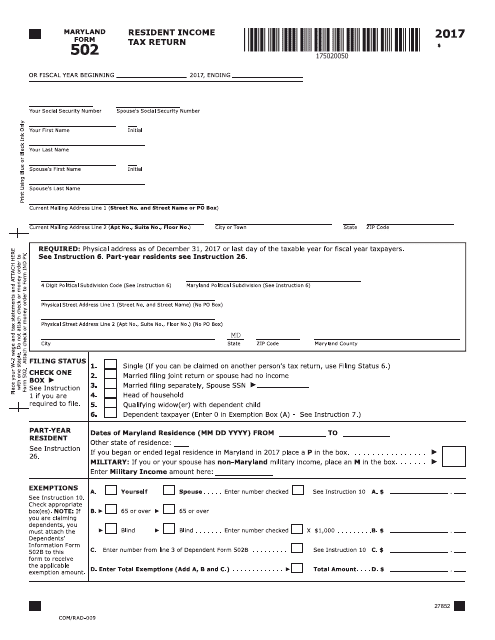

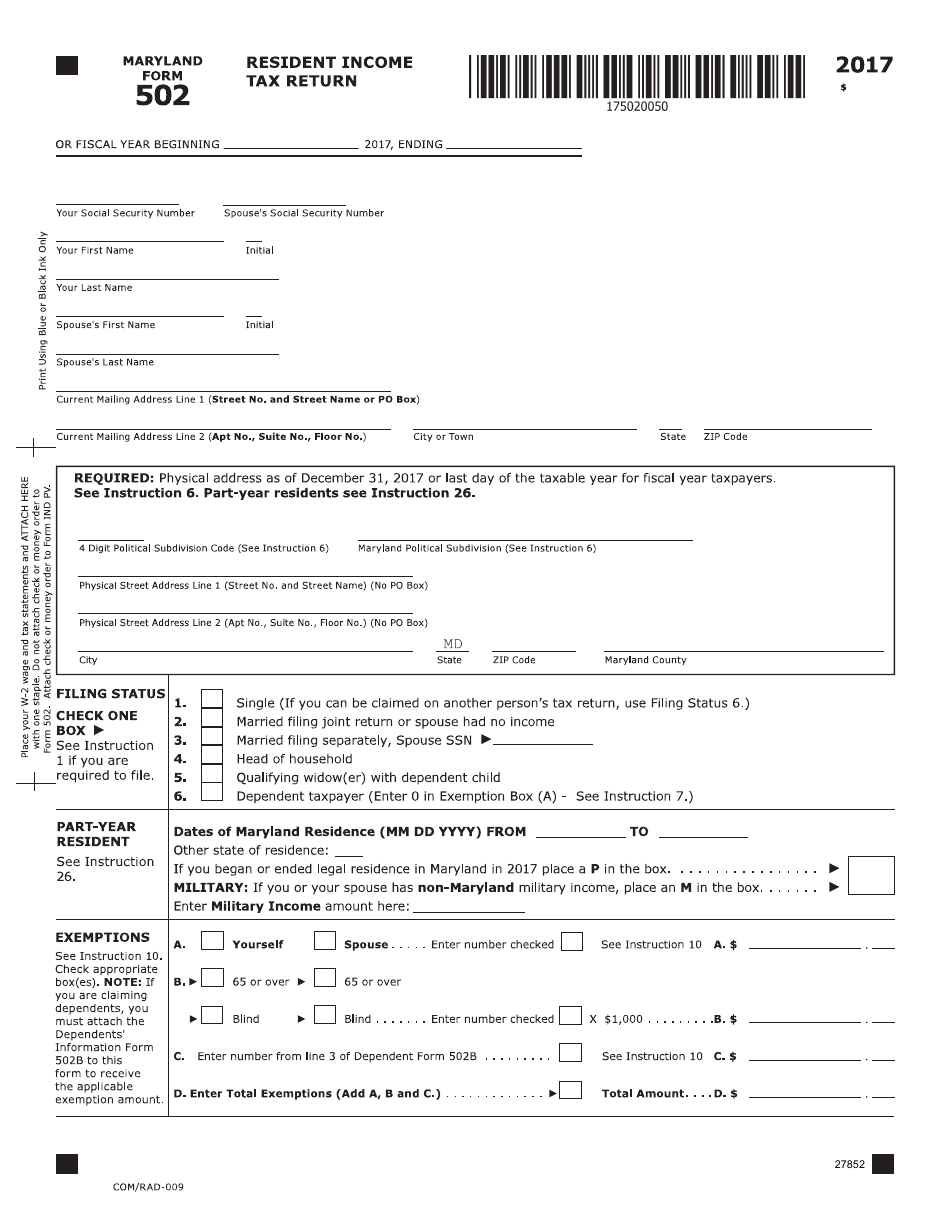

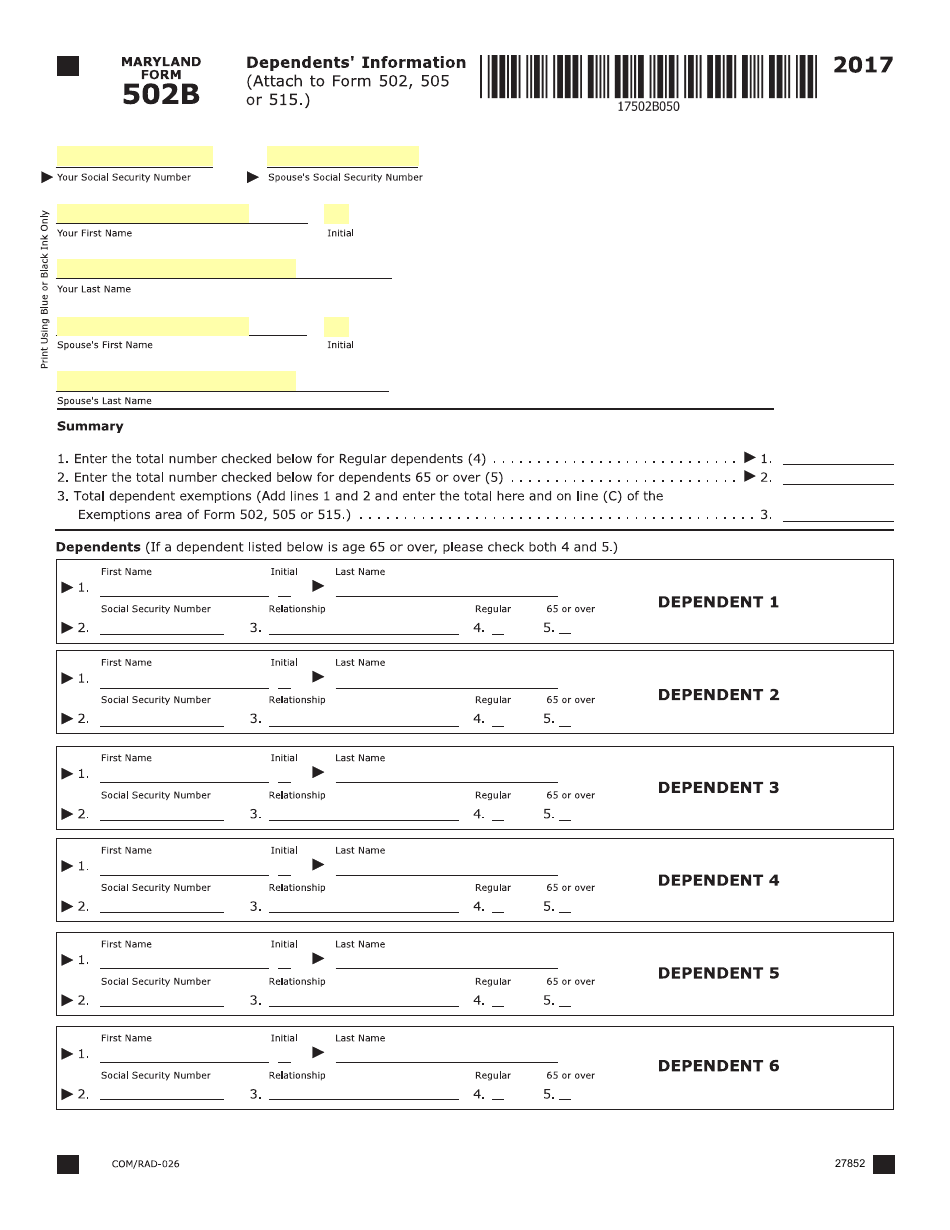

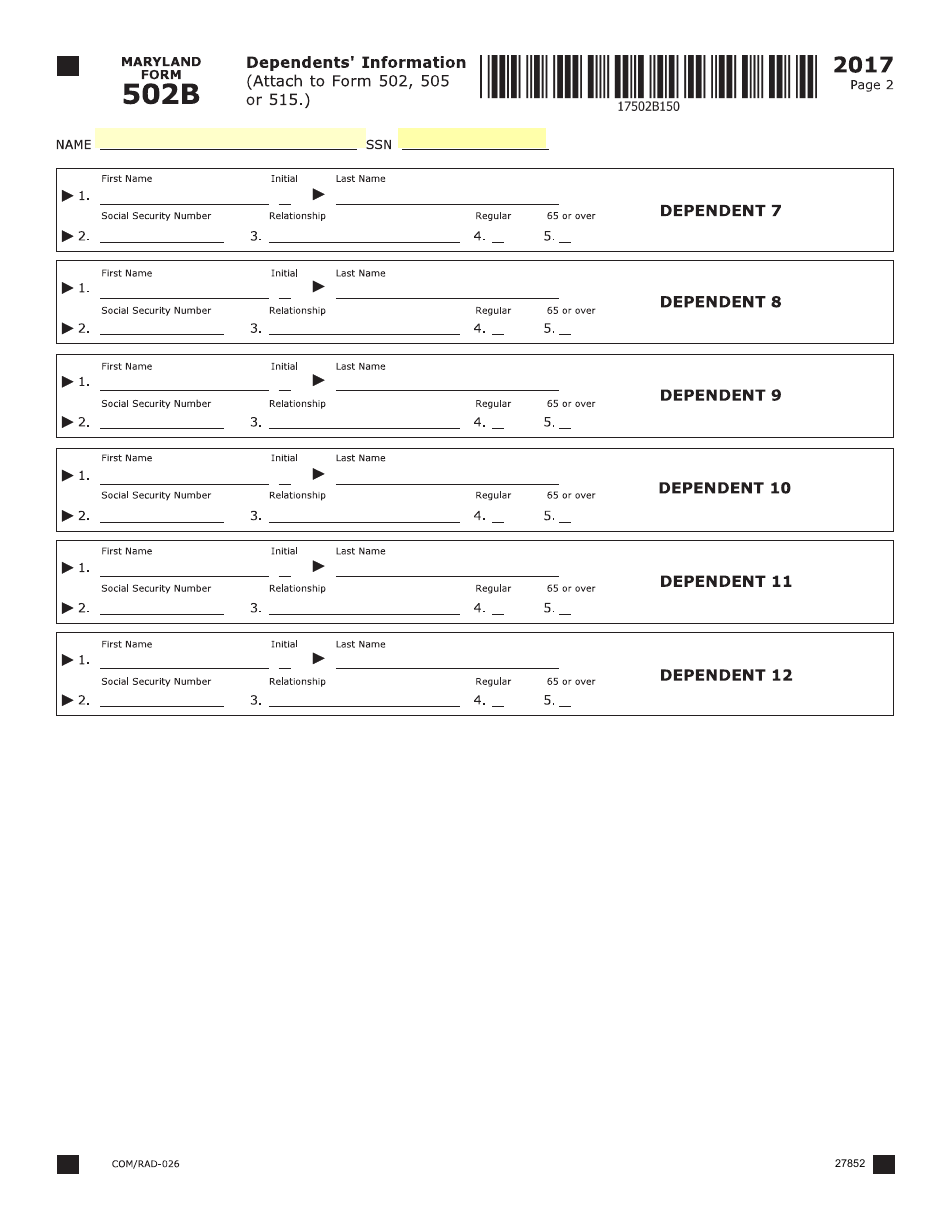

Form 502 Resident Income Tax Return - Maryland

What Is Form 502?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502?

A: Form 502 is a resident income tax return specifically for residents of Maryland.

Q: Who needs to file Form 502?

A: Residents of Maryland who have earned income or are subject to Maryland income tax must file Form 502.

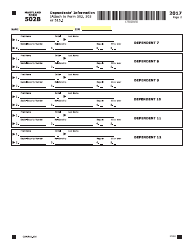

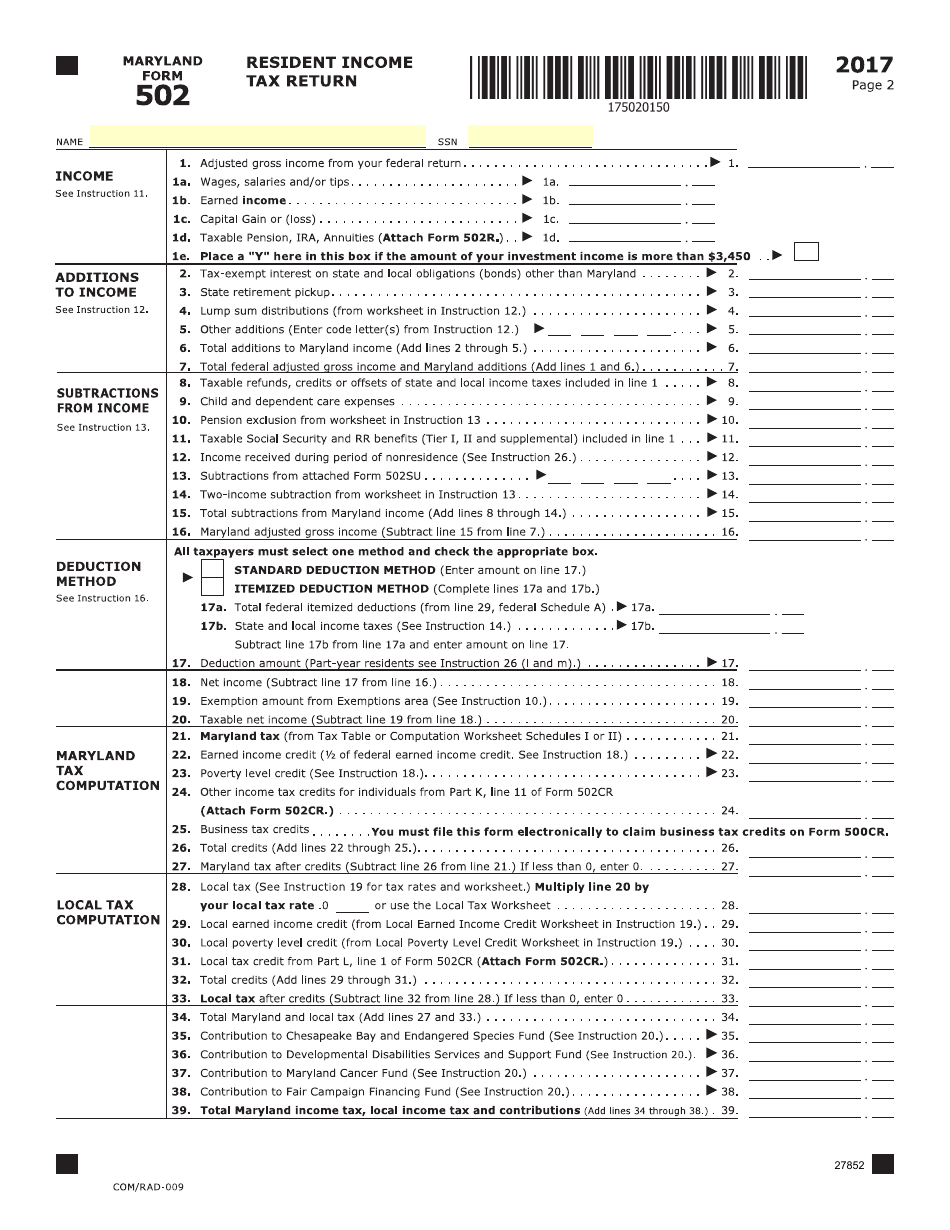

Q: What information is required on Form 502?

A: Form 502 requires information on your income, deductions, credits, and any taxes already paid.

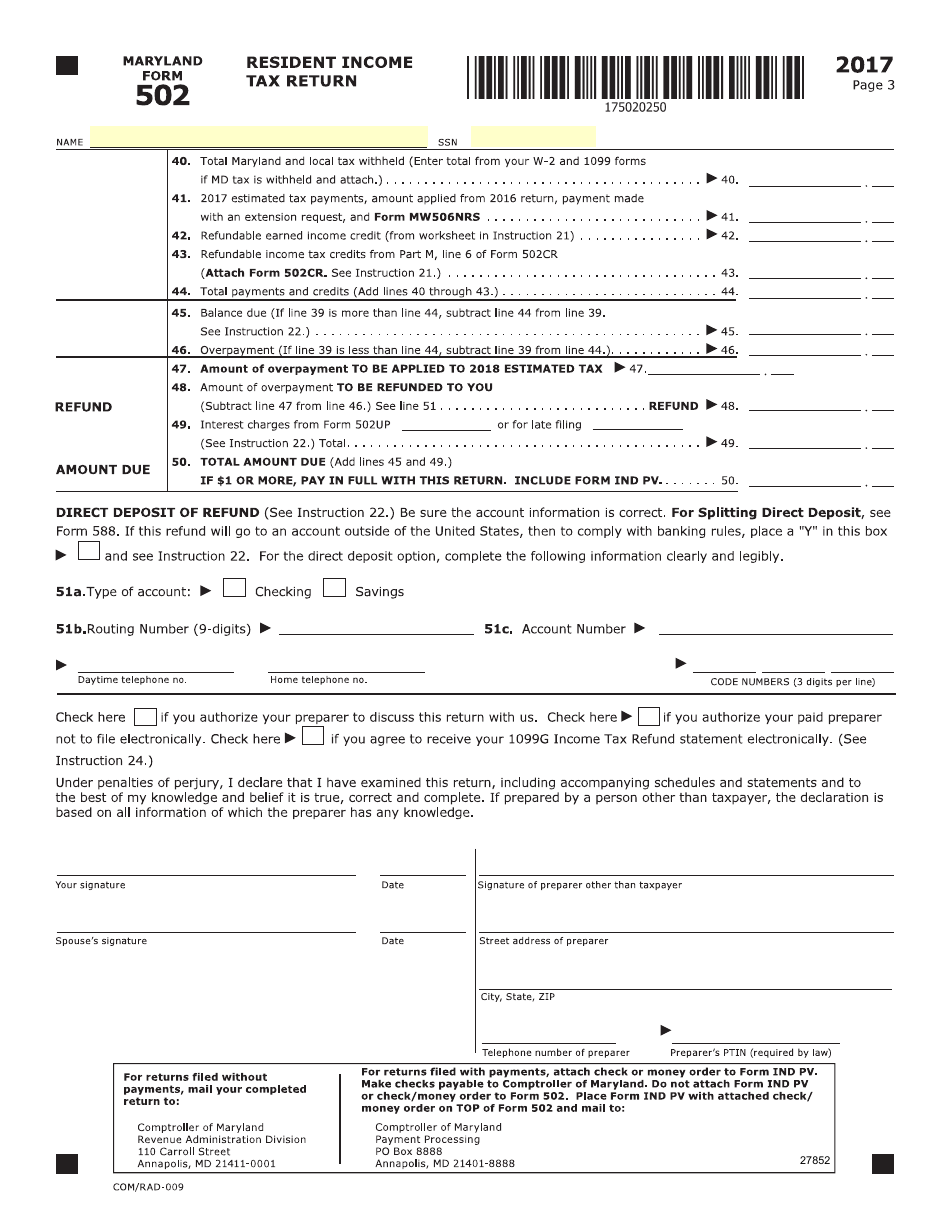

Q: When is the deadline to file Form 502?

A: The deadline to file Form 502 is April 15th, or the next business day if the 15th falls on a weekend or holiday.

Q: Can I get a refund if I file Form 502?

A: If you overpaid your Maryland income taxes, you may be eligible for a refund.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing or late payment of Maryland income taxes.

Q: Do I need to file Form 502 if I didn't earn any income?

A: If you had no income or your income was below the filing threshold, you may not need to file Form 502.

Q: Can I file Form 502 if I'm not a resident of Maryland?

A: No, Form 502 is specifically for residents of Maryland. Non-residents should file the appropriate tax forms for their state.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.