This version of the form is not currently in use and is provided for reference only. Download this version of

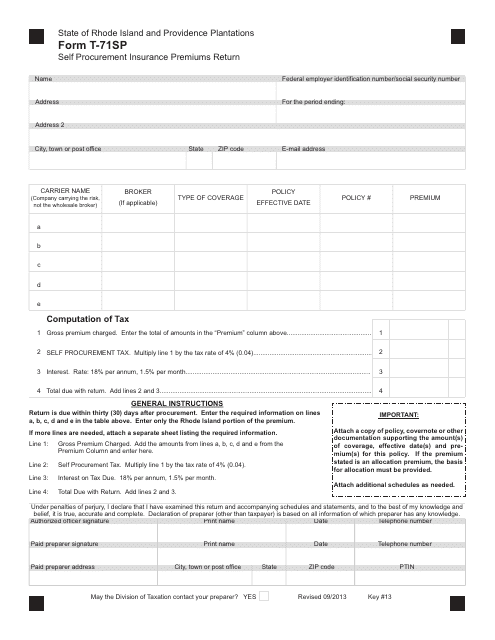

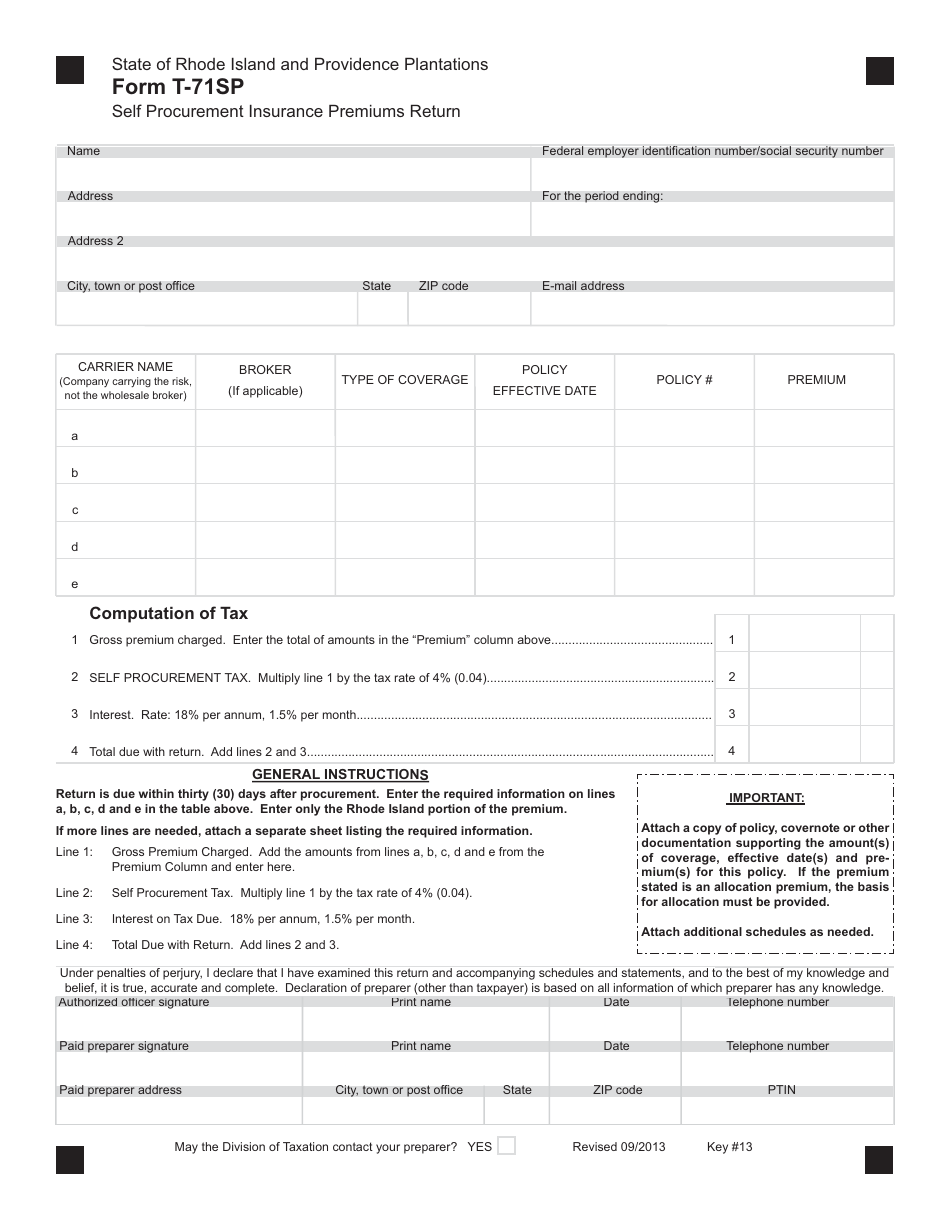

Form T-71SP

for the current year.

Form T-71SP Self Procurement Insurance Premiums Return - Rhode Island

What Is Form T-71SP?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-71SP?

A: Form T-71SP is the Self ProcurementInsurance Premiums Return.

Q: Who needs to file Form T-71SP?

A: Rhode Island residents who have self-procured insurance must file Form T-71SP.

Q: What is self-procured insurance?

A: Self-procured insurance is insurance that is obtained directly by the policyholder, rather than through an insurance agent or broker.

Q: What information is required on Form T-71SP?

A: Form T-71SP requires information about the policyholder, the insurance company, and the premiums paid for self-procured insurance.

Q: When is Form T-71SP due?

A: Form T-71SP is due annually on April 15th.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-71SP by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.