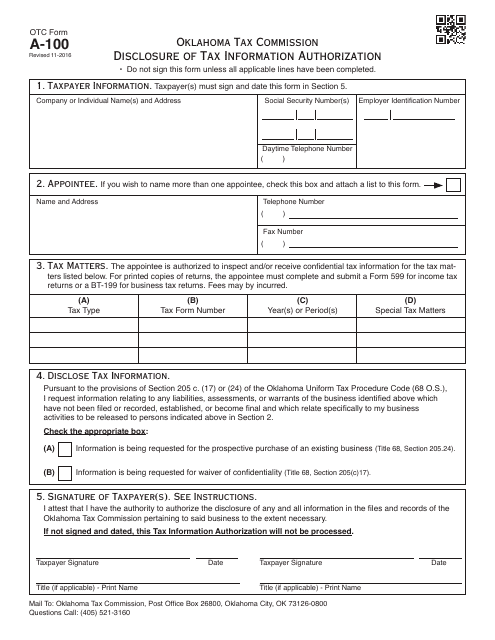

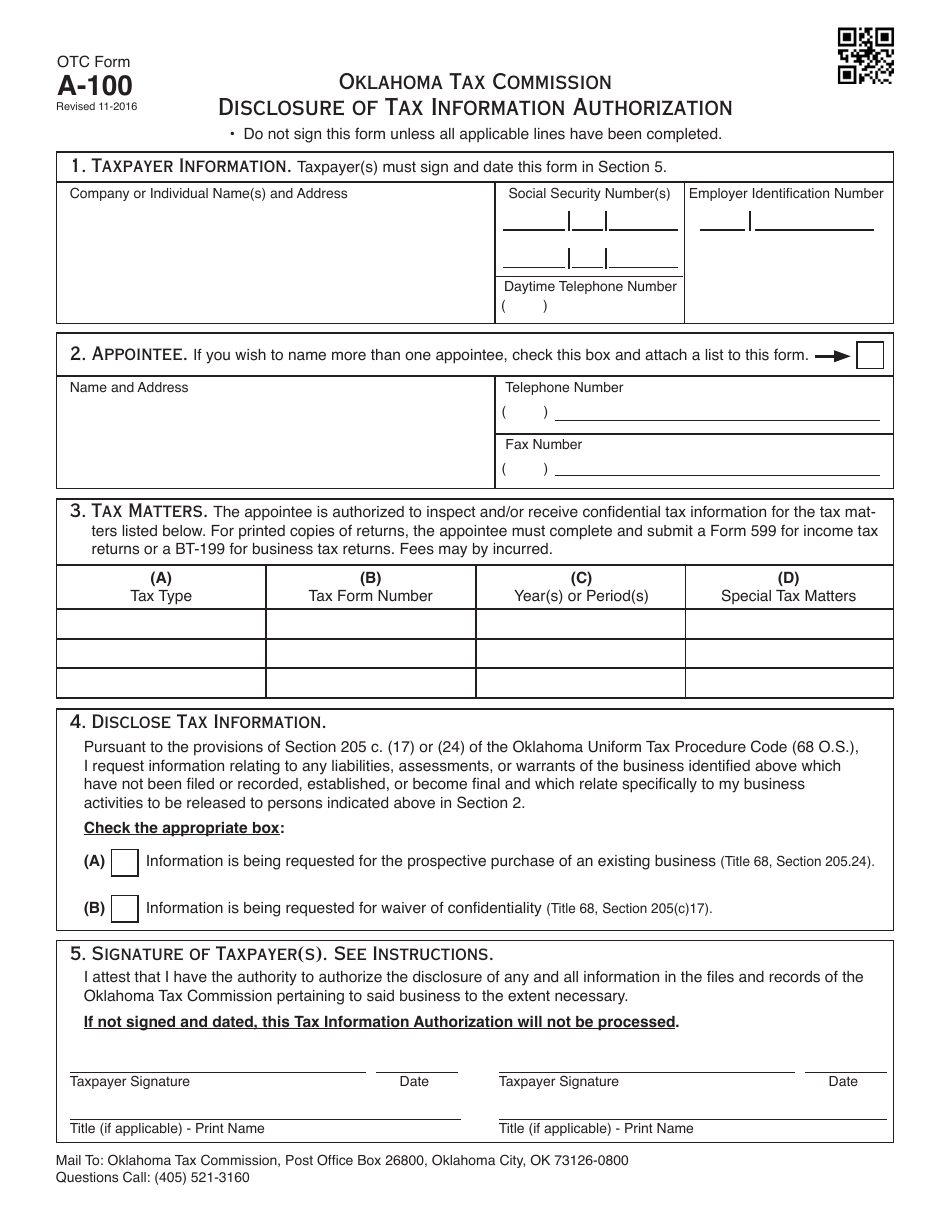

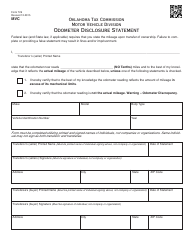

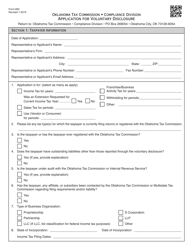

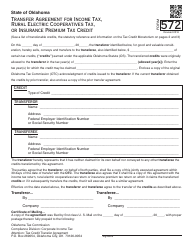

OTC Form A-100 Disclosure of Tax Information Authorization - Oklahoma

What Is OTC Form A-100?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form A-100?

A: OTC Form A-100 is the Disclosure of Tax Information Authorization form in Oklahoma.

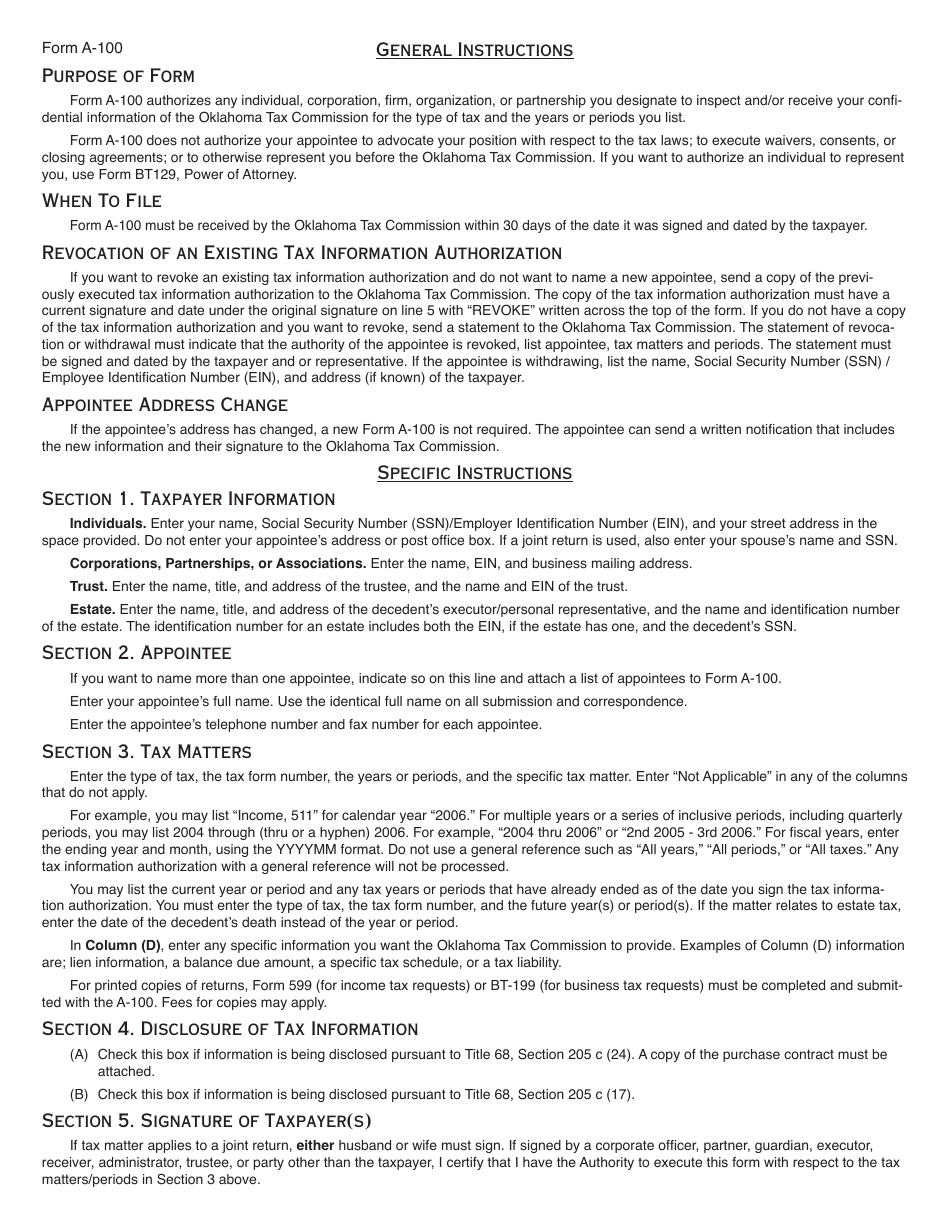

Q: What is the purpose of OTC Form A-100?

A: The purpose of OTC Form A-100 is to authorize the release of tax information to a designated person or organization.

Q: Who needs to complete OTC Form A-100?

A: Any taxpayer in Oklahoma who wants to authorize the release of their tax information to a designated person or organization needs to complete OTC Form A-100.

Q: Is there a fee to complete OTC Form A-100?

A: No, there is no fee to complete OTC Form A-100.

Q: Can I revoke the authorization given on OTC Form A-100?

A: Yes, you can revoke the authorization given on OTC Form A-100 by submitting a written request to the Oklahoma Tax Commission.

Q: How long does the authorization on OTC Form A-100 last?

A: The authorization on OTC Form A-100 remains in effect until it is revoked in writing or until the expiration of the tax year specified on the form.

Q: Can I designate multiple persons or organizations to receive my tax information on OTC Form A-100?

A: Yes, you can designate multiple persons or organizations to receive your tax information on OTC Form A-100 by providing their names and addresses.

Q: What information is disclosed under the authorization on OTC Form A-100?

A: The information disclosed under the authorization on OTC Form A-100 includes your tax return information, payment history, and other tax-related information.

Q: Is the information disclosed on OTC Form A-100 confidential?

A: Yes, the information disclosed on OTC Form A-100 is confidential and can only be used for official purposes by the designated persons or organizations.

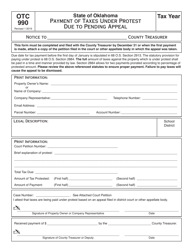

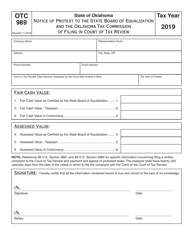

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form A-100 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.