This version of the form is not currently in use and is provided for reference only. Download this version of

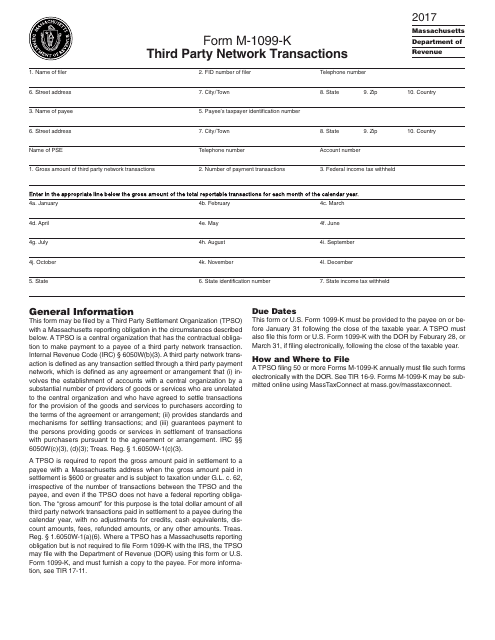

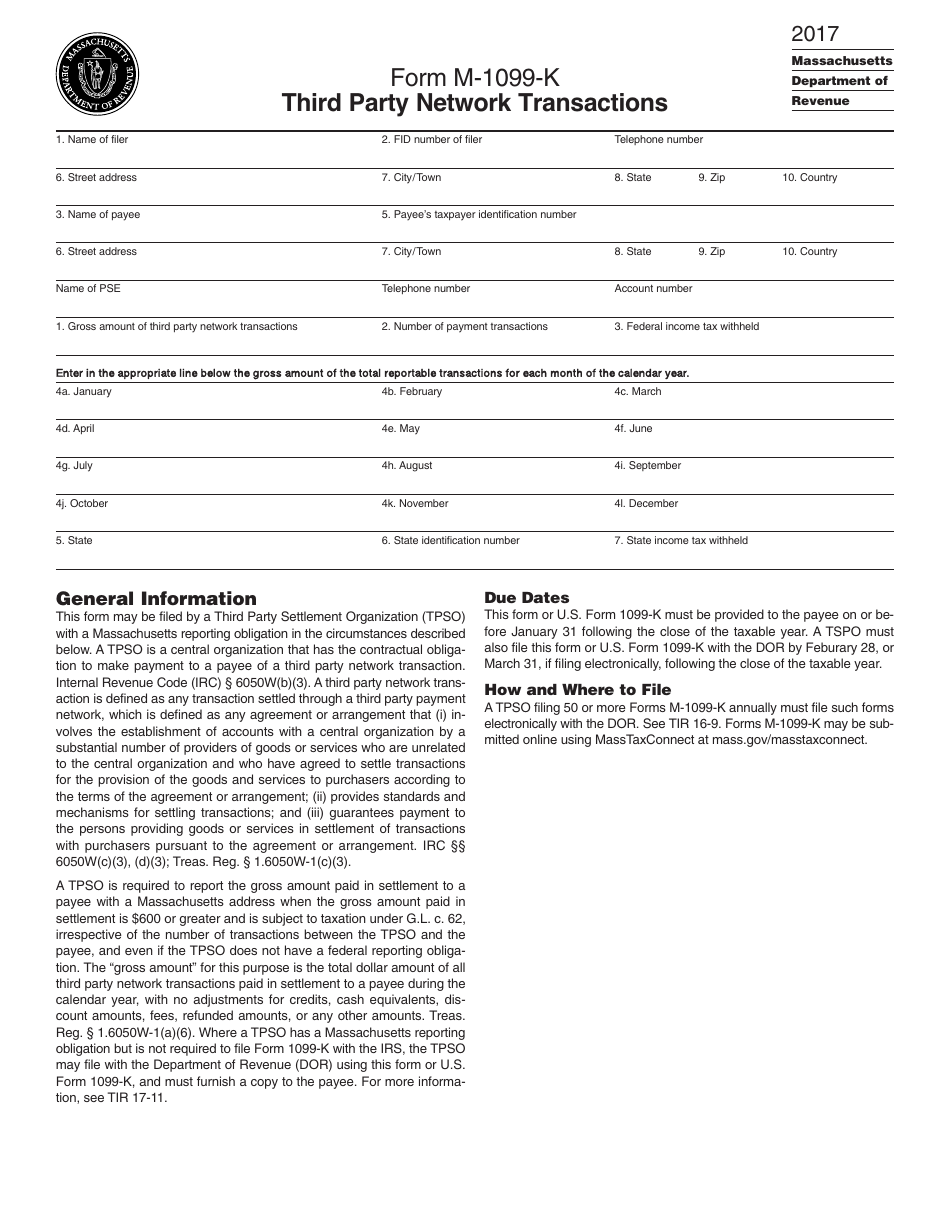

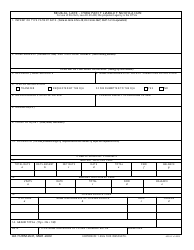

Form M-1099-K

for the current year.

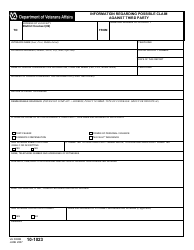

Form M-1099-K Third Party Network Transactions - Massachusetts

What Is Form M-1099-K?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

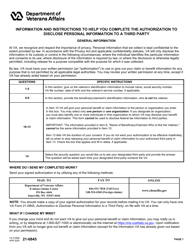

Q: What is Form M-1099-K?

A: Form M-1099-K is a tax form used to report third-party network transactions in Massachusetts.

Q: What are third-party network transactions?

A: Third-party network transactions refer to payments made through a third-party network, such as credit or debit card payments.

Q: Who is required to file Form M-1099-K?

A: Persons or entities that operate a business in Massachusetts and have over $600 in third-party network transactions must file Form M-1099-K.

Q: Do I need to file Form M-1099-K if I only accept cash payments?

A: No, Form M-1099-K is only required for reporting third-party network transactions, such as credit or debit card payments.

Q: When is the deadline for filing Form M-1099-K?

A: Form M-1099-K must be filed annually by January 31st of the following year.

Q: What information do I need to include on Form M-1099-K?

A: You will need to provide your name, address, social security number or taxpayer identification number, and the total amount of third-party network transactions.

Q: Are there any penalties for not filing Form M-1099-K?

A: Yes, failure to file Form M-1099-K or filing incorrect information may result in penalties imposed by the Massachusetts Department of Revenue.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-1099-K by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.