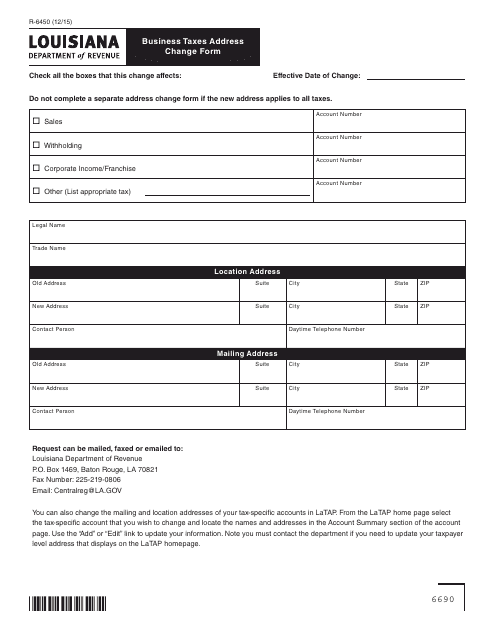

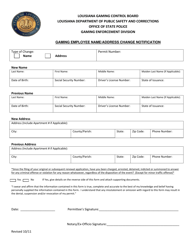

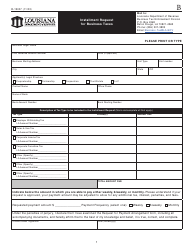

Form R-6450 Business Taxes Address Change Form - Louisiana

What Is Form R-6450?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6450?

A: Form R-6450 is a Business Taxes Address Change Form.

Q: What is the purpose of Form R-6450?

A: The purpose of Form R-6450 is to notify Louisiana Department of Revenue about a change in address for business taxes.

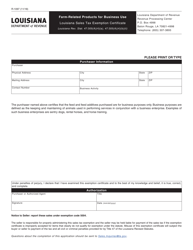

Q: Is Form R-6450 specifically for businesses located in Louisiana?

A: Yes, Form R-6450 is specifically for businesses located in Louisiana.

Q: Do I need to fill out Form R-6450 if I change my business address?

A: Yes, if you change your business address in Louisiana, you need to fill out Form R-6450.

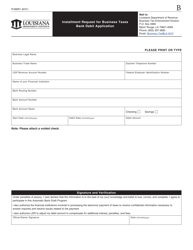

Q: What information do I need to provide on Form R-6450?

A: You need to provide your previous address, new address, business name, taxpayer identification number, and the effective date of the address change.

Q: Can I submit Form R-6450 electronically?

A: Yes, you can submit Form R-6450 electronically.

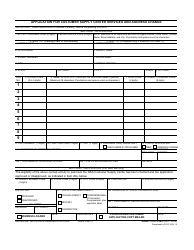

Q: Is there a deadline for submitting Form R-6450?

A: There is no specific deadline mentioned for submitting Form R-6450. It is recommended to submit it as soon as possible after the address change.

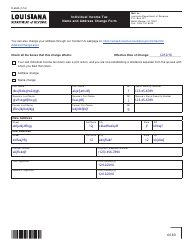

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6450 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.