This version of the form is not currently in use and is provided for reference only. Download this version of

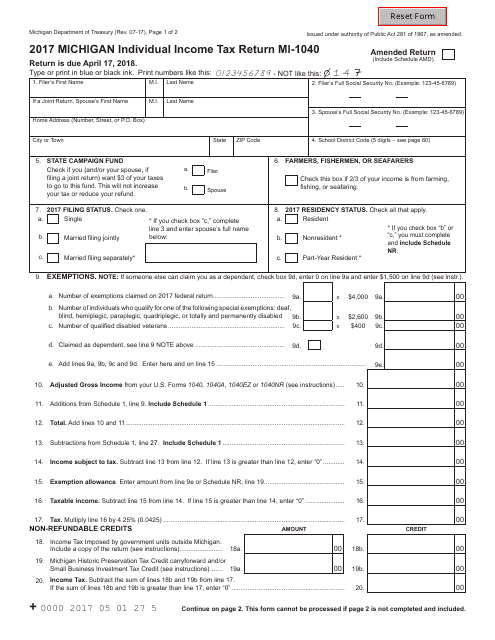

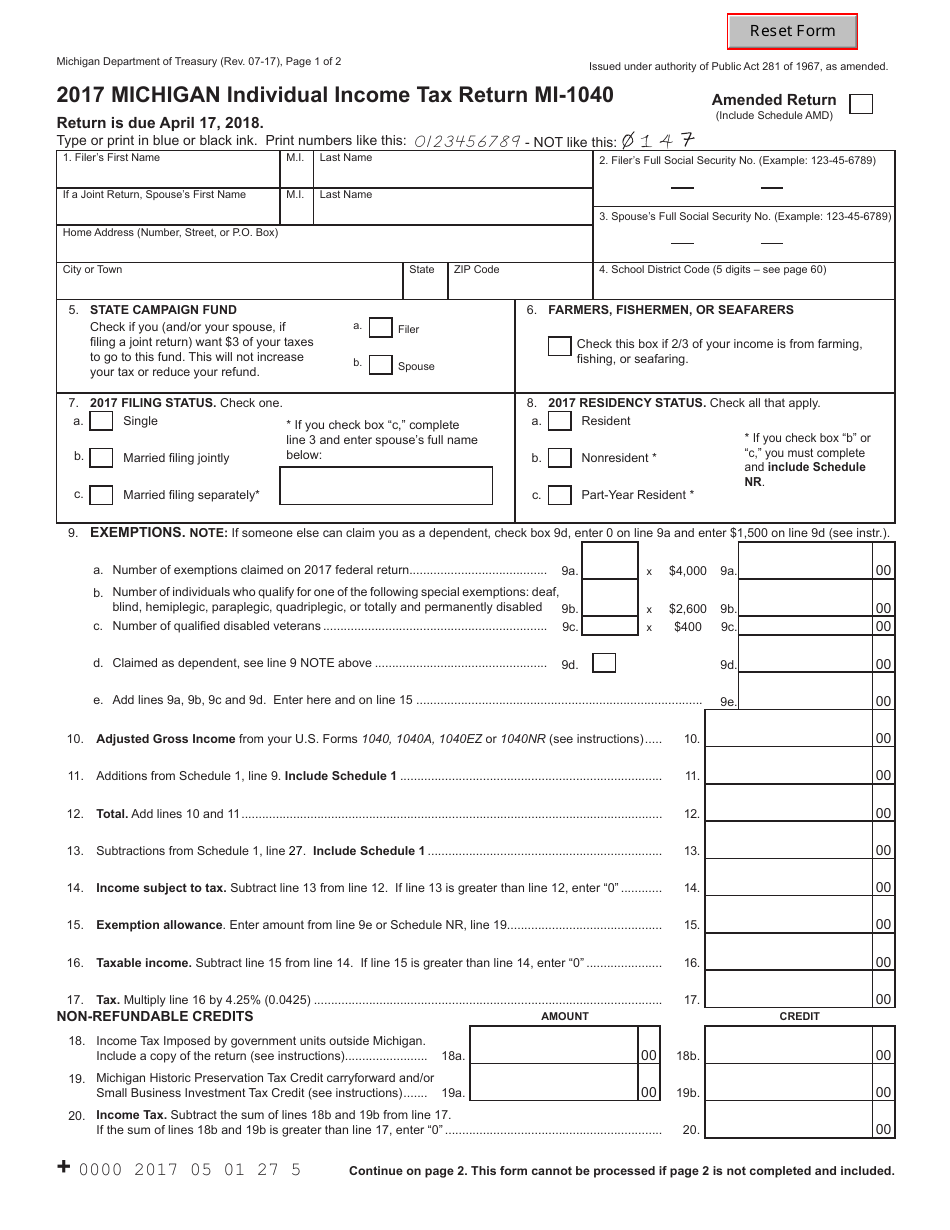

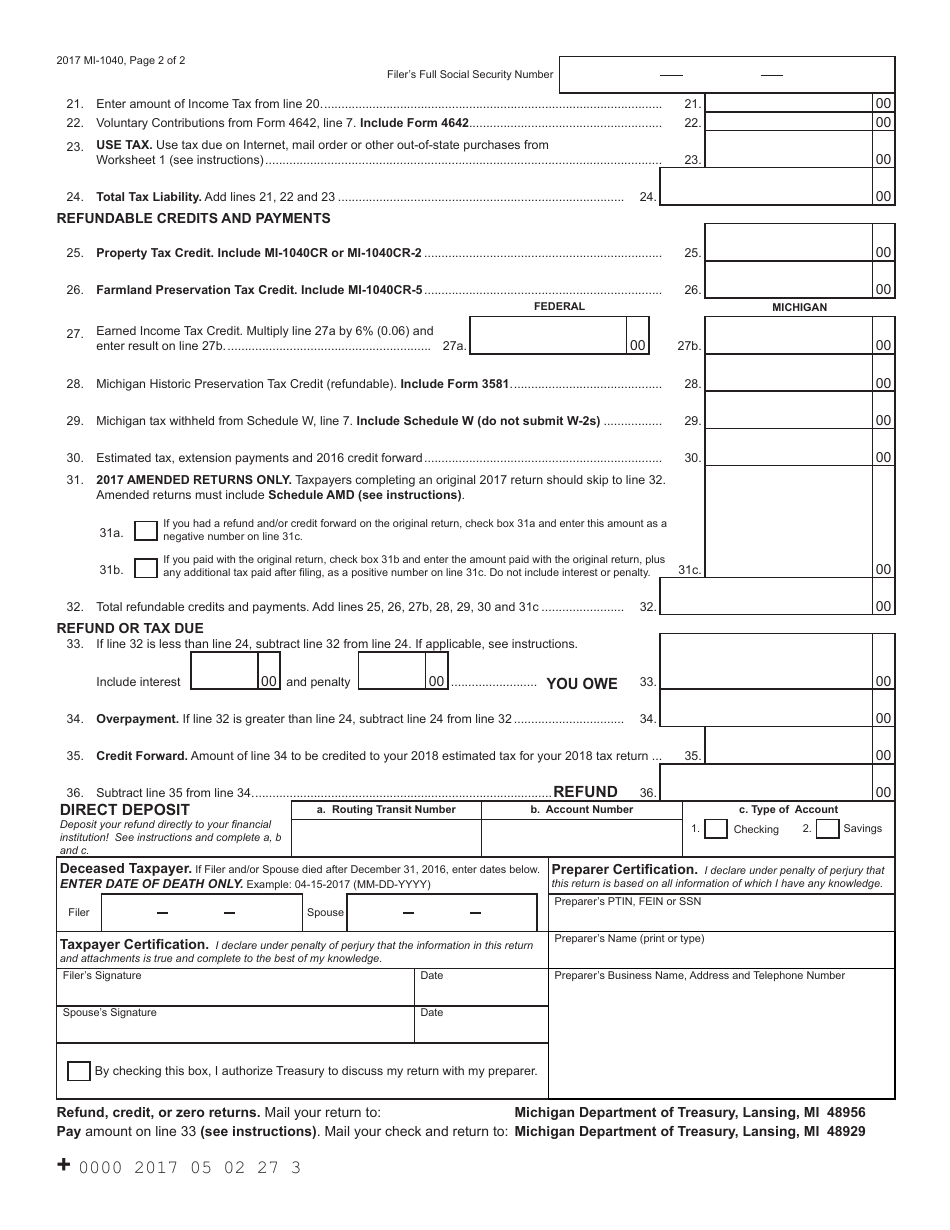

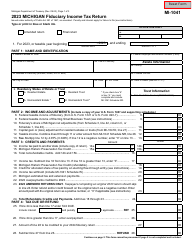

Form MI-1040

for the current year.

Form MI-1040 Michigan Individual Income Tax Return - Michigan

What Is Form MI-1040?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1040?

A: Form MI-1040 is the Michigan Individual Income Tax Return.

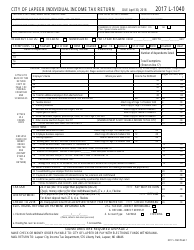

Q: Who needs to file Form MI-1040?

A: Any resident of Michigan who earned income during the tax year needs to file Form MI-1040.

Q: What information do I need to file Form MI-1040?

A: You will need information about your income, deductions, and credits. This includes W-2 forms, 1099 forms, and documentation of any deductions or credits you are claiming.

Q: When is the deadline to file Form MI-1040?

A: The deadline to file Form MI-1040 is typically April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any extensions available for filing Form MI-1040?

A: Yes, you can request an extension to file Form MI-1040. The extension gives you an additional six months to file, but any taxes owed are still due by the original deadline.

Q: Can I file Form MI-1040 electronically?

A: Yes, you can file Form MI-1040 electronically through the Michigan Department of Treasury's e-file system.

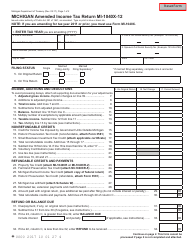

Q: What if I made a mistake on my filed Form MI-1040?

A: If you made a mistake on your filed Form MI-1040, you can file an amended return using Form MI-1040X.

Q: Do I need to include copies of my federal tax return with Form MI-1040?

A: No, you do not need to include copies of your federal tax return with Form MI-1040. However, you should keep a copy of your federal return for your records.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.