This version of the form is not currently in use and is provided for reference only. Download this version of

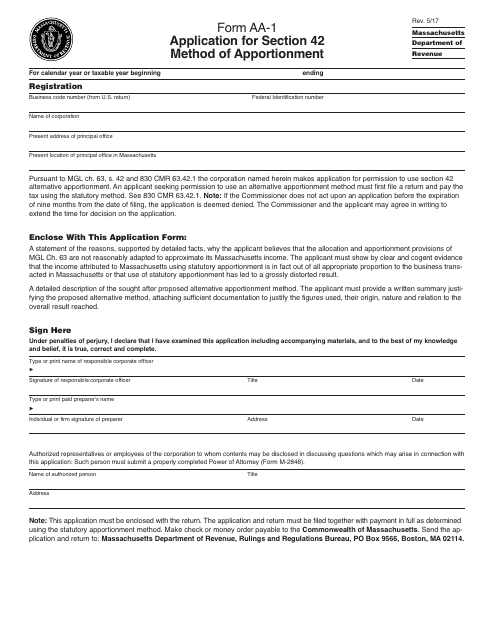

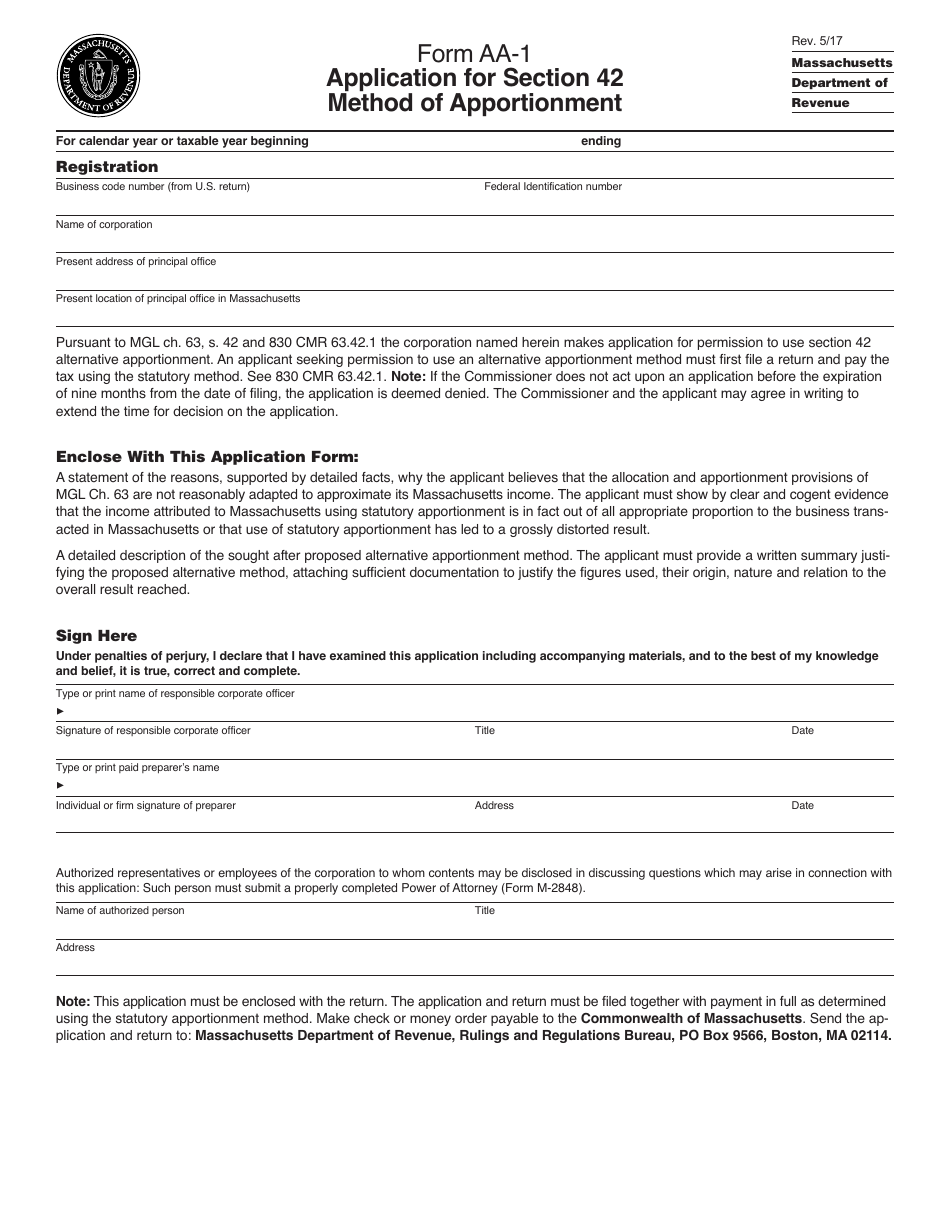

Form AA-1

for the current year.

Form AA-1 Application for Section 42 Method of Apportionment - Massachusetts

What Is Form AA-1?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AA-1?

A: Form AA-1 is an application for the Section 42 method of apportionment in Massachusetts.

Q: What is the Section 42 method of apportionment?

A: The Section 42 method of apportionment is a formula used to allocate property tax liability in Massachusetts.

Q: Who needs to file Form AA-1?

A: Property owners in Massachusetts who are subject to the Section 42 method of apportionment need to file Form AA-1.

Q: Are there any fees associated with filing Form AA-1?

A: No, there are no fees associated with filing Form AA-1.

Q: What information is required on Form AA-1?

A: Form AA-1 requires information about the property being apportioned, as well as information about the property owner.

Q: Can I get help with filling out Form AA-1?

A: Yes, the Massachusetts Department of Revenue provides resources and assistance for filling out Form AA-1.

Q: What happens after I file Form AA-1?

A: After filing Form AA-1, the Massachusetts Department of Revenue will review the application and calculate the property tax liability based on the Section 42 method of apportionment.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AA-1 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.