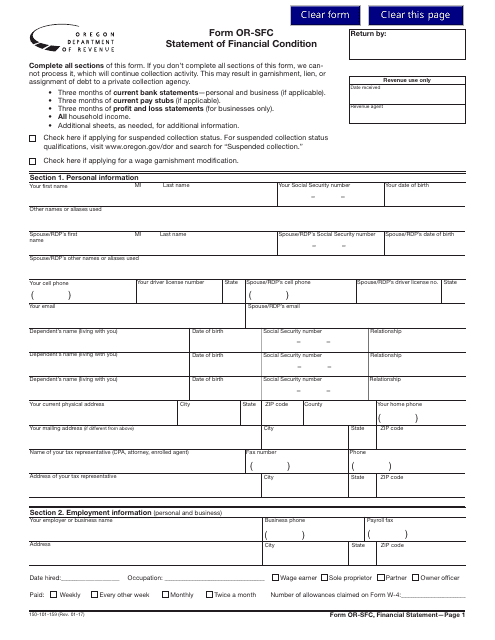

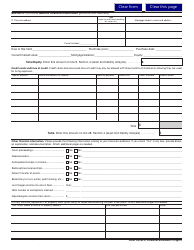

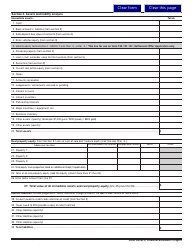

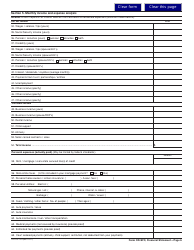

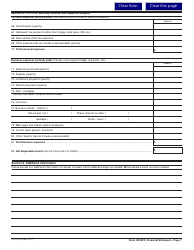

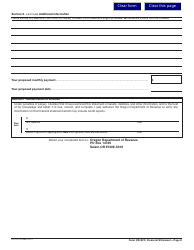

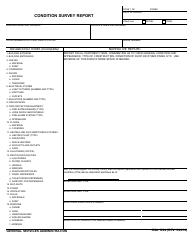

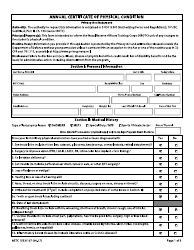

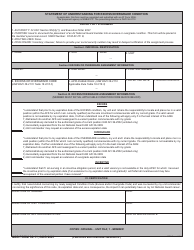

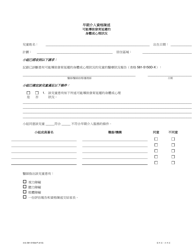

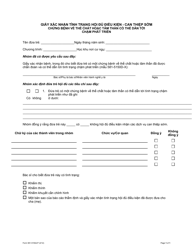

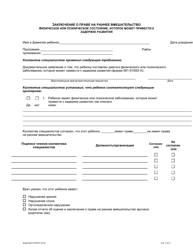

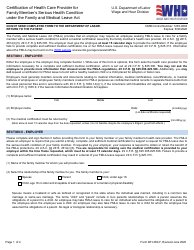

Form 150-101-159 (OR-SFC) Statement of Financial Condition - Oregon

What Is Form 150-101-159 (OR-SFC)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-159?

A: Form 150-101-159 is the Statement of Financial Condition for Oregon.

Q: Who needs to file Form 150-101-159?

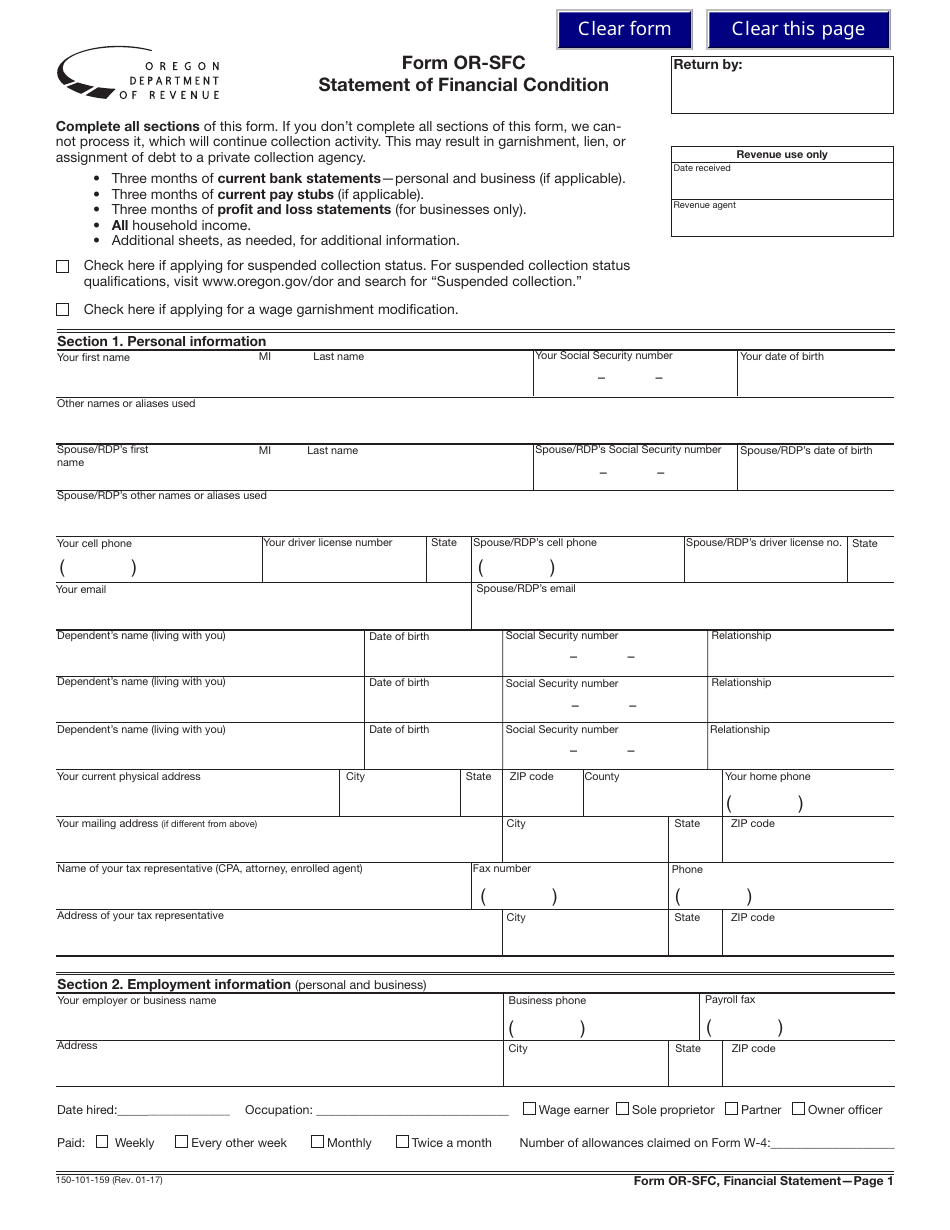

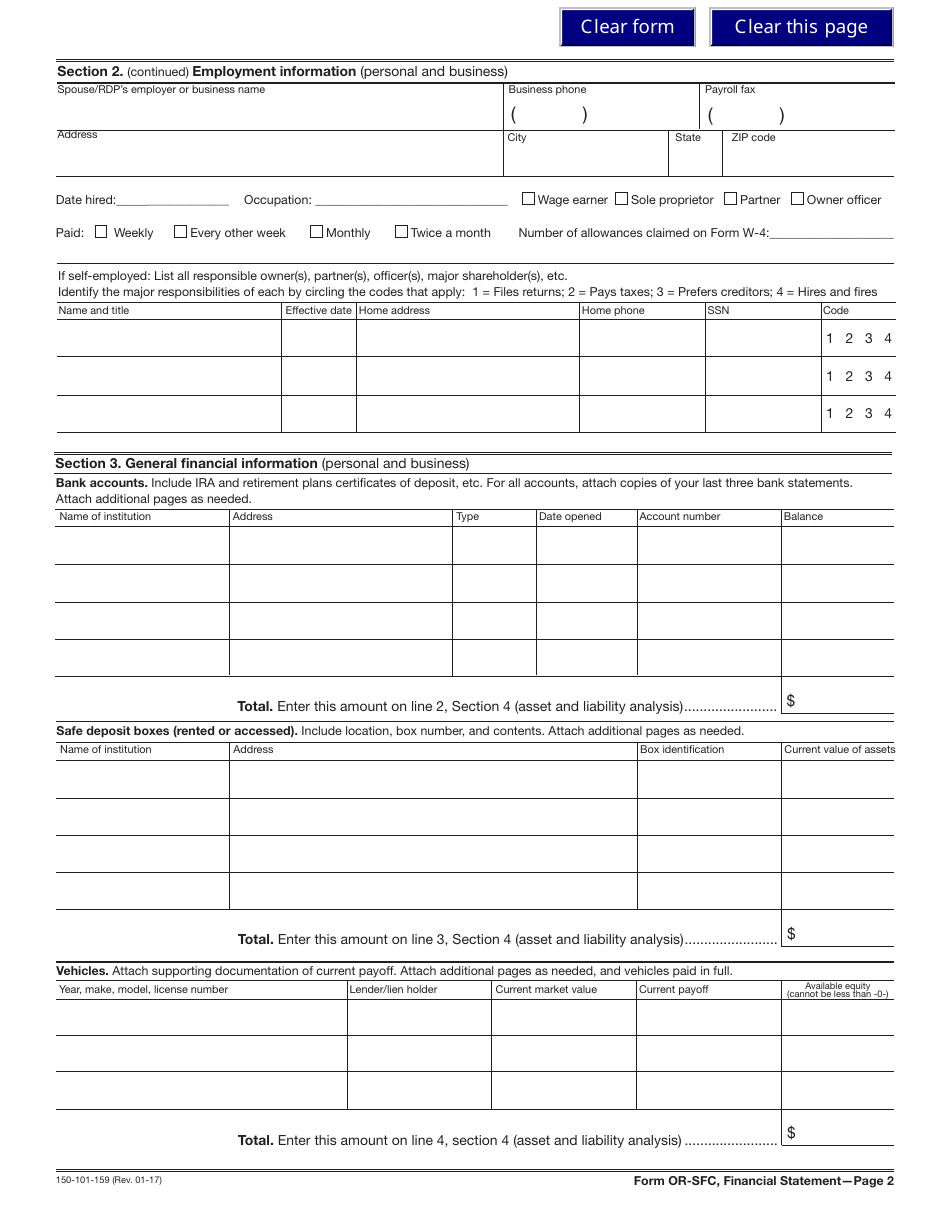

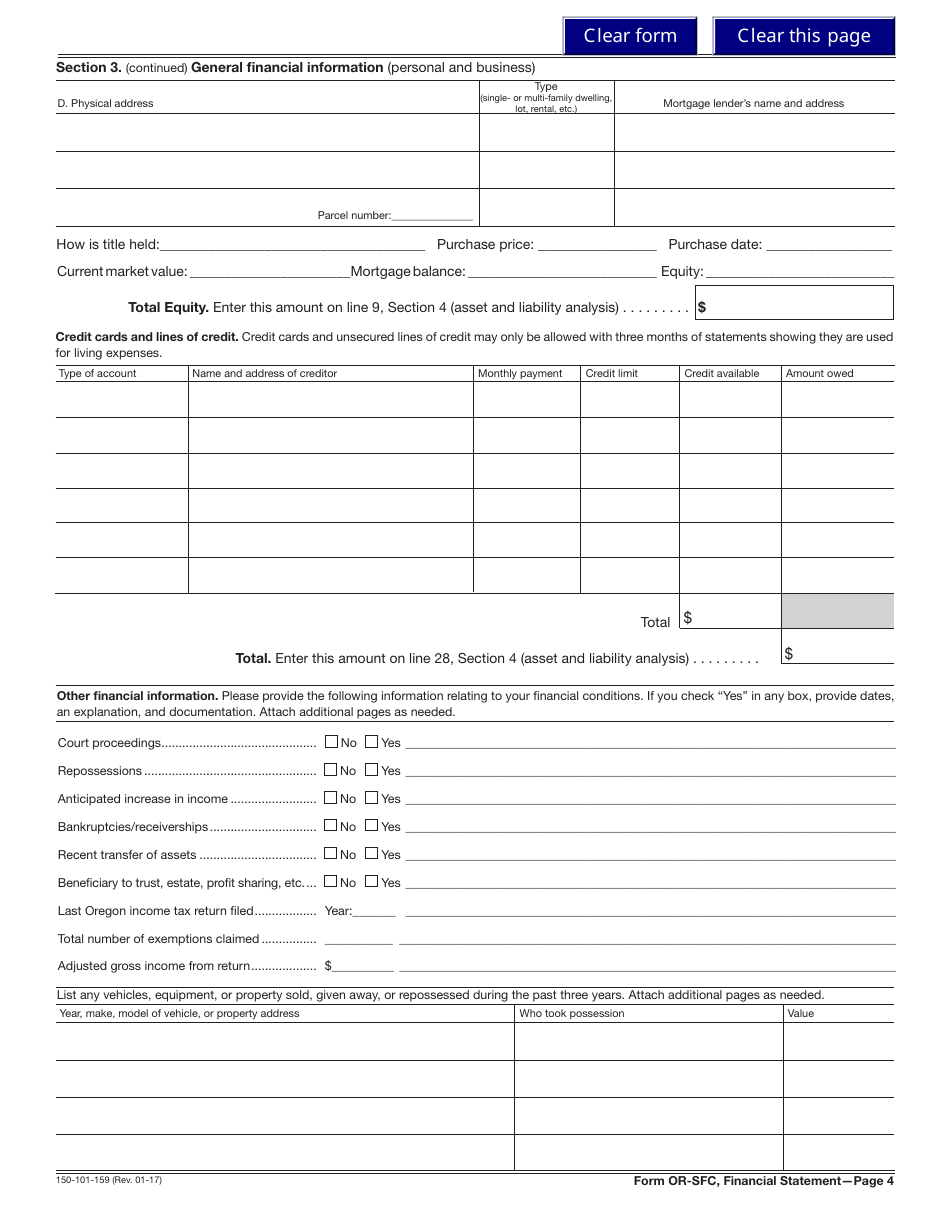

A: Individuals and businesses in Oregon who are required to provide a statement of their financial condition.

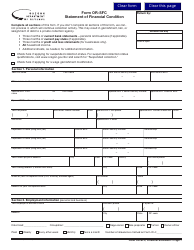

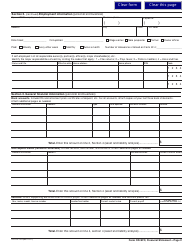

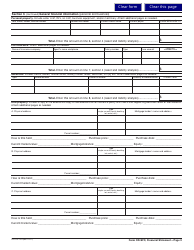

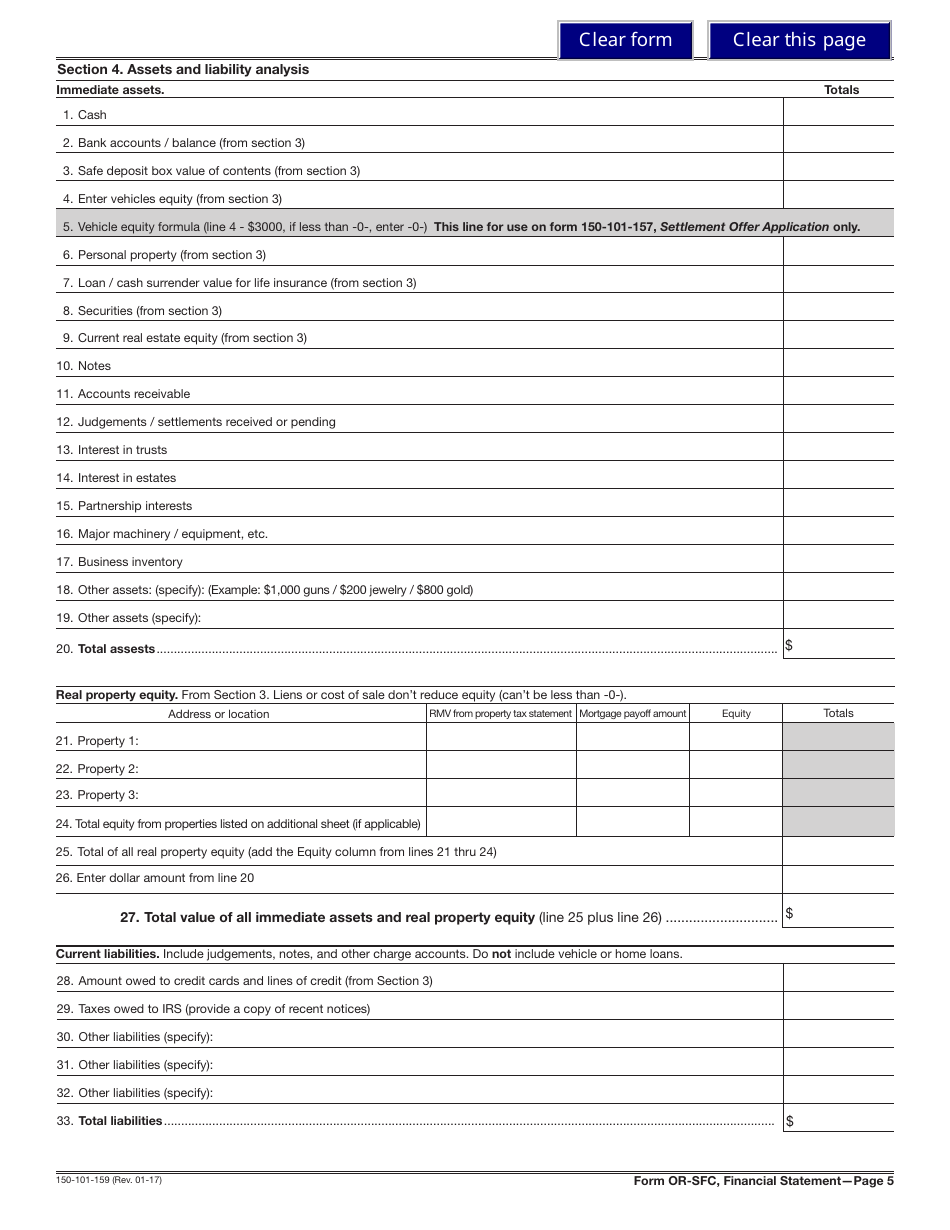

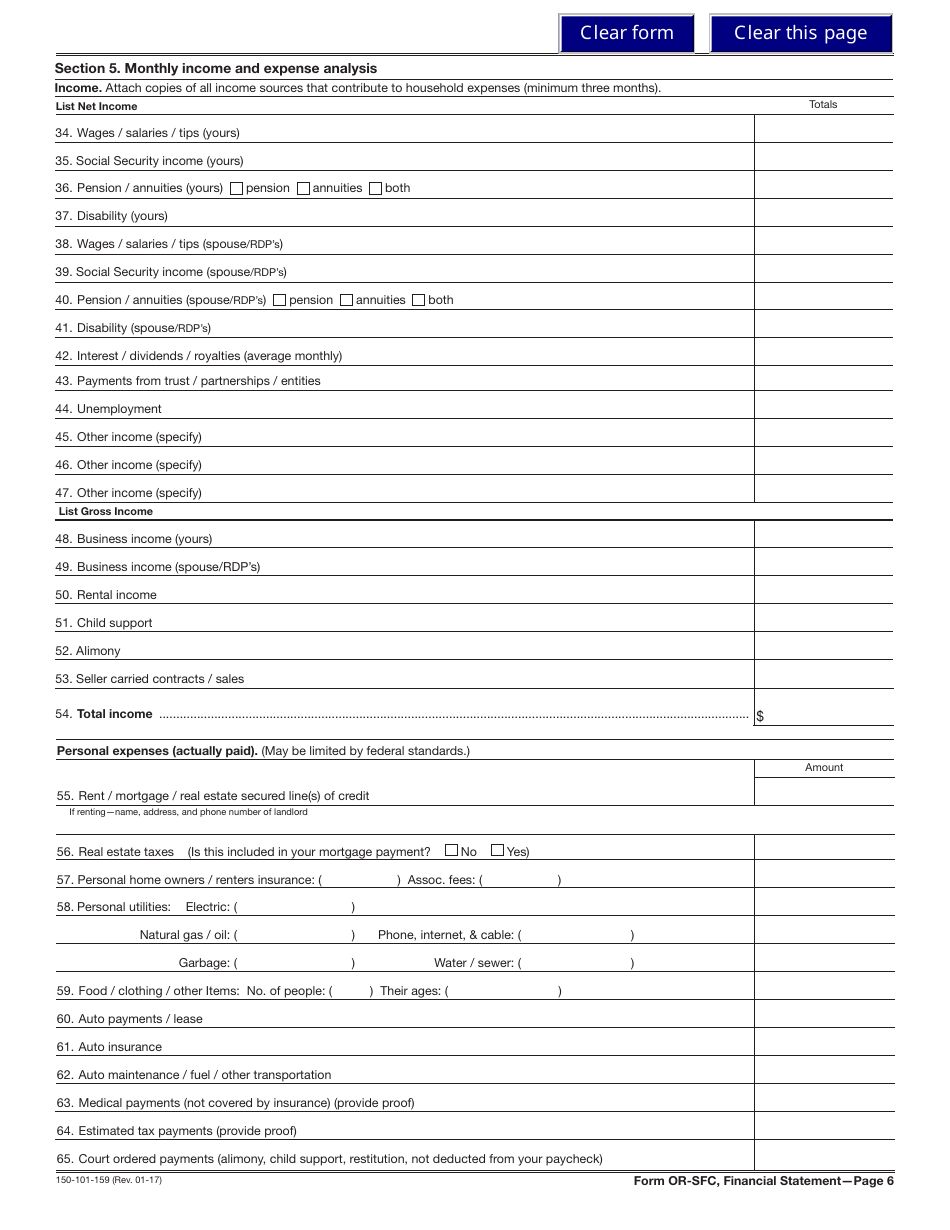

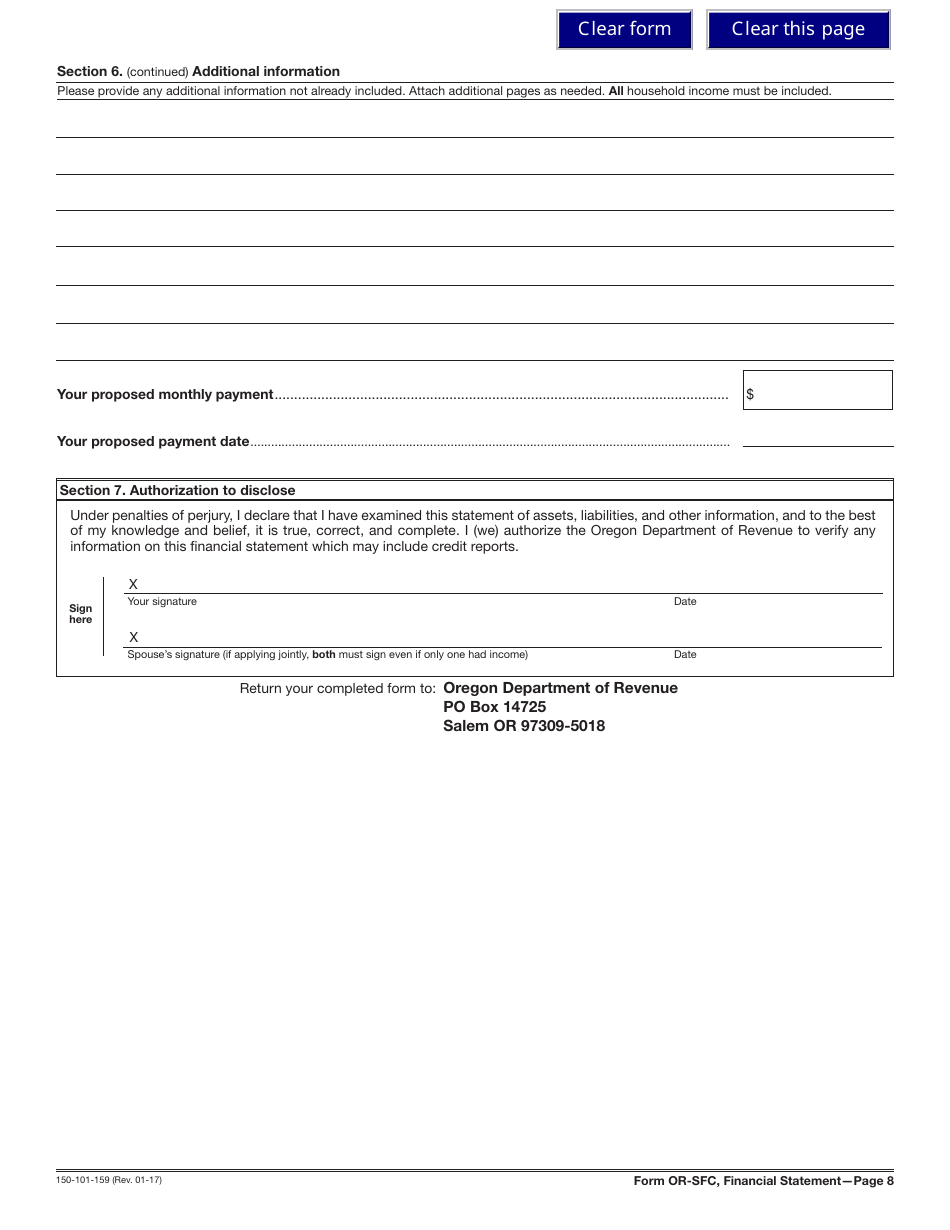

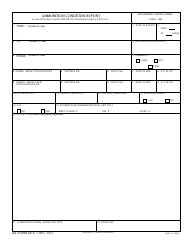

Q: What information is required on Form 150-101-159?

A: Form 150-101-159 requires details about assets, liabilities, income, expenses, and other financial information.

Q: How often do you need to file Form 150-101-159?

A: The filing frequency depends on the specific requirements of the respective taxing authority.

Q: Do I need to include supporting documents with Form 150-101-159?

A: The requirement for supporting documents depends on the instructions provided by the respective taxing authority.

Q: Are there any filing fees for Form 150-101-159?

A: The presence of filing fees depends on the rules and regulations of the respective taxing authority.

Q: What is the deadline for filing Form 150-101-159?

A: The deadline for filing Form 150-101-159 varies and is typically specified by the respective taxing authority.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-159 (OR-SFC) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.