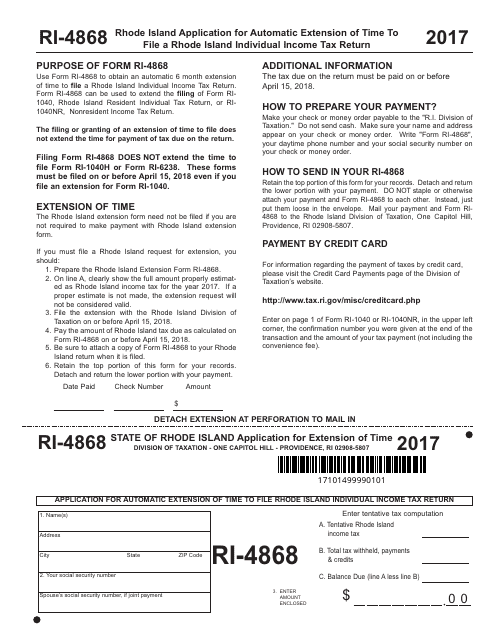

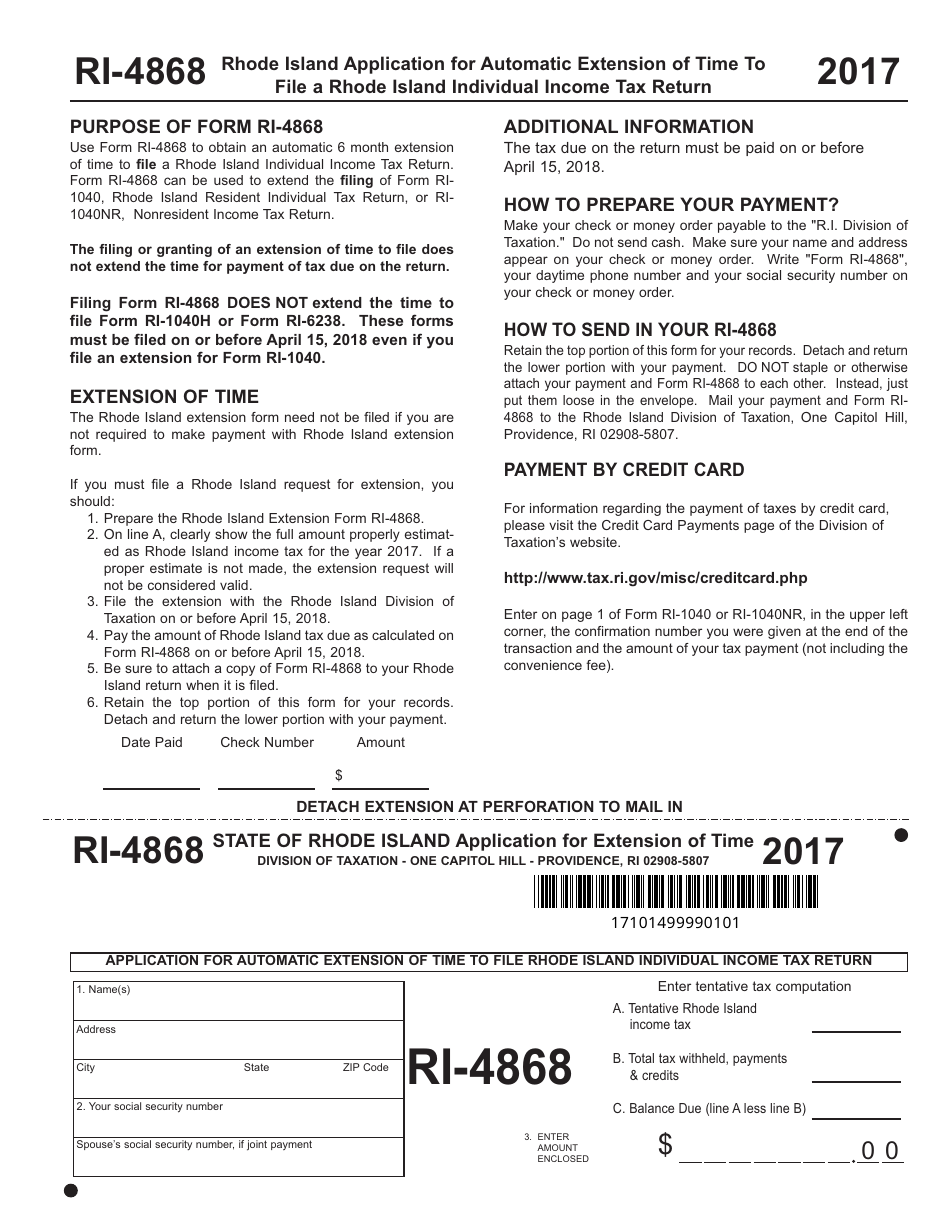

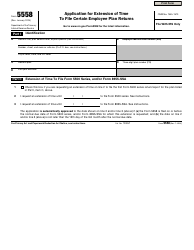

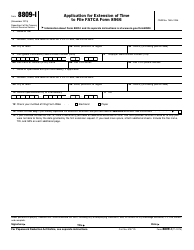

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-4868

for the current year.

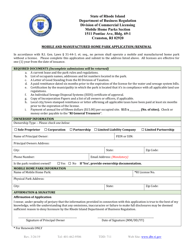

Form RI-4868 Application for Extension of Time - Rhode Island

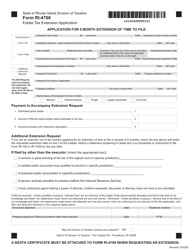

What Is Form RI-4868?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-4868?

A: Form RI-4868 is the Application for Extension of Time for filing Rhode Island state income tax.

Q: Who is eligible to use Form RI-4868?

A: Rhode Island residents and non-residents who need additional time to file their state income tax.

Q: How do I file Form RI-4868?

A: You can file Form RI-4868 by mail or electronically through Rhode Island's tax filing system.

Q: Is there a fee for filing Form RI-4868?

A: No, there is no fee to file Form RI-4868.

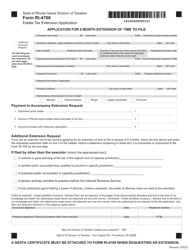

Q: What is the deadline for filing Form RI-4868?

A: Form RI-4868 must be filed by the original due date of your Rhode Island state income tax return.

Q: How much time does Form RI-4868 give me to file my state income tax return?

A: Form RI-4868 grants an extension of up to 6 months to file your Rhode Island state income tax return.

Q: Do I need to include an explanation for requesting an extension on Form RI-4868?

A: No, you do not need to include an explanation for requesting an extension on Form RI-4868.

Q: What should I do if I owe taxes when filing Form RI-4868?

A: If you owe taxes when filing Form RI-4868, you should estimate the amount due and include a payment with your extension request.

Q: Can I e-file my state income tax return after filing Form RI-4868?

A: Yes, you can e-file your state income tax return after filing Form RI-4868.

Q: What happens if I do not file Form RI-4868 and fail to file my state income tax by the due date?

A: If you do not file Form RI-4868 and fail to file your state income tax by the due date, you may be subject to penalties and interest.

Q: Is Form RI-4868 available for both individual and business taxpayers?

A: No, Form RI-4868 is only available for individual taxpayers.

Q: Can I file Form RI-4868 electronically if I am a non-resident?

A: Yes, non-resident taxpayers can file Form RI-4868 electronically if they meet the eligibility requirements.

Q: What if I need more than 6 months to file my Rhode Island state income tax return?

A: If you need more than 6 months to file your Rhode Island state income tax return, you should contact the Rhode Island Division of Taxation for further instructions.

Q: Can I file Form RI-4868 if I am requesting an extension for my federal income tax return?

A: No, Form RI-4868 is only for requesting an extension for your Rhode Island state income tax return.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-4868 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.