This version of the form is not currently in use and is provided for reference only. Download this version of

Form MI-8949

for the current year.

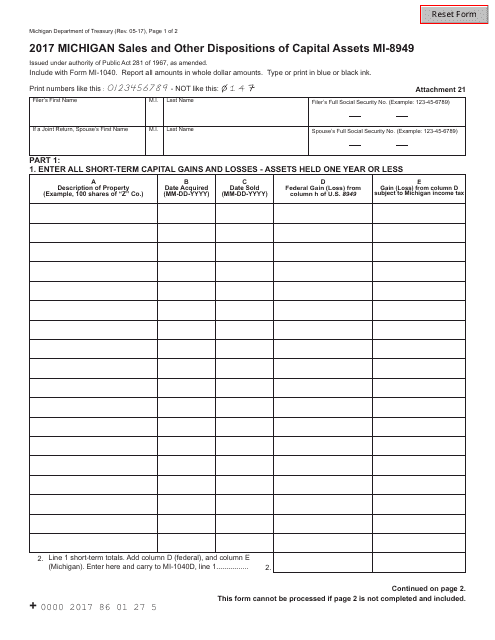

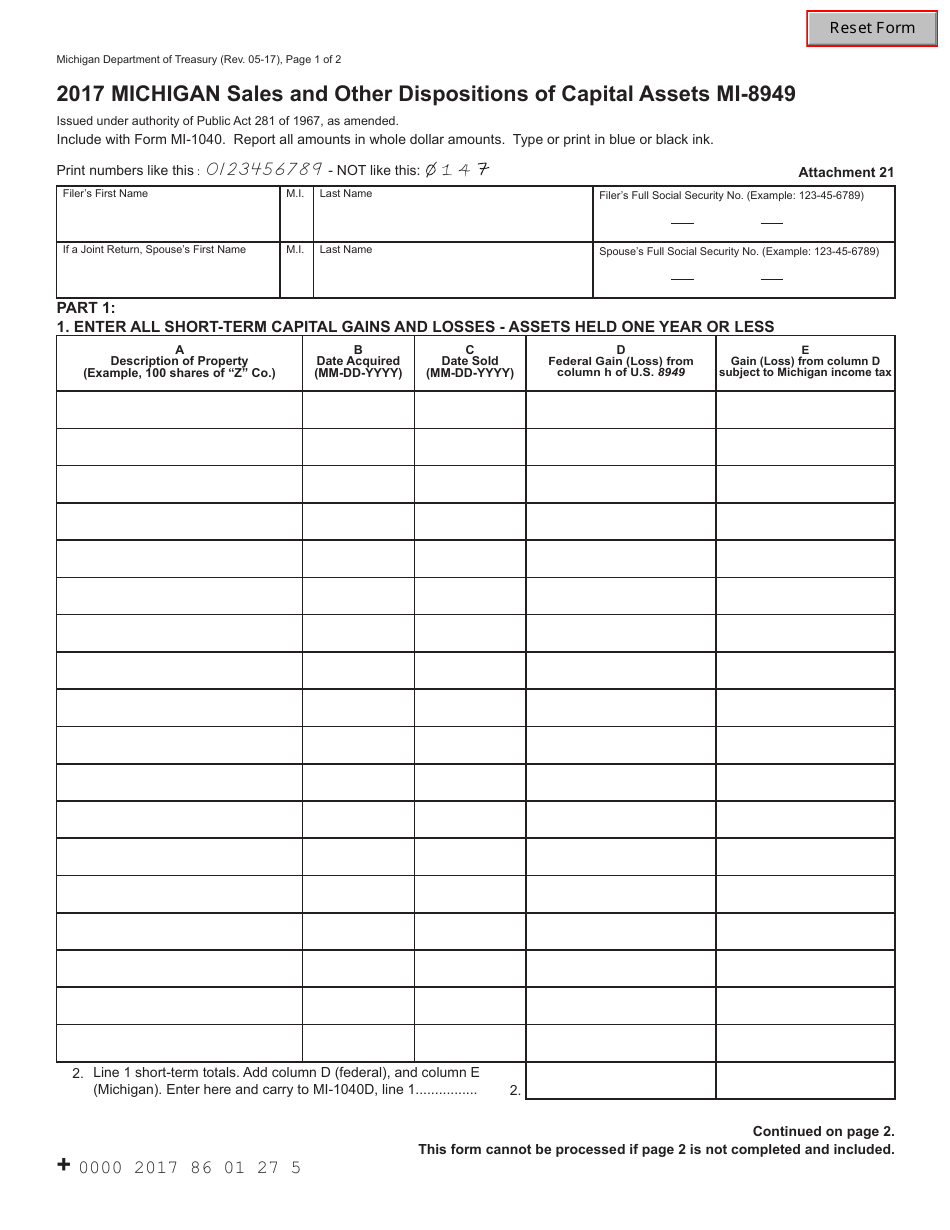

Form MI-8949 Michigan Sales and Other Dispositions of Capital Assets - Michigan

What Is Form MI-8949?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-8949?

A: Form MI-8949 is a tax form used in Michigan to report sales and other dispositions of capital assets.

Q: Who needs to file Form MI-8949?

A: Anyone who has made sales or other dispositions of capital assets in Michigan needs to file Form MI-8949.

Q: What information is required on Form MI-8949?

A: Form MI-8949 requires you to provide detailed information about each sale or disposition of a capital asset, including the date of sale, description of the asset, and the proceeds from the sale.

Q: When is Form MI-8949 due?

A: Form MI-8949 is typically due on the same date as your Michigan income tax return, which is usually April 15th.

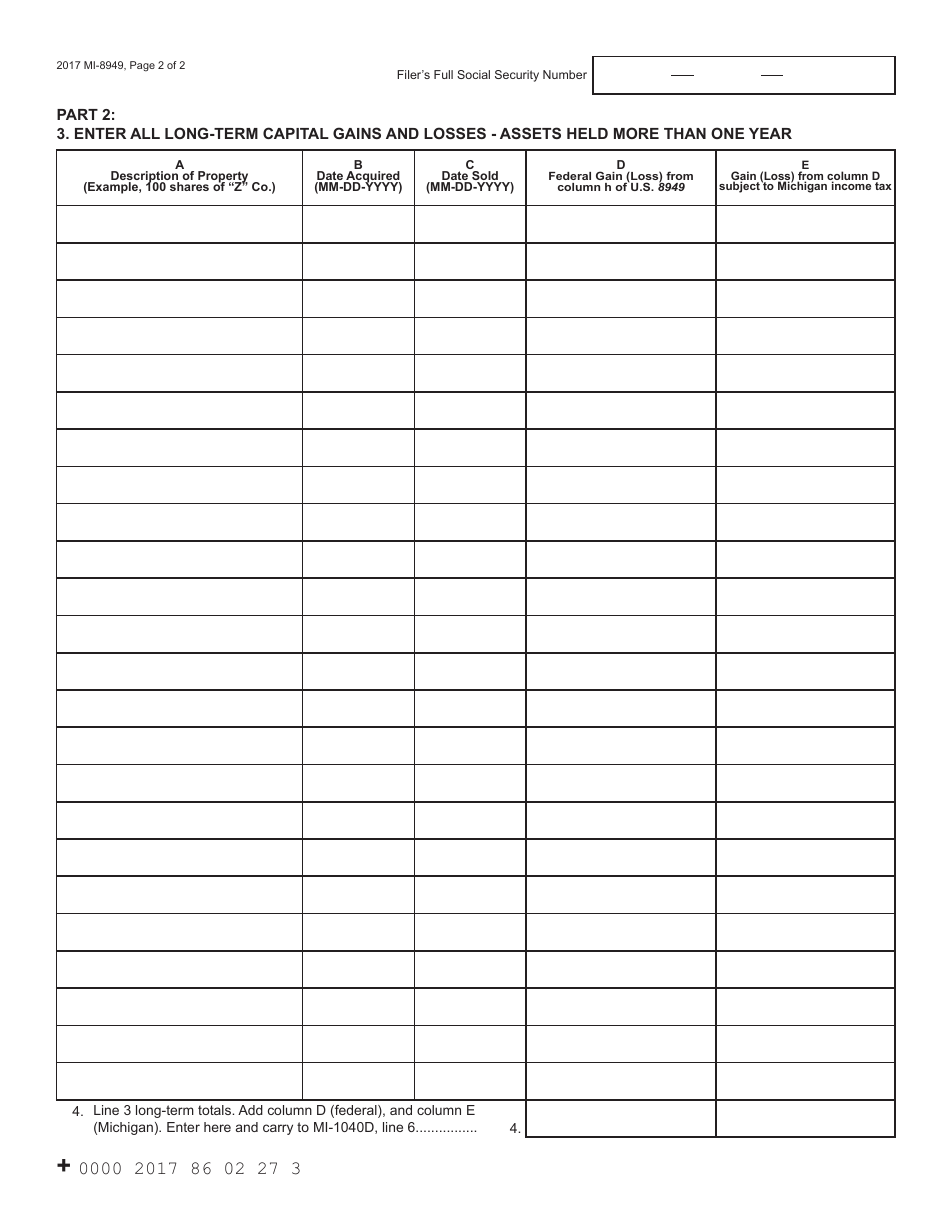

Q: Are there any specific instructions for filling out Form MI-8949?

A: Yes, the instructions for Form MI-8949 provide detailed guidance on how to complete the form correctly. It is important to read and follow these instructions carefully.

Q: Can I file Form MI-8949 electronically?

A: Yes, you can file Form MI-8949 electronically using Michigan's efile system, or through approved tax preparation software.

Q: Do I need to keep a copy of Form MI-8949 for my records?

A: Yes, it is important to keep a copy of Form MI-8949 for your records in case you need to refer back to it in the future.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-8949 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.