This version of the form is not currently in use and is provided for reference only. Download this version of

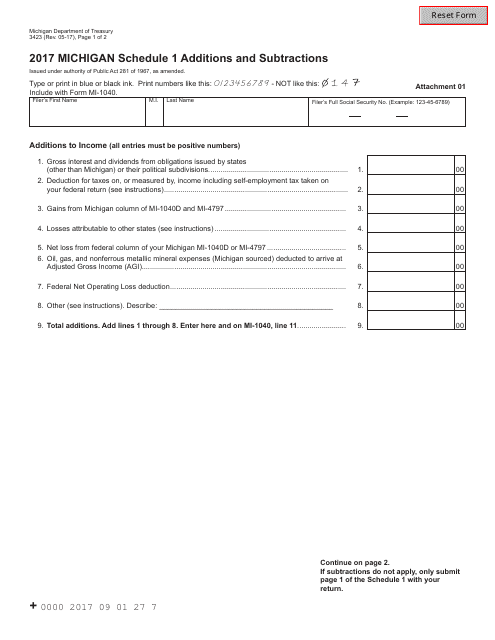

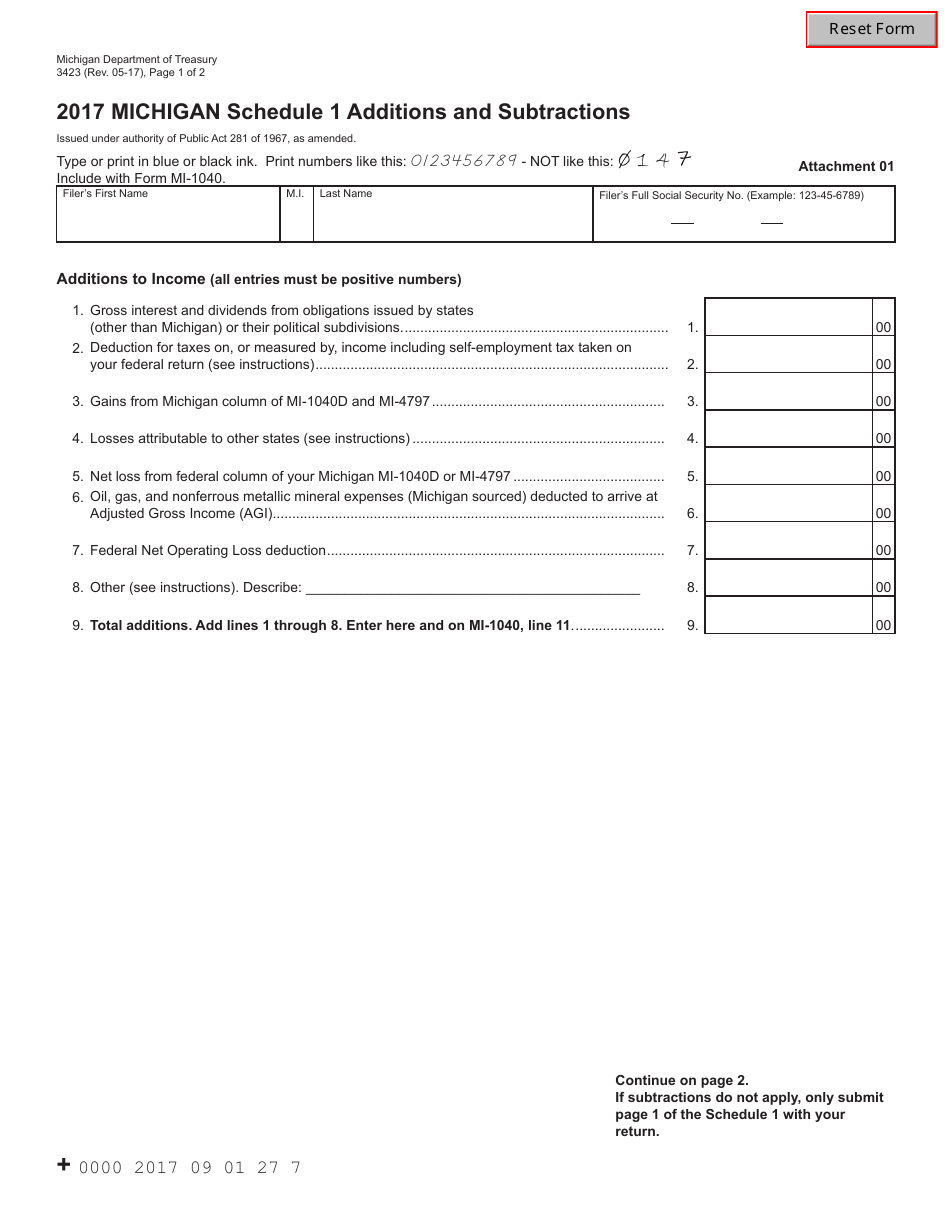

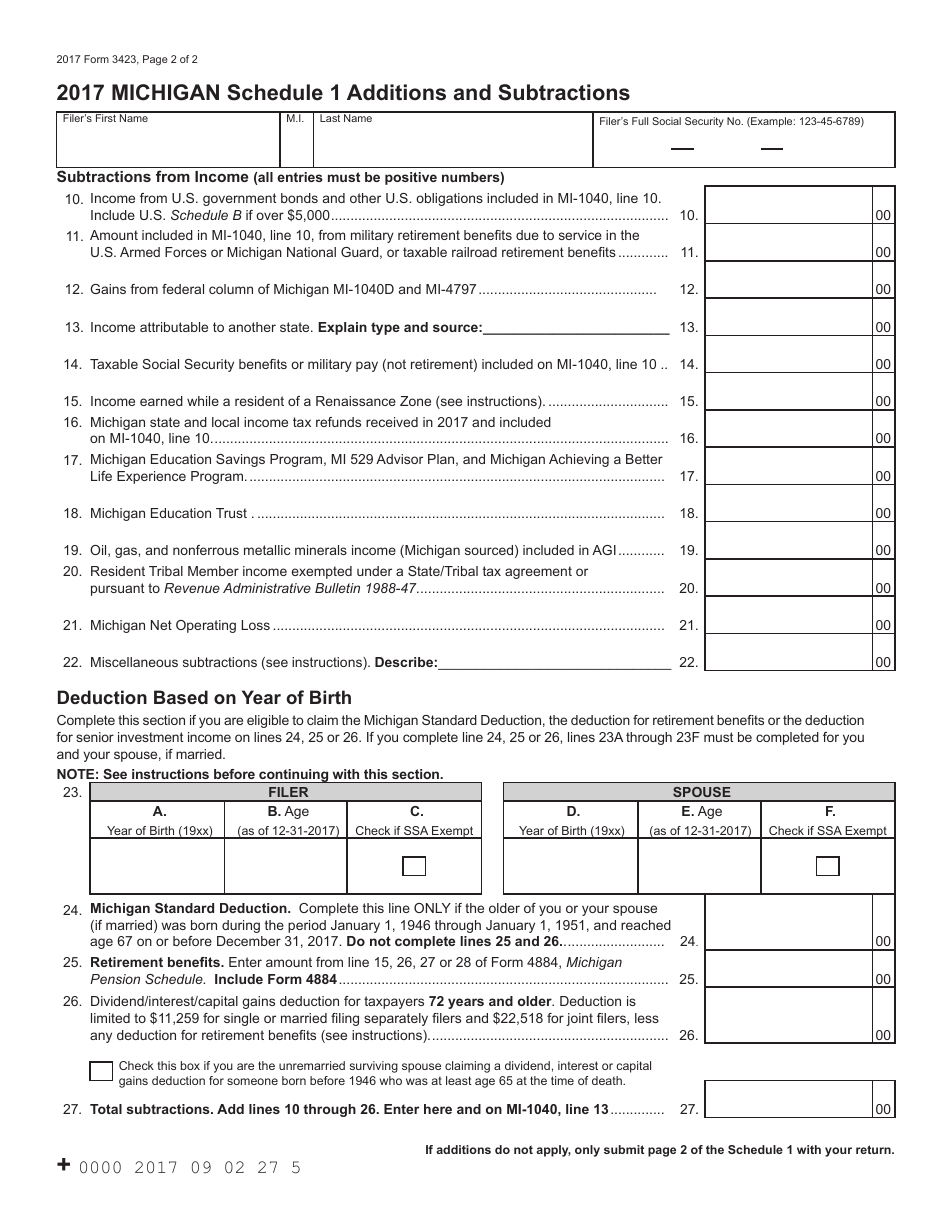

Form 3423 Schedule 1

for the current year.

Form 3423 Schedule 1 Additions and Subtractions - Michigan

What Is Form 3423 Schedule 1?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3423 Schedule 1?

A: Form 3423 Schedule 1 is a tax form used in Michigan to report additions and subtractions to income.

Q: What is the purpose of Form 3423 Schedule 1?

A: The purpose of Form 3423 Schedule 1 is to calculate the total additions and subtractions to be made to Michigan taxable income.

Q: Who needs to file Form 3423 Schedule 1?

A: Residents of Michigan who have additions or subtractions to their income for tax purposes need to file Form 3423 Schedule 1.

Q: What types of additions and subtractions are reported on Form 3423 Schedule 1?

A: Form 3423 Schedule 1 is used to report various additions and subtractions, such as contributions to retirement plans, moving expenses, and certain deductions.

Q: When is Form 3423 Schedule 1 due?

A: Form 3423 Schedule 1 is typically due on the same date as the Michigan income tax return, which is April 15th.

Q: Is Form 3423 Schedule 1 only for Michigan residents?

A: Yes, Form 3423 Schedule 1 is specifically for residents of Michigan.

Q: Are there any penalties for not filing Form 3423 Schedule 1?

A: Failure to file Form 3423 Schedule 1 or reporting incorrect information may result in penalties and interest charges.

Q: Can Form 3423 Schedule 1 be filed electronically?

A: Yes, Form 3423 Schedule 1 can be filed electronically alongside the Michigan income tax return.

Q: Can I claim deductions on Form 3423 Schedule 1?

A: Yes, Form 3423 Schedule 1 allows you to claim certain deductions, such as medical expenses and student loan interest.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3423 Schedule 1 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.