This version of the form is not currently in use and is provided for reference only. Download this version of

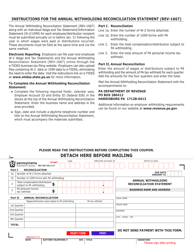

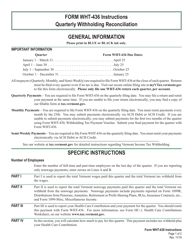

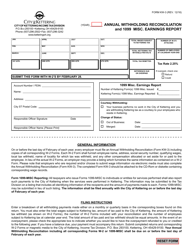

Instructions for VT Form WHT-436

for the current year.

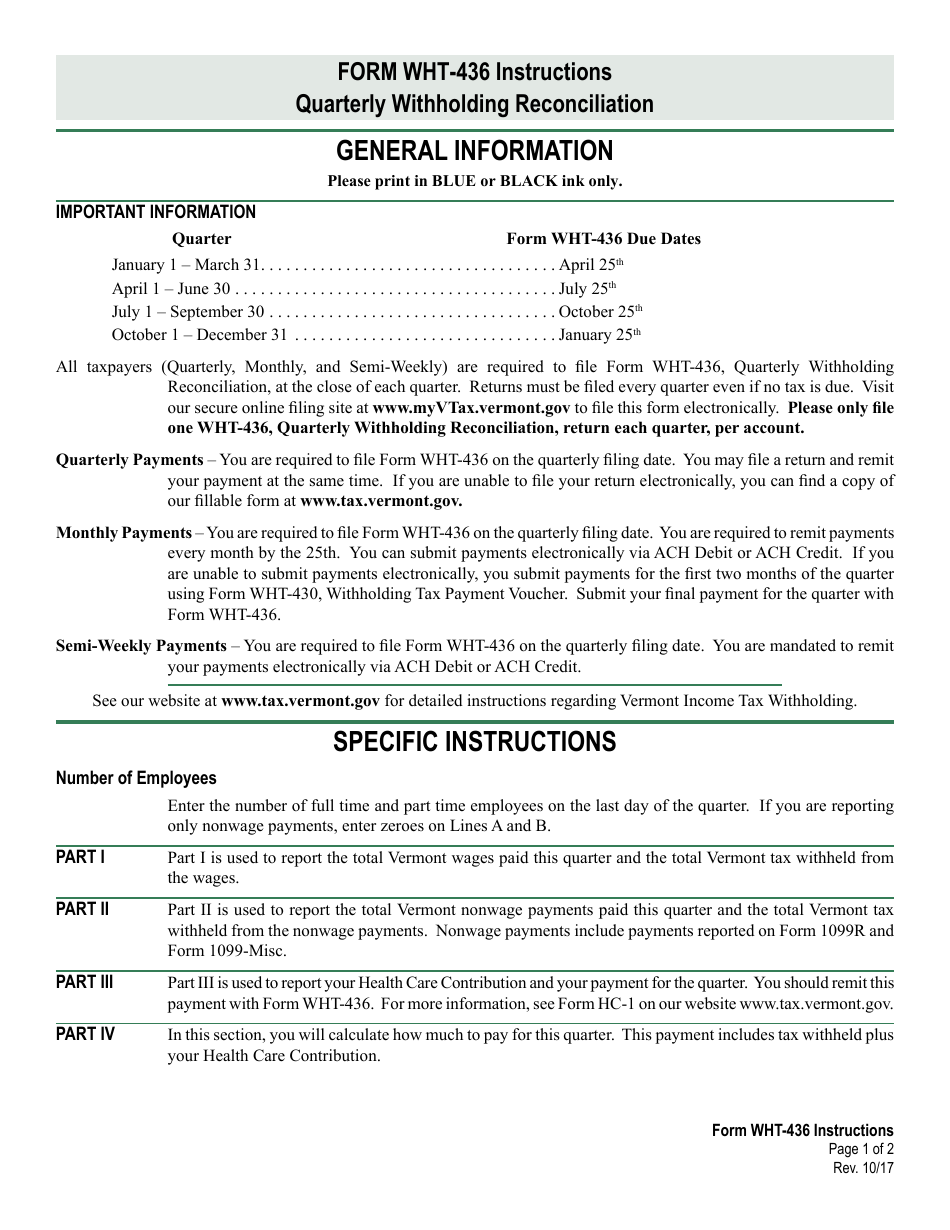

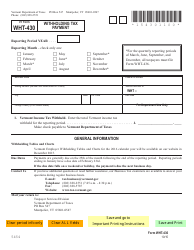

Instructions for VT Form WHT-436 Quarterly Withholding Reconciliation - Vermont

This document contains official instructions for VT Form WHT-436 , Quarterly Withholding Reconciliation - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is VT Form WHT-436?

A: VT Form WHT-436 is the Quarterly Withholding Reconciliation form used in Vermont.

Q: What is the purpose of VT Form WHT-436?

A: The purpose of VT Form WHT-436 is to report and reconcile the quarterly withholding taxes withheld from employees' wages in Vermont.

Q: Who needs to file VT Form WHT-436?

A: Any employer who has withheld Vermont income tax from employees' wages during the quarter needs to file VT Form WHT-436.

Q: When is VT Form WHT-436 due?

A: VT Form WHT-436 is due on or before the last day of the month following the end of the quarter.

Q: What information is required on VT Form WHT-436?

A: Some of the information required on VT Form WHT-436 includes the employer's name and address, total wages paid to employees, total tax withheld, and any adjustments or credits.

Q: Are there any penalties for not filing VT Form WHT-436?

A: Yes, failure to file VT Form WHT-436 or filing it late may result in penalties imposed by the Vermont Department of Taxes.

Q: Is VT Form WHT-436 the only form I need to file for withholding taxes in Vermont?

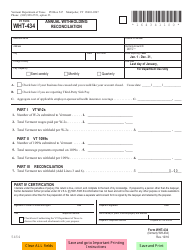

A: No, in addition to VT Form WHT-436, employers also need to file VT Form WHT-434, which is the Quarterly Wage and Contribution Report.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.