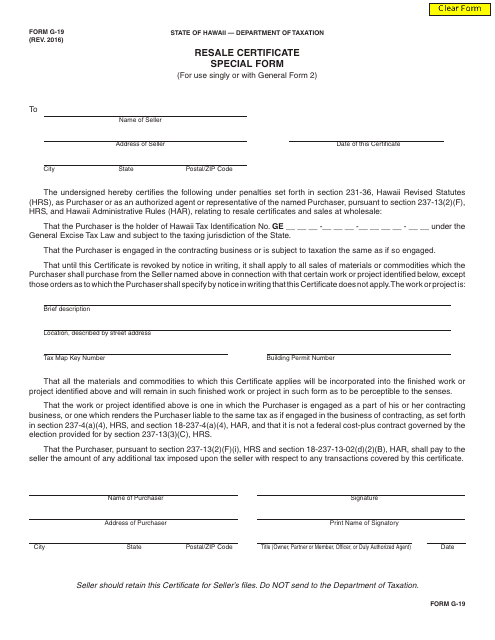

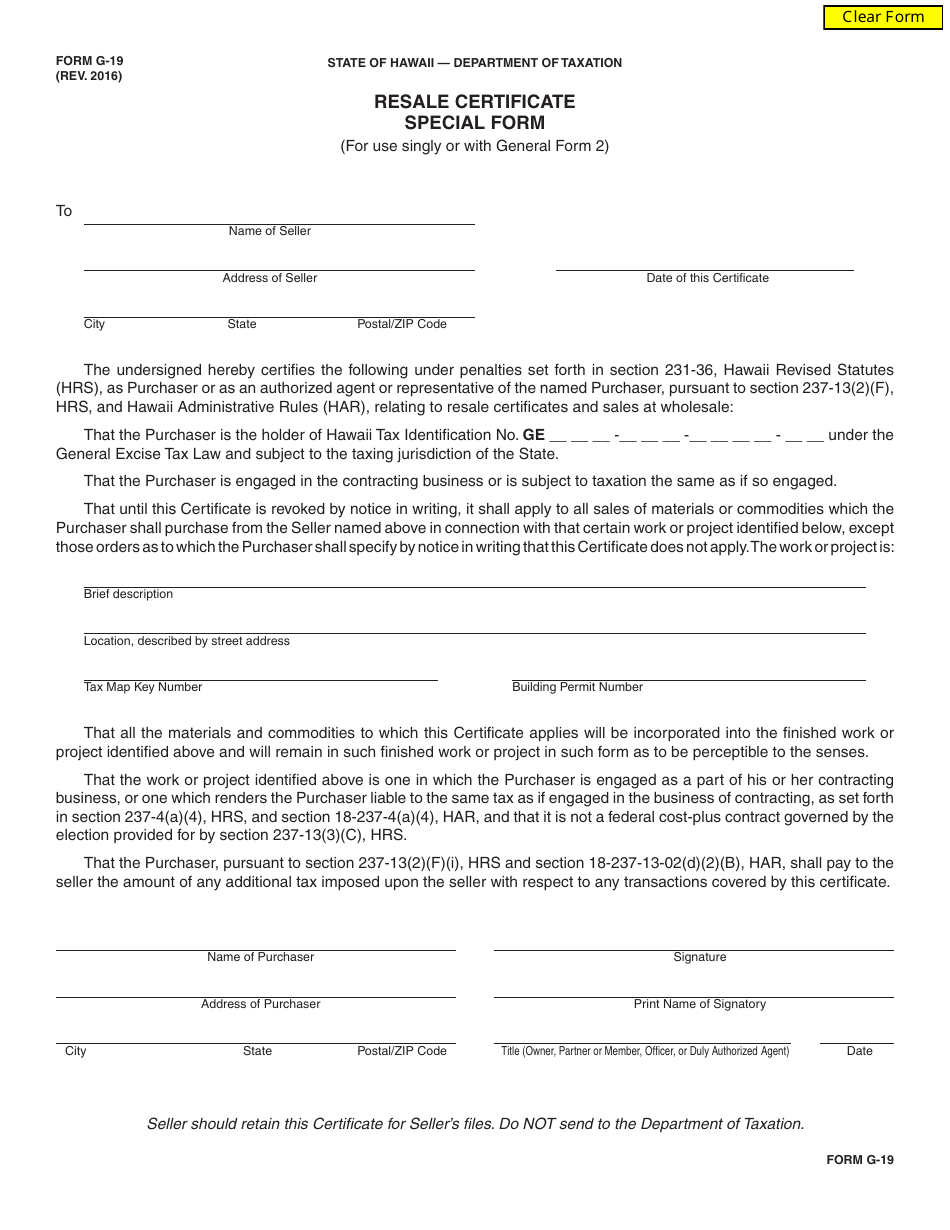

Form G-19 Resale Certificate Special Form - Hawaii

What Is Form G-19?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-19?

A: Form G-19 is a resale certificate special form for the state of Hawaii.

Q: Who needs to use Form G-19?

A: Form G-19 is used by businesses engaged in retail sales to document exempt transactions for resale purposes.

Q: What is the purpose of Form G-19?

A: The purpose of Form G-19 is to provide proof to vendors that a purchase is for resale, thus exempting it from sales tax.

Q: Do I need to renew or refile Form G-19?

A: No, Form G-19 does not need to be renewed or refiled unless there are changes to the business or its information.

Q: What should I do with completed Form G-19?

A: Completed Form G-19 should be provided to vendors when making tax-exempt purchases.

Q: Are there any penalties for misuse of Form G-19?

A: Yes, misuse of Form G-19 can result in penalties and possible legal consequences.

Q: Can I use Form G-19 for non-resale purchases?

A: No, Form G-19 is specifically for documenting exempt transactions for resale purposes.

Q: Is Form G-19 valid for purchases outside of Hawaii?

A: No, Form G-19 is only valid for purchases made within the state of Hawaii.

Q: What other documentation may be required in addition to Form G-19?

A: In addition to Form G-19, vendors may require additional documentation to verify the validity of a resale transaction.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-19 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.