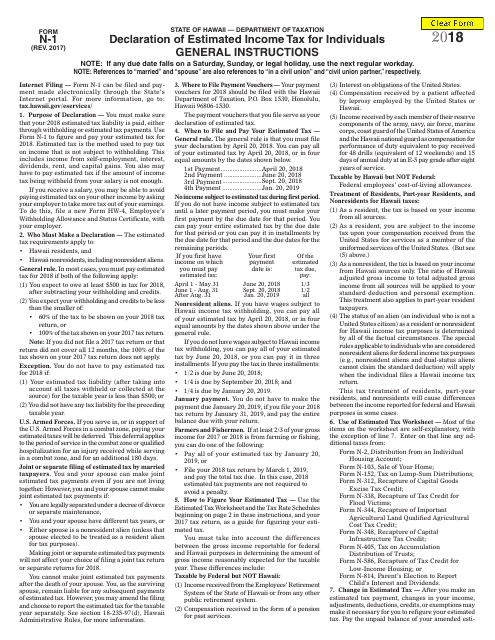

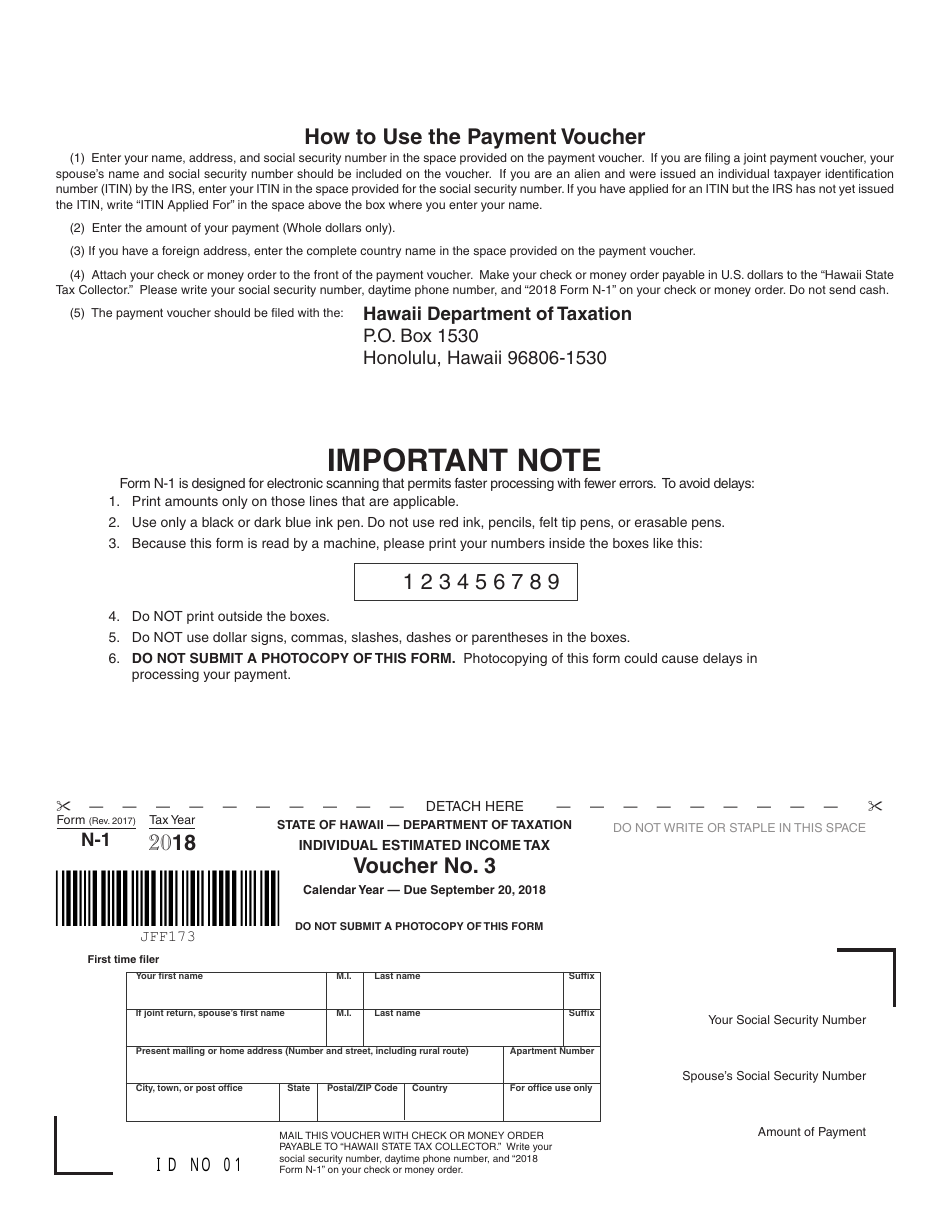

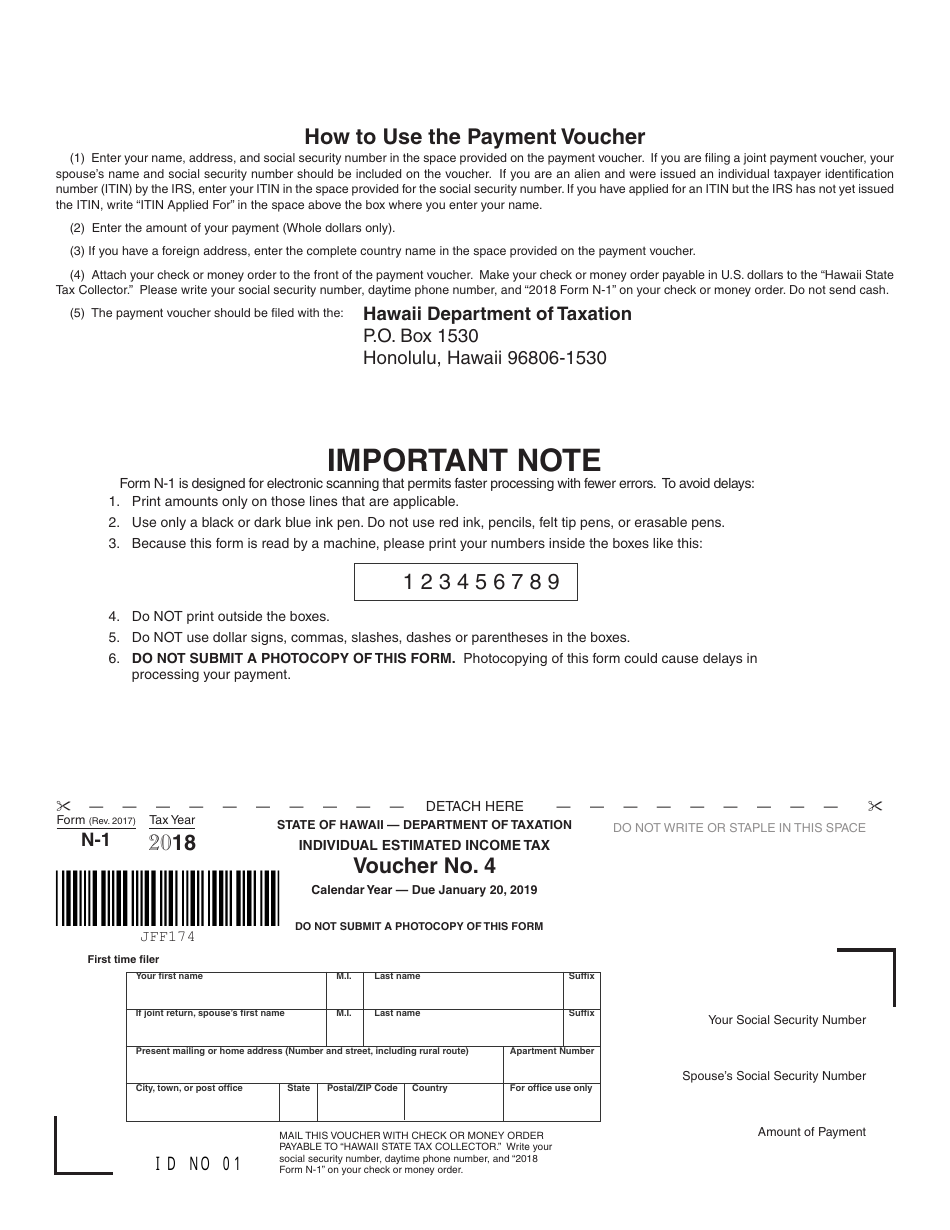

Form N-1 Declaration of Estimated Income Tax for Individuals - Hawaii

What Is Form N-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-1?

A: Form N-1 is the Declaration of Estimated Income Tax for Individuals in Hawaii.

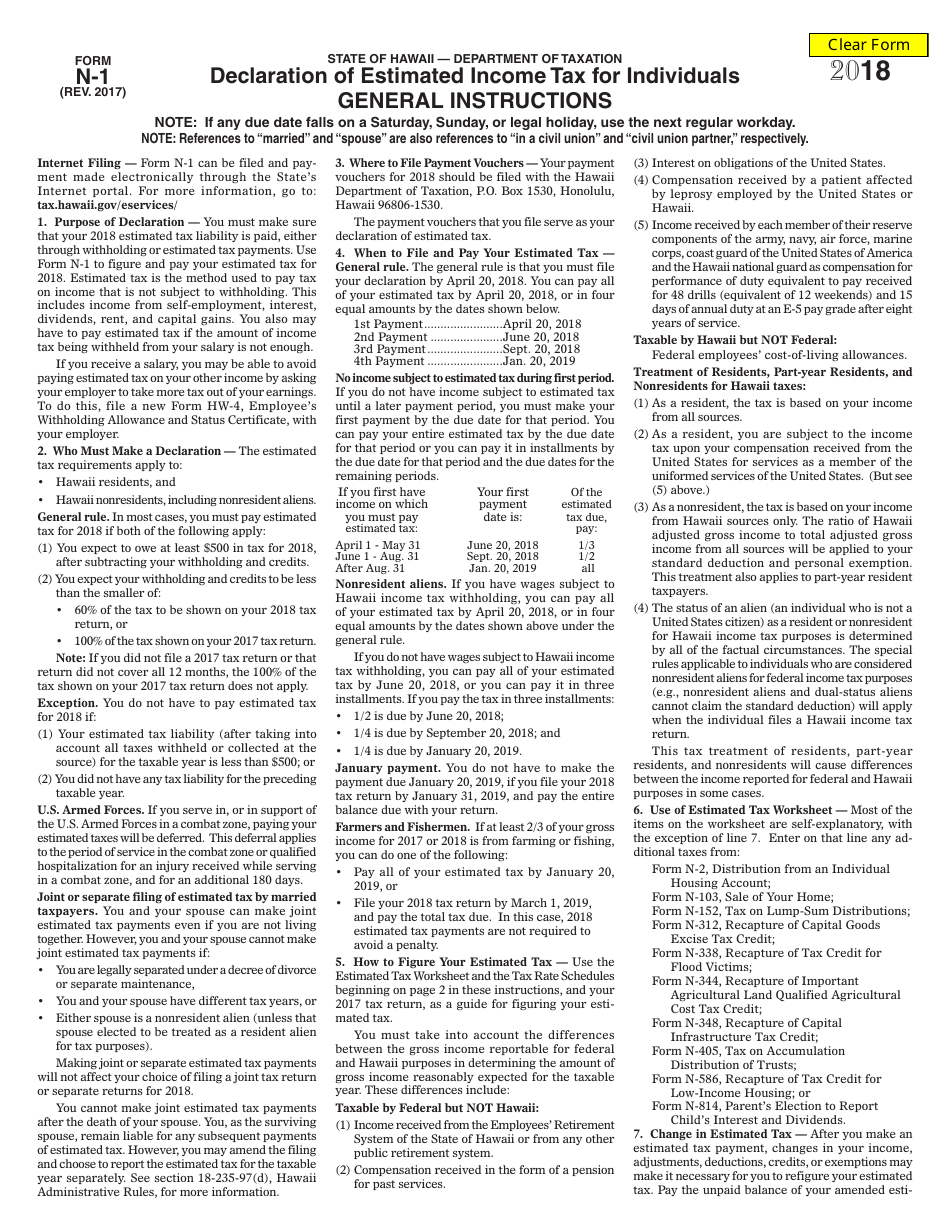

Q: Who should file Form N-1?

A: Individuals in Hawaii who expect to owe income tax and want to make estimated tax payments should file Form N-1.

Q: When should Form N-1 be filed?

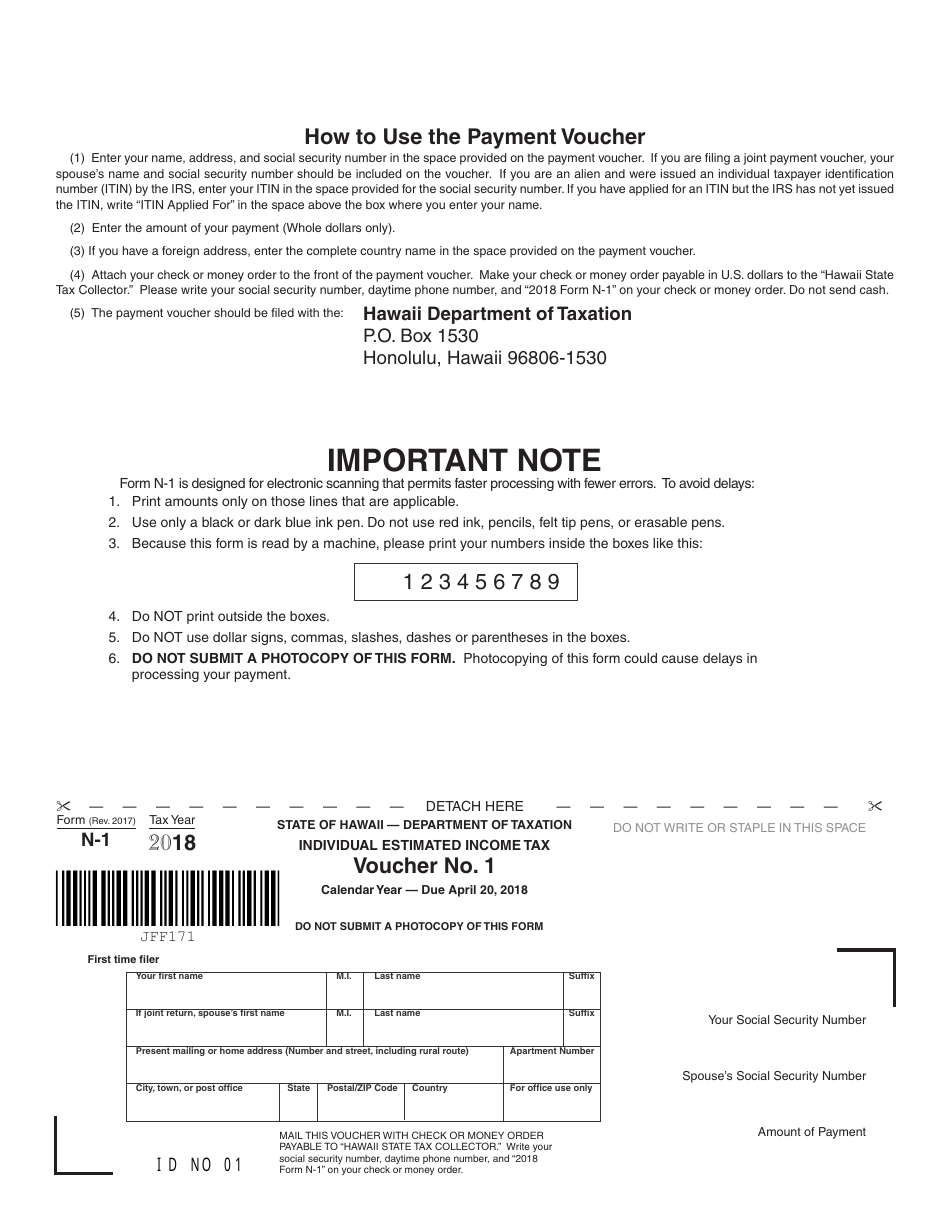

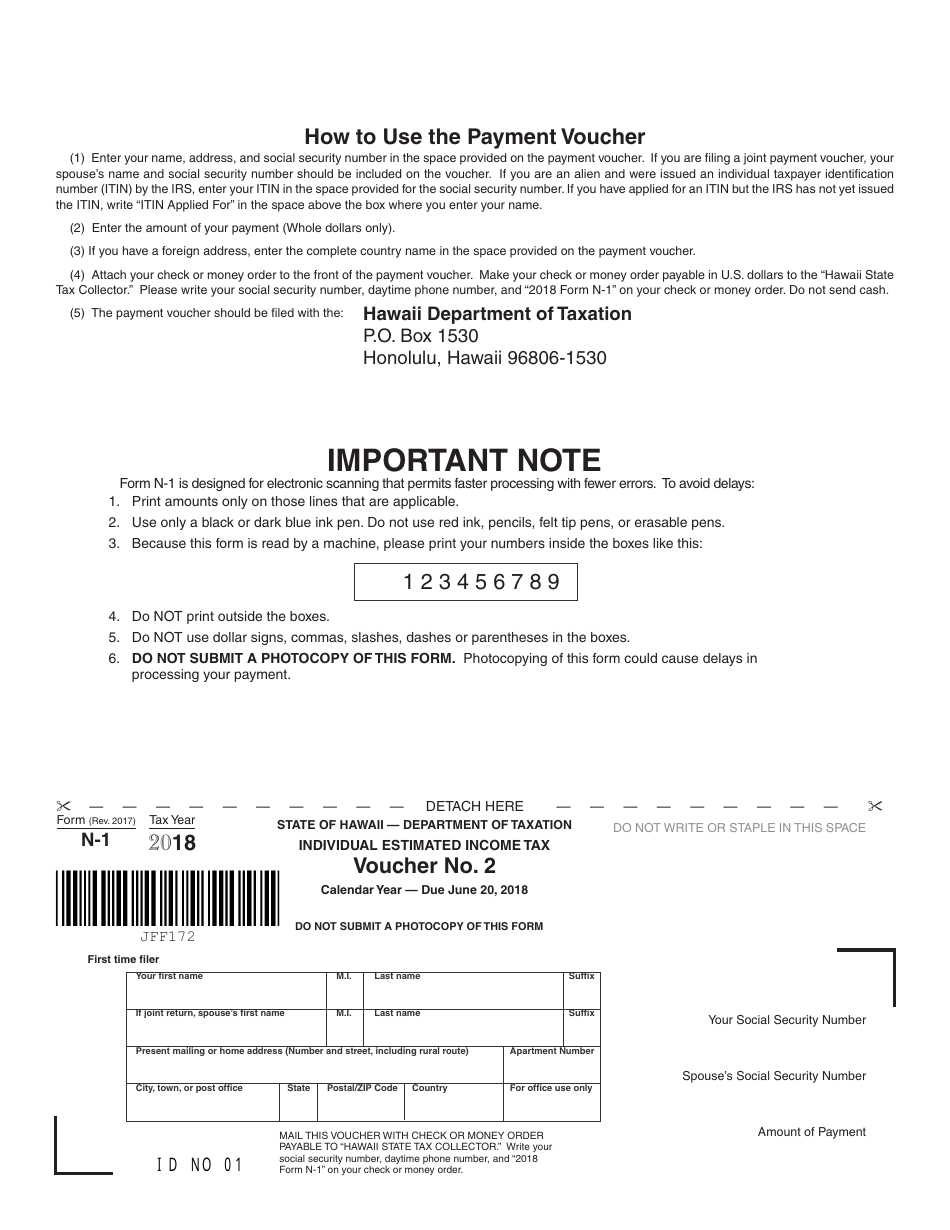

A: Form N-1 should be filed by individuals in Hawaii on or before the 20th day of the fourth month of the taxable year, or on the due date of the taxpayer's federal income tax return, whichever is later.

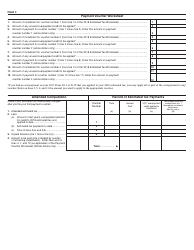

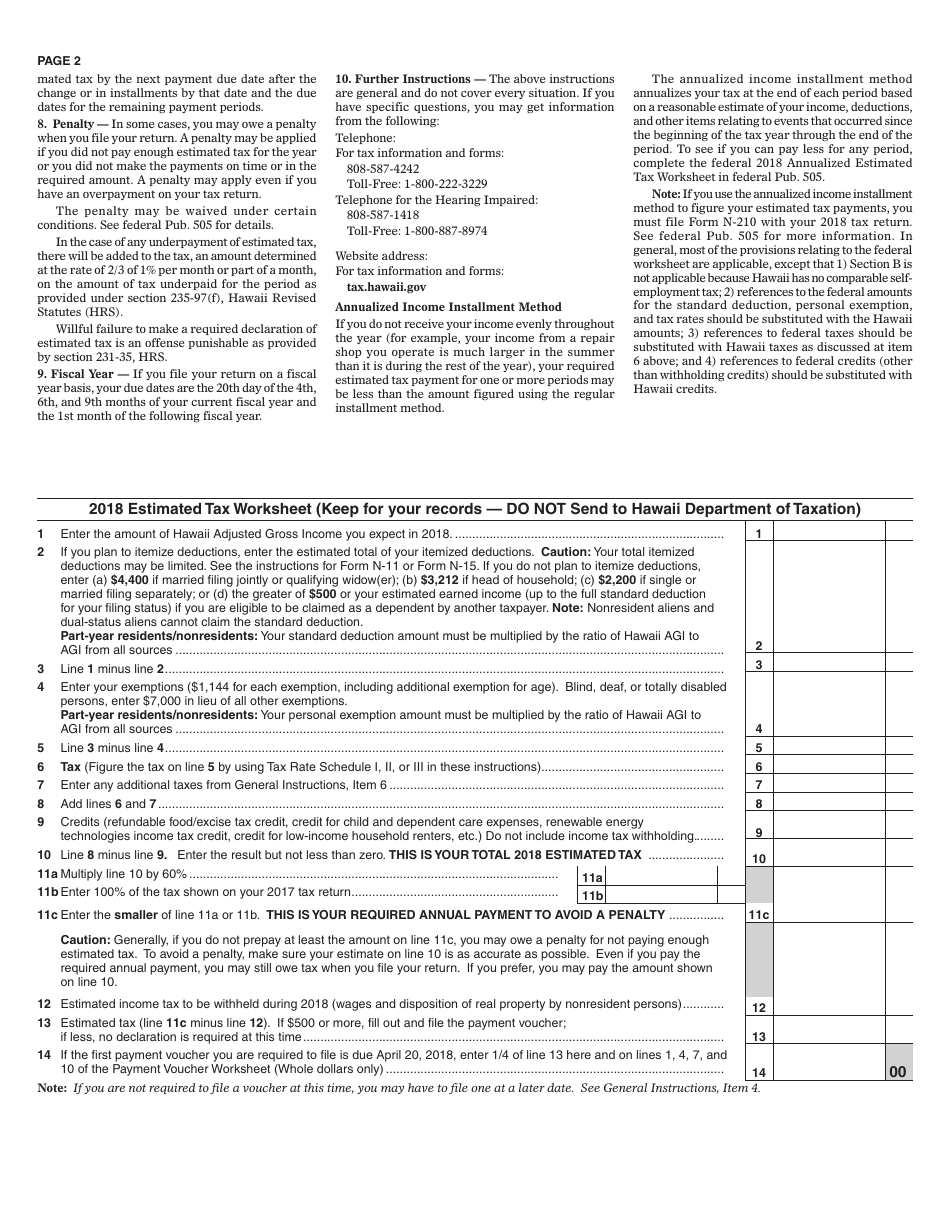

Q: What information do I need to complete Form N-1?

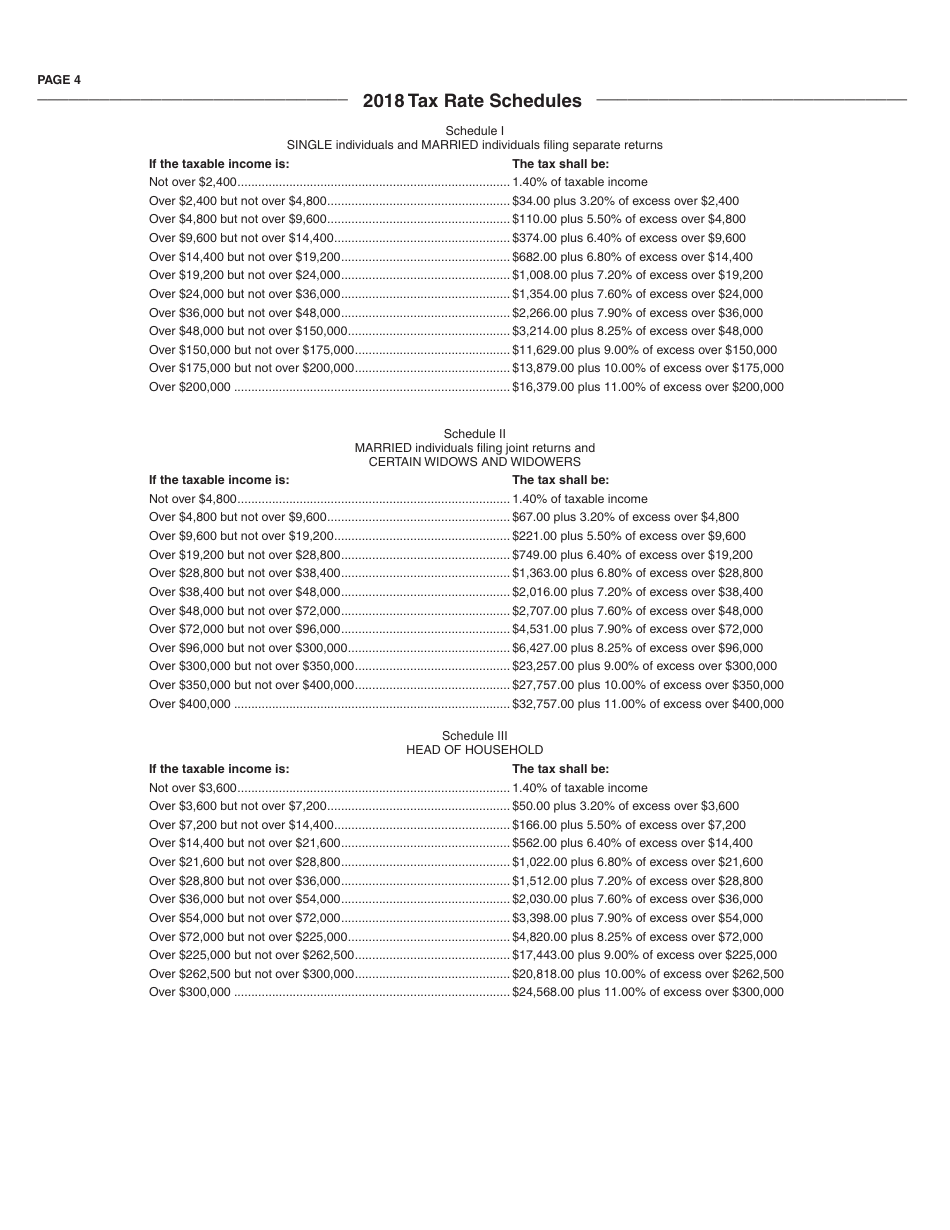

A: You will need to provide your personal information, estimate your income, deductions, and credits, and calculate your estimated tax liability.

Q: Do I have to make estimated tax payments if I file Form N-1?

A: If you expect to owe $500 or more in income tax, you are generally required to make estimated tax payments.

Q: What are the penalties for not filing Form N-1 or underpaying estimated tax?

A: Penalties may apply for failure to file Form N-1 or underpayment of estimated tax, including interest charges and penalties based on the amount of tax owed.

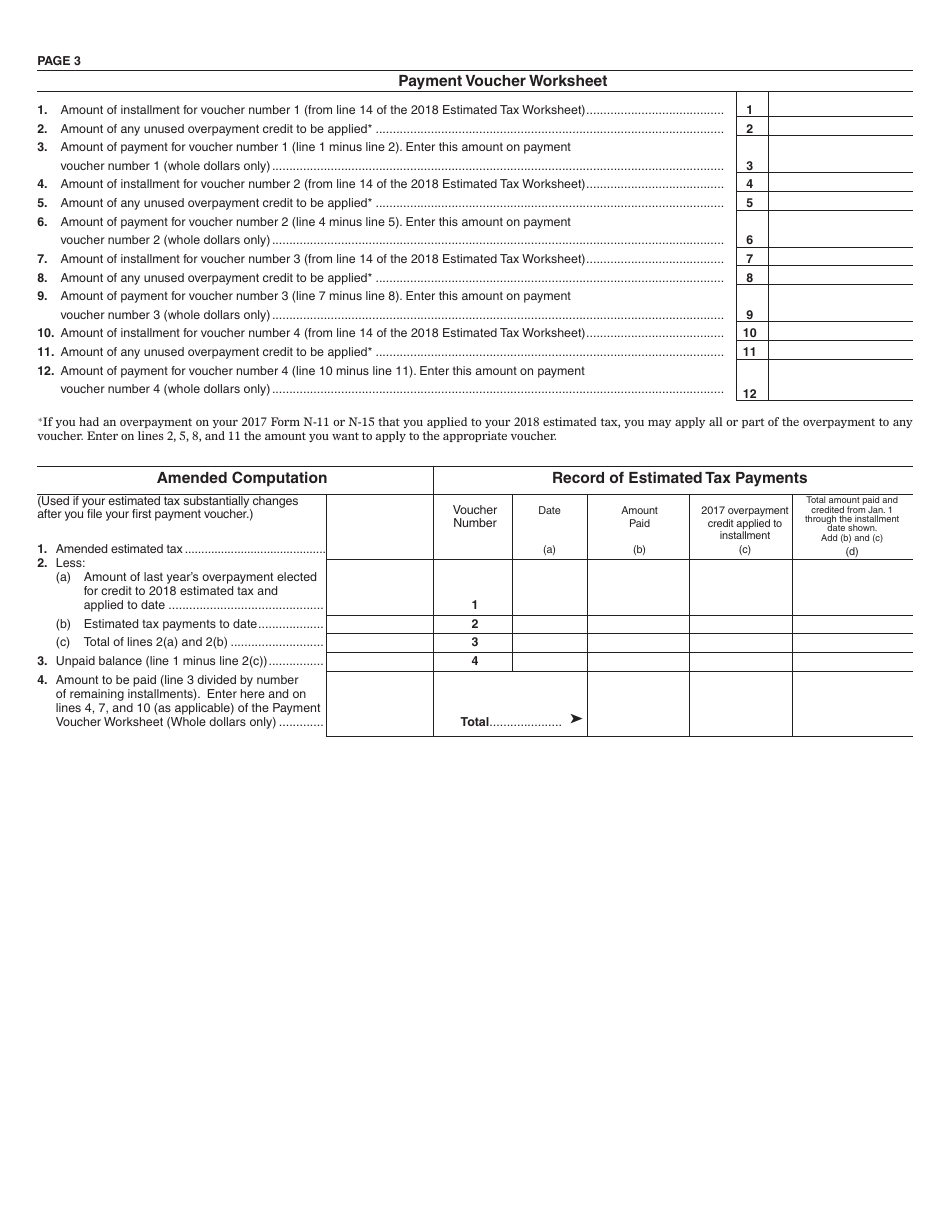

Q: Can I make changes to my estimated tax payments after filing Form N-1?

A: Yes, you can make changes to your estimated tax payments by filing a revised Form N-1. It is important to keep your estimated payments up to date if your income or deductions change during the year.

Q: Is there a separate form for federal estimated tax payments?

A: Yes, the federal estimated tax payments are made using Form 1040-ES.

Q: Are there any exceptions to filing Form N-1?

A: There are certain exceptions to filing Form N-1, such as if your income is primarily from wages and you expect to have enough tax withheld to cover your tax liability.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.