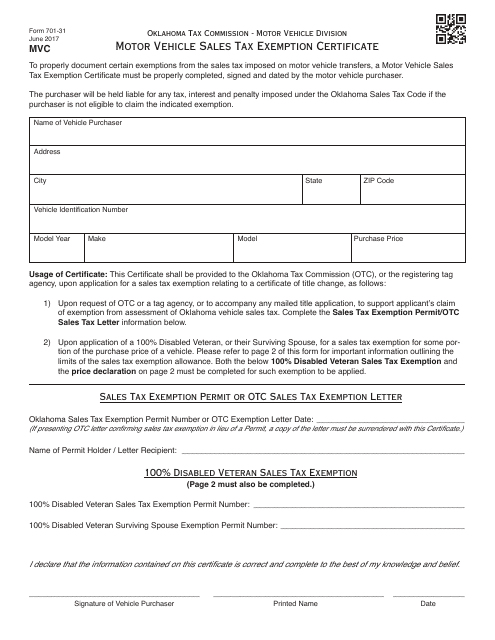

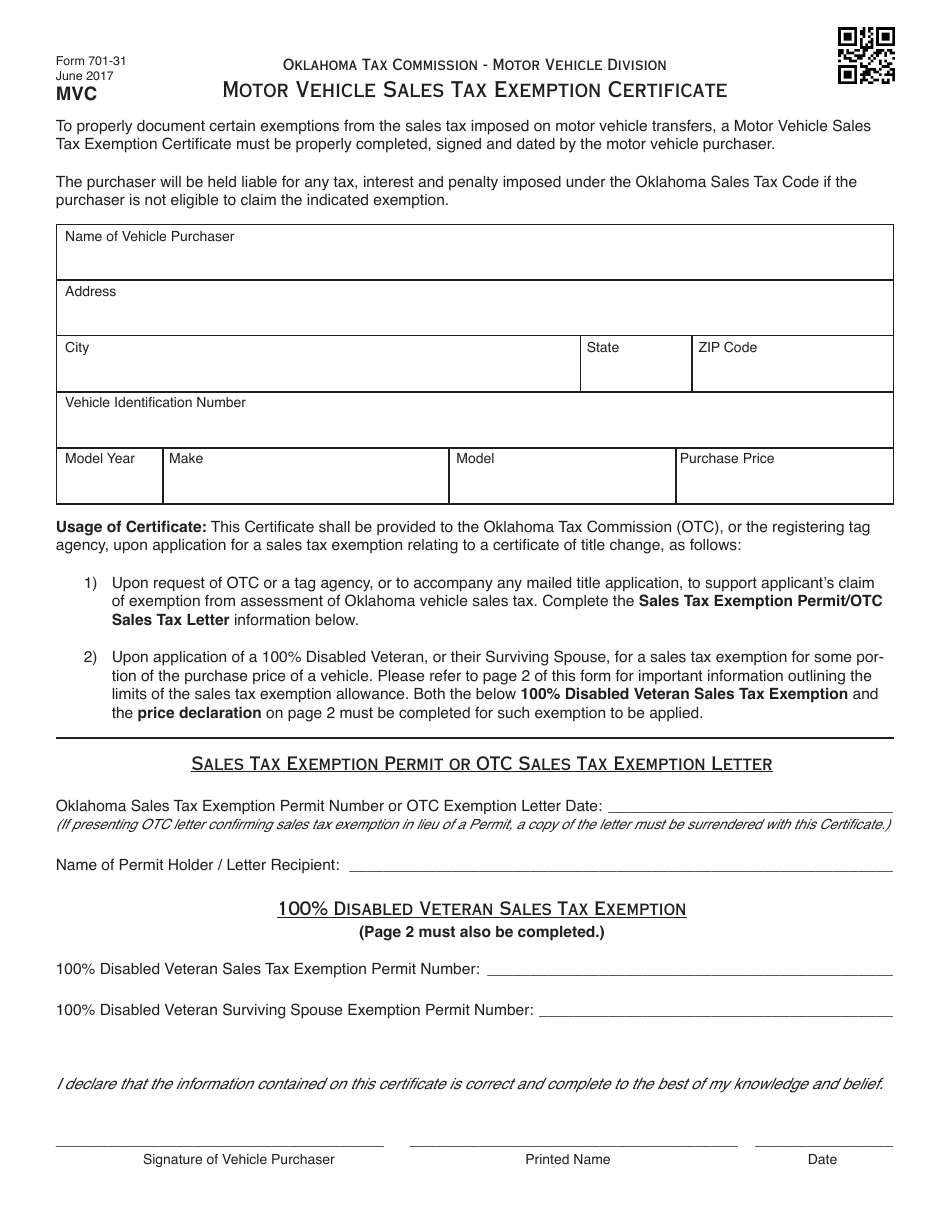

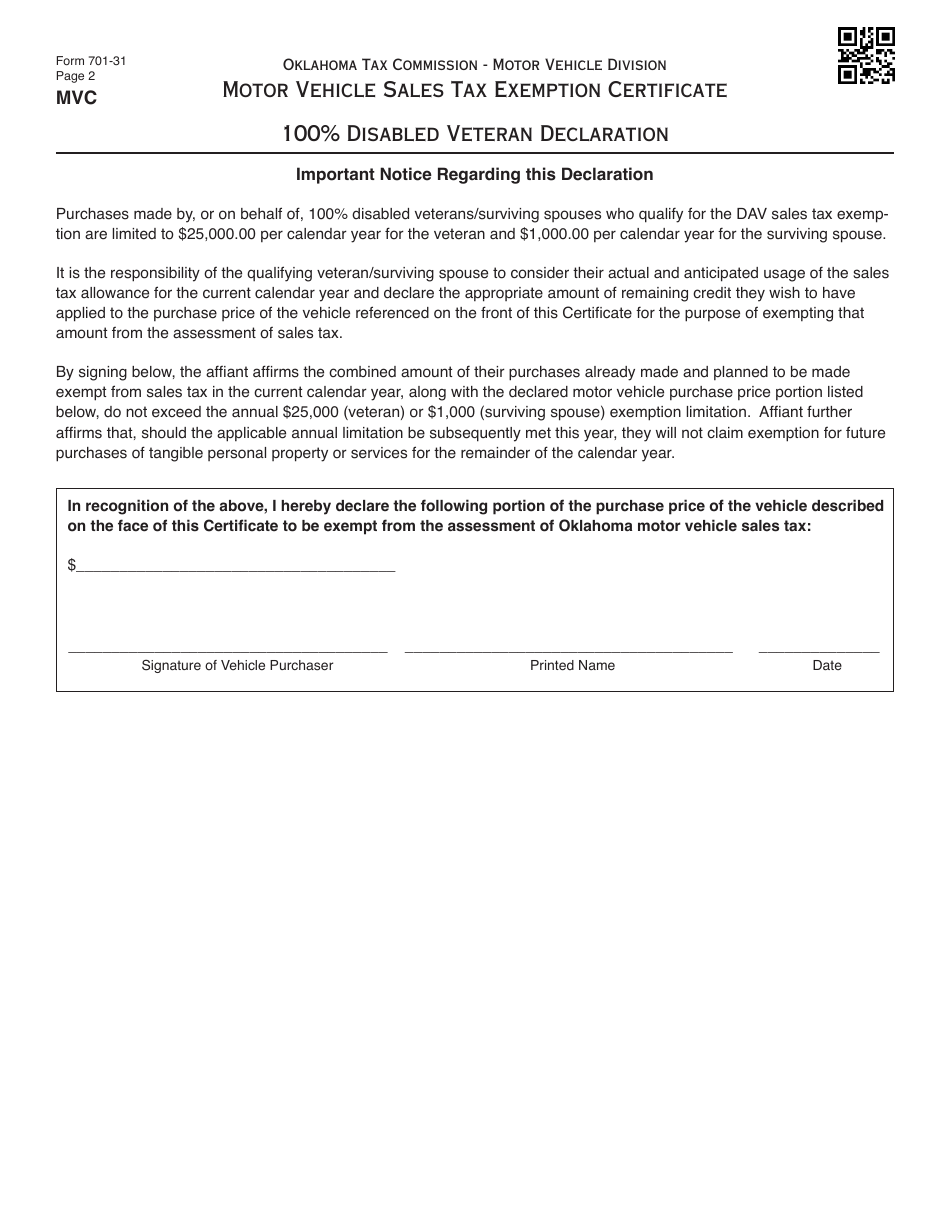

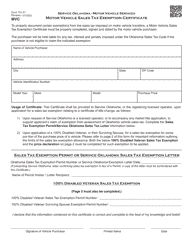

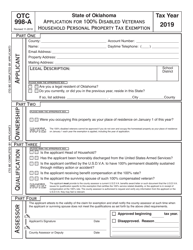

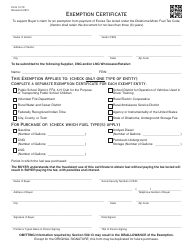

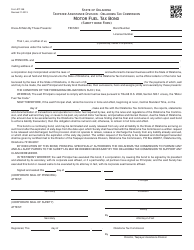

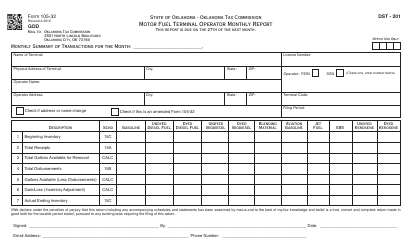

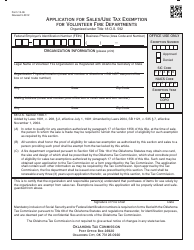

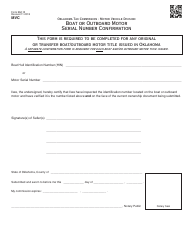

OTC Form 701-31 Motor Vehicle Sales Tax Exemption Certificate - Oklahoma

What Is OTC Form 701-31?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 701-31?

A: OTC Form 701-31 is the Motor Vehicle Sales Tax Exemption Certificate for Oklahoma.

Q: What is the purpose of OTC Form 701-31?

A: The purpose of OTC Form 701-31 is to claim an exemption from paying sales tax when purchasing a motor vehicle in Oklahoma.

Q: Who uses OTC Form 701-31?

A: OTC Form 701-31 is used by individuals or entities who qualify for a sales tax exemption when buying a motor vehicle in Oklahoma.

Q: What information is required on OTC Form 701-31?

A: OTC Form 701-31 requires information such as the buyer's name and address, vehicle information, reason for exemption, and signature.

Q: What documents should I include with OTC Form 701-31?

A: You may need to include additional documents such as proof of eligibility for the sales tax exemption, vehicle purchase documents, and identification.

Q: Are there any fees associated with OTC Form 701-31?

A: There is no fee associated with OTC Form 701-31, but you may still need to pay other registration or titling fees when registering your vehicle.

Q: What should I do if I have more questions about OTC Form 701-31?

A: If you have more questions about OTC Form 701-31, you can contact the Oklahoma Tax Commission or a local tag agency for assistance.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 701-31 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.