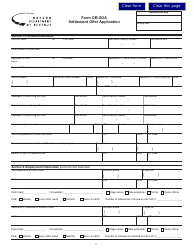

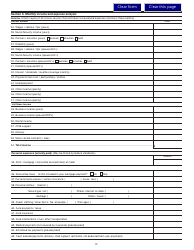

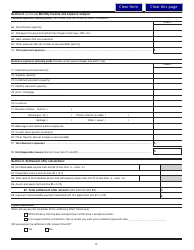

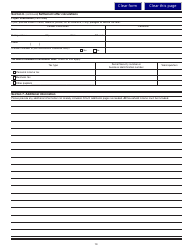

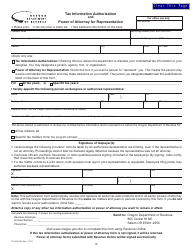

Form 150-101-157 (OR-SOA) Settlement Offer Application - Oregon

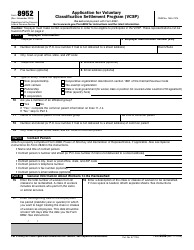

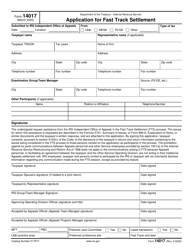

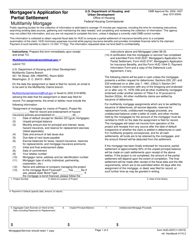

What Is Form 150-101-157 (OR-SOA)?

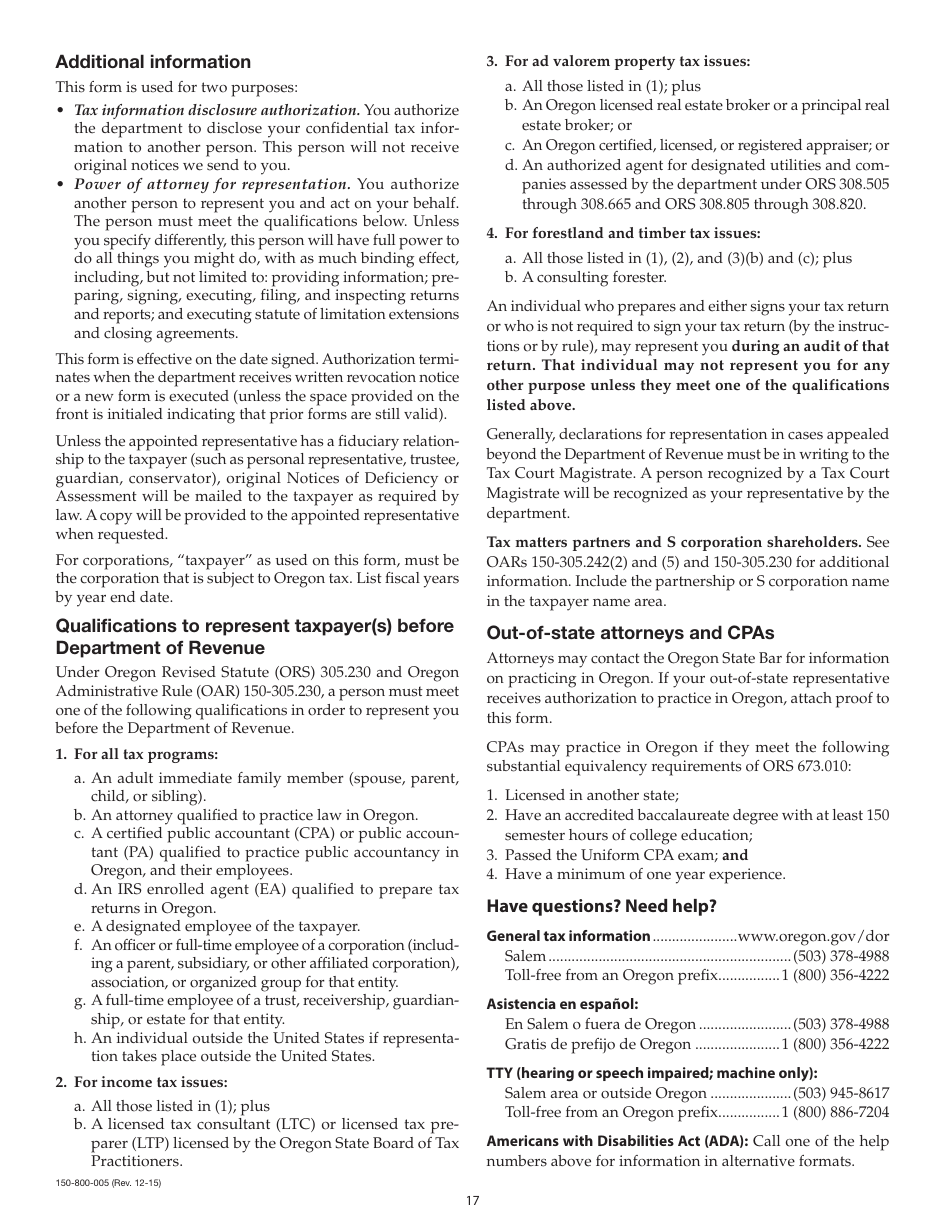

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-157 (OR-SOA)?

A: Form 150-101-157 (OR-SOA) is the Settlement Offer Application form specific to Oregon.

Q: What is the purpose of Form 150-101-157 (OR-SOA)?

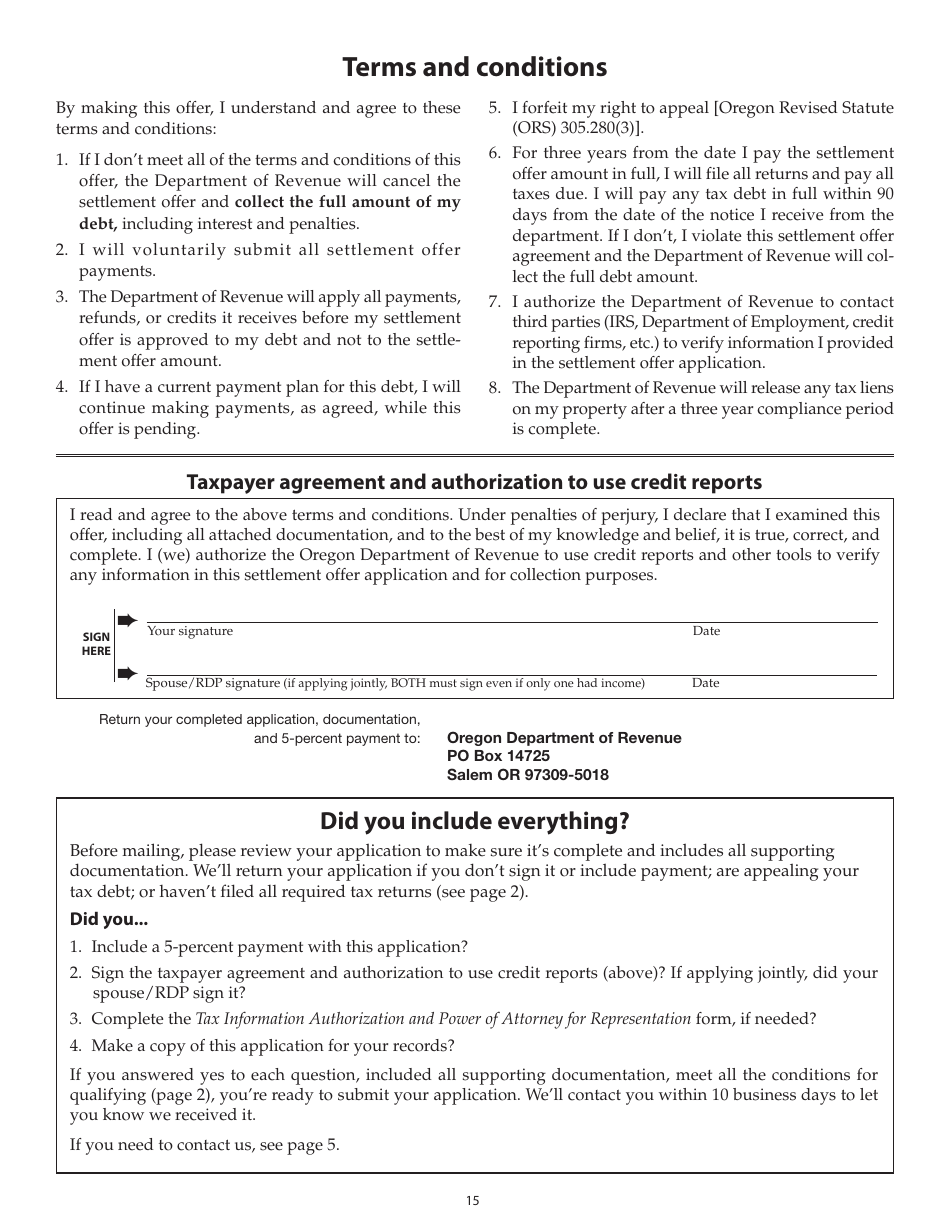

A: The purpose of Form 150-101-157 (OR-SOA) is to apply for a settlement offer regarding a tax debt in Oregon.

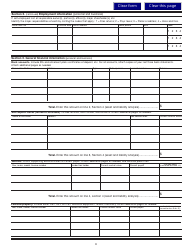

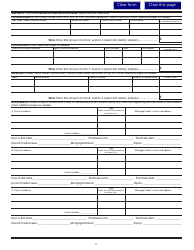

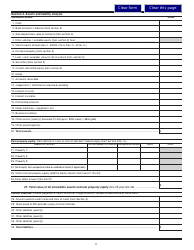

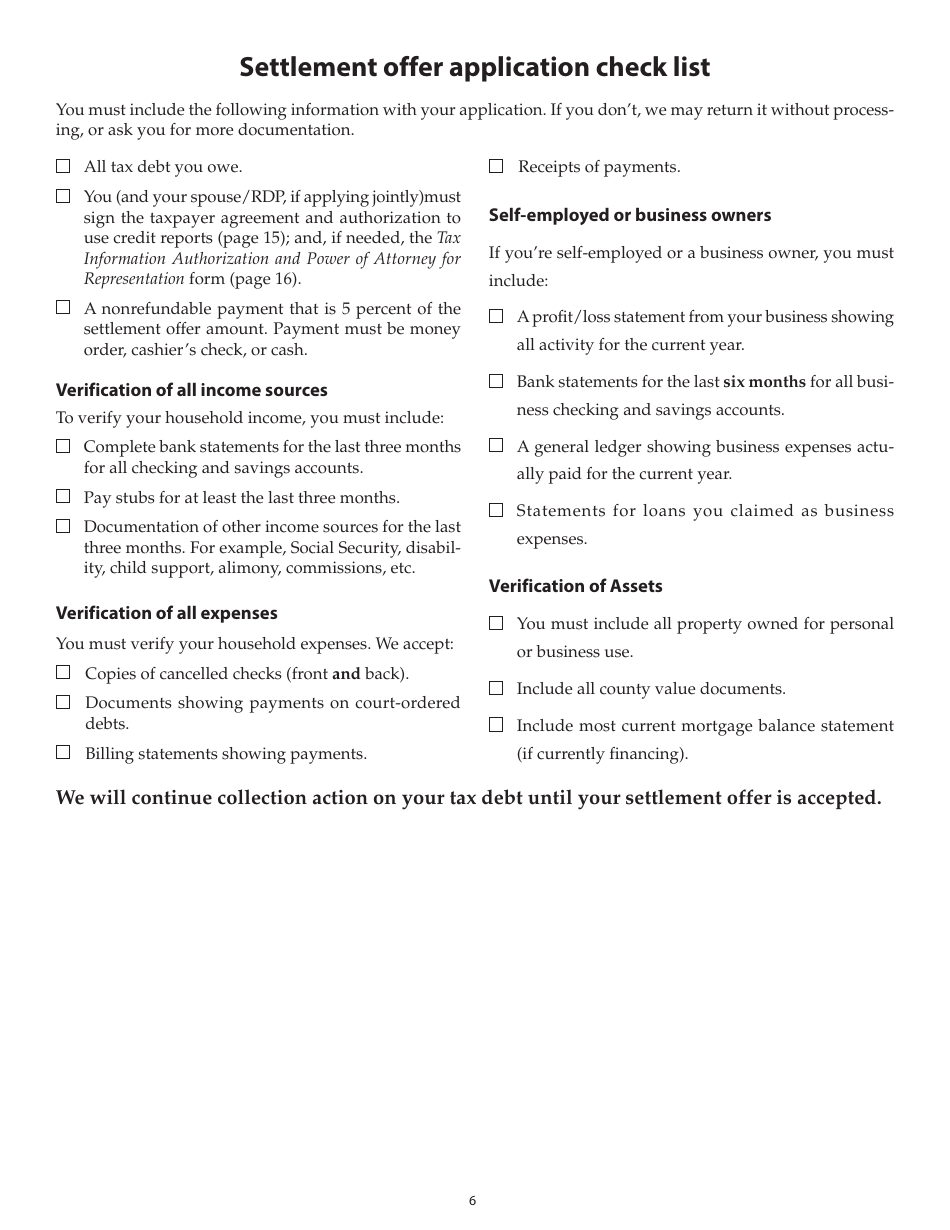

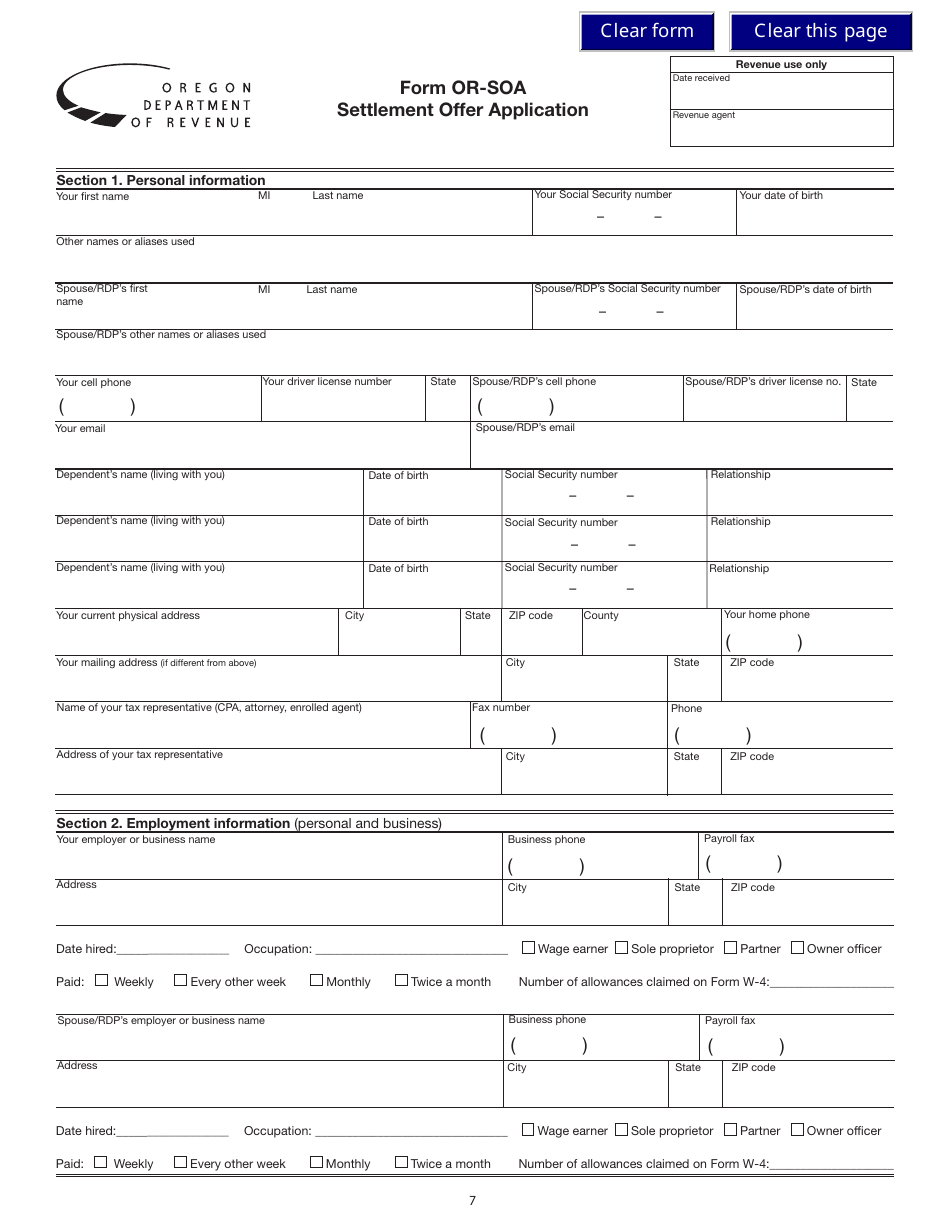

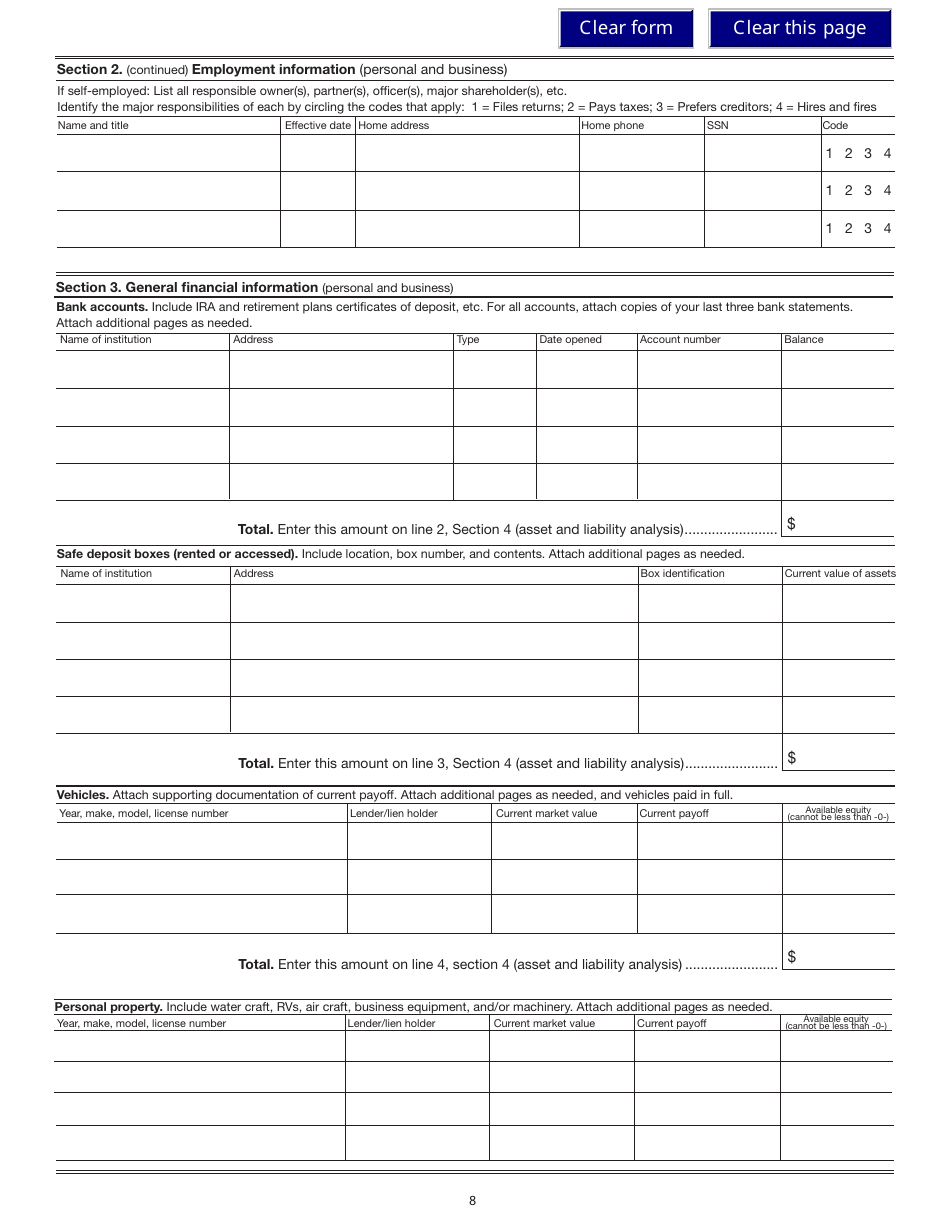

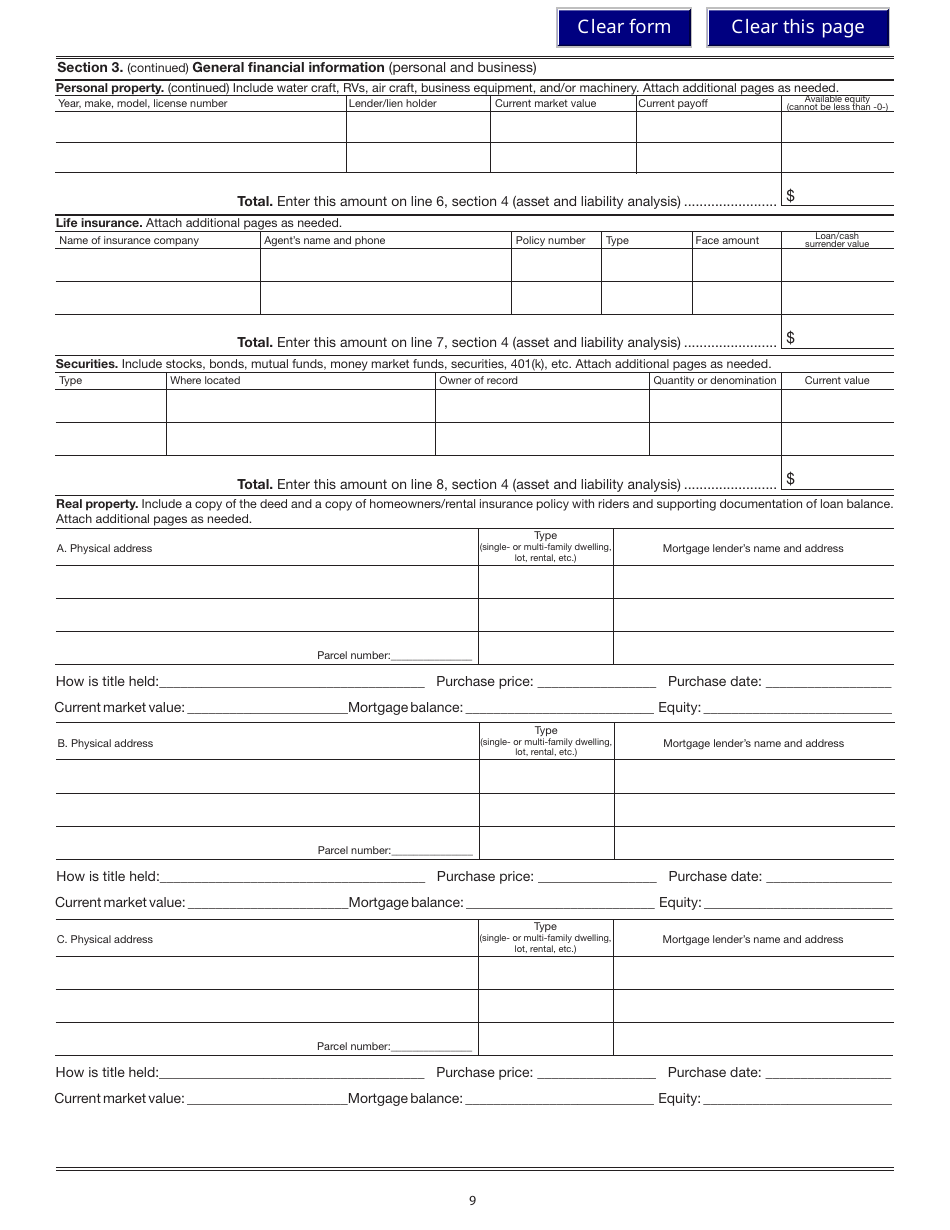

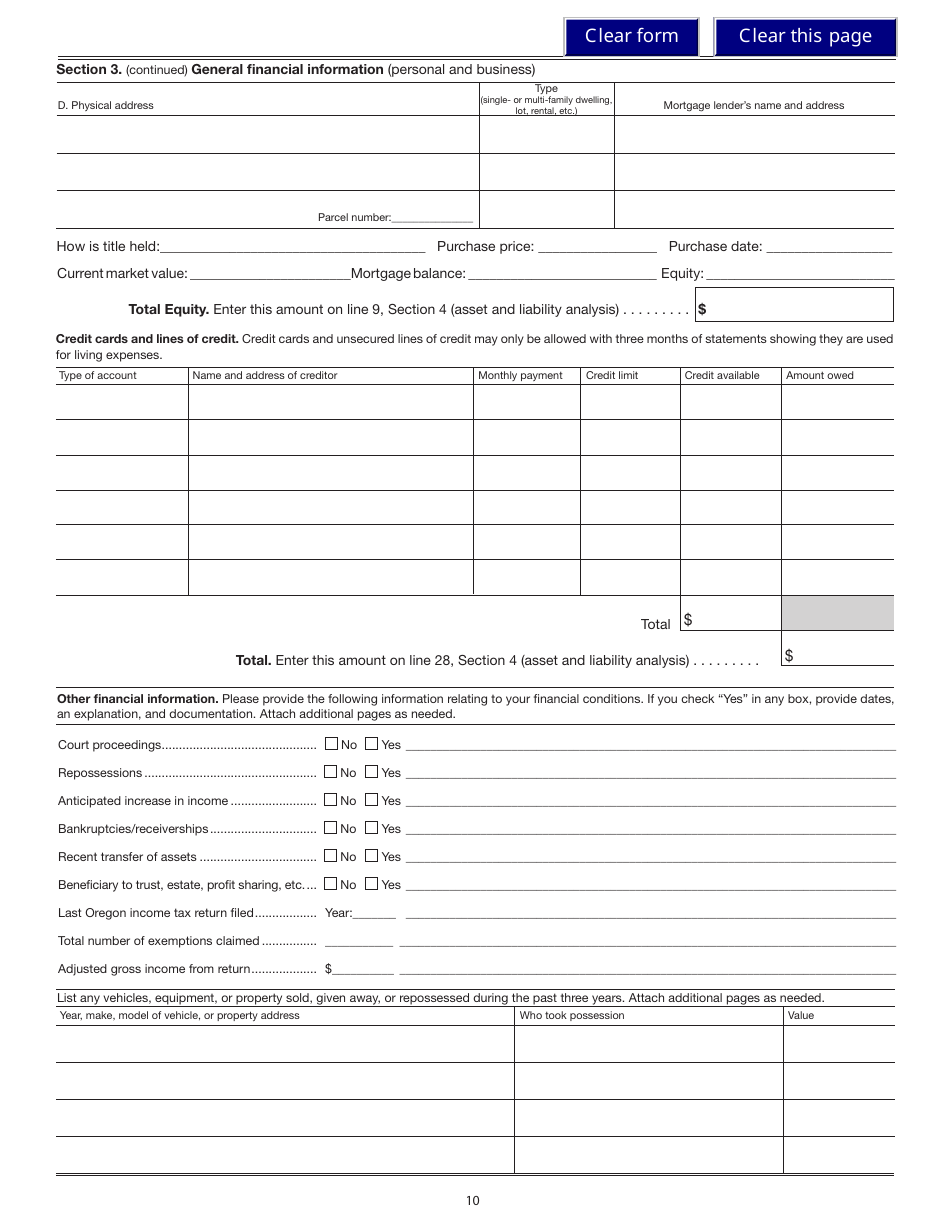

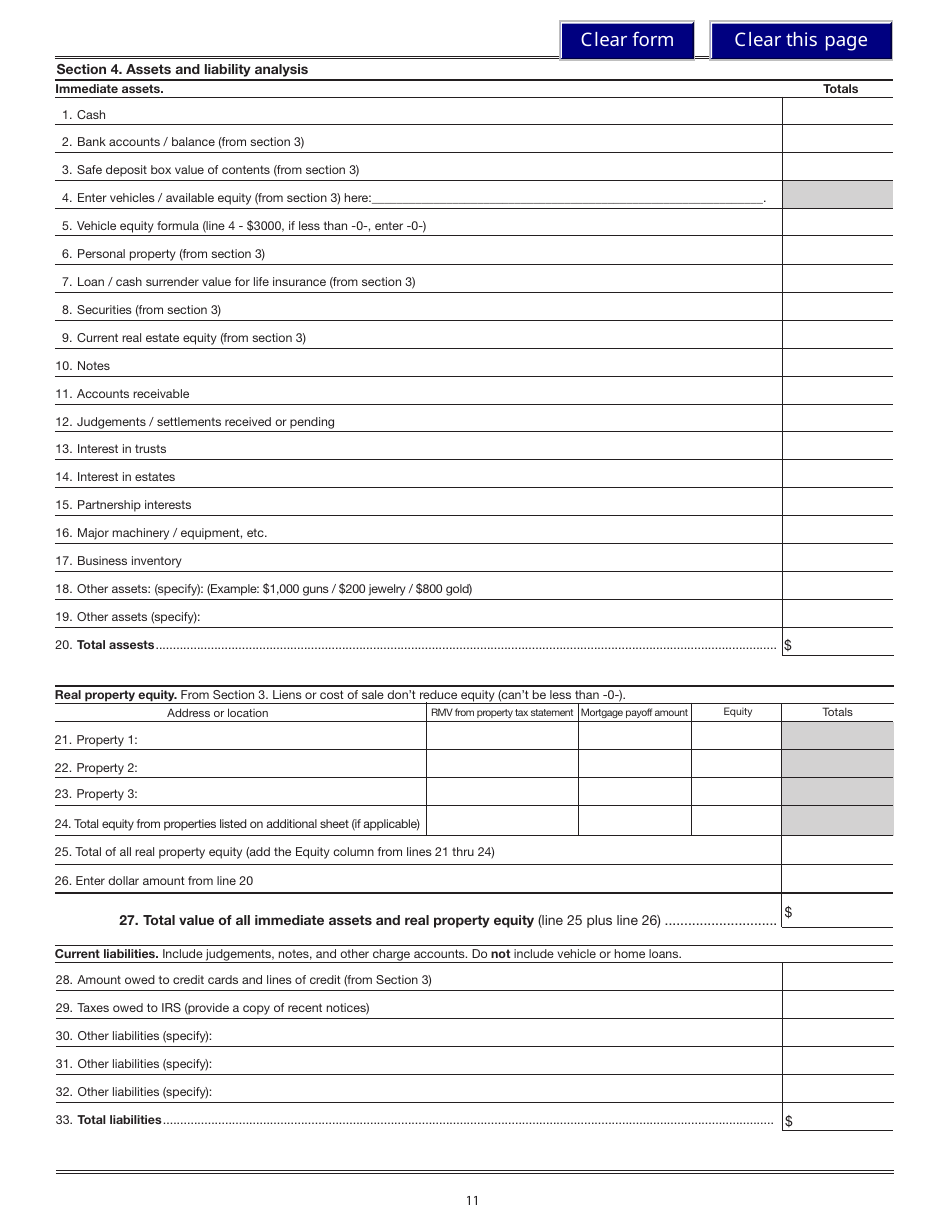

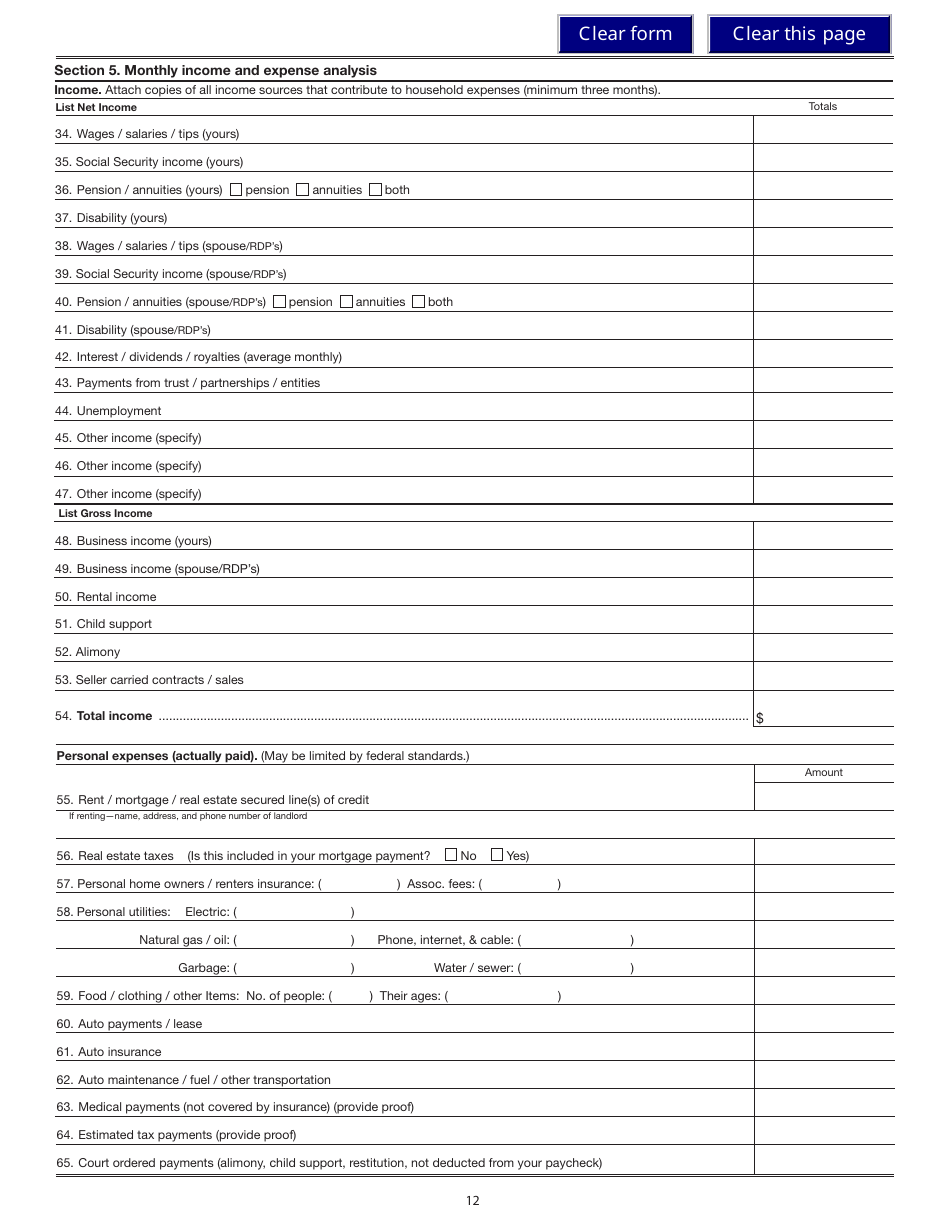

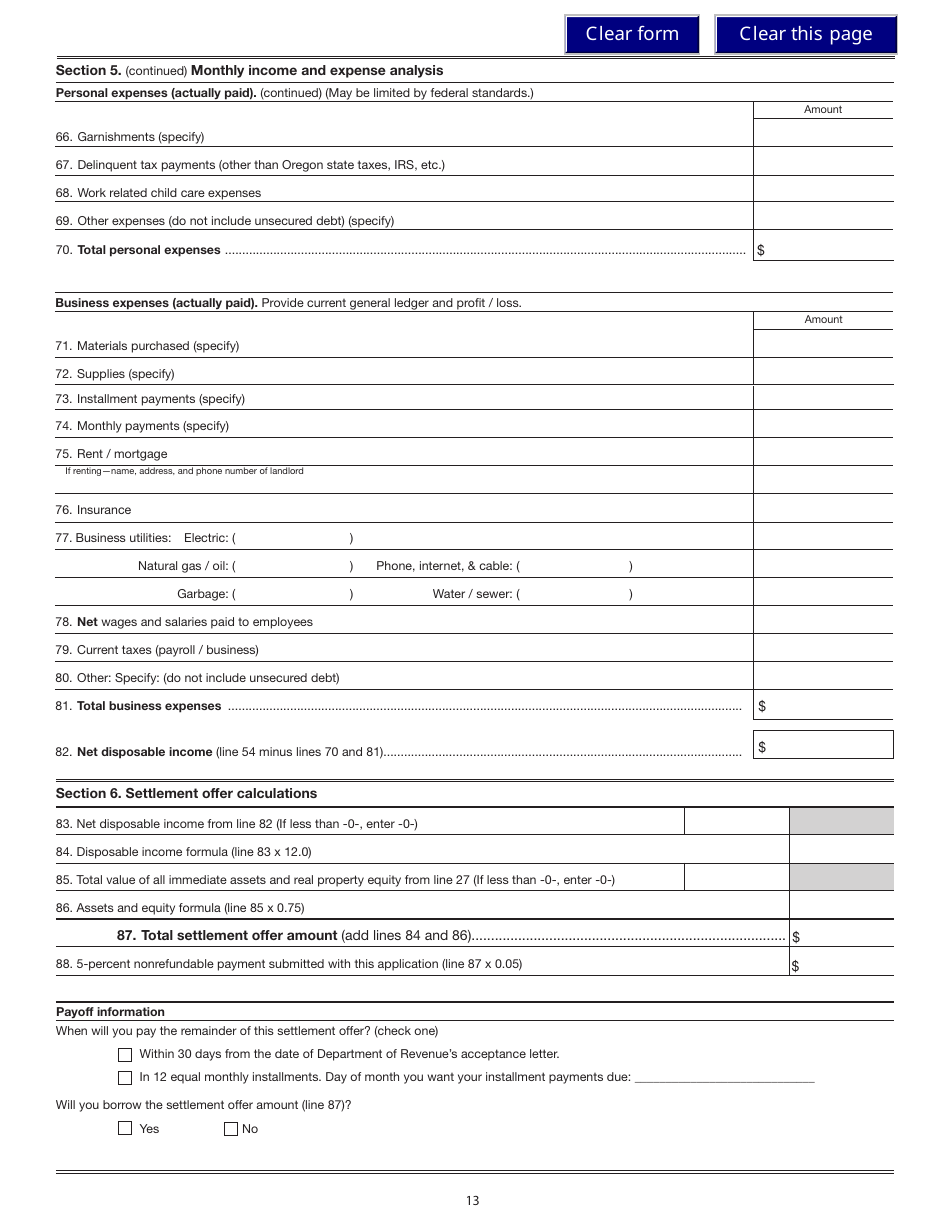

Q: What information is required on Form 150-101-157 (OR-SOA)?

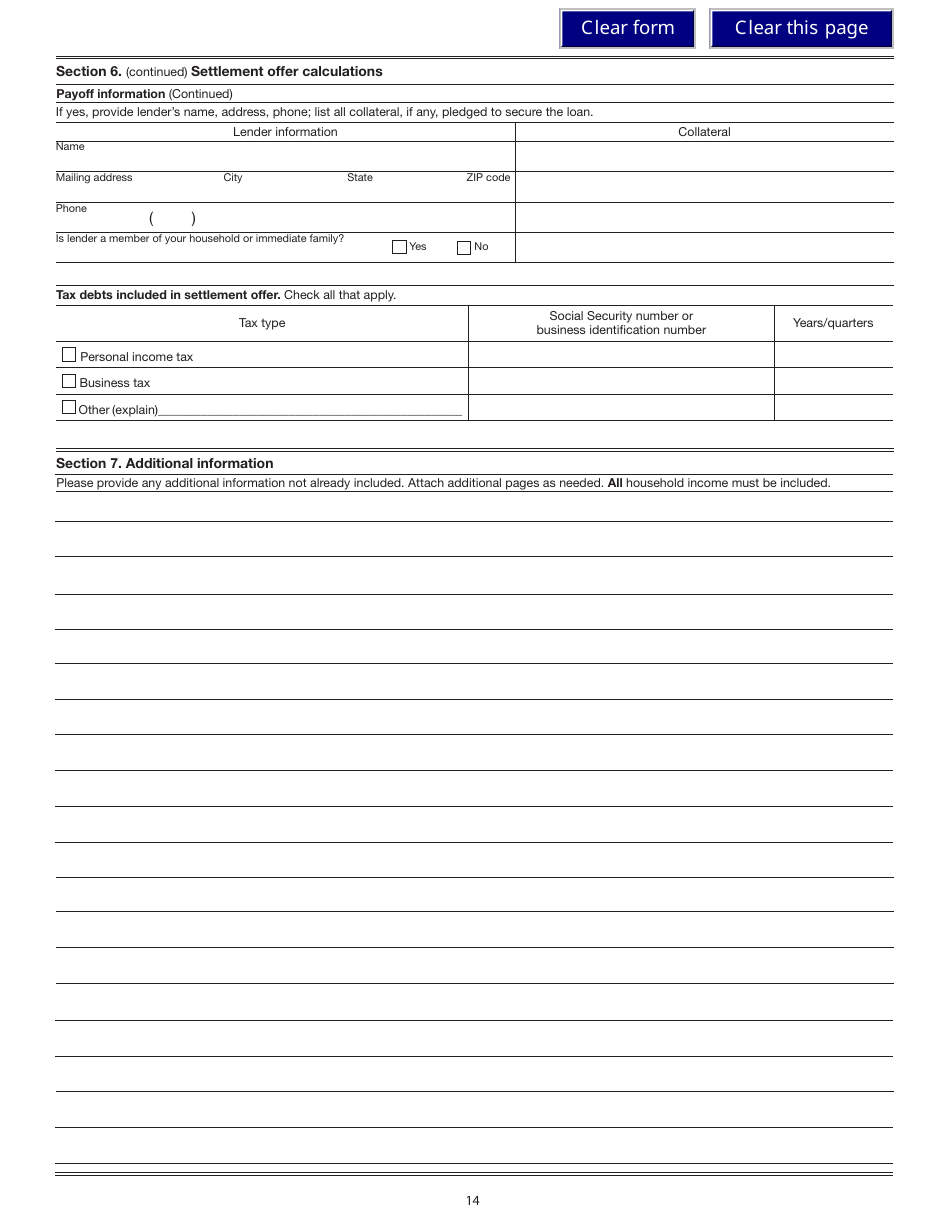

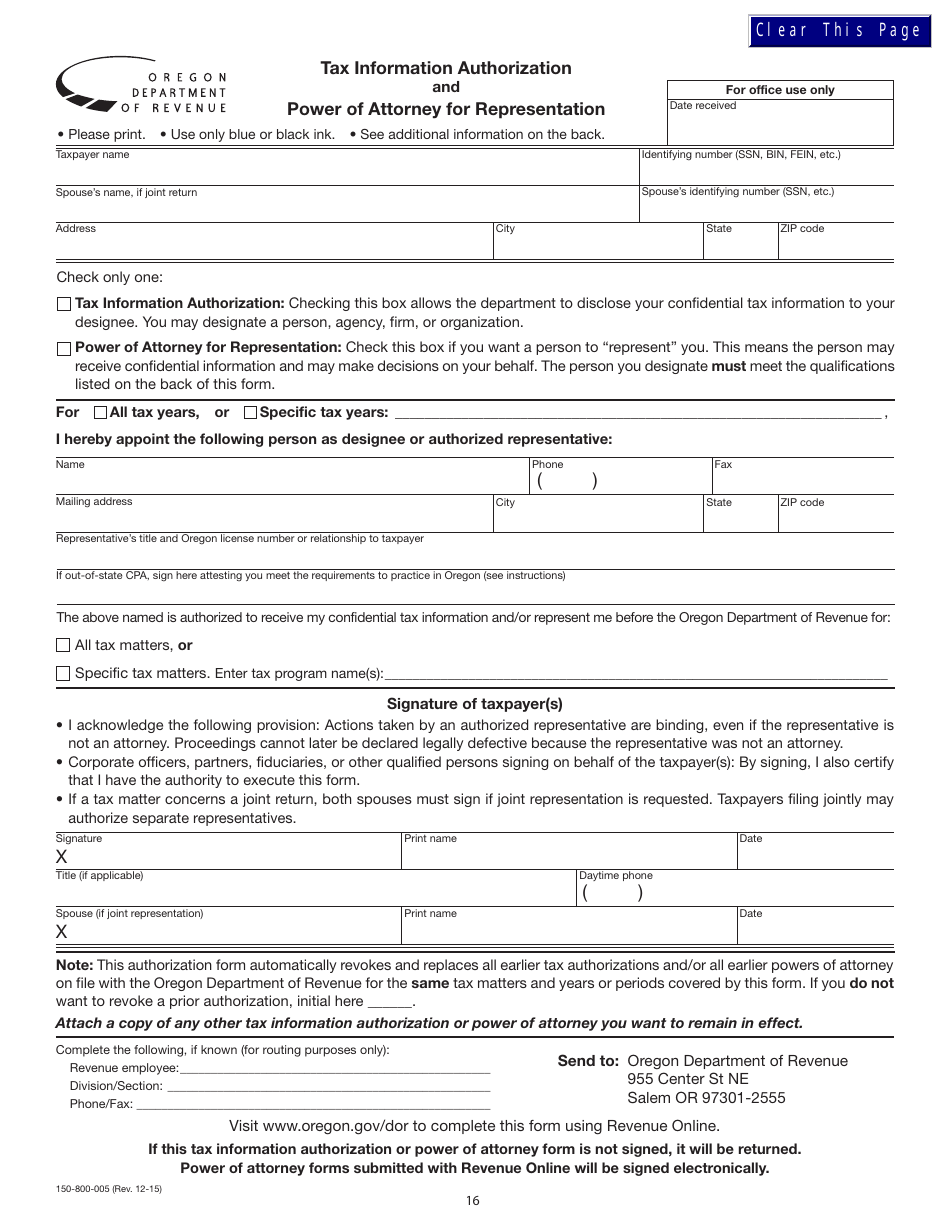

A: Form 150-101-157 (OR-SOA) requires information about the taxpayer, the tax debt being settled, and financial information to support the settlement offer.

Q: Who is eligible to use Form 150-101-157 (OR-SOA)?

A: Any taxpayer in Oregon who has a tax debt and wishes to apply for a settlement offer can use Form 150-101-157 (OR-SOA).

Q: Is there a fee for submitting Form 150-101-157 (OR-SOA)?

A: No, there is no fee for submitting Form 150-101-157 (OR-SOA).

Q: What happens after submitting Form 150-101-157 (OR-SOA)?

A: After submitting Form 150-101-157 (OR-SOA), the Oregon Department of Revenue will review the application and determine whether to accept or reject the settlement offer.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-157 (OR-SOA) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.