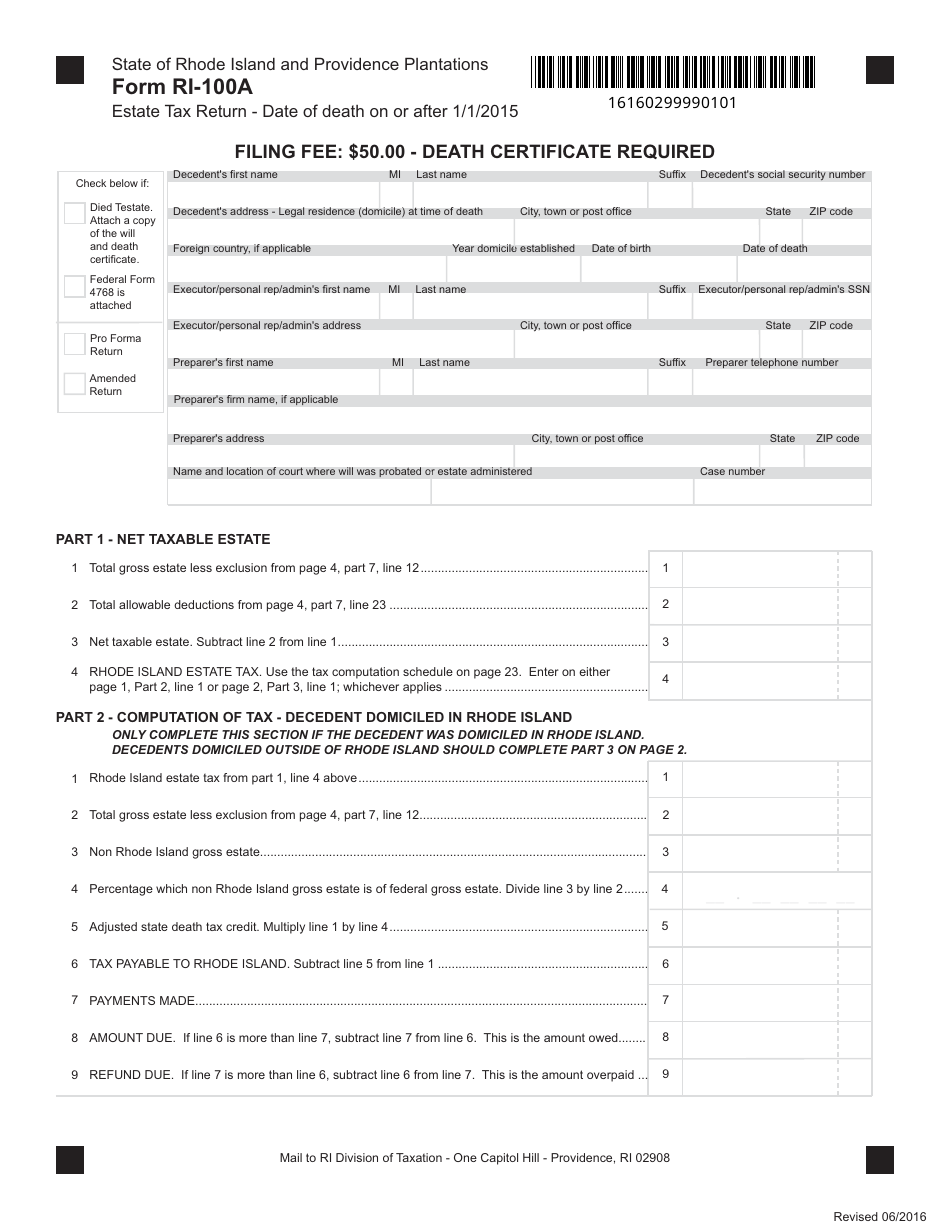

This version of the form is not currently in use and is provided for reference only. Download this version of

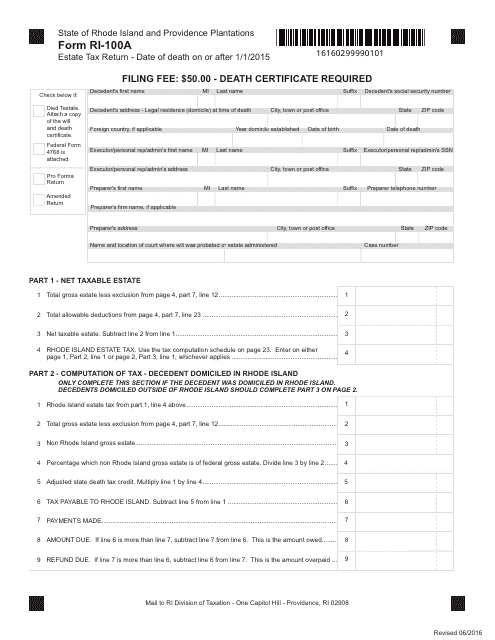

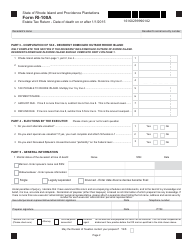

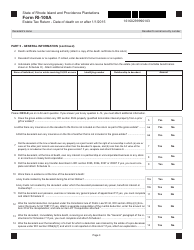

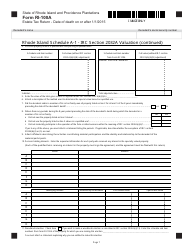

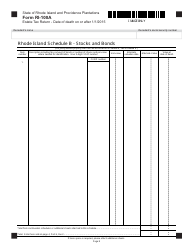

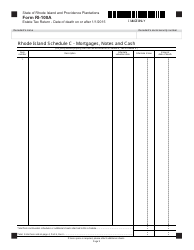

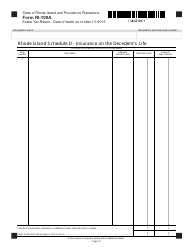

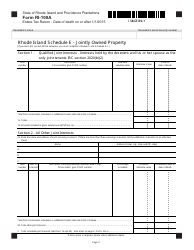

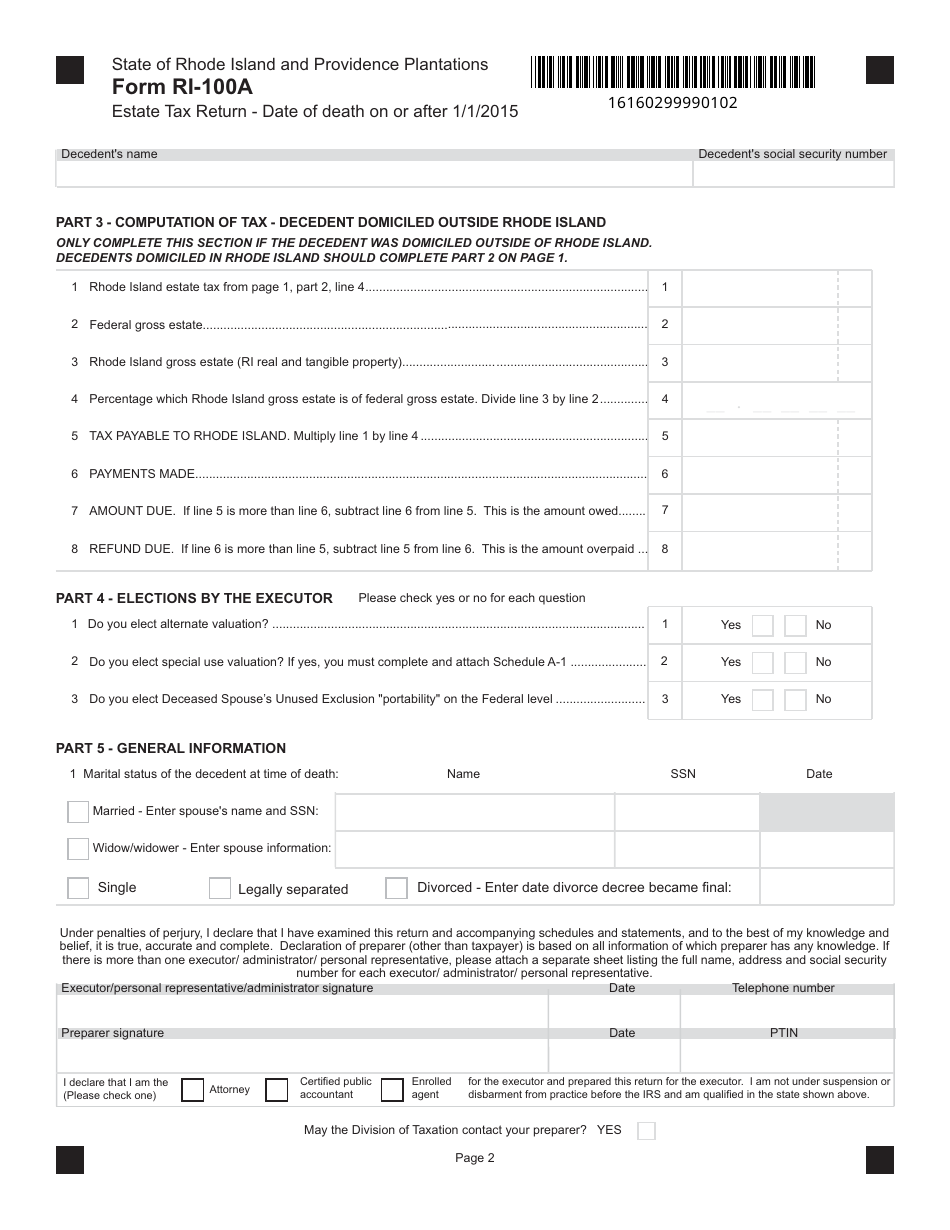

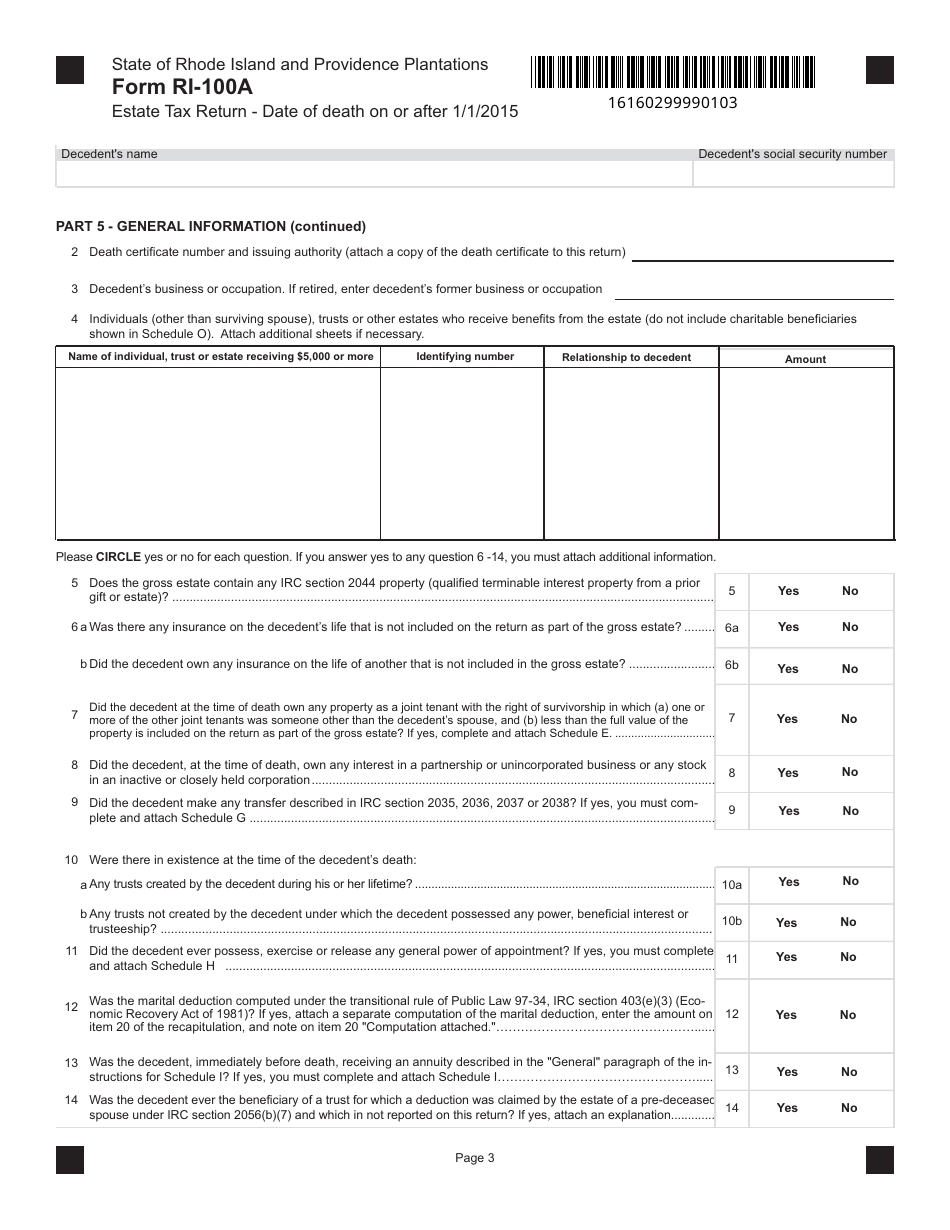

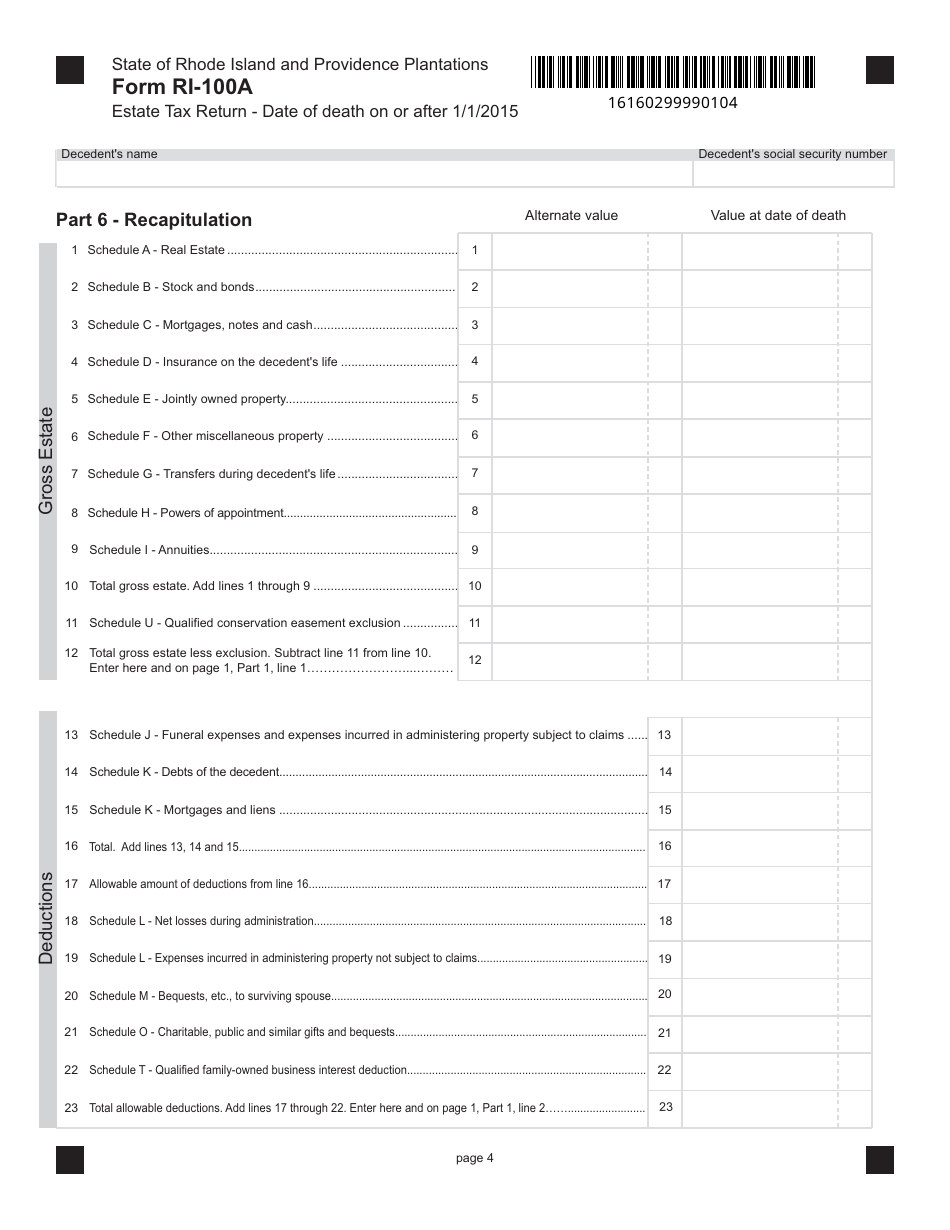

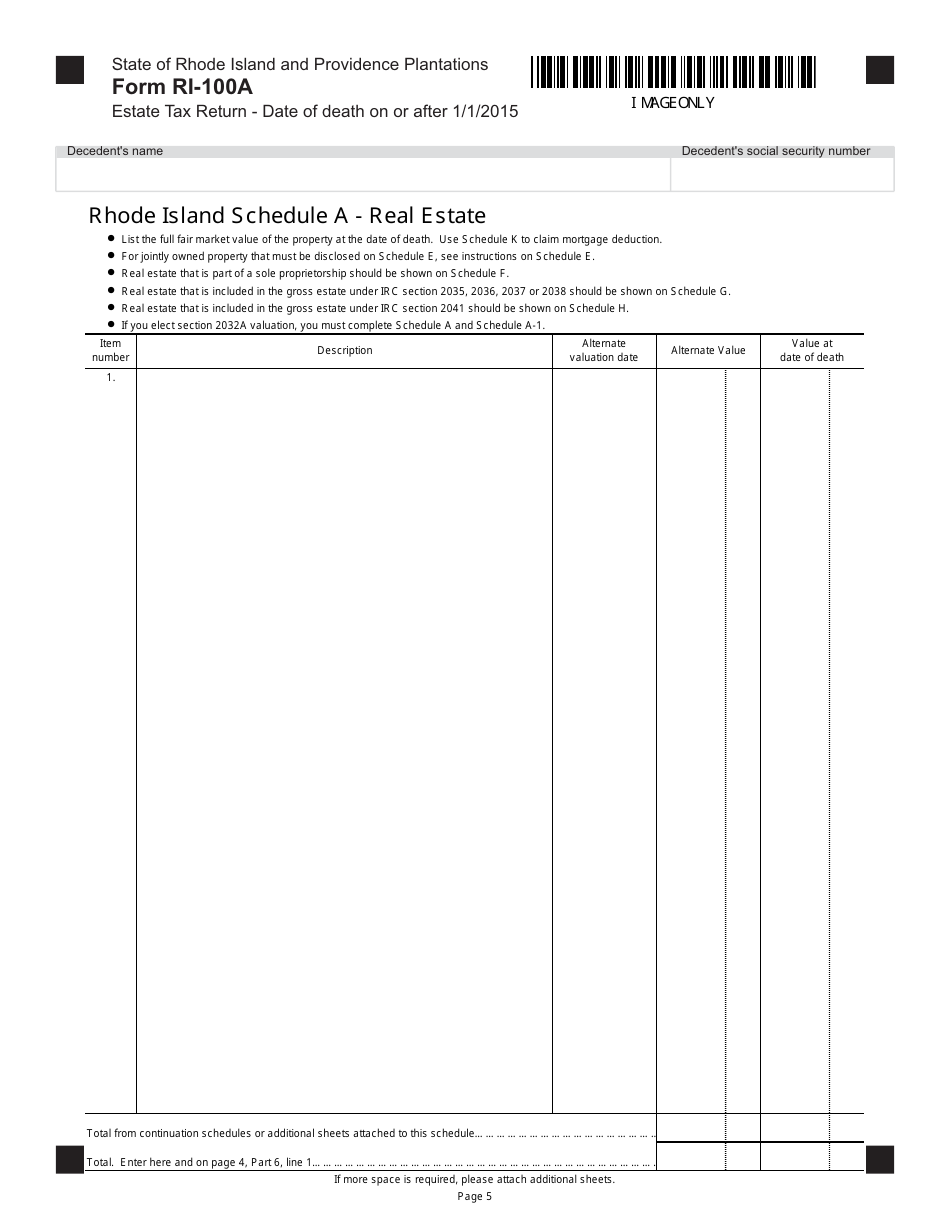

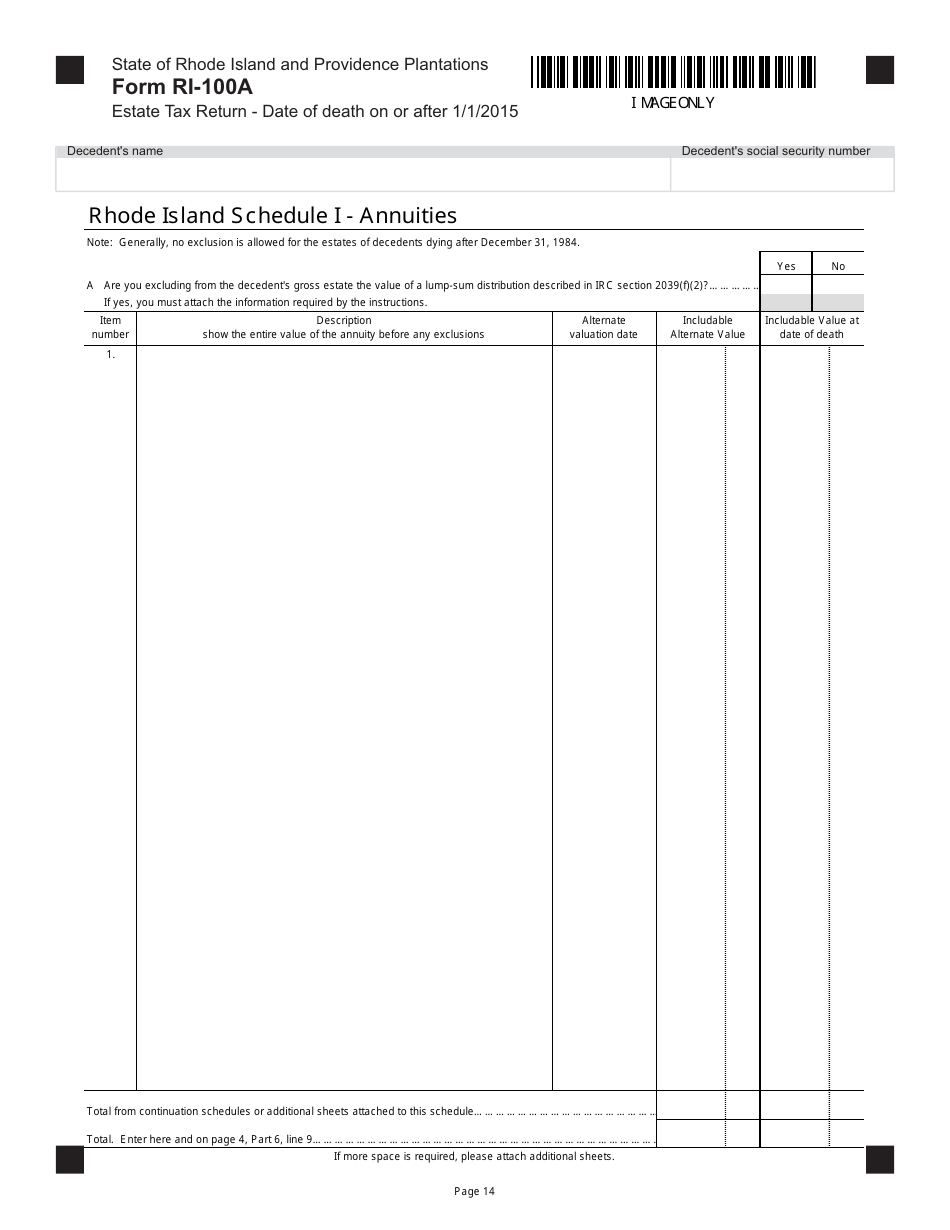

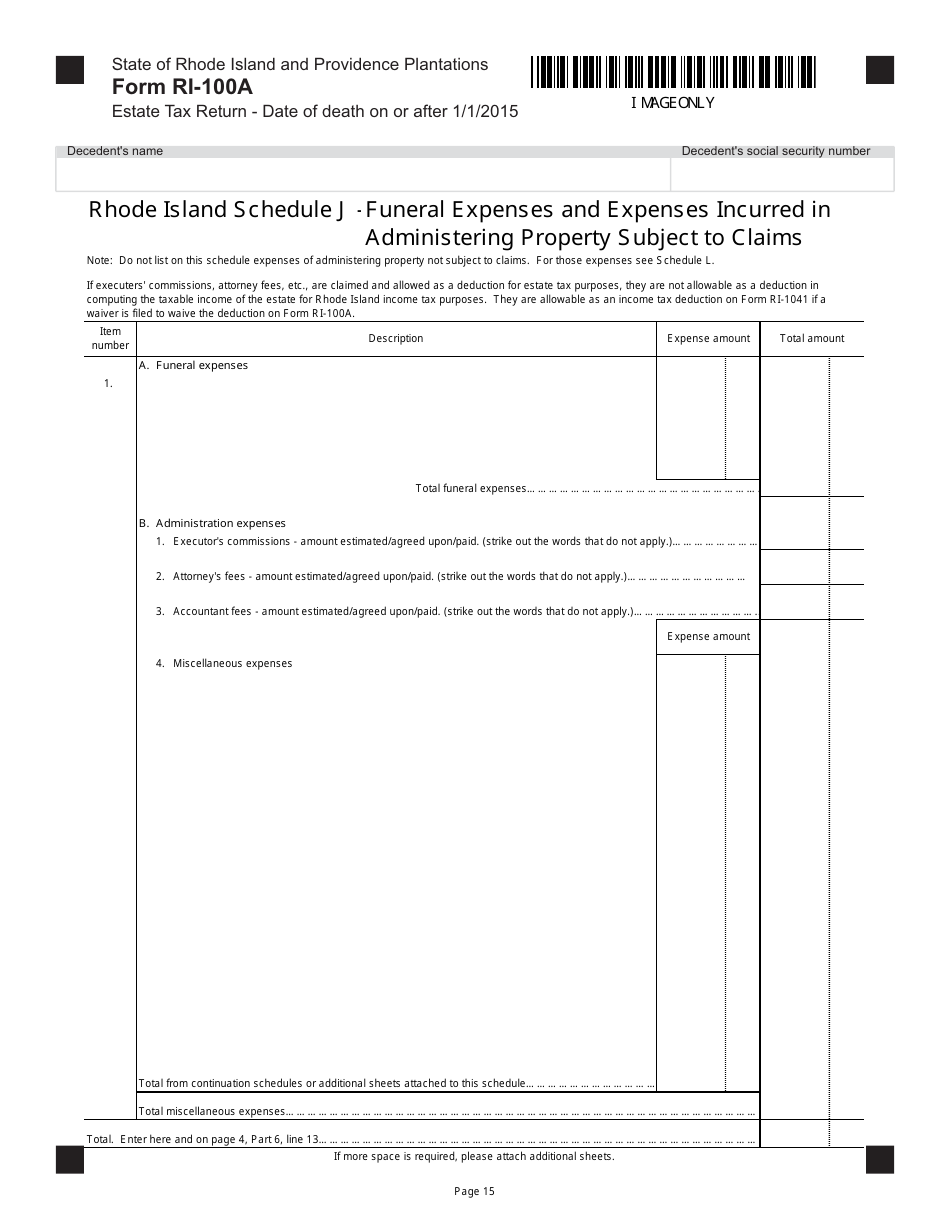

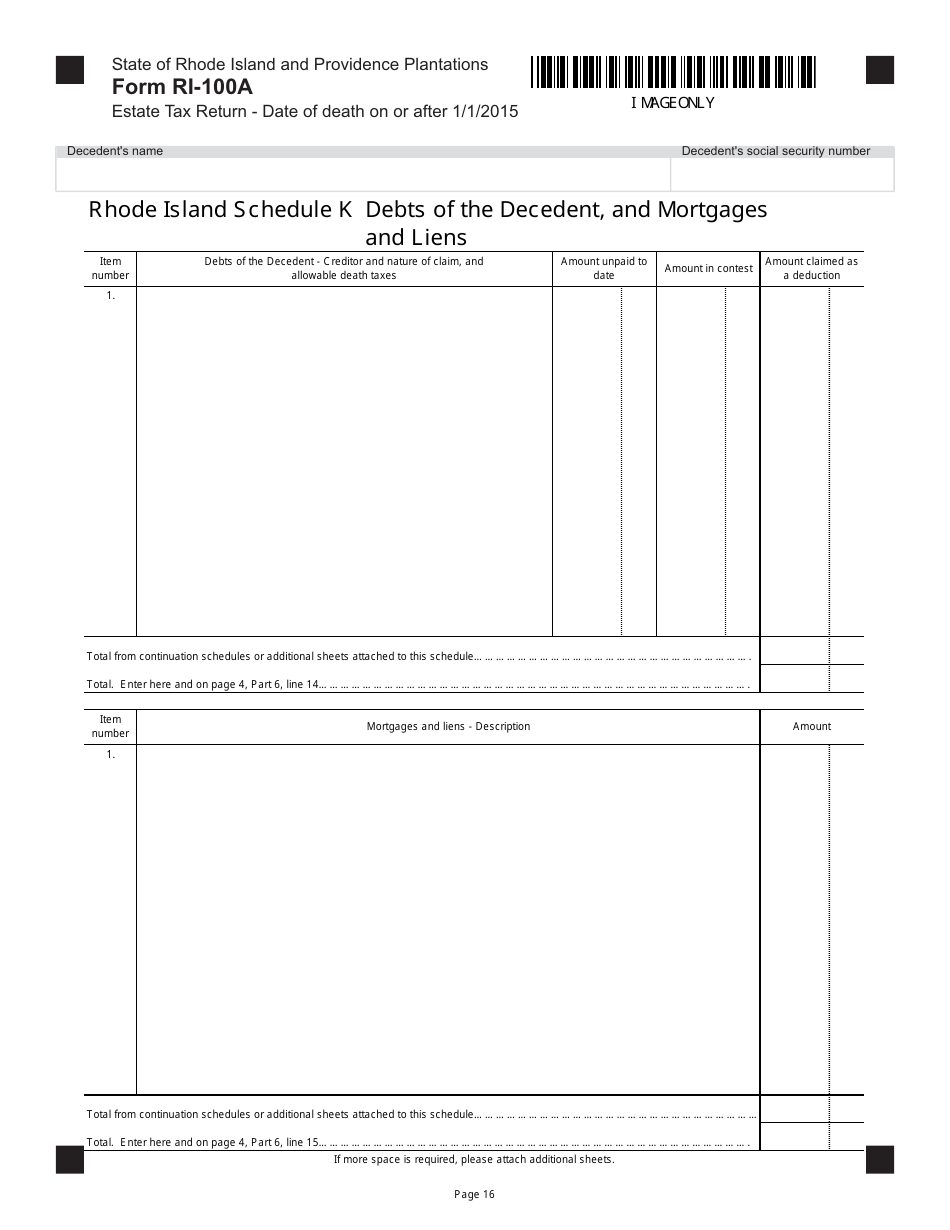

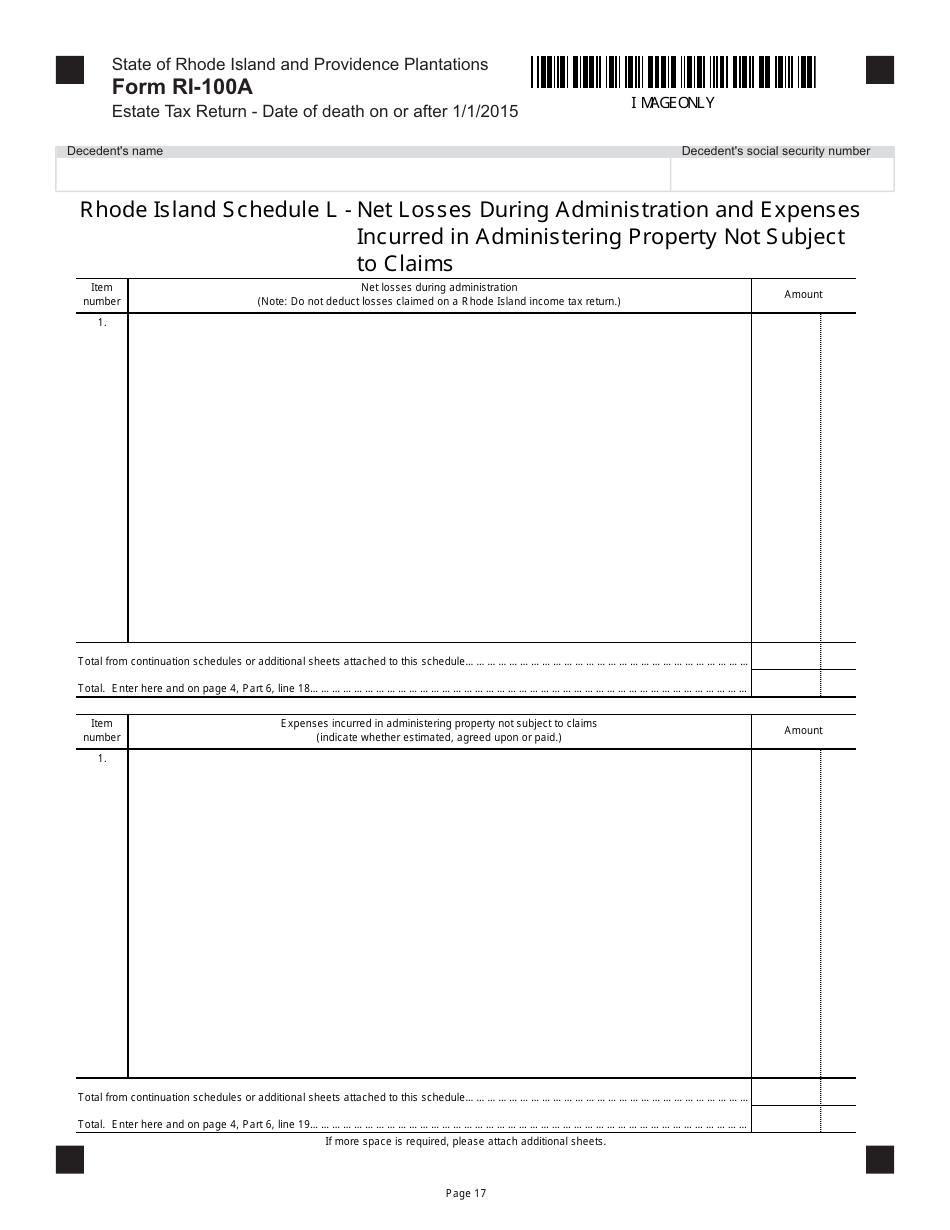

Form RI-100A

for the current year.

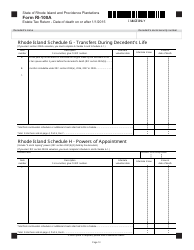

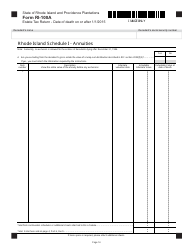

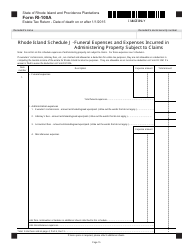

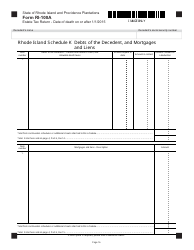

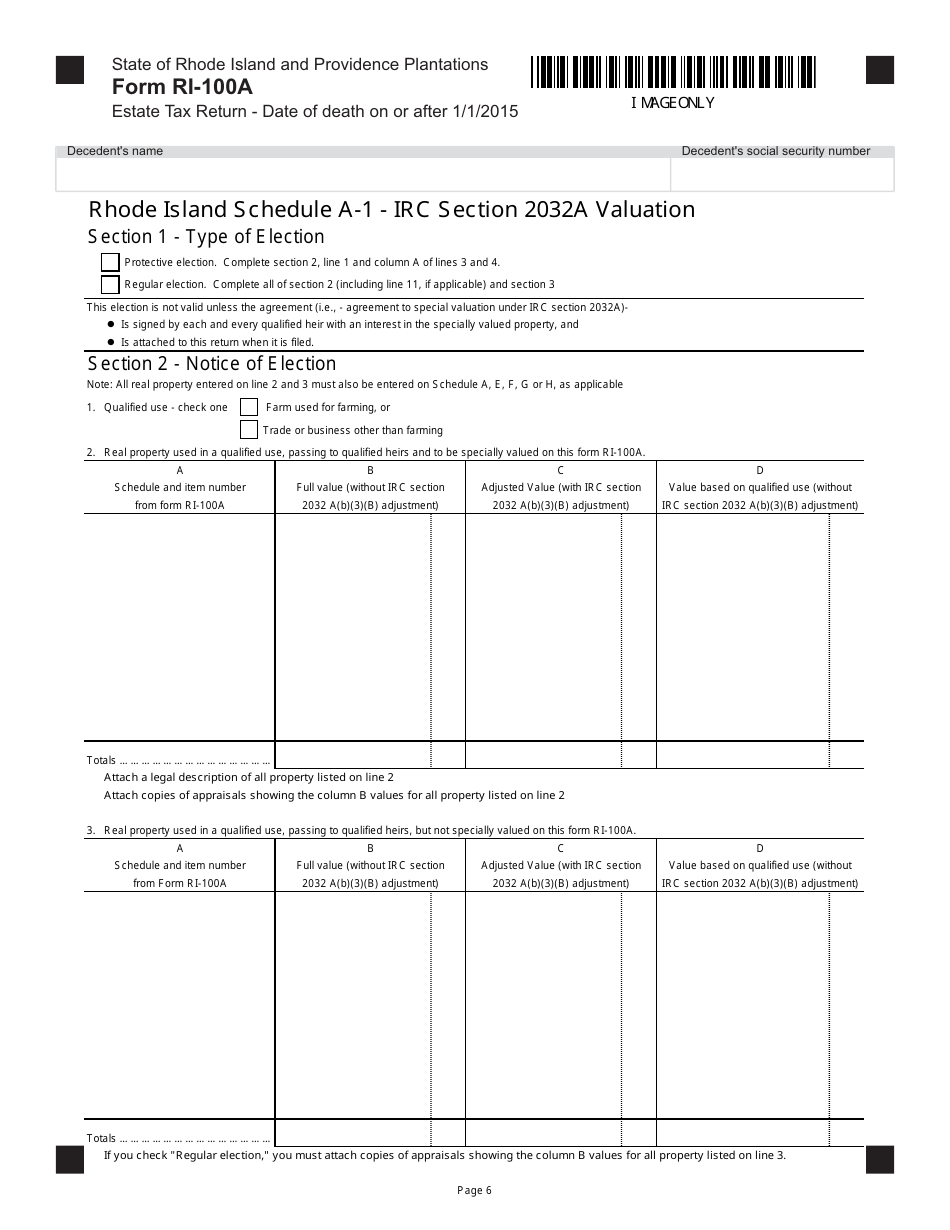

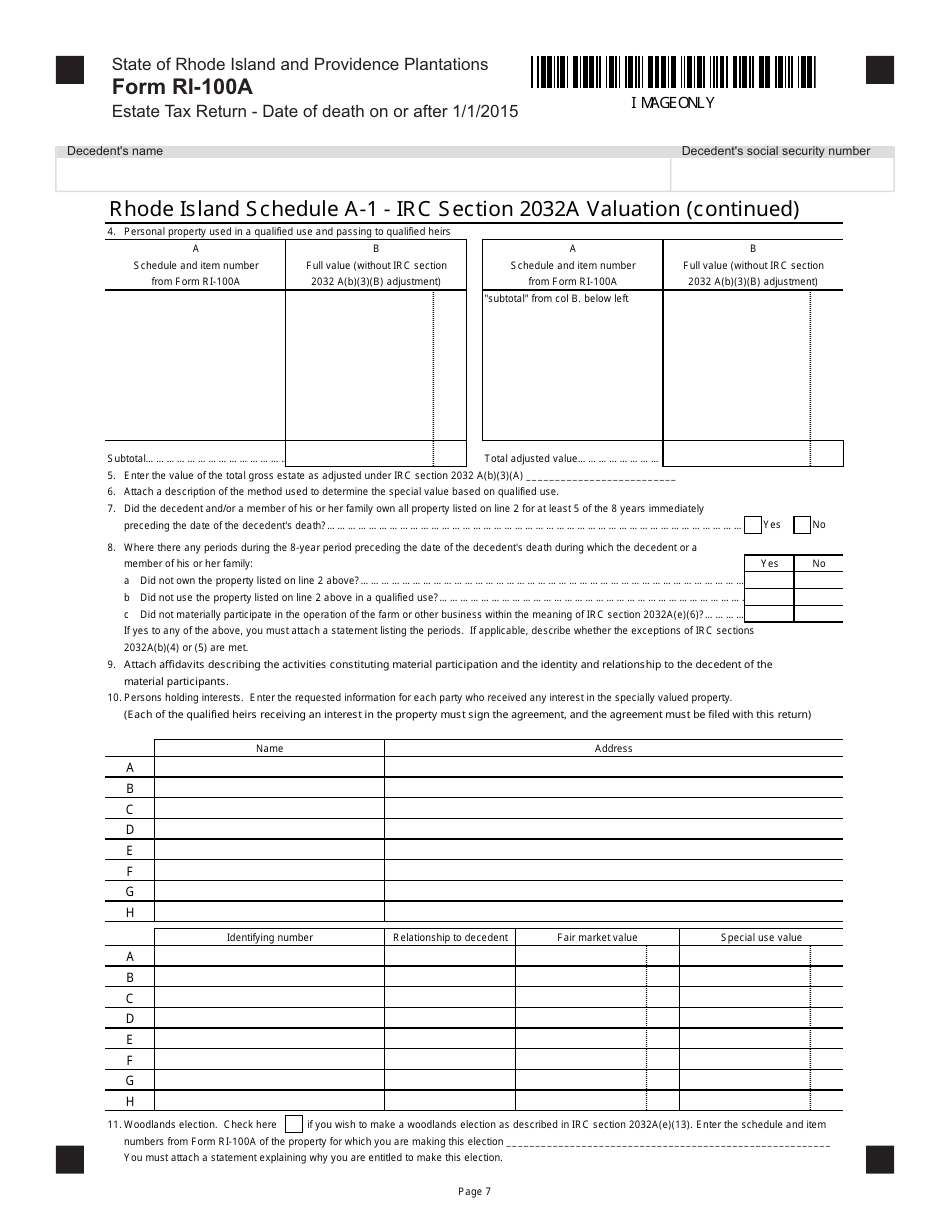

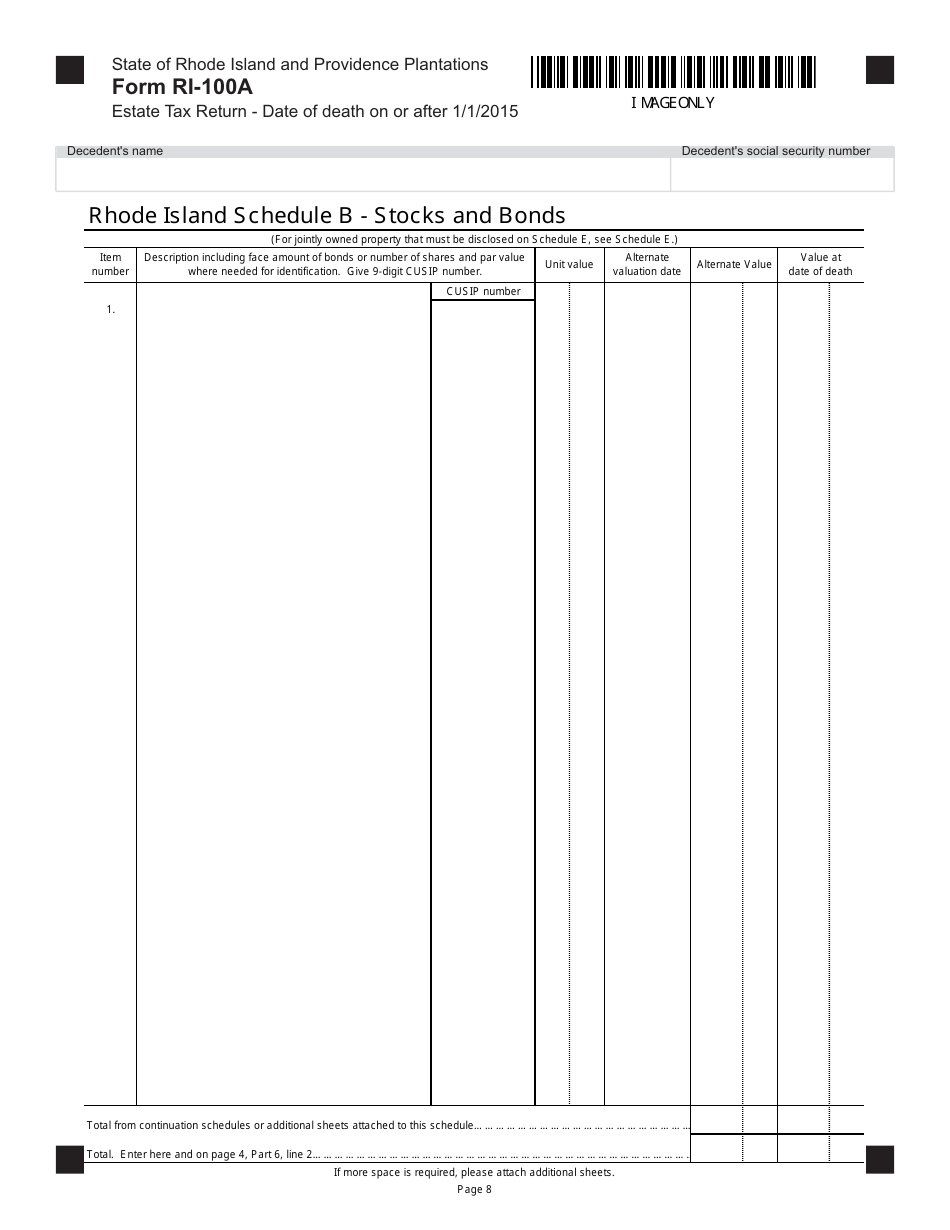

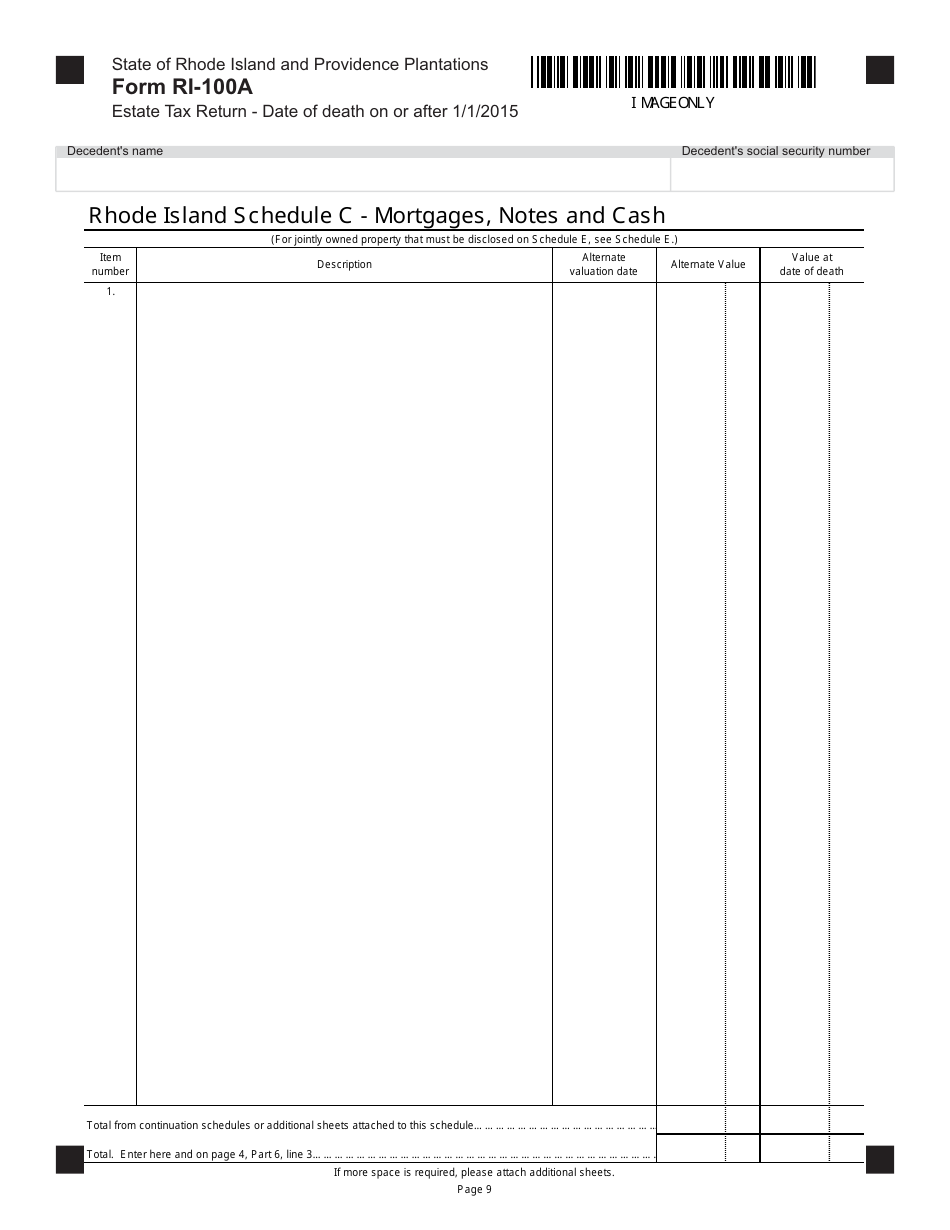

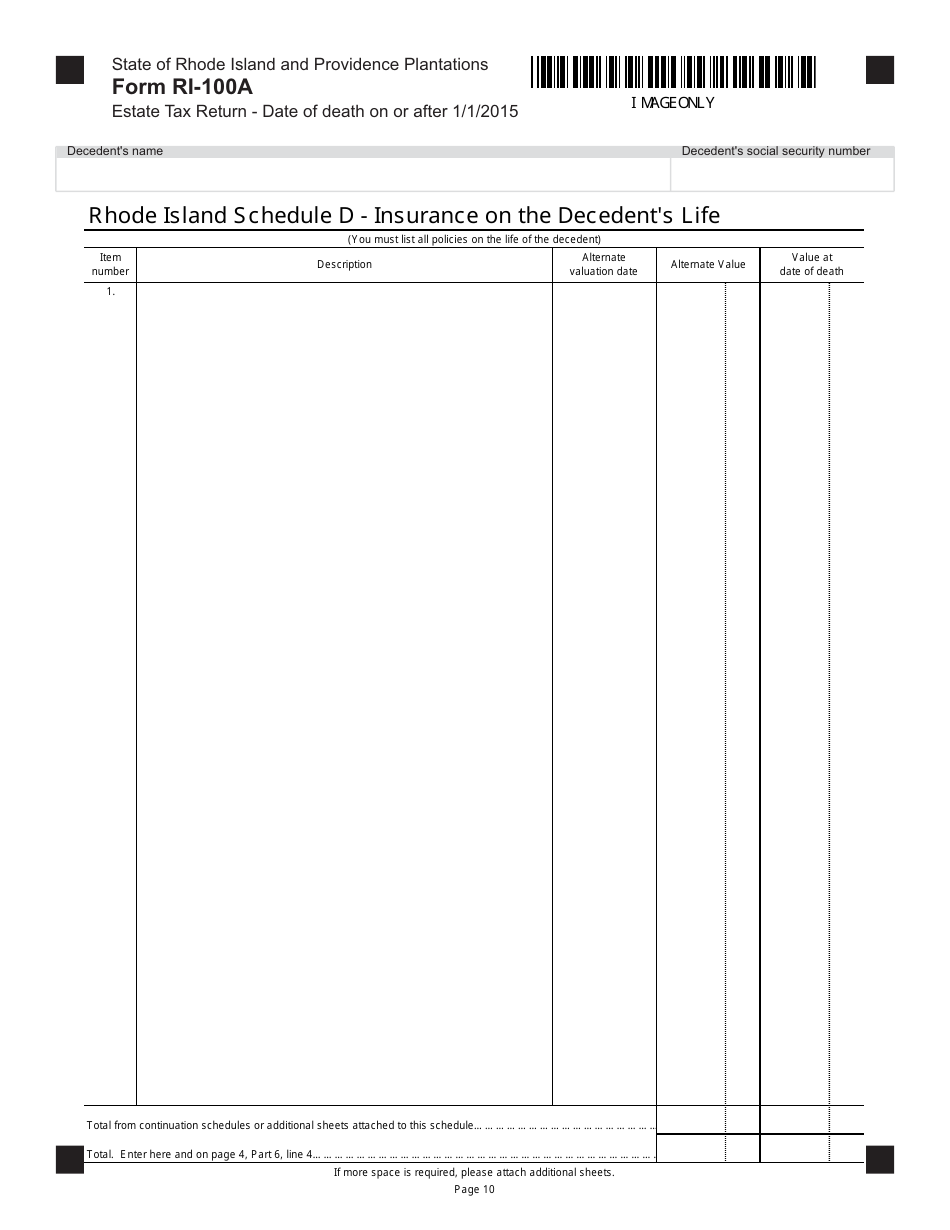

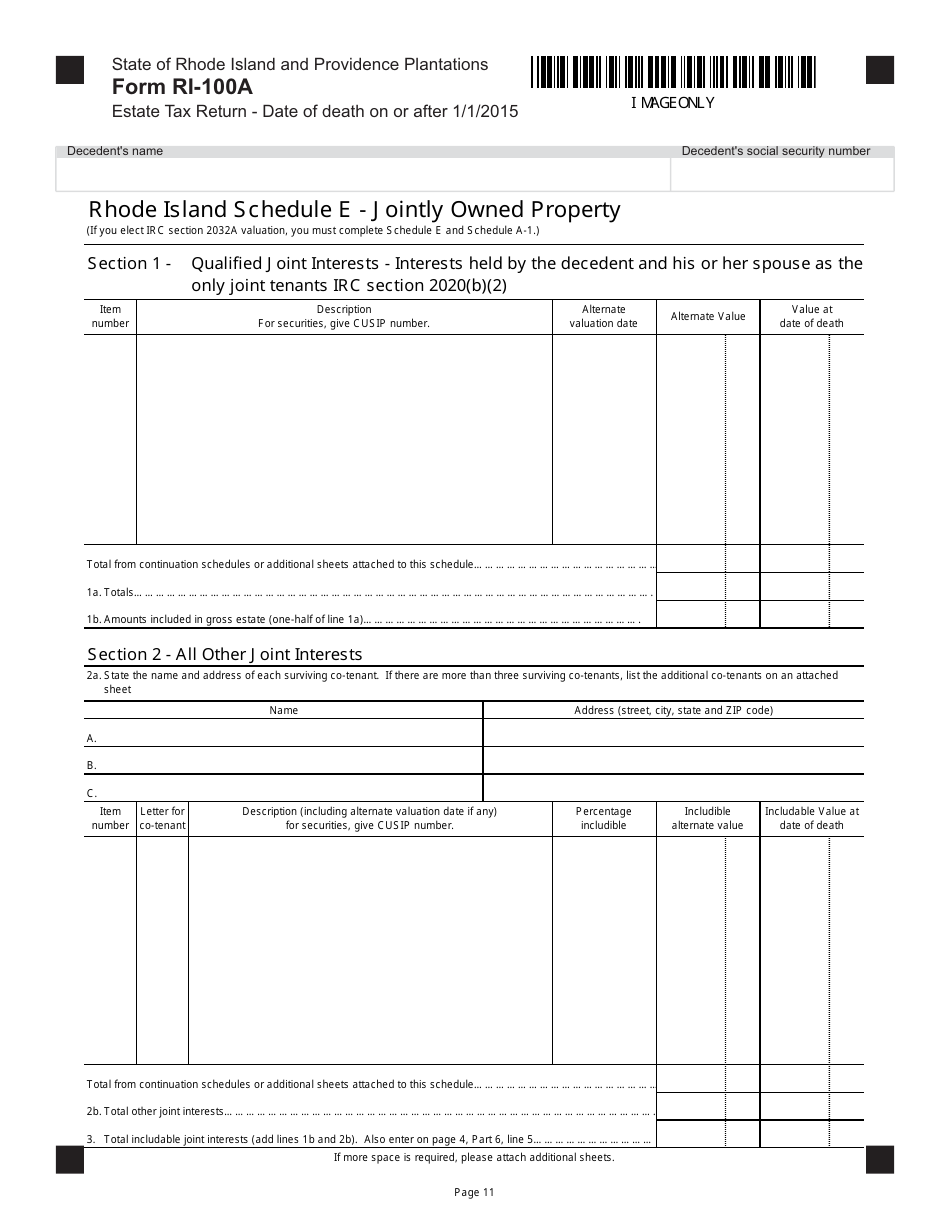

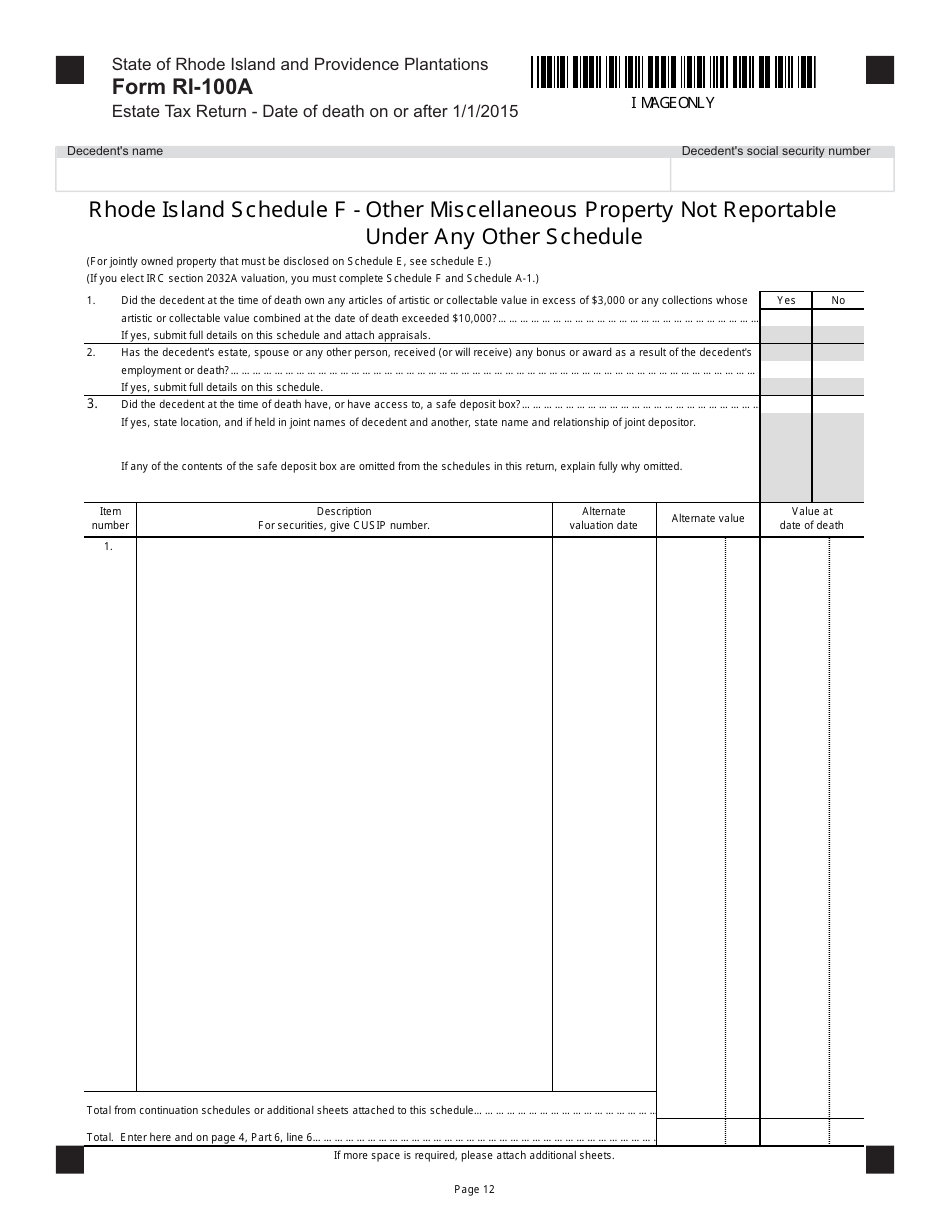

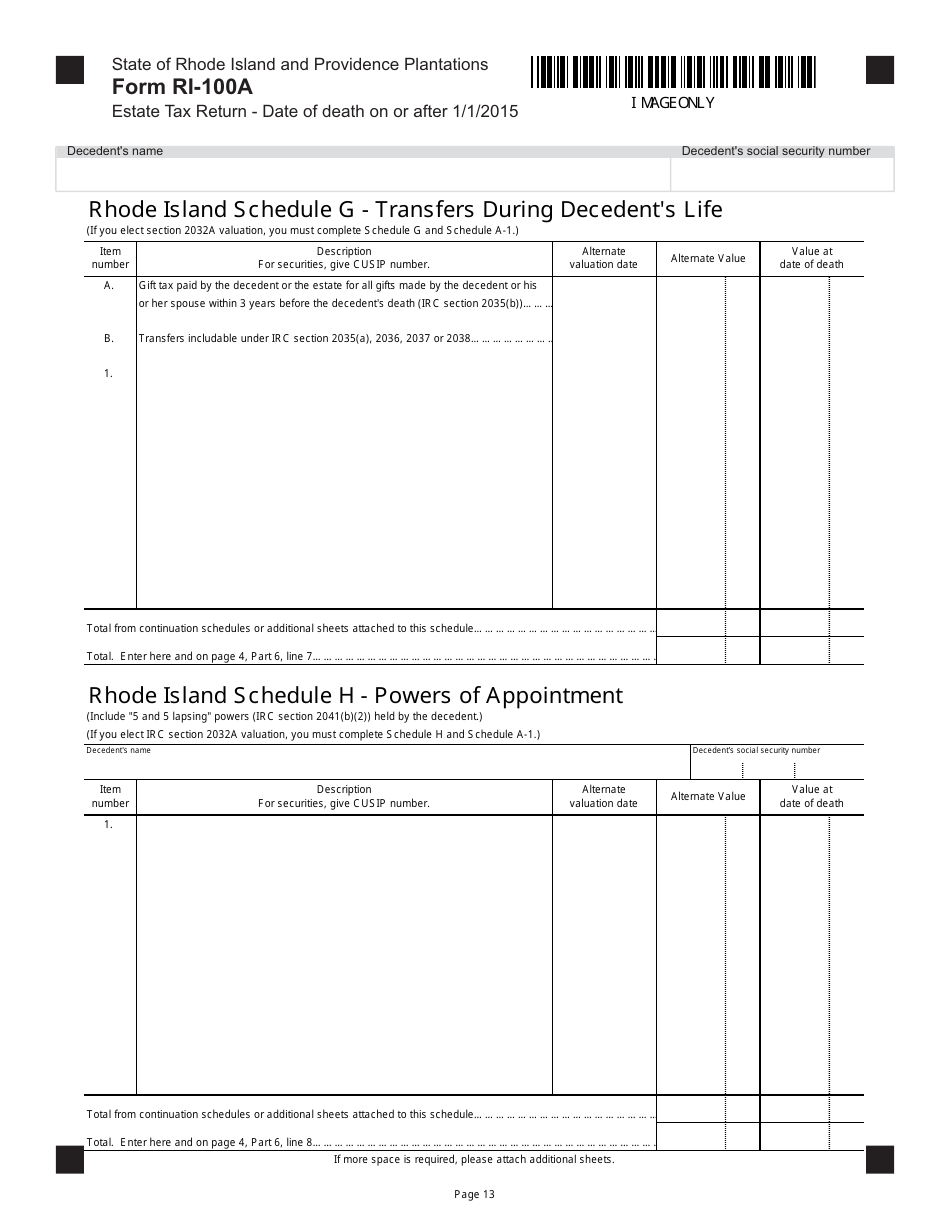

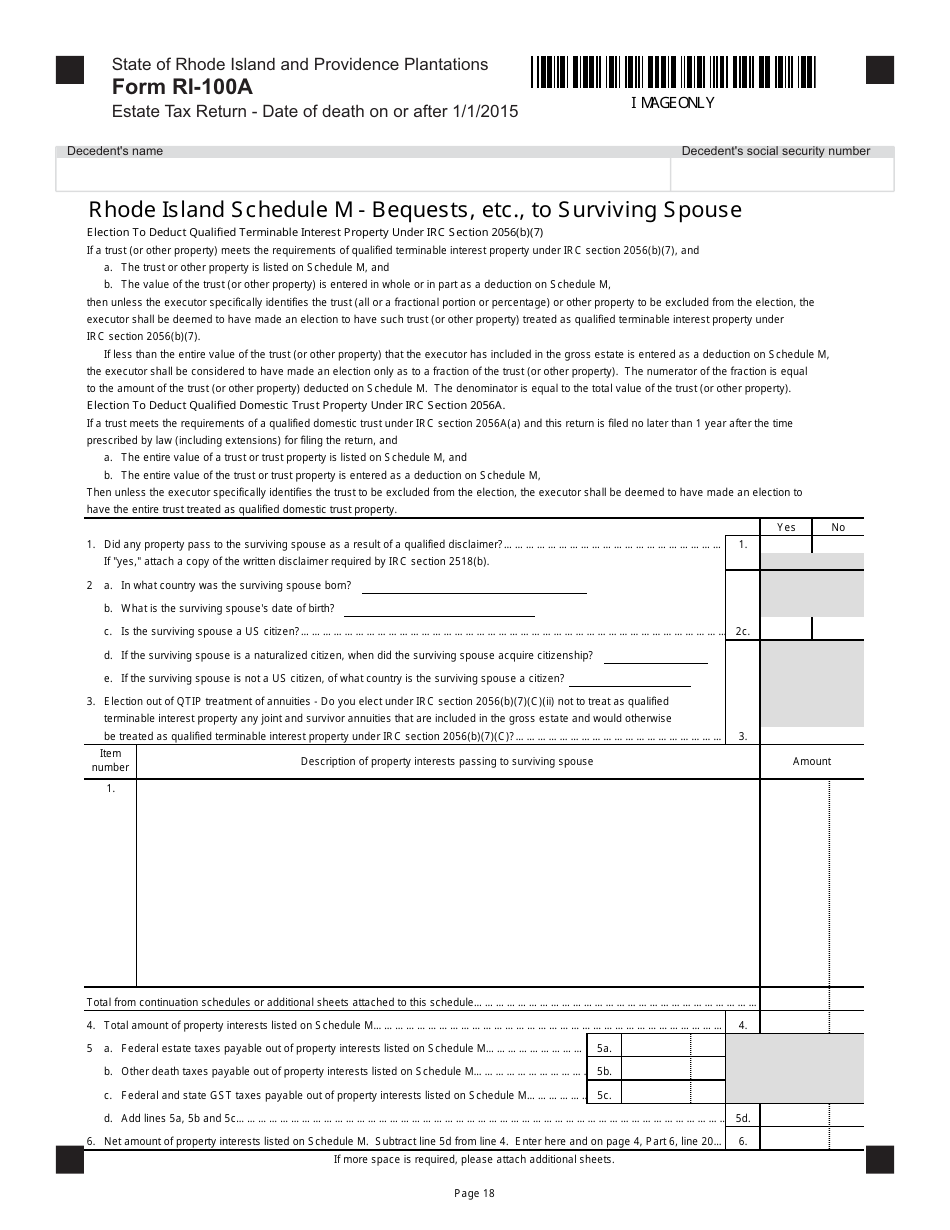

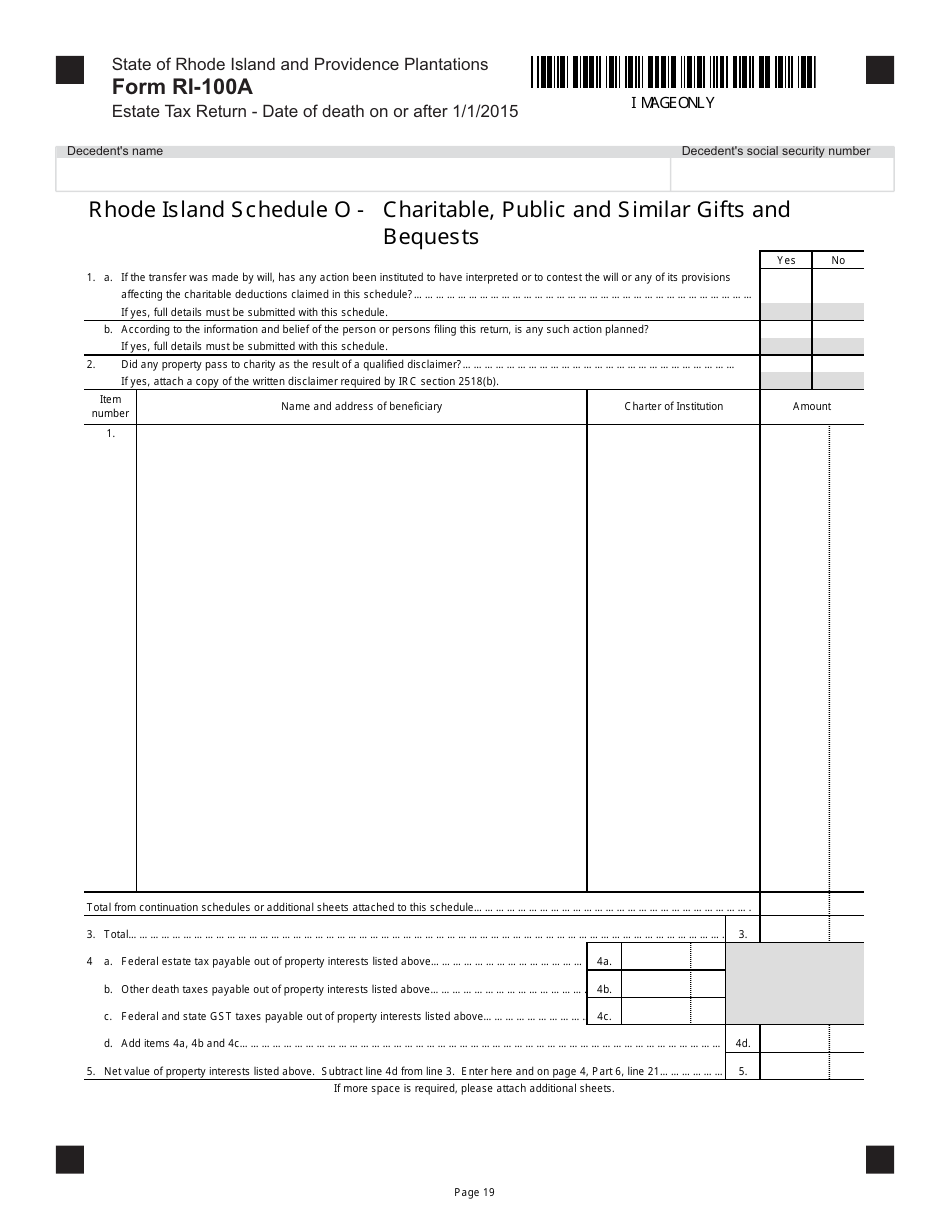

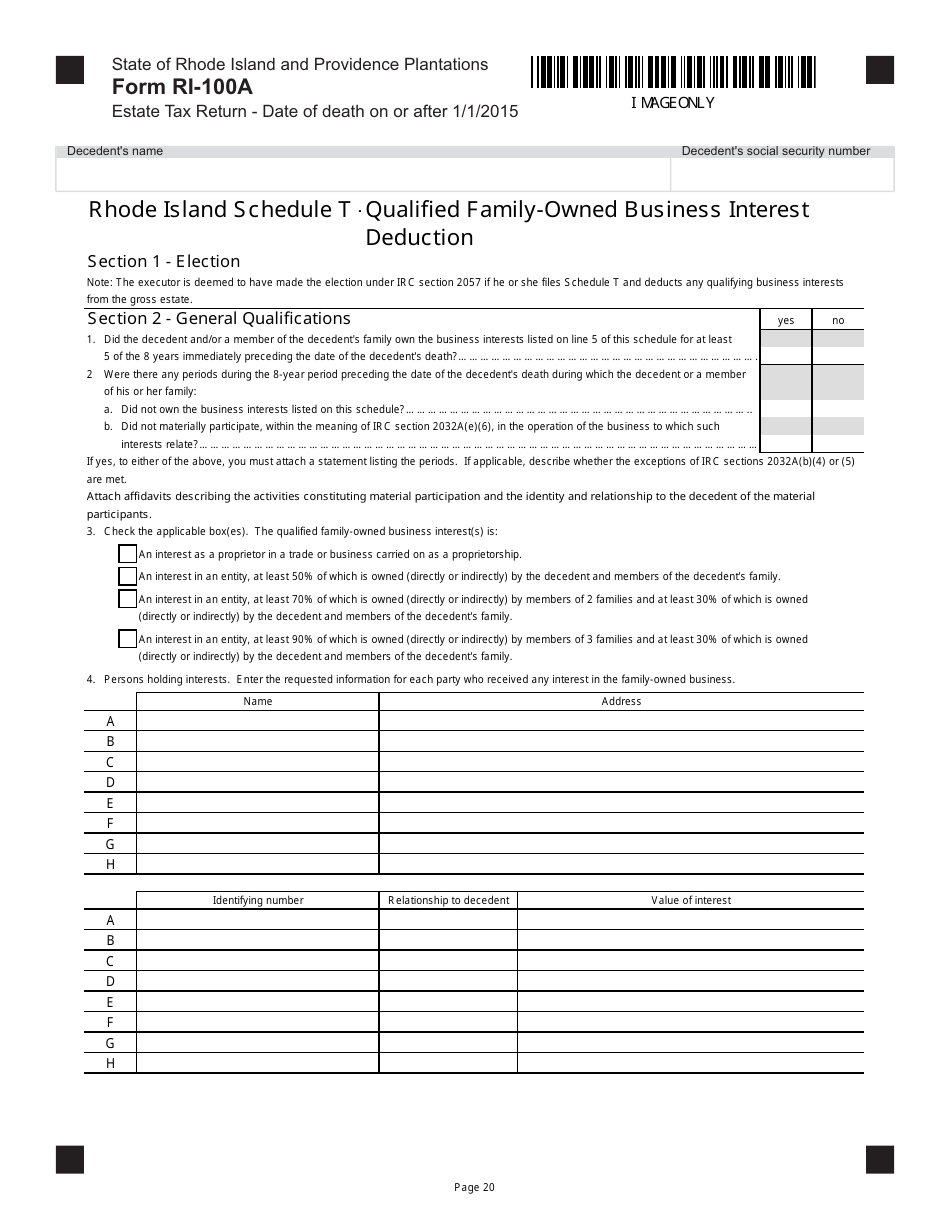

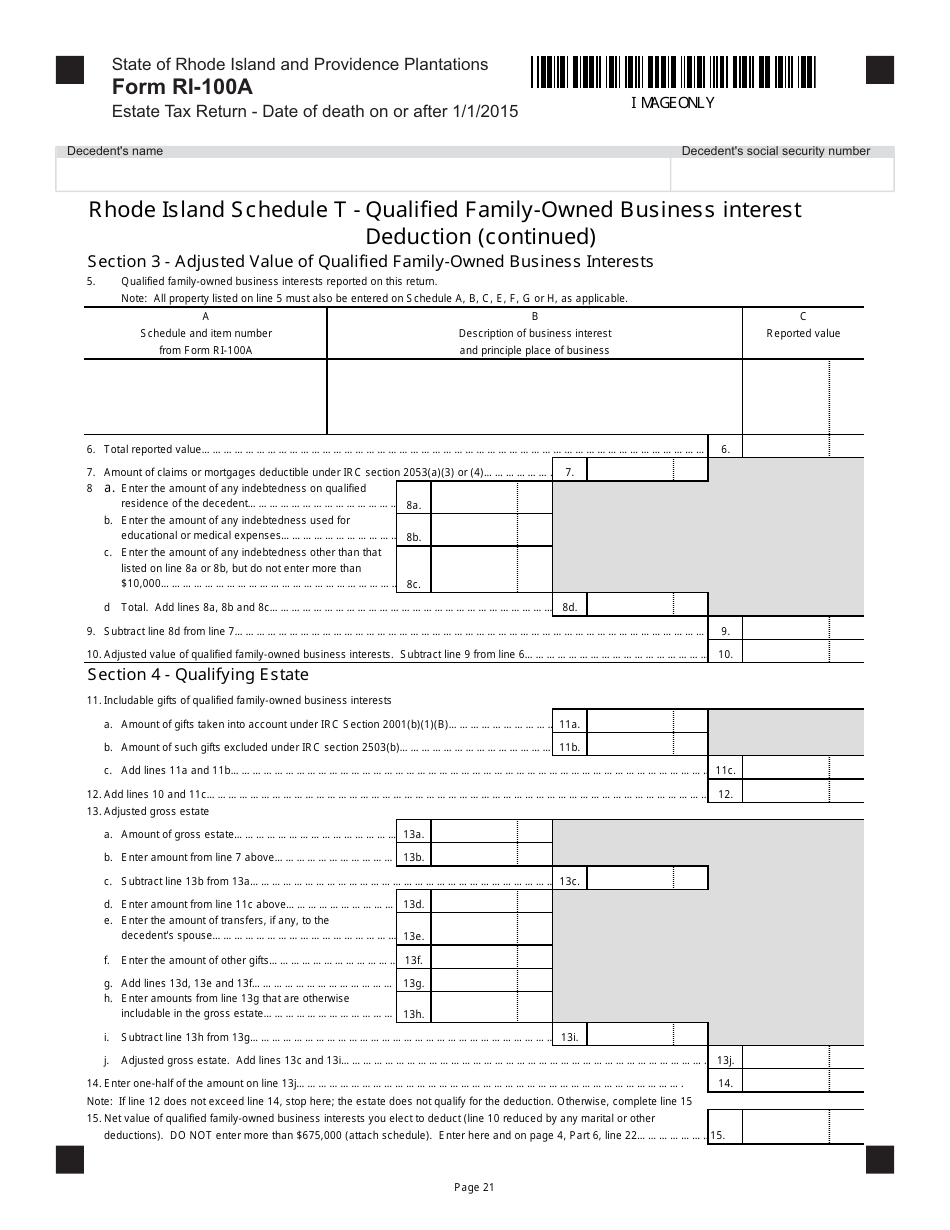

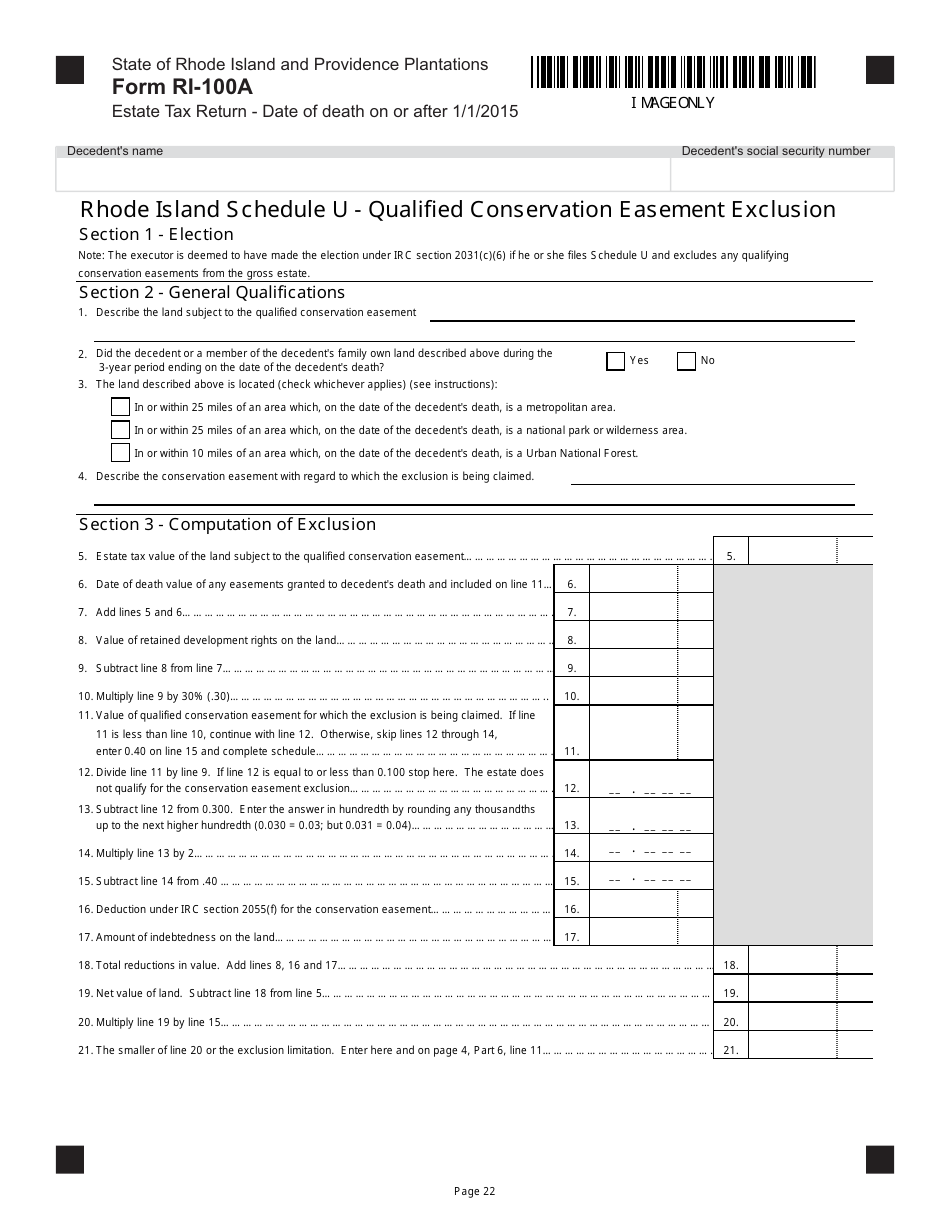

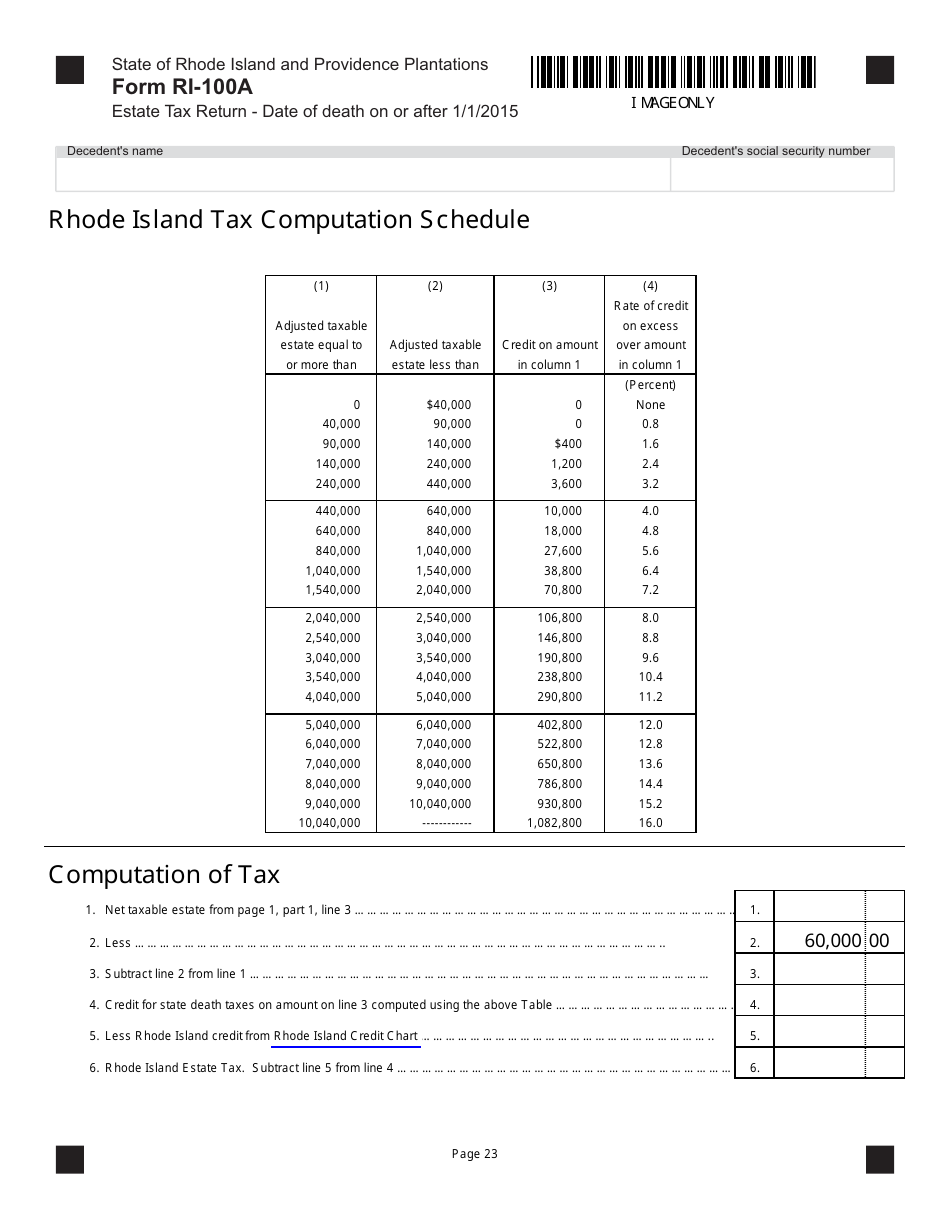

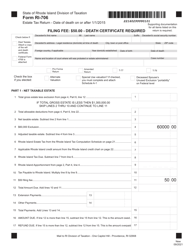

Form RI-100A Estate Tax Return - Date of Death on or After 1 / 1 / 2015 - Rhode Island

What Is Form RI-100A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-100A?

A: Form RI-100A is the Estate Tax Return specifically for Rhode Island.

Q: Who should file Form RI-100A?

A: Form RI-100A should be filed by the executor or administrator of an estate where the date of death is on or after 1/1/2015 in Rhode Island.

Q: What is the purpose of Form RI-100A?

A: The purpose of Form RI-100A is to report the estate tax due for an estate where the date of death is on or after 1/1/2015 in Rhode Island.

Q: When should Form RI-100A be filed?

A: Form RI-100A must be filed within nine months from the date of death.

Q: Is there a filing fee for Form RI-100A?

A: Yes, there is a filing fee for Form RI-100A. The fee amount depends on the value of the estate.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-100A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.