This version of the form is not currently in use and is provided for reference only. Download this version of

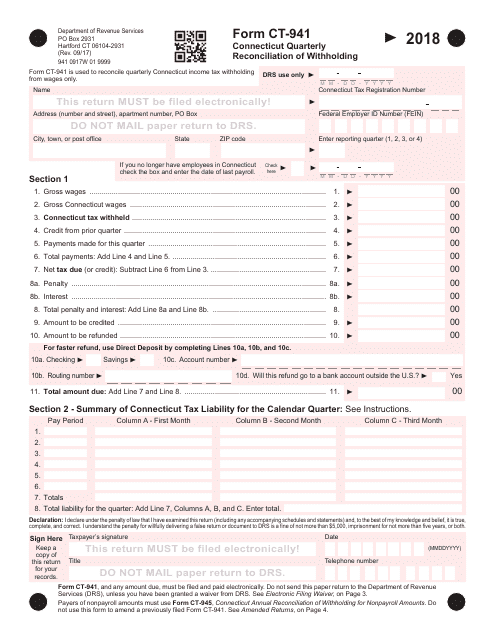

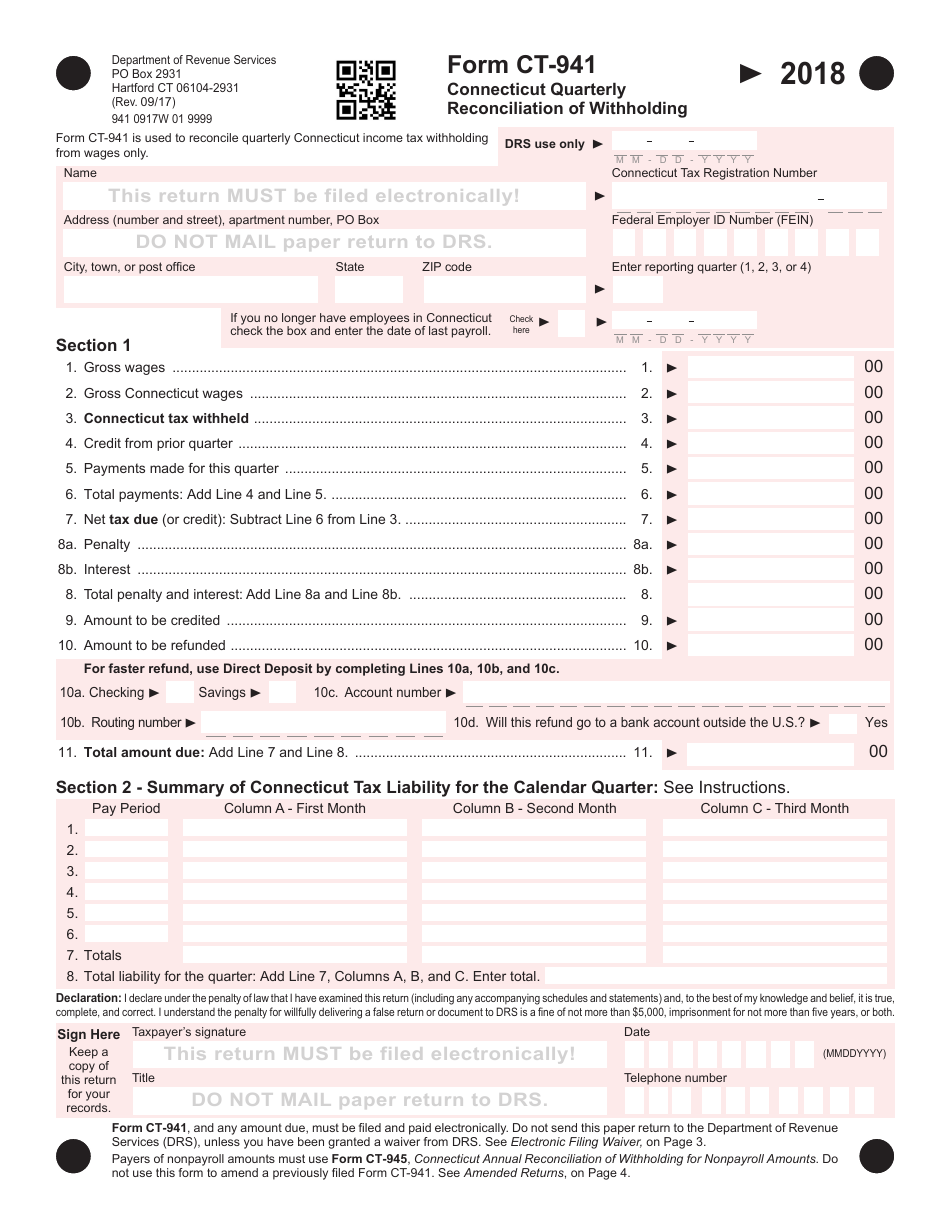

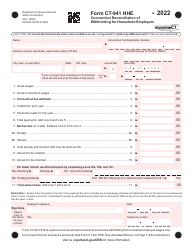

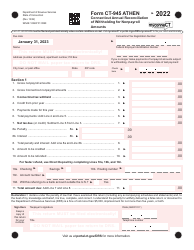

Form CT-941

for the current year.

Form CT-941 Connecticut Quarterly Reconciliation of Withholding - Connecticut

What Is Form CT-941?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-941?

A: Form CT-941 is the Quarterly Reconciliation of Withholding form for the state of Connecticut.

Q: What is the purpose of Form CT-941?

A: The purpose of Form CT-941 is to reconcile the amount of withholding tax that an employer has collected from employee wages with the amount of withholding tax due to the state of Connecticut.

Q: Who must file Form CT-941?

A: Employers in Connecticut who have withheld income tax from employee wages are required to file Form CT-941.

Q: How often do I need to file Form CT-941?

A: Form CT-941 must be filed quarterly, meaning it needs to be filed four times a year.

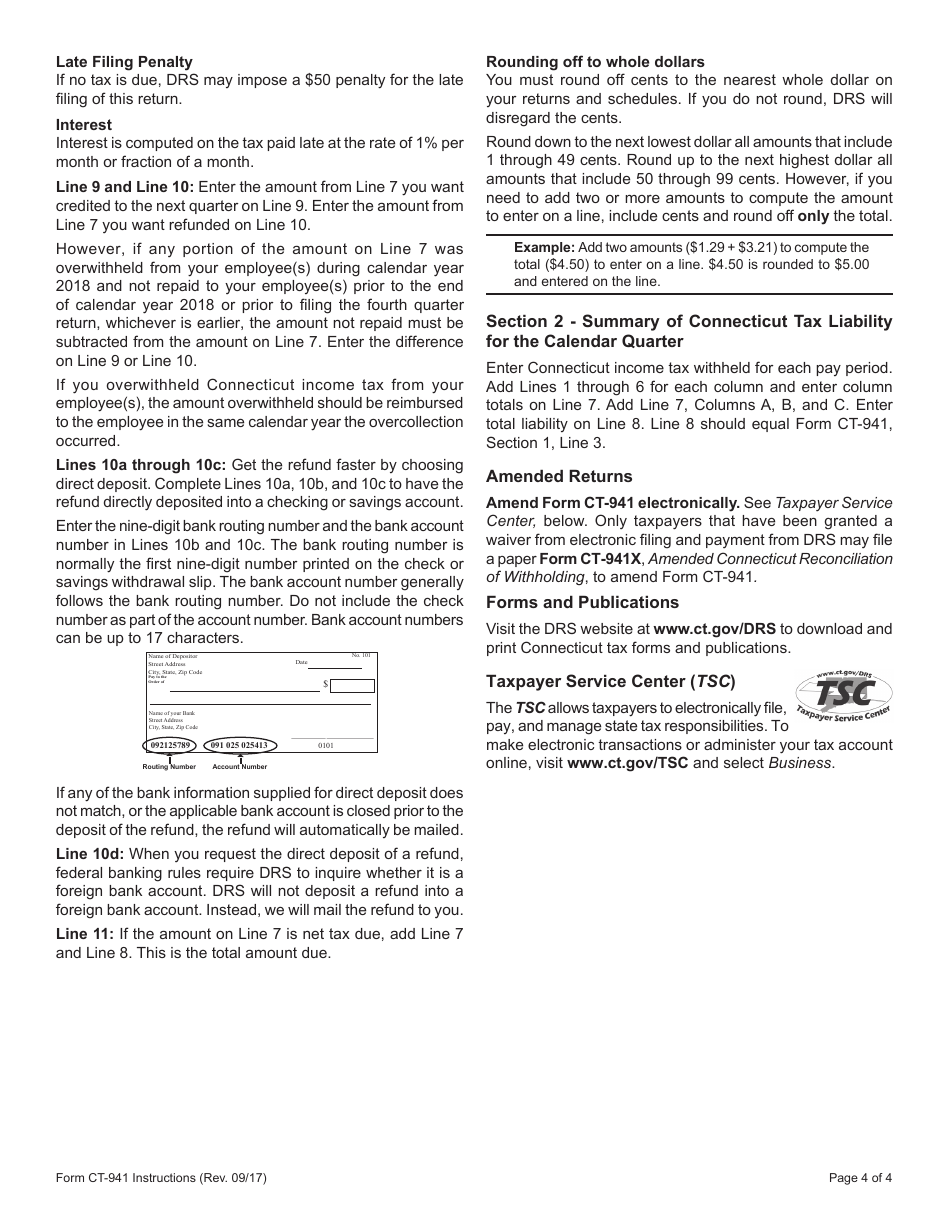

Q: What information do I need to complete Form CT-941?

A: You will need information about your employees' wages, tax withheld, and any adjustments or credits that need to be reported.

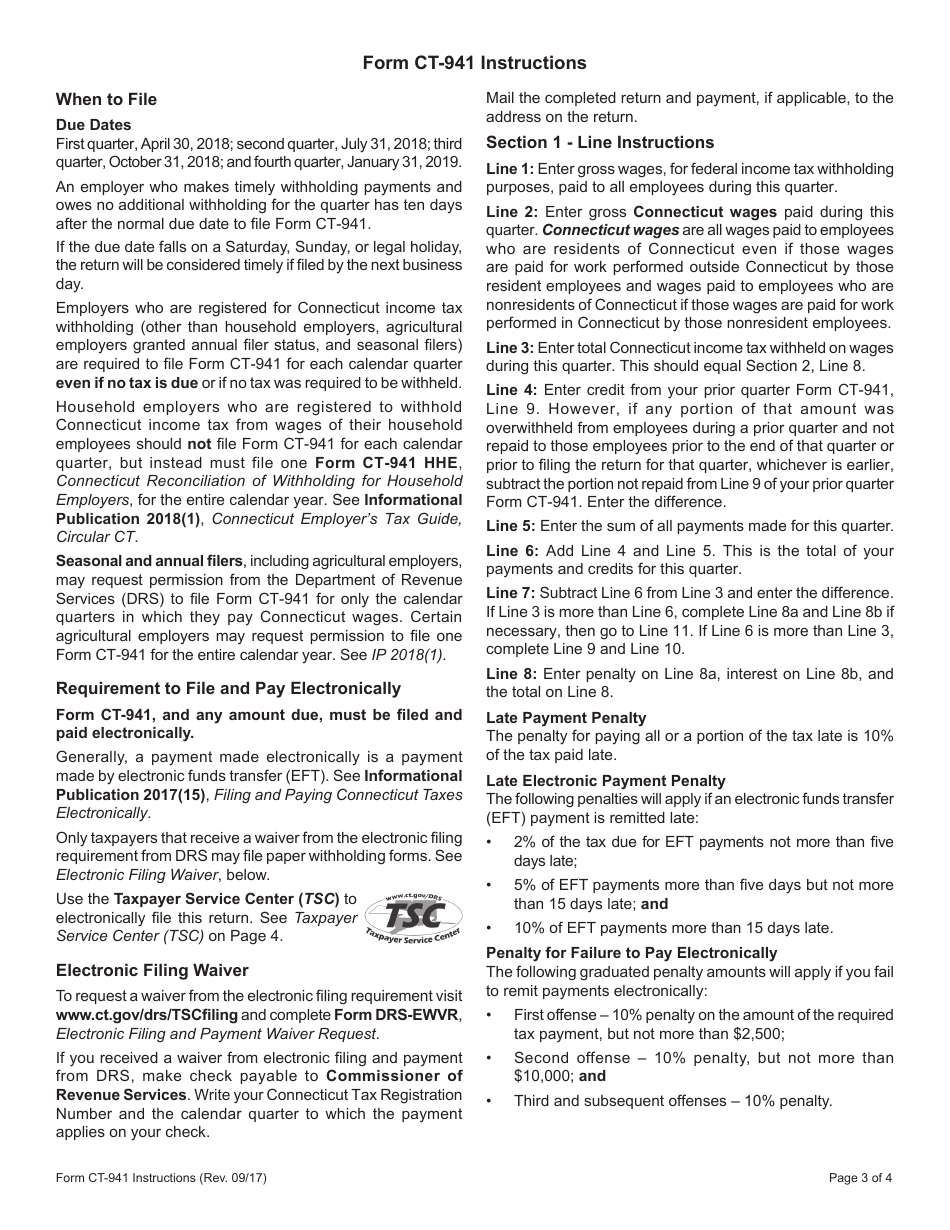

Q: When is the deadline to file Form CT-941?

A: The due date for filing Form CT-941 is the last day of the month following the end of the quarter. For example, the due date for the first quarter is April 30th.

Q: What happens if I don't file Form CT-941?

A: If you don't file Form CT-941 or file it late, you may be subject to penalties and interest on the amount of tax owed.

Q: Can I file Form CT-941 electronically?

A: Yes, you can file Form CT-941 electronically using the Connecticut Taxpayer Service Center.

Q: Do I need to include payment with Form CT-941?

A: Yes, if you have tax due, you must include payment with Form CT-941.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-941 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.