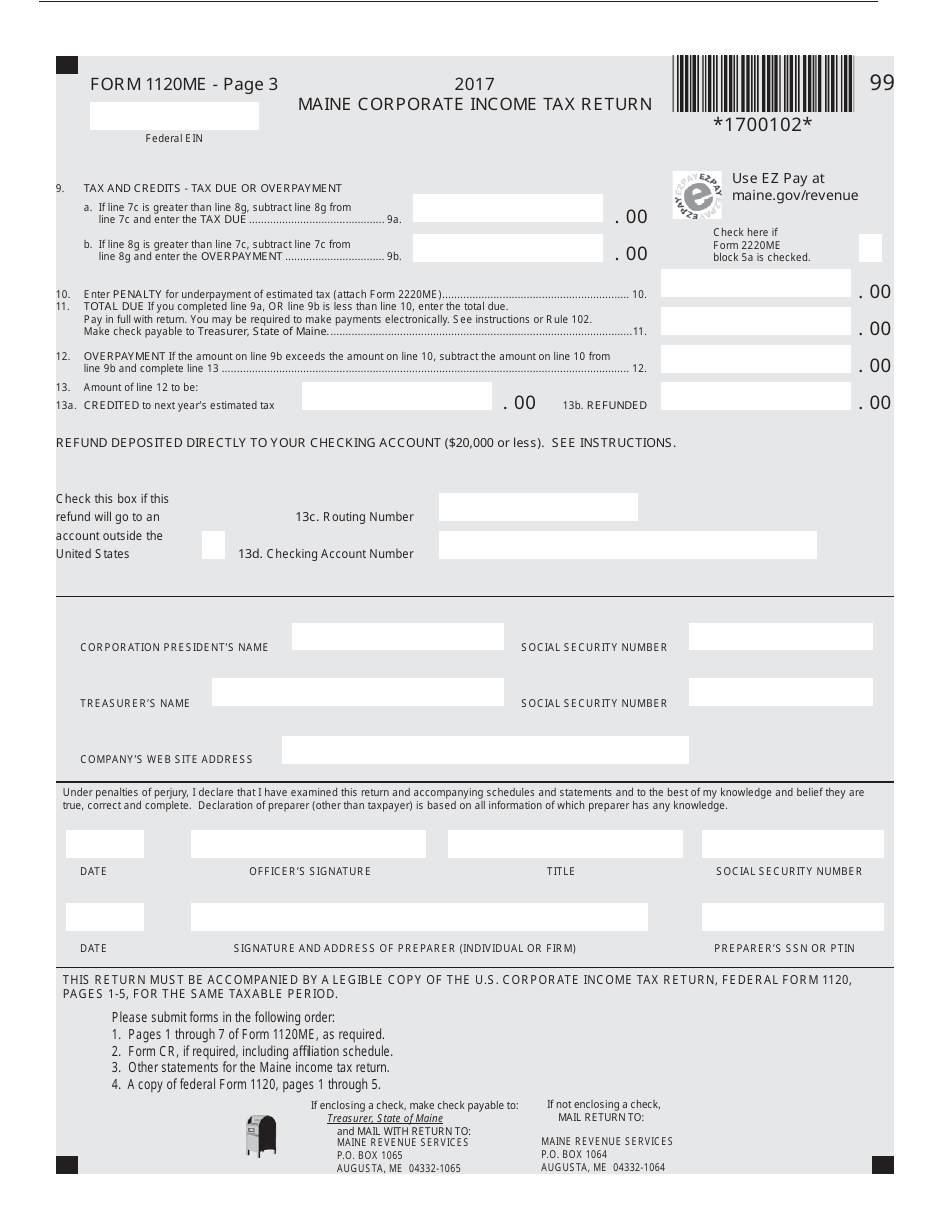

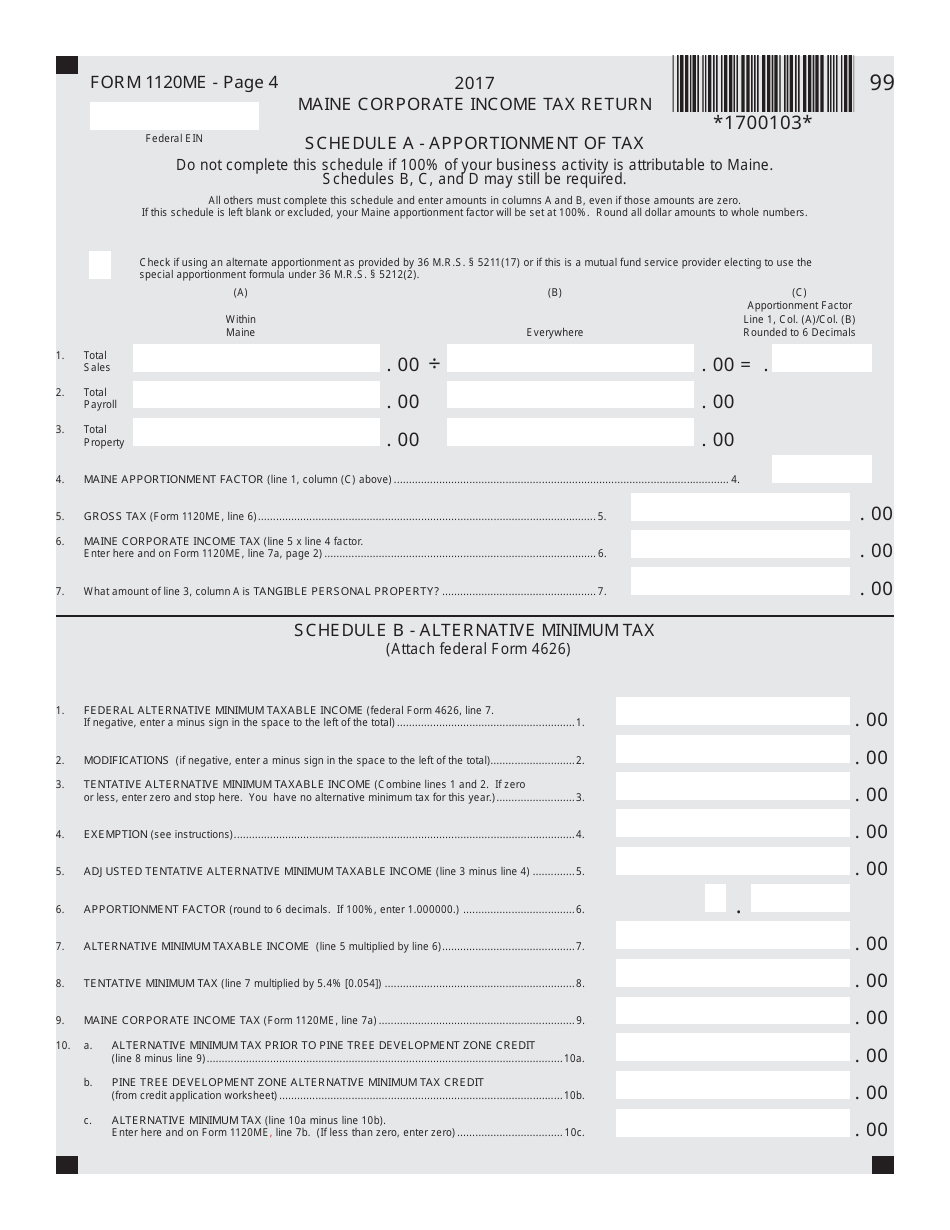

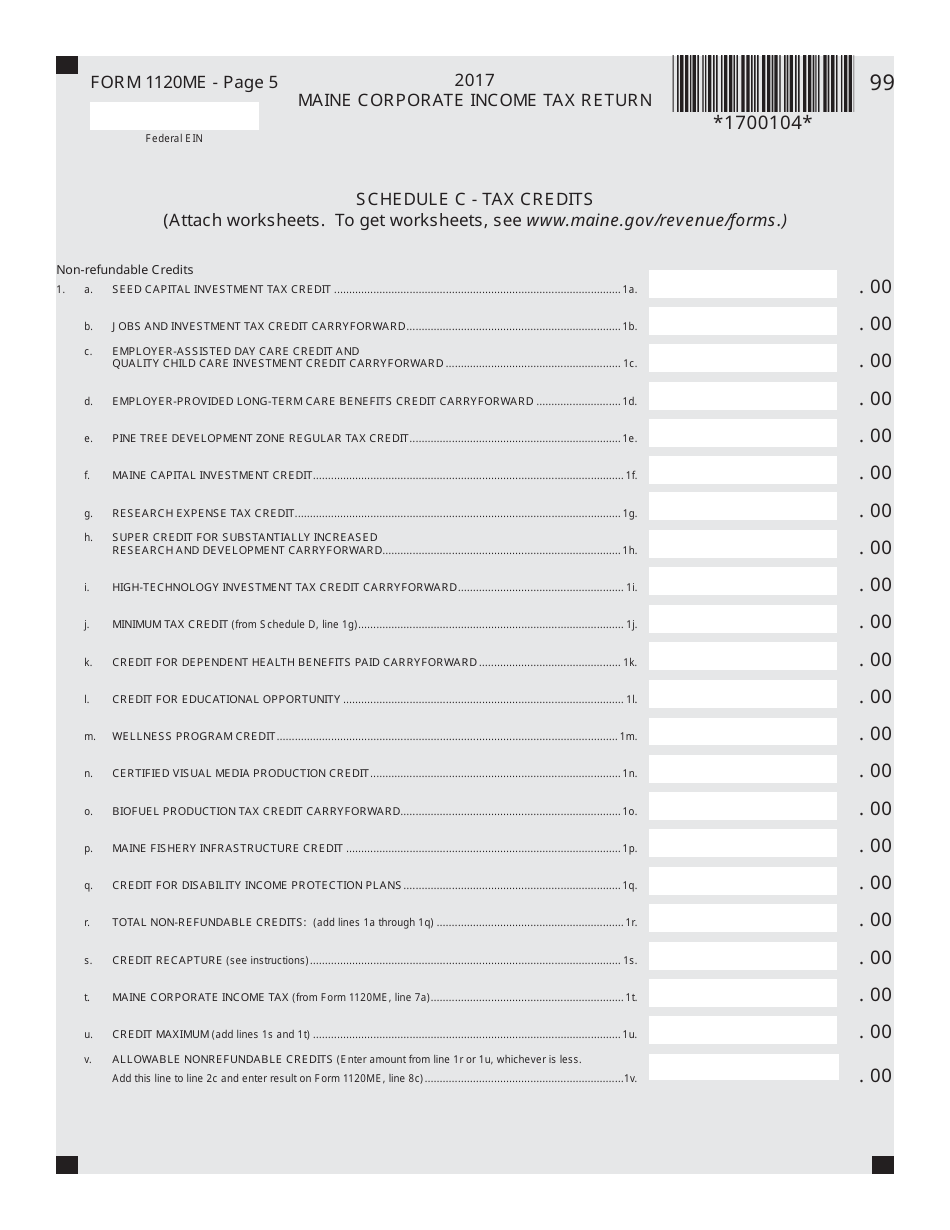

Q: What information is required on Form 1120ME?

A: Form 1120ME requires information about the corporation's income, deductions, credits, and tax liability in the state of Maine.

Q: When is Form 1120ME due?

A: Form 1120ME is due on the 15th day of the 4th month following the close of the corporation's tax year, which is usually April 15th for calendar year filers.

Q: Are there any extensions available for filing Form 1120ME?

A: Yes, corporations can request a 6-month extension to file Form 1120ME by using Form 1120EXT.

Q: Do I need to include any supporting documents with Form 1120ME?

A: Yes, corporations should include any necessary schedules, statements, and documentation to support the amounts reported on Form 1120ME.

Q: What are the penalties for late filing of Form 1120ME?

A: The penalties for late filing of Form 1120ME include a late filing penalty and interest on the unpaid tax amount.

Q: Can Form 1120ME be filed electronically?

A: Yes, corporations can file Form 1120ME electronically through the Maine Revenue Services' e-file system.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.