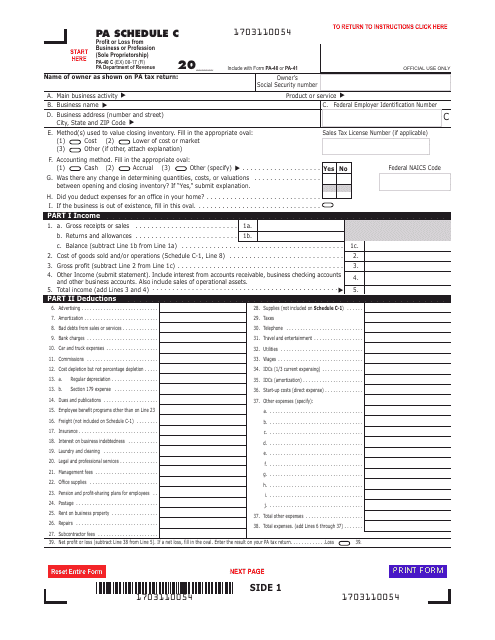

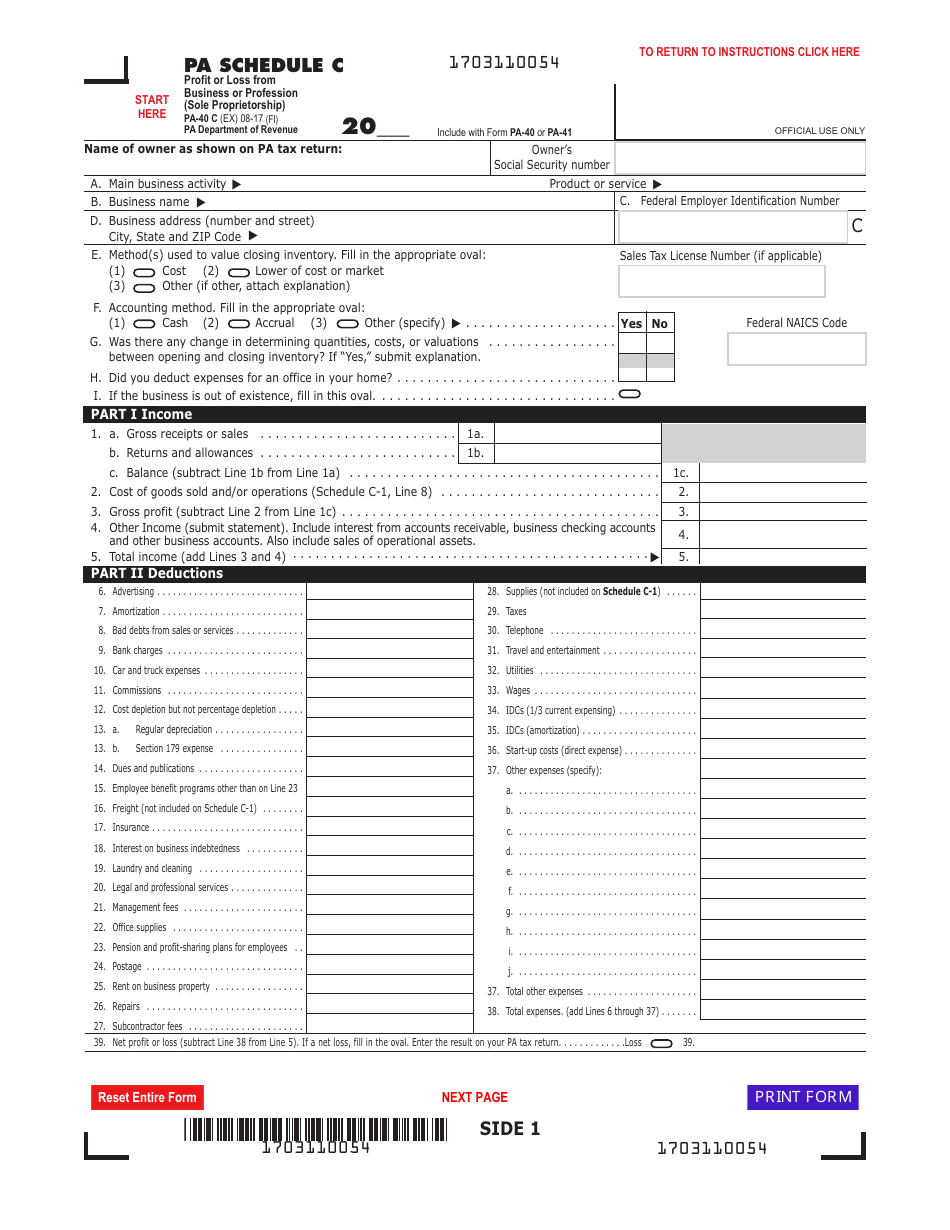

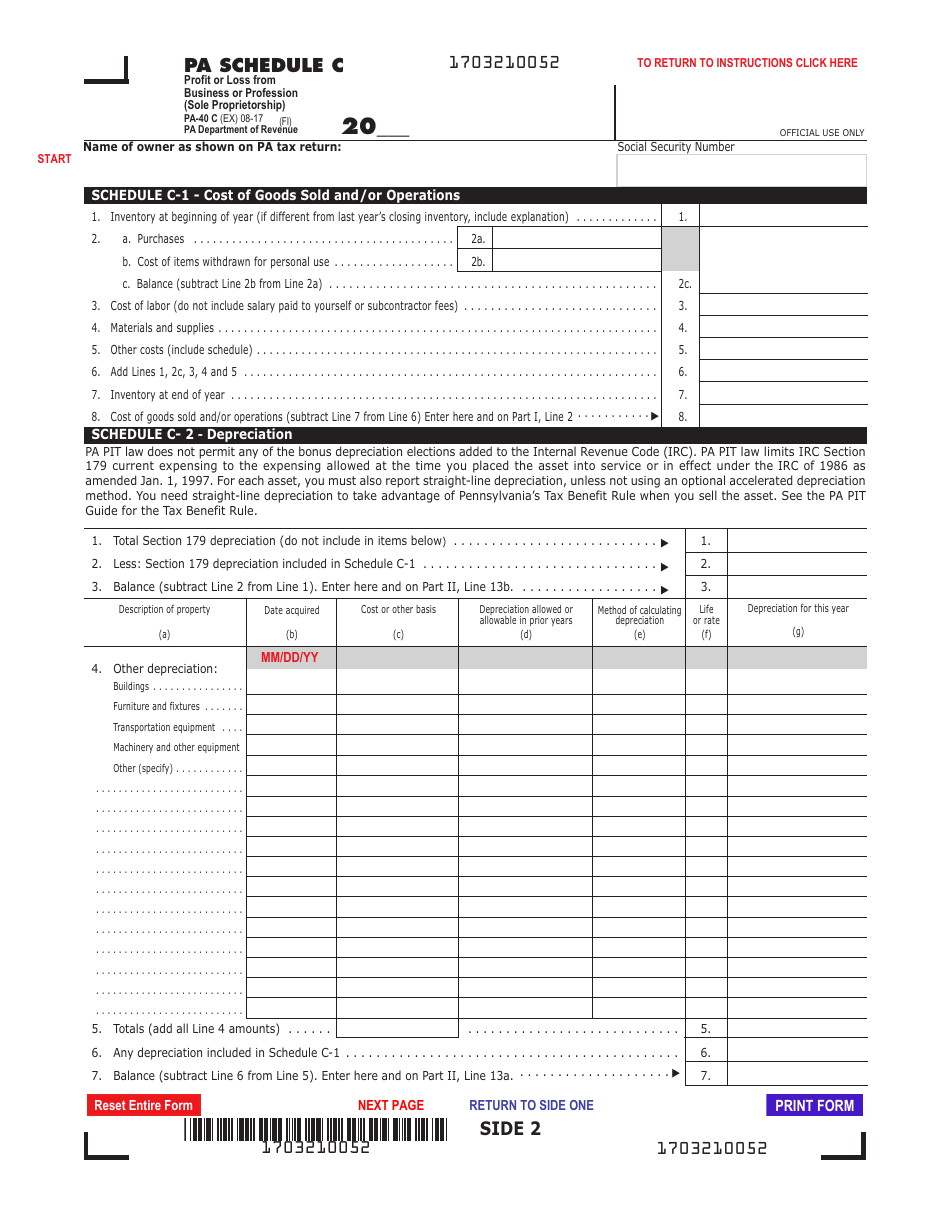

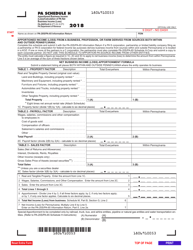

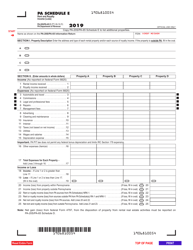

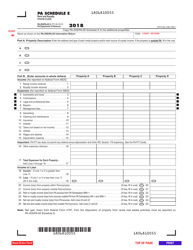

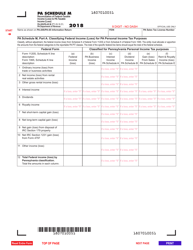

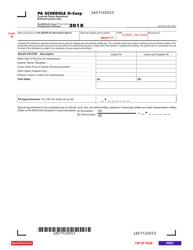

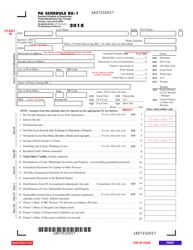

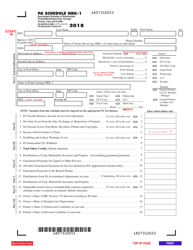

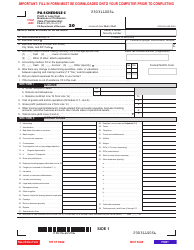

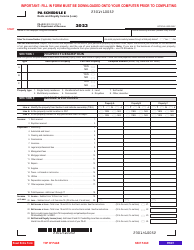

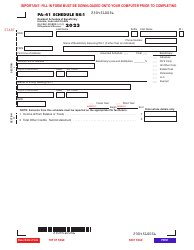

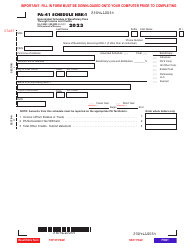

Form PA-40 C (EX) Schedule C Profit or Loss From Business or Profession (Sole Proprietorship) - Pennsylvania

What Is Form PA-40 C (EX) Schedule C?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 C (EX)?

A: Form PA-40 C (EX) is a schedule used to report the profit or loss from a sole proprietorship business or profession in Pennsylvania.

Q: Who should file Form PA-40 C (EX)?

A: You should file Form PA-40 C (EX) if you are a sole proprietor and have a business or profession in Pennsylvania.

Q: What information is required for Form PA-40 C (EX)?

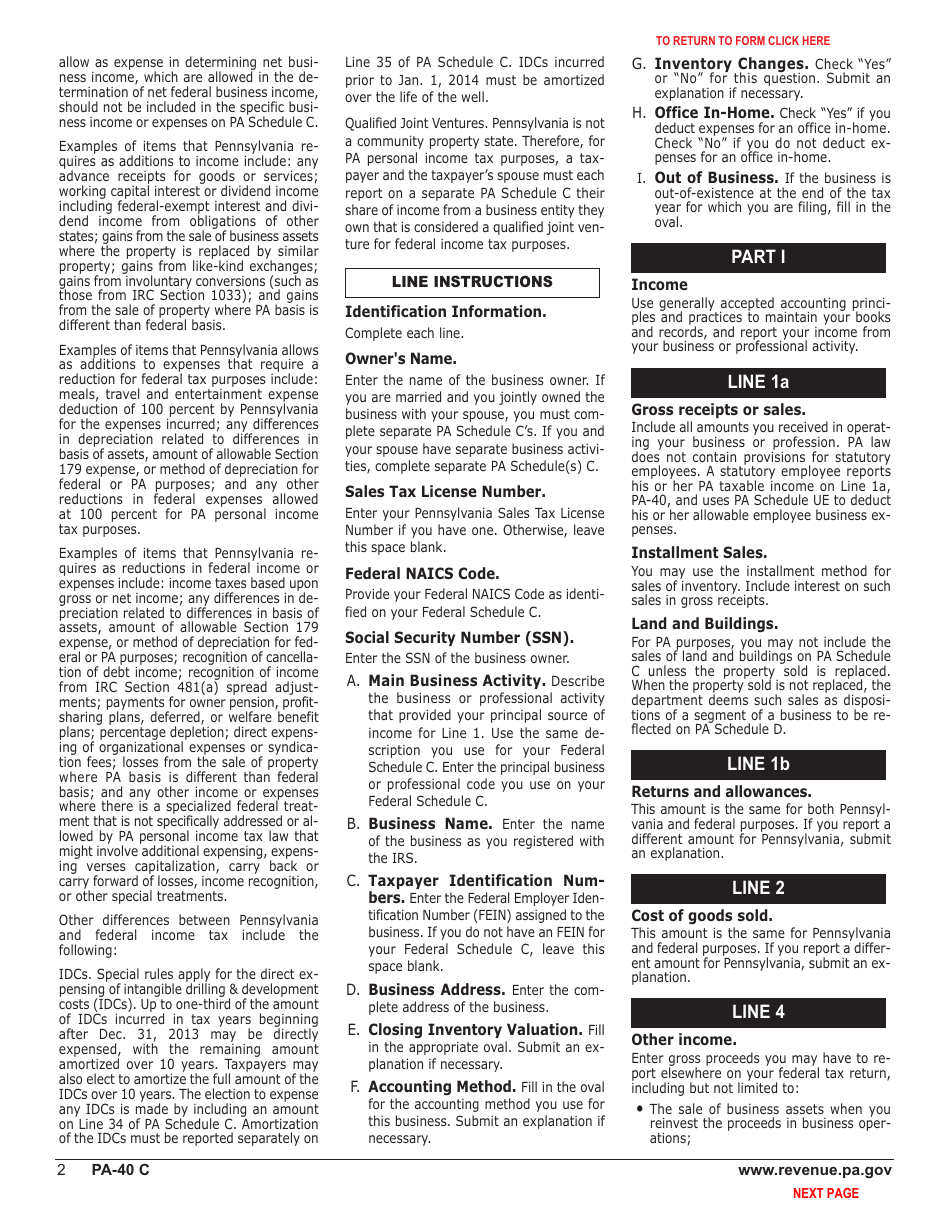

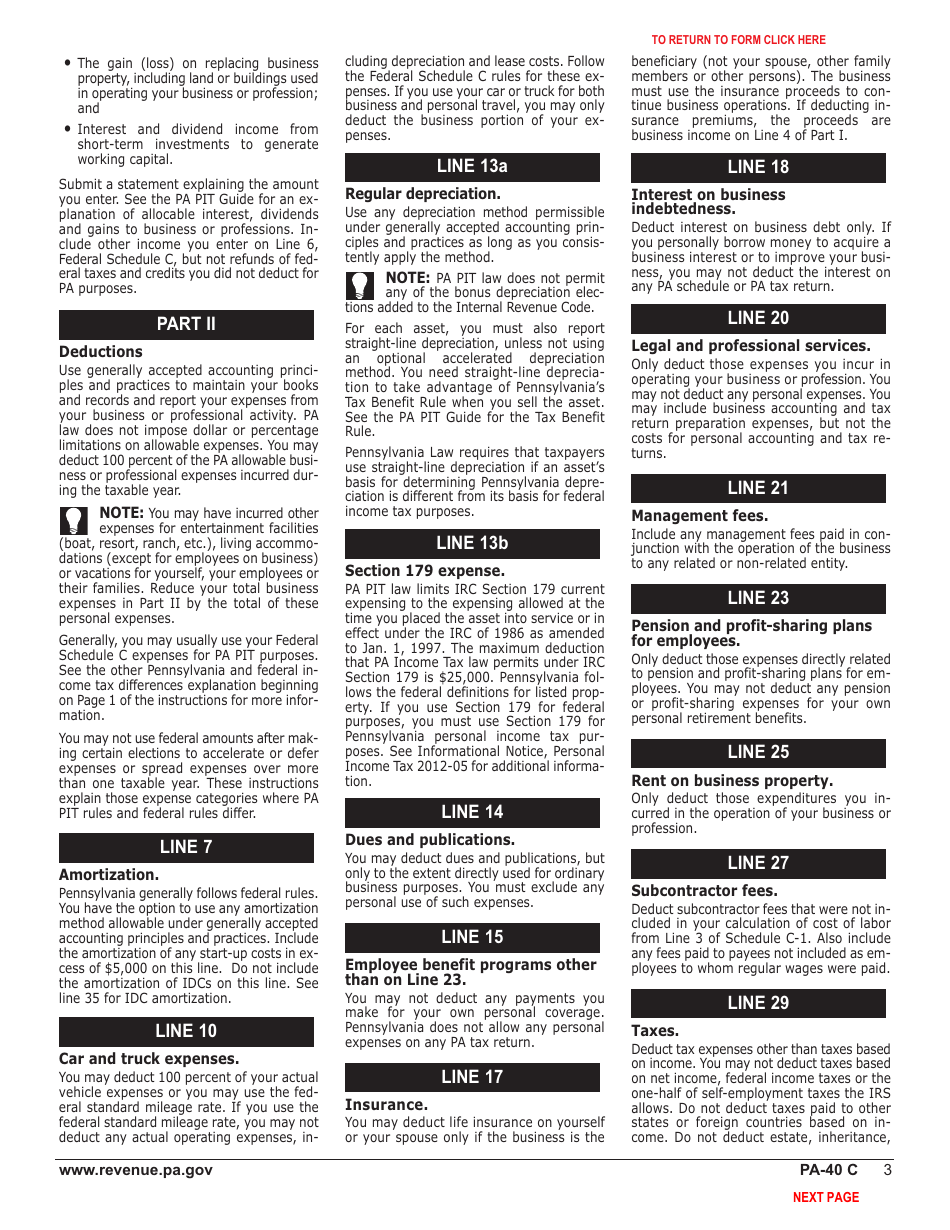

A: Form PA-40 C (EX) requires information about your business income, expenses, and any other relevant details related to your sole proprietorship.

Q: When is Form PA-40 C (EX) due?

A: Form PA-40 C (EX) is due on the same date as your Pennsylvania personal income tax return, which is usually April 15th of each year.

Q: Are there any filing fees for Form PA-40 C (EX)?

A: No, there are no filing fees for Form PA-40 C (EX). However, you may be required to pay taxes on the income reported on this form.

Q: Can I e-file Form PA-40 C (EX)?

A: Yes, you can e-file Form PA-40 C (EX) if you are filing your Pennsylvania personal income tax return electronically.

Q: What if I have more than one sole proprietorship business in Pennsylvania?

A: If you have multiple sole proprietorship businesses in Pennsylvania, you will need to file a separate Form PA-40 C (EX) for each business.

Q: What if I am a partner in a partnership or member of an LLC?

A: If you are a partner in a partnership or a member of an LLC, you should not file Form PA-40 C (EX). Instead, the partnership or LLC should file a separate return.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 C (EX) Schedule C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.