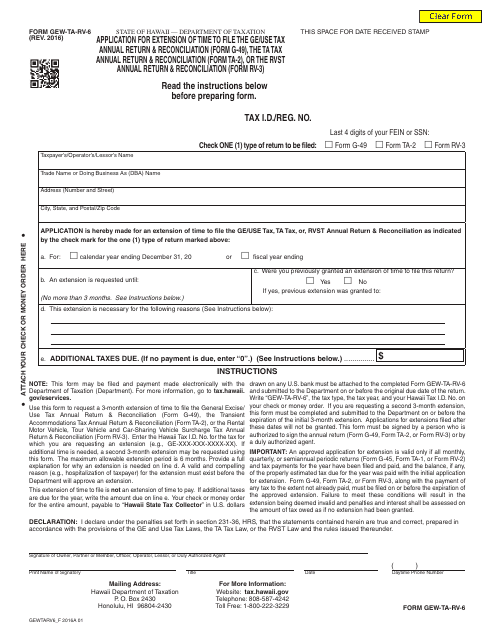

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GEW-TA-RV-6

for the current year.

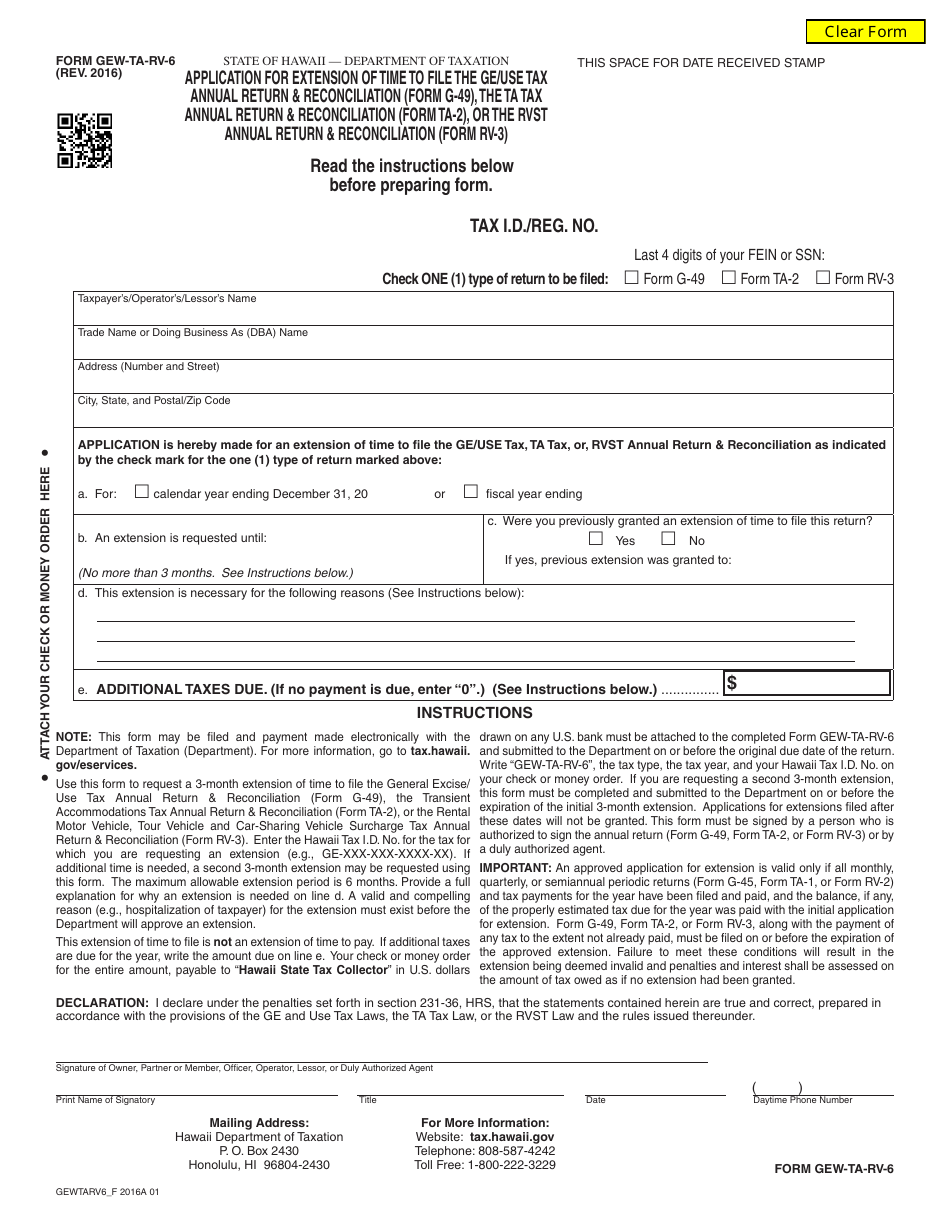

Form GEW-TA-RV-6 Application for Extension of Time to File the Ge / Use Tax Annual Return & Reconciliation (Form G-49), the Ta Tax Annual Return & Reconciliation (Form Ta-2), or the Rvst Annual Return & Reconciliation (Dual Rate Form Rv-3) - Hawaii

What Is Form GEW-TA-RV-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GEW-TA-RV-6?

A: It is an application for extension of time to file certain tax annual returns and reconciliations in Hawaii.

Q: What forms can be extended using GEW-TA-RV-6?

A: It can be used to extend the filing of the GE/Use Tax Annual Return & Reconciliation (Form G-49), the Ta Tax Annual Return & Reconciliation (Form Ta-2), or the Rvst Annual Return & Reconciliation (Dual Rate Form Rv-3).

Q: What is the purpose of the extension?

A: It allows individuals or businesses to request additional time to file their tax annual return and reconciliation forms.

Q: Who can use GEW-TA-RV-6?

A: Any individual or business in Hawaii that needs extra time to file their GE/Use Tax, Ta Tax, or Rvst Annual Return & Reconciliation.

Q: Is there a fee for filing GEW-TA-RV-6?

A: No, there is no fee to file this application for extension.

Q: How much extra time can an individual or business get with the extension?

A: The extension can provide up to six additional months to file the tax annual return and reconciliation forms.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GEW-TA-RV-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.