This version of the form is not currently in use and is provided for reference only. Download this version of

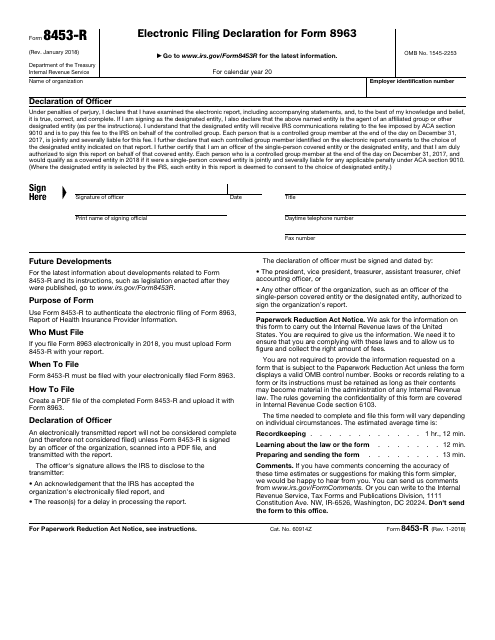

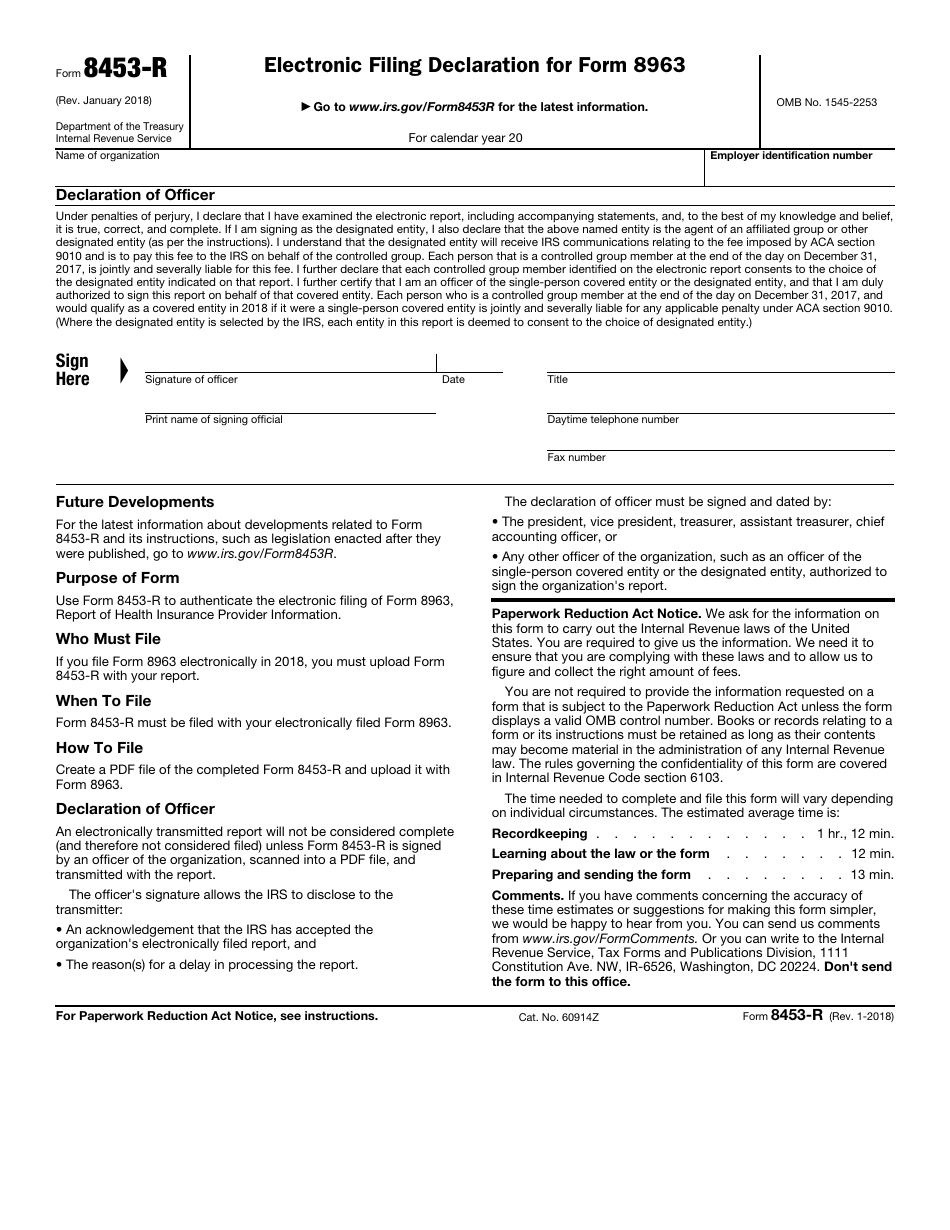

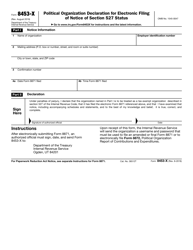

IRS Form 8453-R

for the current year.

IRS Form 8453-R Electronic Filing Declaration for Form 8963

What Is IRS Form 8453-R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 8453-R?

A: Form 8453-R is the Electronic Filing Declaration for Form 8963.

Q: What is the purpose of Form 8453-R?

A: The purpose of Form 8453-R is to declare that the taxpayer is electronically filing Form 8963.

Q: When is Form 8453-R used?

A: Form 8453-R is used when electronically filing Form 8963.

Q: Do I need to submit a paper copy of Form 8453-R?

A: In most cases, a paper copy of Form 8453-R is not required to be submitted.

Q: How do I file Form 8453-R?

A: Form 8453-R is typically filed electronically through the IRS e-file system.

Q: Is Form 8453-R only for individual taxpayers?

A: No, Form 8453-R can be used by both individual and business taxpayers.

Q: What other forms are related to Form 8453-R?

A: Form 8453-R is specifically related to Form 8963, which is used to claim the alternative fuel credit.

Q: What should I do if I make a mistake on Form 8453-R?

A: If you make a mistake on Form 8453-R, you may need to file an amended Form 8453-R to correct the error.

Q: Can I file Form 8453-R separately from Form 8963?

A: No, Form 8453-R is filed in conjunction with Form 8963 and cannot be filed separately.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8453-R through the link below or browse more documents in our library of IRS Forms.