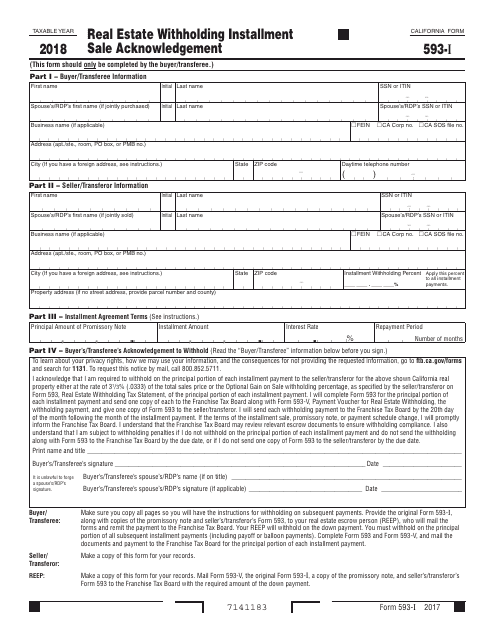

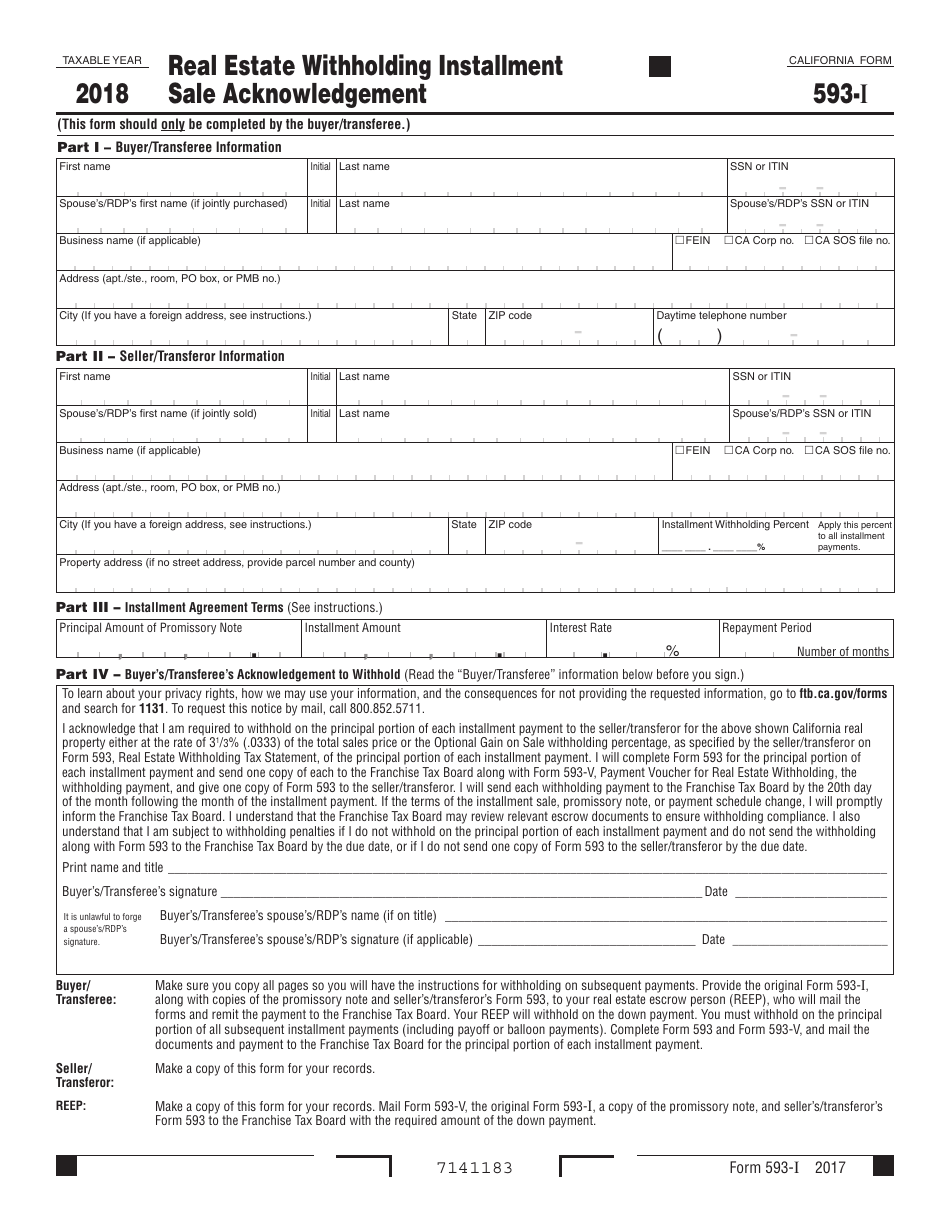

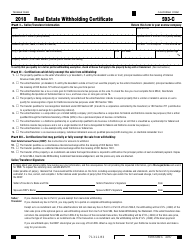

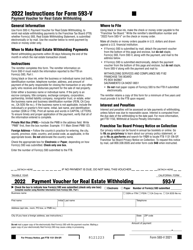

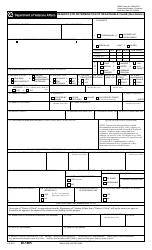

Form 593-I Real Estate Withholding Installment Sale Acknowledgement - California

What Is Form 593-I?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 593-I?

A: Form 593-I is the Real Estate Withholding Installment Sale Acknowledgement form in California.

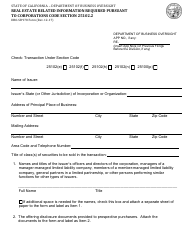

Q: When is Form 593-I used?

A: Form 593-I is used when a seller of real estate elects to report the gain on the sale of the property over multiple tax years.

Q: Who needs to file Form 593-I?

A: The seller of real estate who wants to report the gain on the sale over multiple tax years needs to file Form 593-I.

Q: What information is required on Form 593-I?

A: Form 593-I requires the seller's name, social security number or taxpayer identification number, the description of the property sold, and the calculation of the installment sale gain.

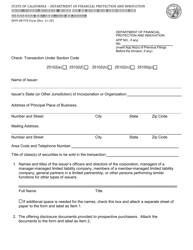

Q: Is there a filing fee for Form 593-I?

A: No, there is no filing fee for Form 593-I.

Q: When is the deadline for filing Form 593-I?

A: Form 593-I must be filed within 30 days after the close of escrow.

Q: What happens if I fail to file Form 593-I?

A: Failing to file Form 593-I may result in penalties and interest being assessed by the California Franchise Tax Board.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 593-I by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.