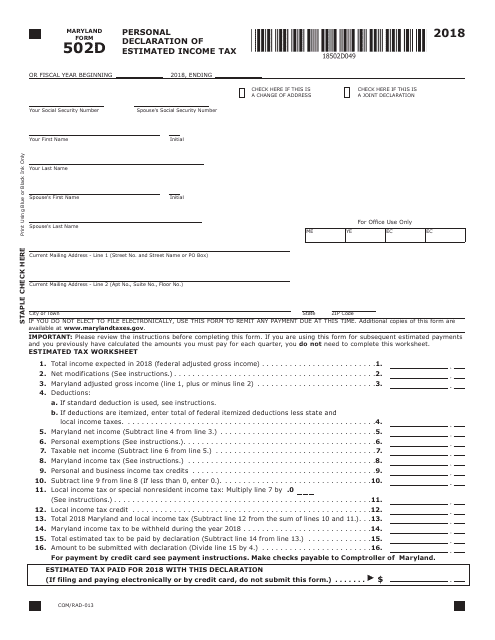

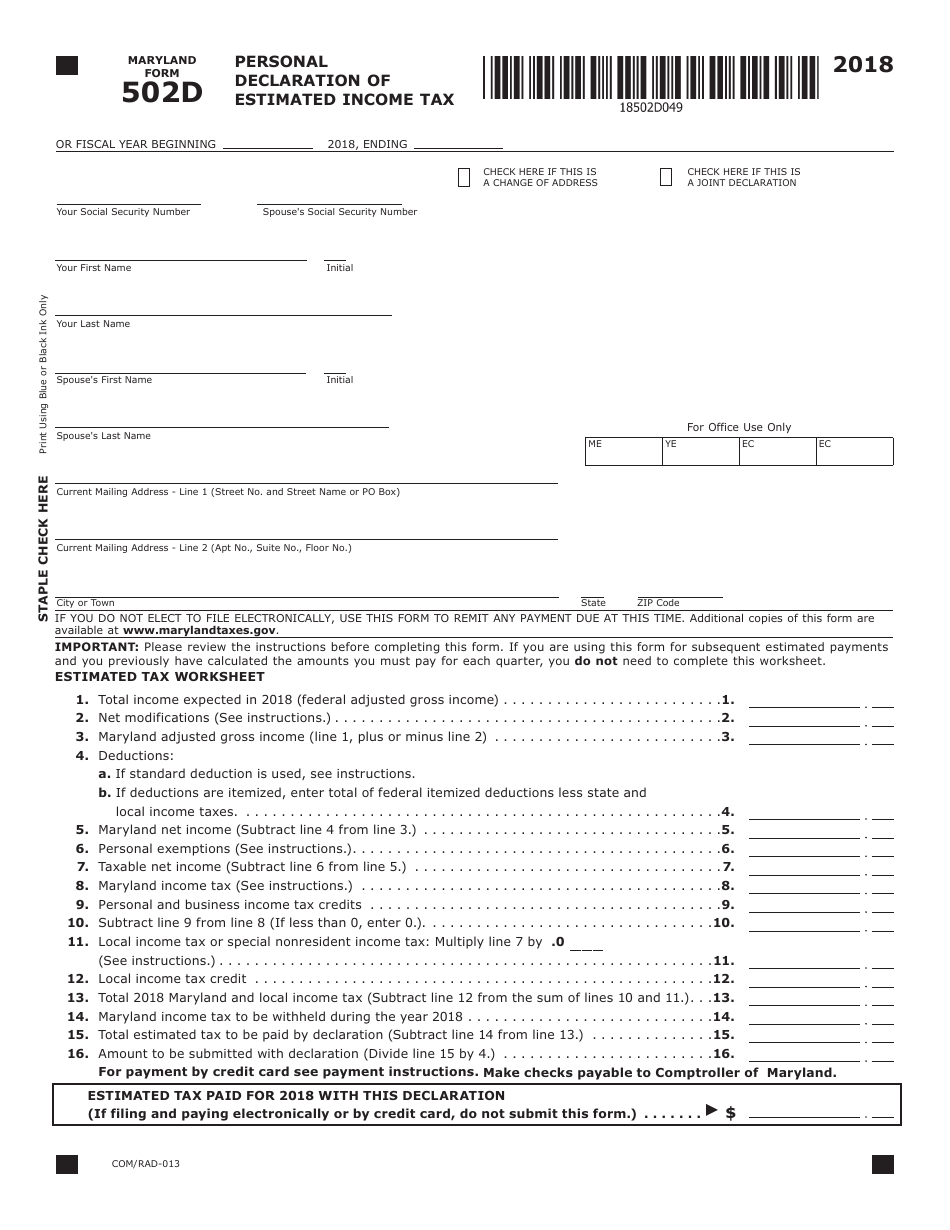

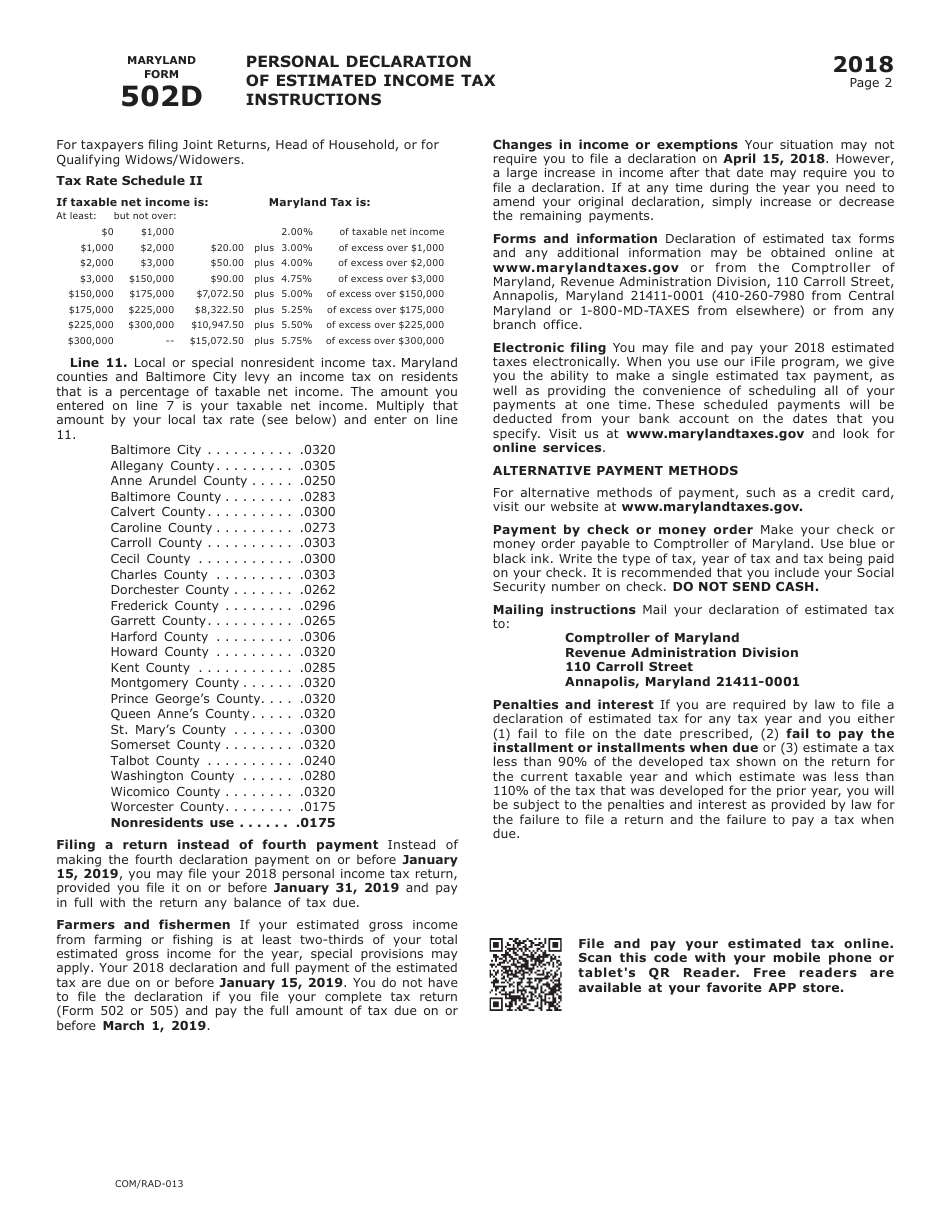

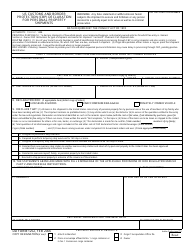

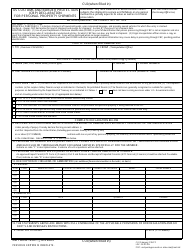

Form 502D Personal Declaration of Estimated Income Tax - Maryland

What Is Form 502D?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

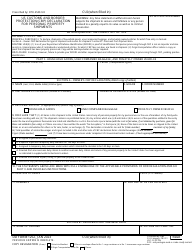

Q: What is Form 502D?

A: Form 502D is a Personal Declaration of Estimated Income Tax for residents of Maryland.

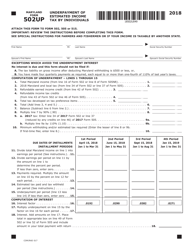

Q: Who needs to file Form 502D?

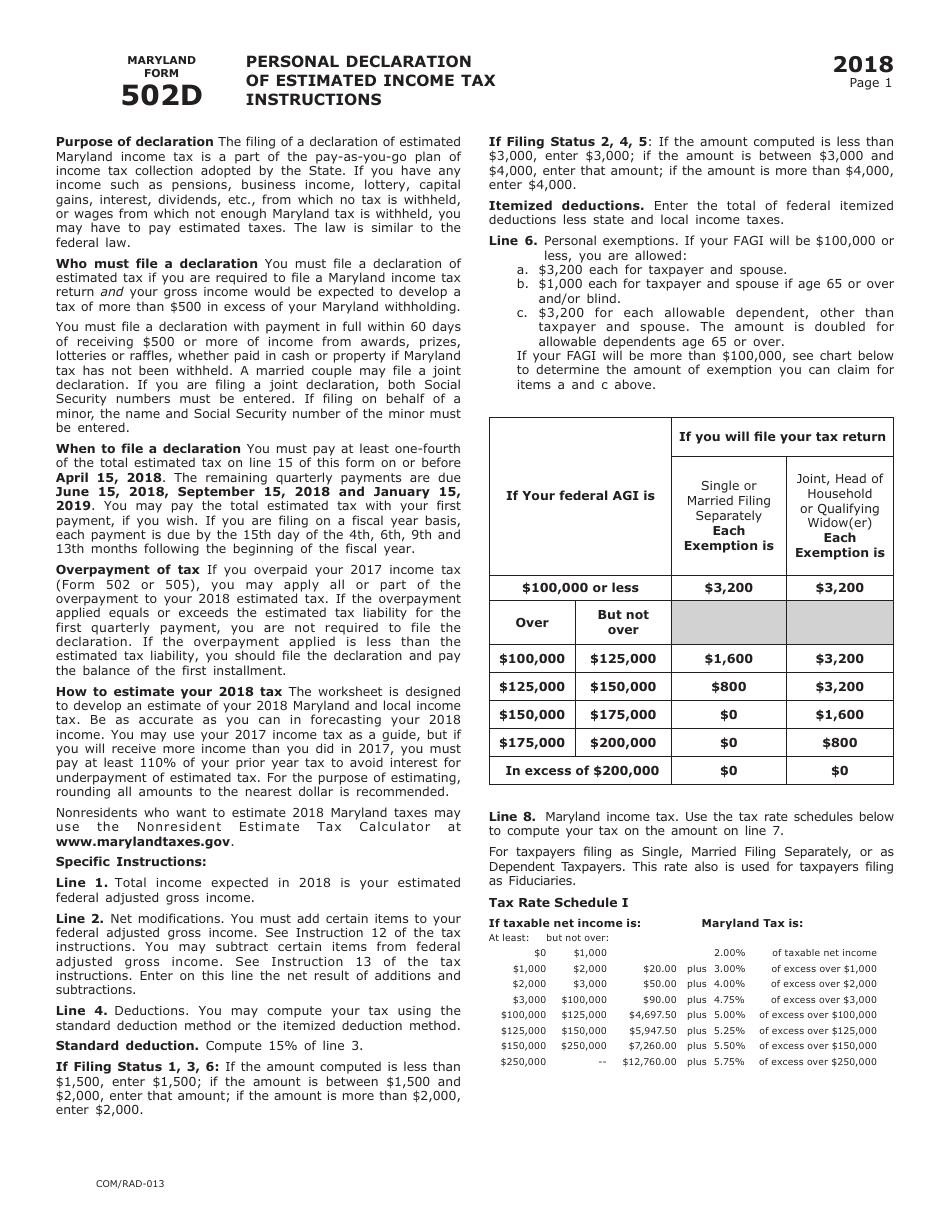

A: Residents of Maryland who expect to owe more than $500 in state income tax for the year must file Form 502D.

Q: What is the purpose of Form 502D?

A: The purpose of Form 502D is to declare the estimated income tax that will be owed to the state of Maryland.

Q: When is Form 502D due?

A: Form 502D is generally due on April 15th, or on the same day as the federal tax return.

Q: What information is required on Form 502D?

A: Form 502D requires the taxpayer to provide their personal information, estimate their income, deductions, and credits, and calculate the estimated tax owed.

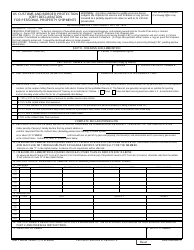

Q: Can I e-file Form 502D?

A: Yes, Maryland taxpayers have the option to e-file Form 502D.

Q: What happens if I don't file Form 502D?

A: Failure to file Form 502D or pay the estimated tax can result in penalties and interest charges.

Q: Can I make changes to my estimated tax payments?

A: Yes, taxpayers can make changes by filing an amended Form 502D if their estimated income or deductions change significantly.

Q: Can I get an extension to file Form 502D?

A: Maryland does not provide an automatic extension for filing Form 502D, but taxpayers can request an extension if they need more time to file.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502D by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.