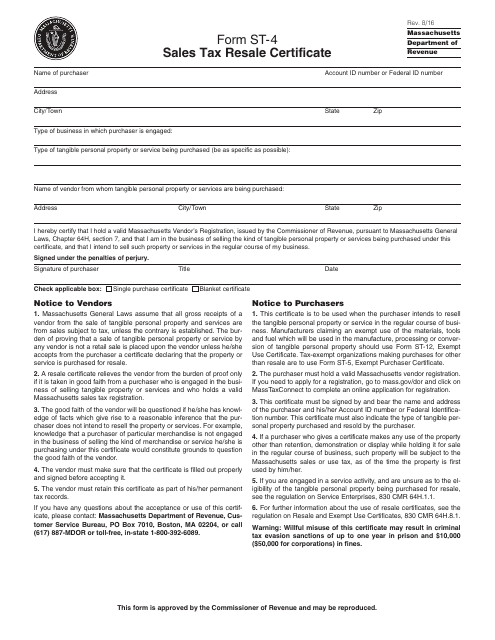

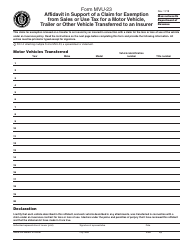

Form ST-4 Sales Tax Resale Certificate - Massachusetts

What Is Form ST-4 (Massachusetts)?

Form ST-4, Sales Tax Resale Certificate , is a legal document presented by a retailer to a Massachusetts merchant from whom the retailer is buying merchandise to resell it later in the regular course of business. It is needed to avoid paying sales taxes twice because the law assumes that all receipts from the sale of services and tangible personal property are subject to tax. A resale certificate will relieve a vendor from the burden of proving this sale was not a retail sale. And instead of paying sales tax, a retailer will charge sales tax to their customer on the final price of the merchandise.

The Massachusetts Sales Tax Resale Certificate was released by the Massachusetts Department of Revenue . The latest version of the form was issued on August 1, 2016 , with all previous editions obsolete. A fillable Massachusetts Form ST-4 is available for download below.

Massachusetts Form ST-4 Instructions

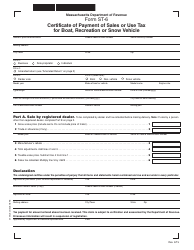

Provide the following details in MA Form ST-4:

- Name and address of the purchaser. The retailer is also identified by their account ID number assigned by the Massachusetts DOR or Federal ID number assigned by the Internal Revenue Service.

- Type of business in which the purchaser is engaged.

- Type of service or tangible personal property being purchased. It is required to describe it as fully as possible.

- Name and address of the vendor who sells tangible personal property or services.

- Signature and title of the purchaser. The purchaser certifies the intention to sell the property or services via the usual customs, practices, and transactions of the business. Do not forget to state the actual date of signing.

- Type of certificate. Select the applicable box - a single purchase certificate or a blanket certificate. If you make similar purchases from a vendor, it may be convenient to use a blanket certificate. This way, you only have to give the vendor one certificate to cover all similar purchases, rather than a single purchase certificate. A blanket certificate is valid as long as the purchaser buys from the seller.

How to Get a Sales Tax Resale Certificate in MA?

If you wish to use an MA ST-4 Form, you must first register as a vendor and obtain a Sales Tax Permit from the DOR - this document will allow you to sell and collect taxes from taxable services and products. Then, you can print out a Massachusetts Resale Certificate and fill it out. Sign the document and give it to the vendor for their permanent tax and audit records - do not send the form anywhere. The vendor must accept the document only when being sure the certificate is completed properly and signed by the purchaser.