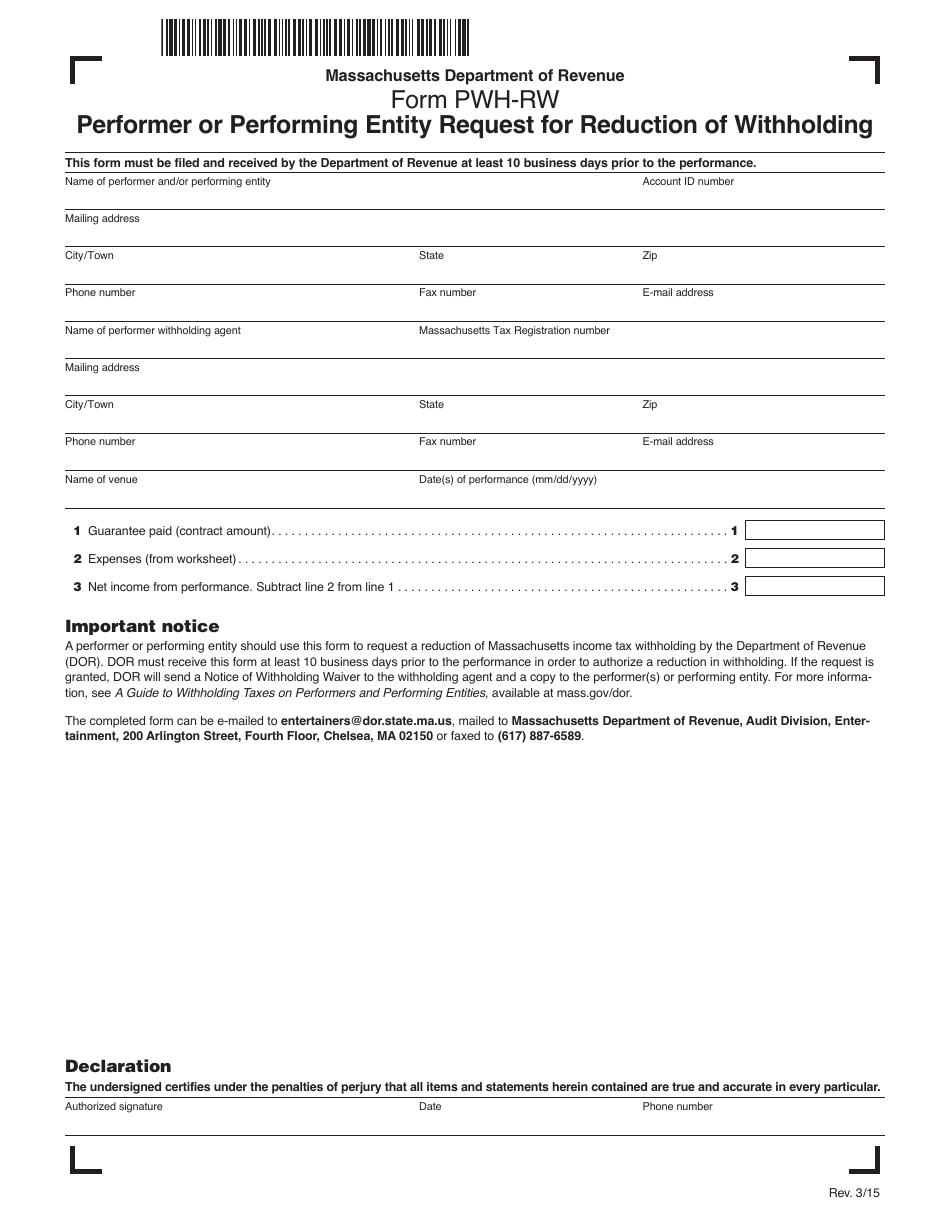

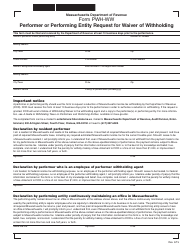

Form PWH-RW Performer or Performing Entity Request for Reduction of Withholding - Massachusetts

What Is Form PWH-RW?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PWH-RW?

A: Form PWH-RW is a form used in Massachusetts by performers or performing entities to request a reduction of withholding taxes.

Q: Who can use Form PWH-RW?

A: Performers or performing entities in Massachusetts can use Form PWH-RW to request a reduction of withholding taxes.

Q: What is the purpose of Form PWH-RW?

A: The purpose of Form PWH-RW is to request a reduction of withholding taxes for performers or performing entities in Massachusetts.

Q: How do I fill out Form PWH-RW?

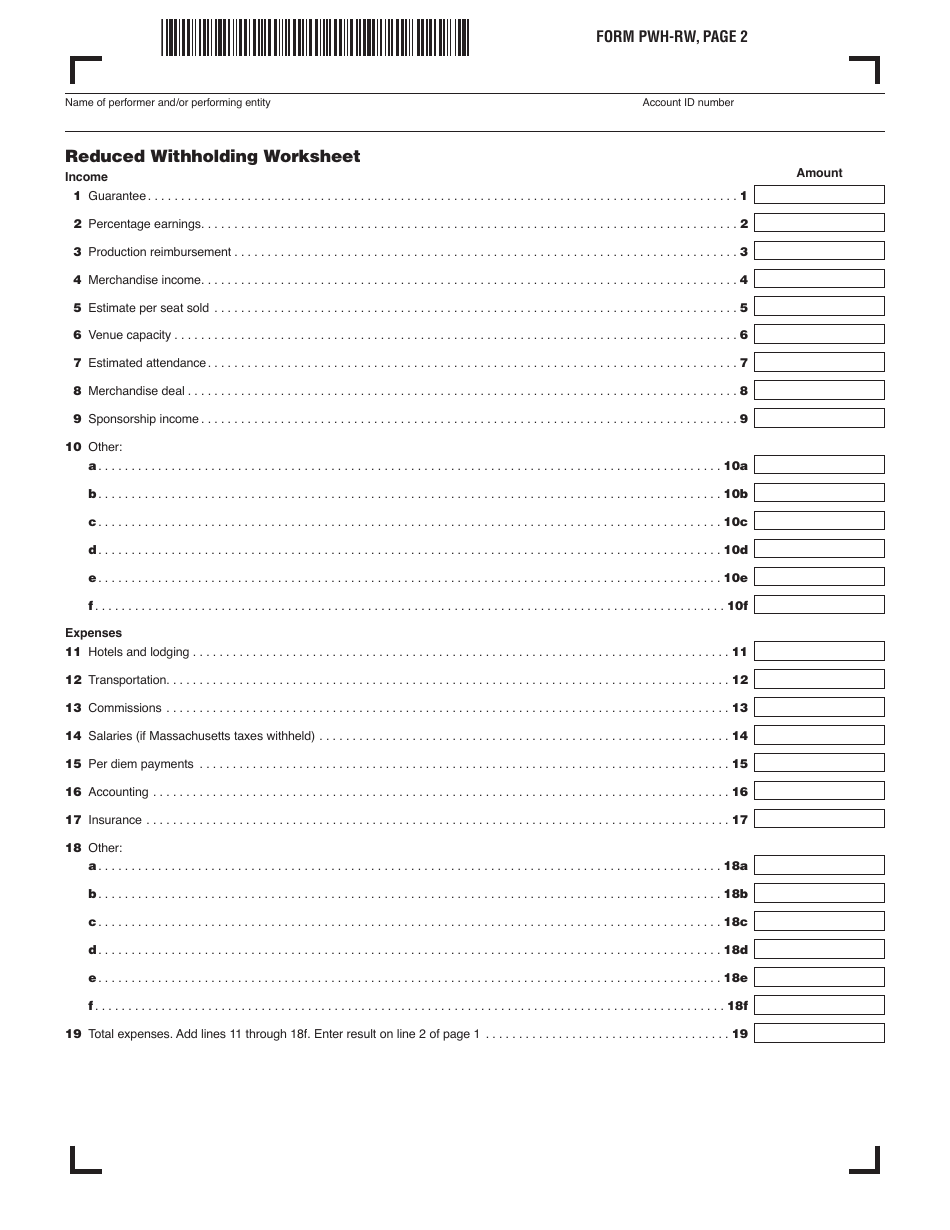

A: To fill out Form PWH-RW, provide your personal information, details about the performance, and request the desired reduction of withholding taxes.

Q: Can I request a reduction of withholding taxes without Form PWH-RW?

A: No, in Massachusetts, performers or performing entities need to use Form PWH-RW to request a reduction of withholding taxes.

Q: Is there a deadline to submit Form PWH-RW?

A: Yes, performers or performing entities must submit Form PWH-RW at least 60 days before the performance or engagement.

Q: Will I automatically get a reduction in withholding taxes if I submit Form PWH-RW?

A: No, the reduction of withholding taxes requested on Form PWH-RW is subject to approval by the Massachusetts Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PWH-RW by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.