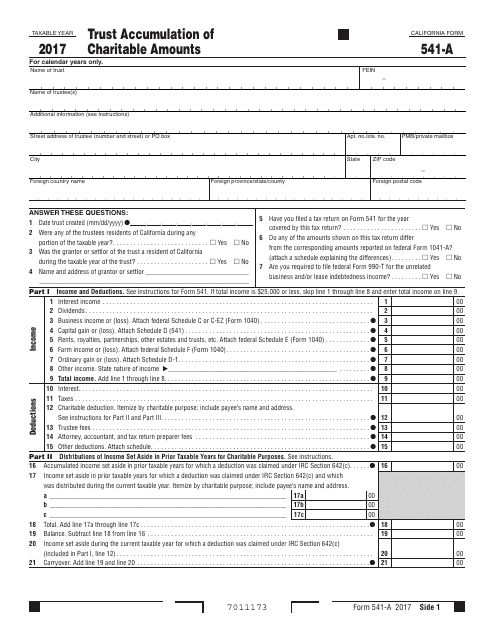

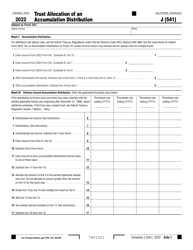

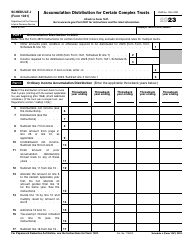

Form 541-A Trust Accumulation of Charitable Amounts - California

What Is Form 541-A?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 541-A?

A: Form 541-A is a tax form used in California to report the accumulation of charitable amounts in a trust.

Q: Who needs to file Form 541-A?

A: This form must be filed by the trustee of a trust that has accumulated charitable amounts.

Q: What is the purpose of Form 541-A?

A: The purpose of Form 541-A is to report the accumulation and distribution of charitable amounts in a trust.

Q: When is Form 541-A due?

A: Form 541-A is due on the 15th day of the 4th month following the close of the tax year.

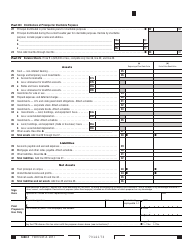

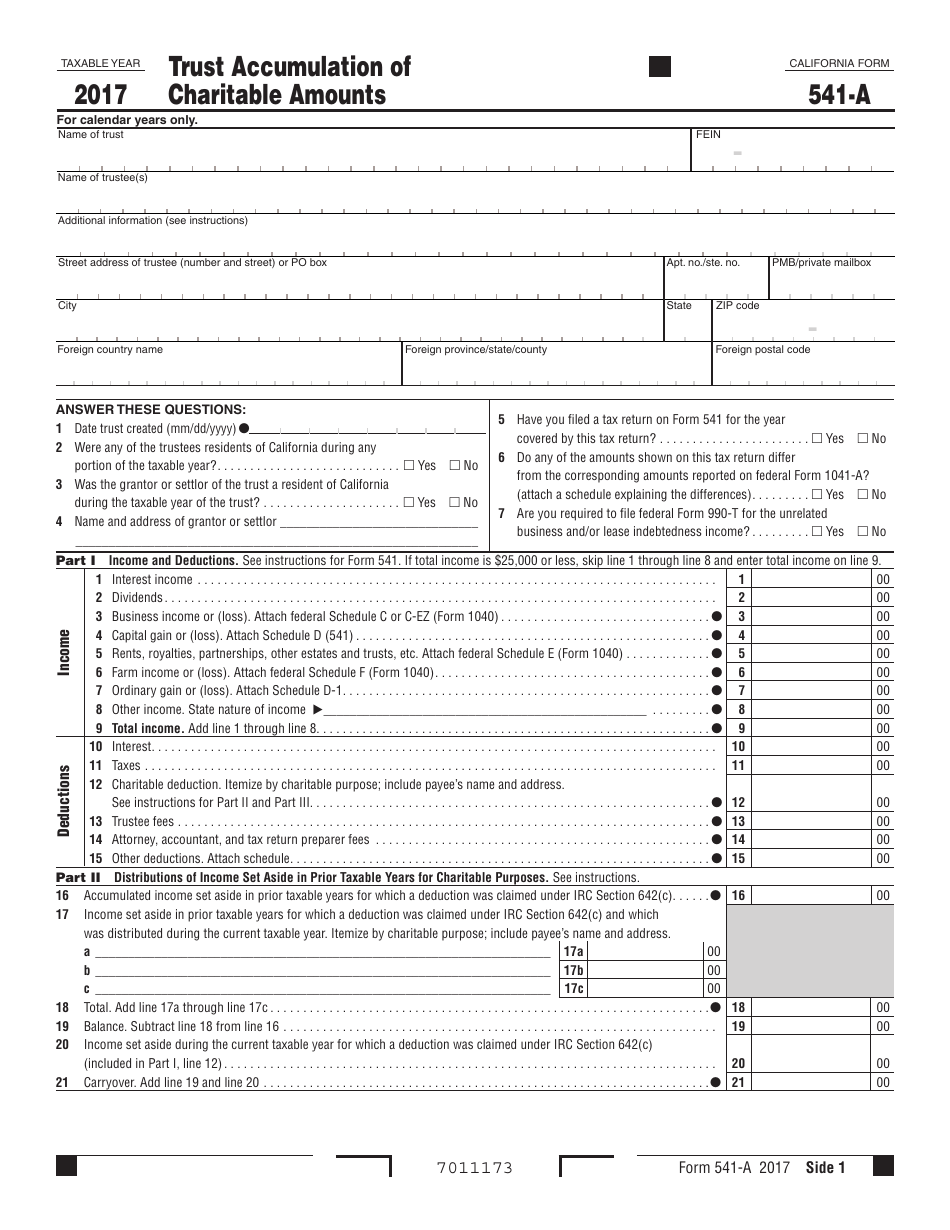

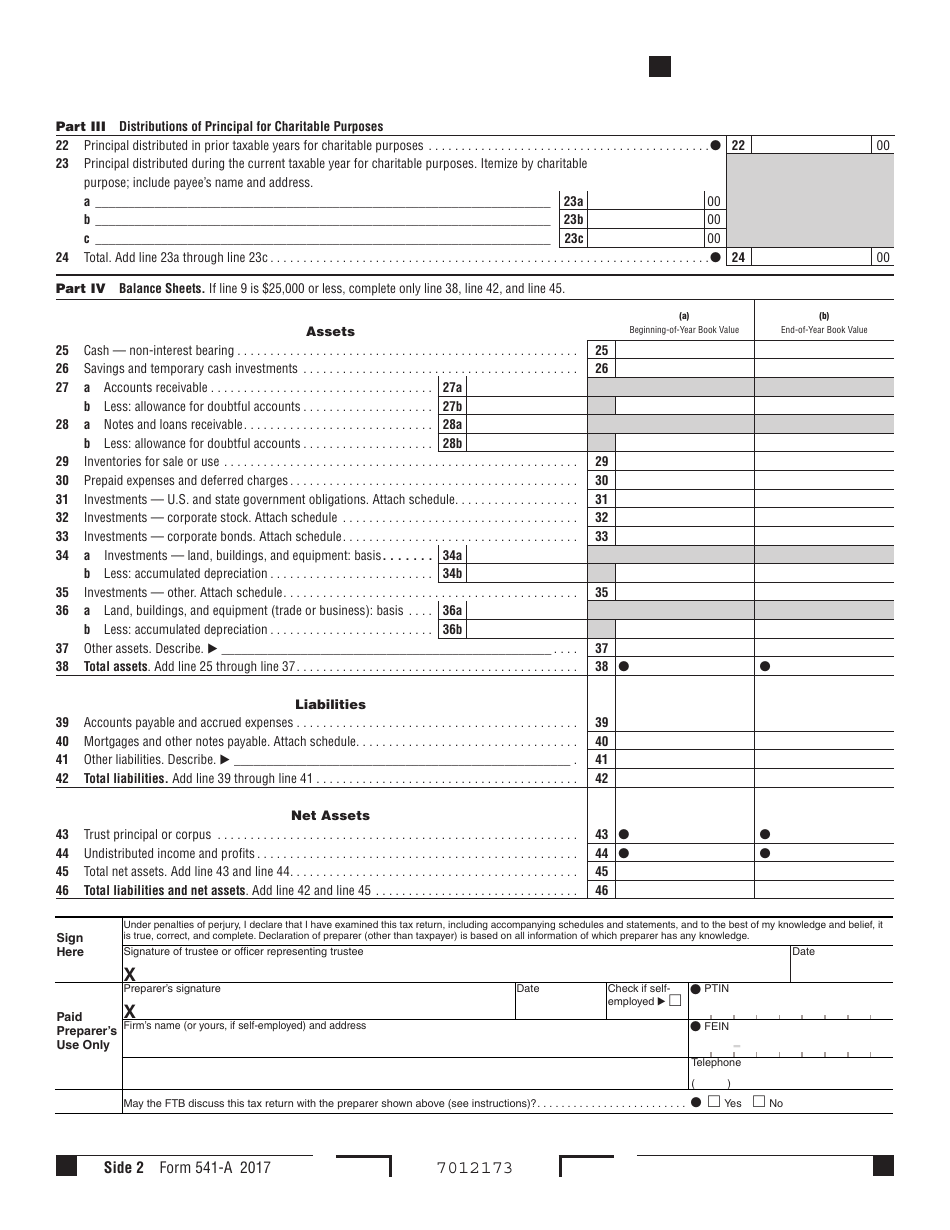

Q: What information is required on Form 541-A?

A: Form 541-A requires information about the trust, the accumulated charitable amounts, and any distributions made during the tax year.

Q: Are there any penalties for not filing Form 541-A?

A: Yes, there are penalties for failing to file Form 541-A, including interest charges and potential loss of tax deductions.

Q: Can I e-file Form 541-A?

A: No, currently, Form 541-A cannot be e-filed. It must be filed by mail.

Q: Is there a fee for filing Form 541-A?

A: No, there is no fee for filing Form 541-A.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 541-A by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.