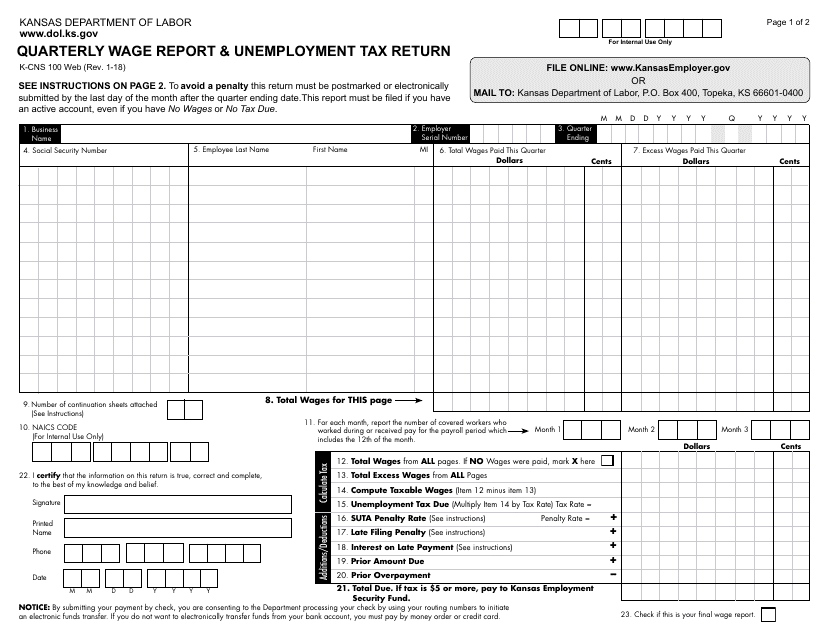

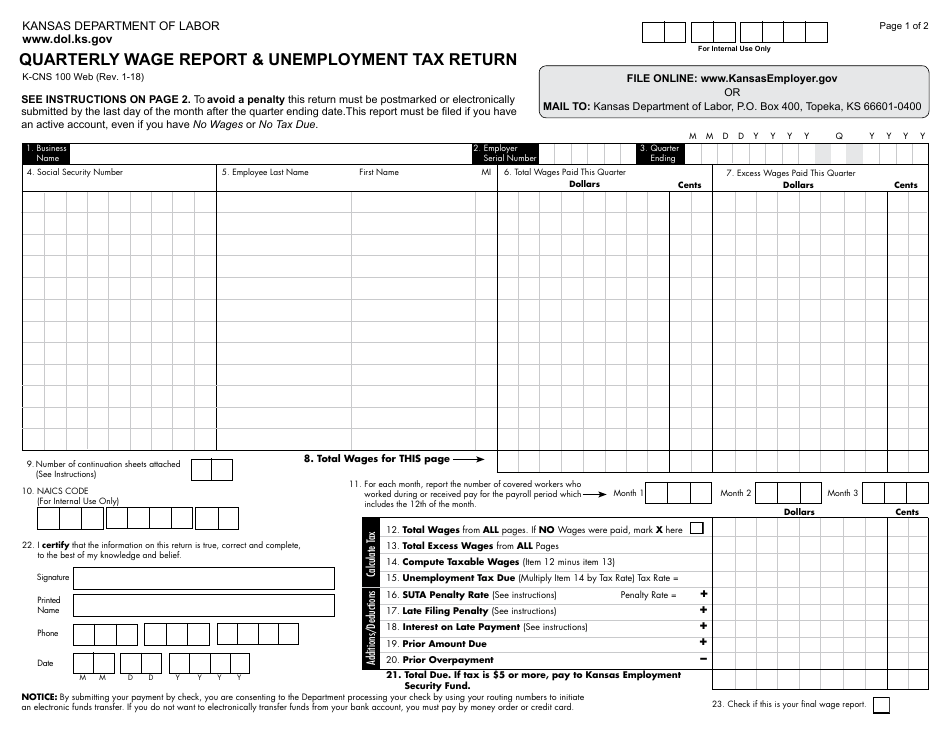

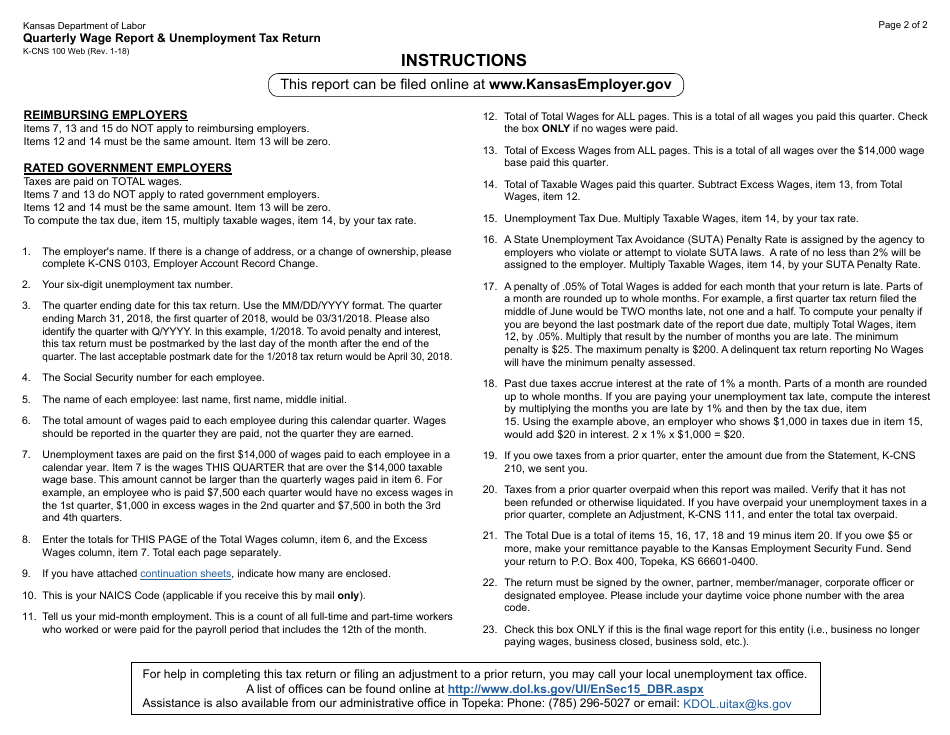

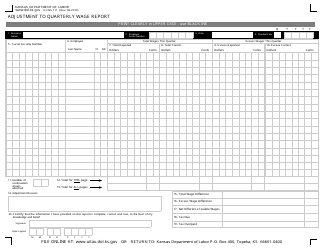

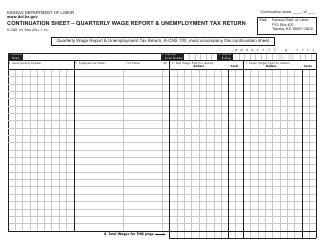

Form K-CNS100 Quarterly Wage Report & Unemployment Tax Return - Kansas

What Is Form K-CNS100?

This is a legal form that was released by the Kansas Department of Labor - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the K-CNS100 Quarterly Wage Report & Unemployment Tax Return?

A: The K-CNS100 is a form used in Kansas to report quarterly wages and pay unemployment taxes.

Q: Who needs to file the K-CNS100 form?

A: Employers in Kansas who have employees and are liable for paying unemployment taxes need to file the K-CNS100 form.

Q: How often do I need to file the K-CNS100 form?

A: The form needs to be filed quarterly, which means four times a year.

Q: What information do I need to provide on the K-CNS100 form?

A: You will need to provide information about your business and your employees, including wages paid and unemployment taxes owed.

Q: What happens if I don't file the K-CNS100 form?

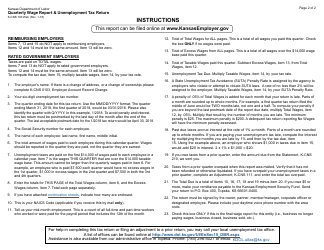

A: Failing to file the form or submitting it late may result in penalties and interest charges, so it's important to file on time.

Q: Are there any resources available to help me fill out the K-CNS100 form?

A: Yes, the Kansas Department of Labor provides instructions and guides to help employers fill out the form correctly.

Q: Can I hire a professional to help me with the K-CNS100 form?

A: Yes, you can hire an accountant or payroll service to assist you with completing and filing the K-CNS100 form.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Kansas Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-CNS100 by clicking the link below or browse more documents and templates provided by the Kansas Department of Labor.