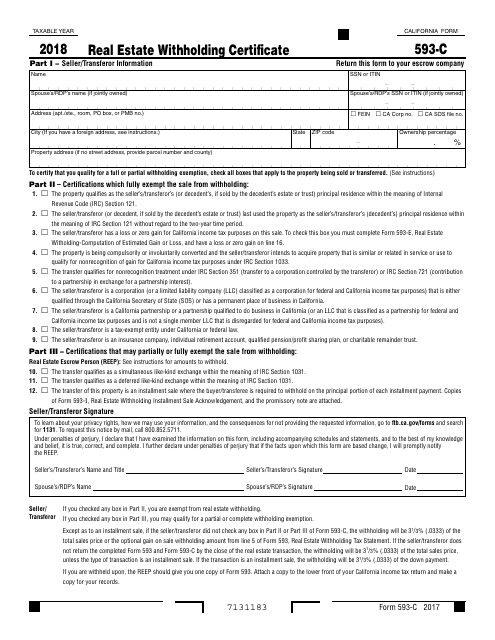

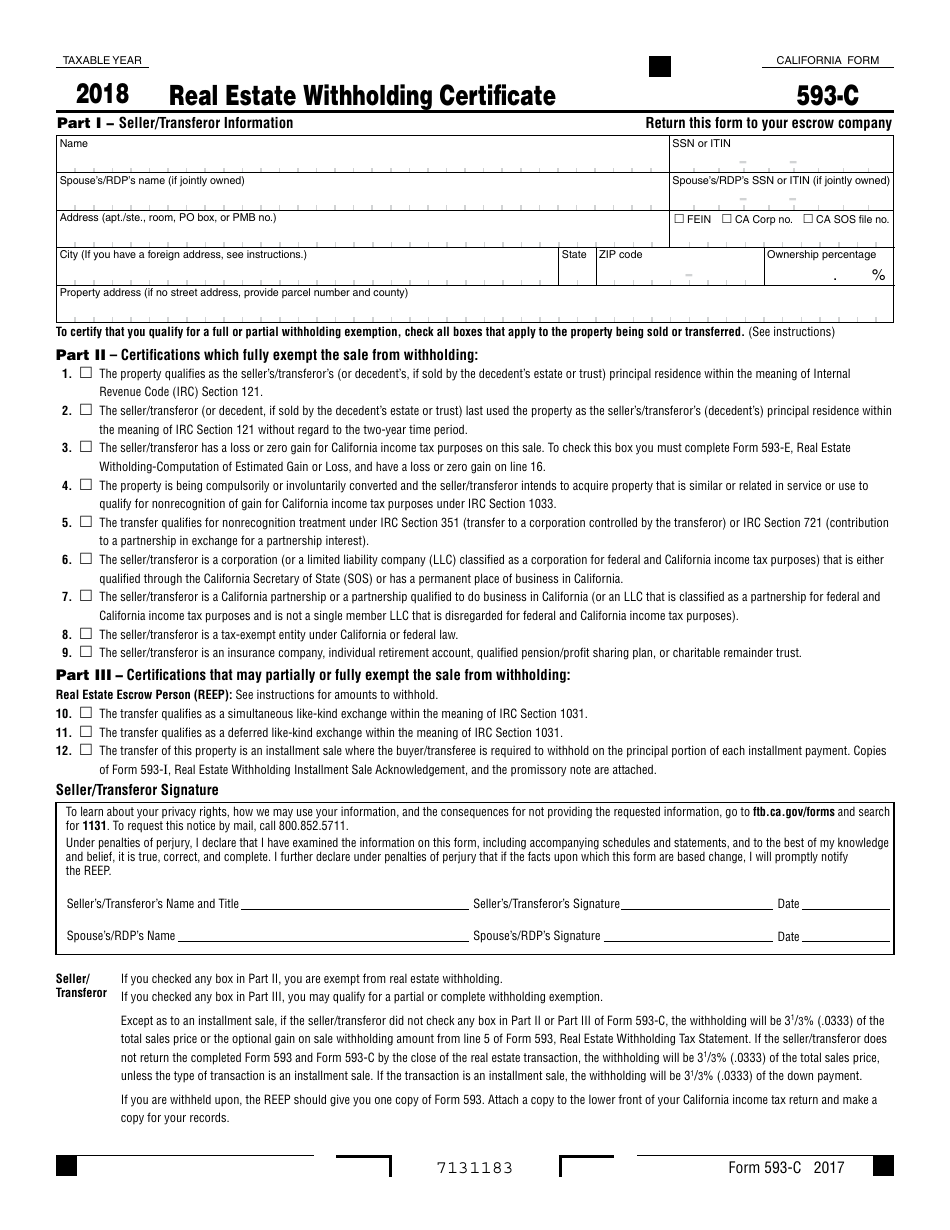

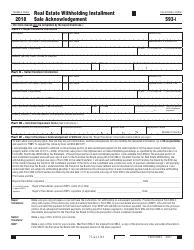

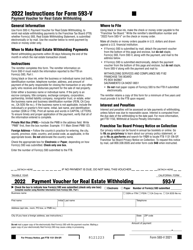

Form 593-c Real Estate Withholding Certificate - California

What Is Form 593-c?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 593-C?

A: Form 593-C is the Real Estate Withholding Certificate for California.

Q: What is the purpose of Form 593-C?

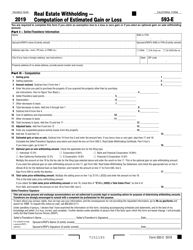

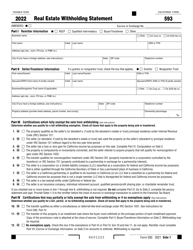

A: Form 593-C is used to determine the amount of withholding tax on the sale or transfer of real property in California.

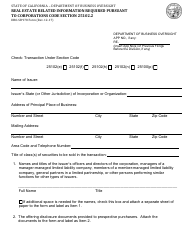

Q: Who needs to file Form 593-C?

A: Sellers or transferors of real property in California may need to file Form 593-C.

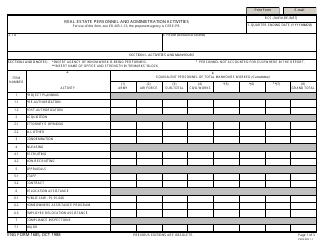

Q: What information is required on Form 593-C?

A: Form 593-C requires information about the buyer, the seller, and the property being sold or transferred.

Q: When should Form 593-C be filed?

A: Form 593-C should be filed at least 21 days before the close of escrow or transfer of the property.

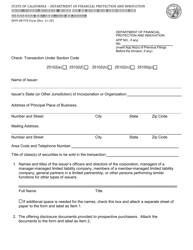

Q: Are there any exceptions to filing Form 593-C?

A: There are certain exceptions to filing Form 593-C, such as transfers between spouses or transfers where no consideration is exchanged.

Q: What happens if Form 593-C is not filed?

A: If Form 593-C is not filed, the buyer is required to withhold 3.33% of the purchase price or transferor's pro-rata share of the sales price.

Q: Can Form 593-C be filed electronically?

A: Yes, Form 593-C can be filed electronically through the California Franchise Tax Board's e-Services system.

Q: Is there a fee for filing Form 593-C?

A: No, there is no fee for filing Form 593-C.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 593-c by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.