This version of the form is not currently in use and is provided for reference only. Download this version of

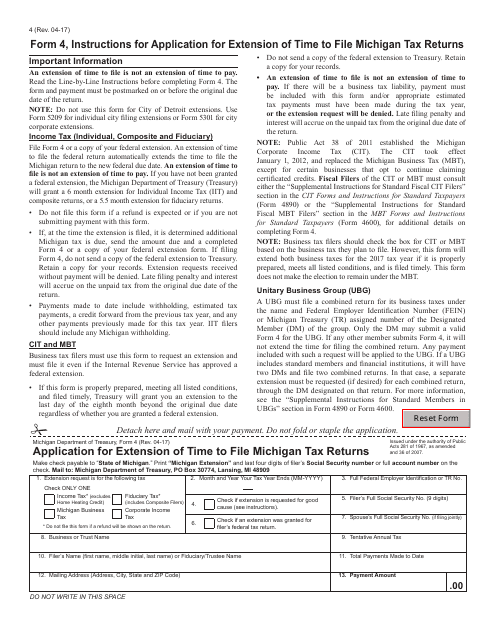

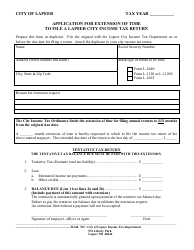

Form 4

for the current year.

Form 4 Application for Extension of Time to File Michigan Tax Returns - Michigan

What Is Form 4?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

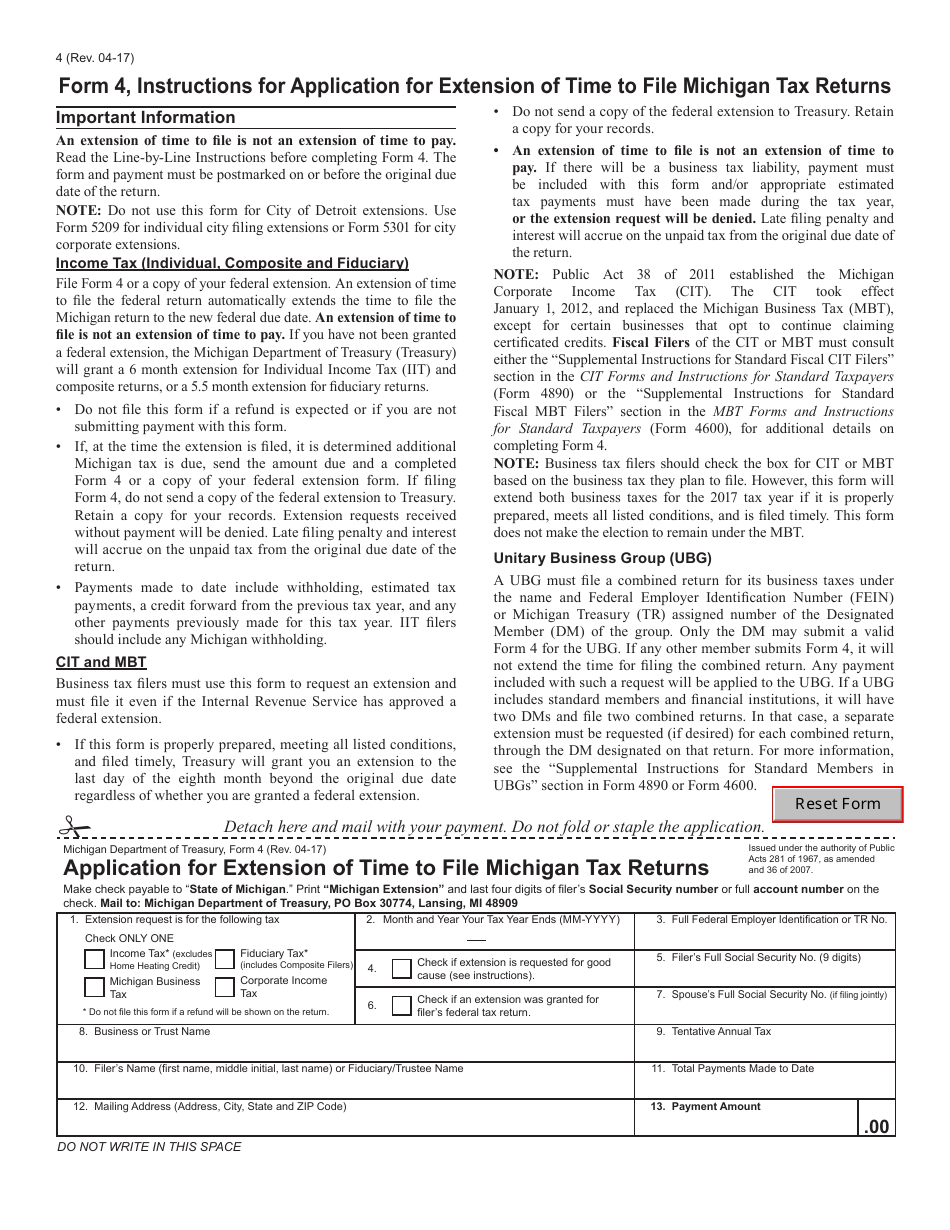

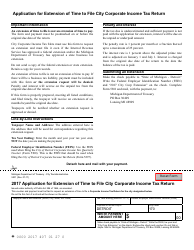

Q: What is Form 4?

A: Form 4 is an application for extension of time to file Michigan tax returns.

Q: Who can use Form 4?

A: Individuals and businesses who need additional time to file their Michigan tax returns can use Form 4.

Q: What is the deadline to file Form 4?

A: Form 4 must be filed by the original due date of the tax return, which is usually April 15th for individuals.

Q: How much time does Form 4 provide for an extension?

A: Form 4 provides a six-month extension to file the tax return, moving the deadline to October 15th.

Q: Is there a penalty for filing Form 4?

A: There is no penalty for filing Form 4 if it is filed by the original due date and the full amount of tax owed is paid by the original due date.

Q: Can I file Form 4 if I owe taxes?

A: Yes, you can still file Form 4 even if you owe taxes. However, interest and penalties may apply to any unpaid tax balance.

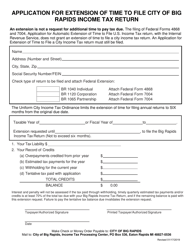

Q: What if I miss the deadline to file Form 4?

A: If you miss the deadline to file Form 4, you may still be able to file for an extension using Form 2766, but late filing penalties may apply.

Q: Can I file Form 4 for federal taxes?

A: No, Form 4 is specific to Michigan tax returns. For federal tax returns, you will need to file Form 4868 for an extension.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

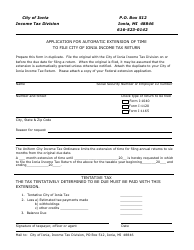

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.