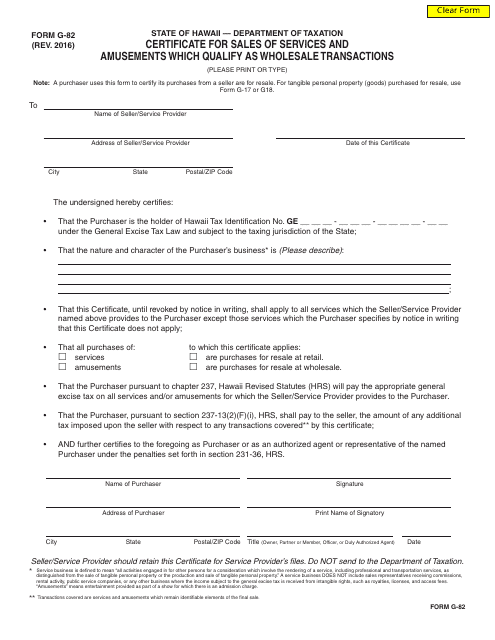

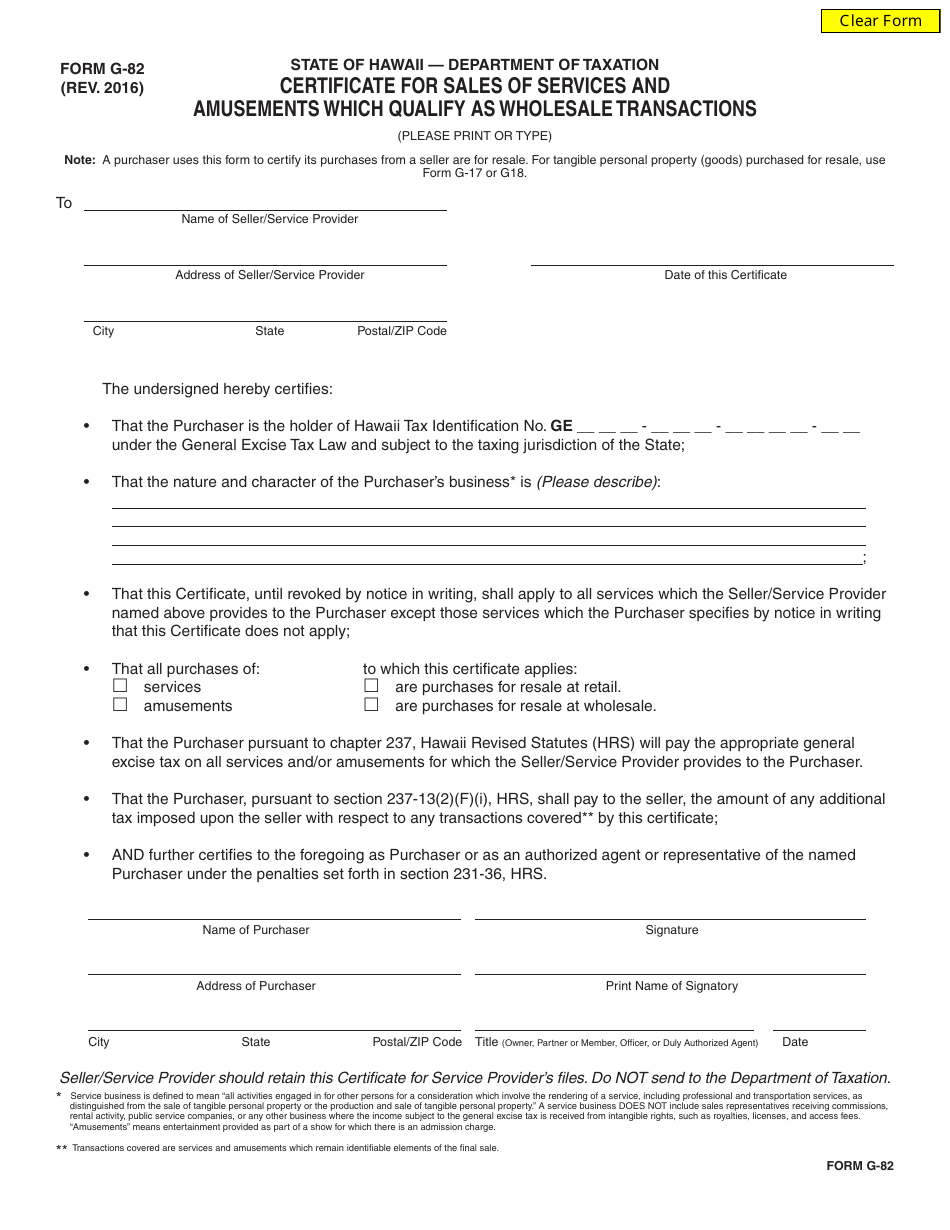

Form G-82 Certificate for Sales of Goods, Services, and Amusements Which Qualify for the Phased-In Wholesale Deduction - Hawaii

What Is Form G-82?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-82?

A: Form G-82 is a certificate used in Hawaii for sales of goods, services, and amusements that qualify for the phased-in wholesale deduction.

Q: What is the phased-in wholesale deduction?

A: The phased-in wholesale deduction is a tax deduction available in Hawaii for certain sales transactions.

Q: Who should use Form G-82?

A: Businesses in Hawaii selling goods, services, or amusements that qualify for the phased-in wholesale deduction should use Form G-82.

Q: How do I complete Form G-82?

A: You should fill out the required information on the form, including details about the sale, the buyer, and the qualification for the phased-in wholesale deduction.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-82 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.