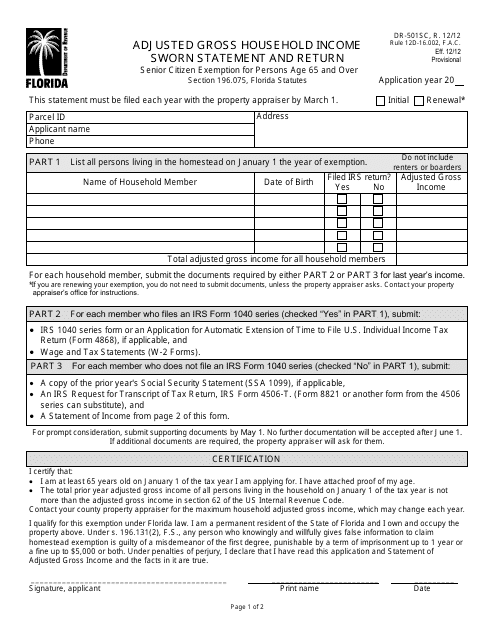

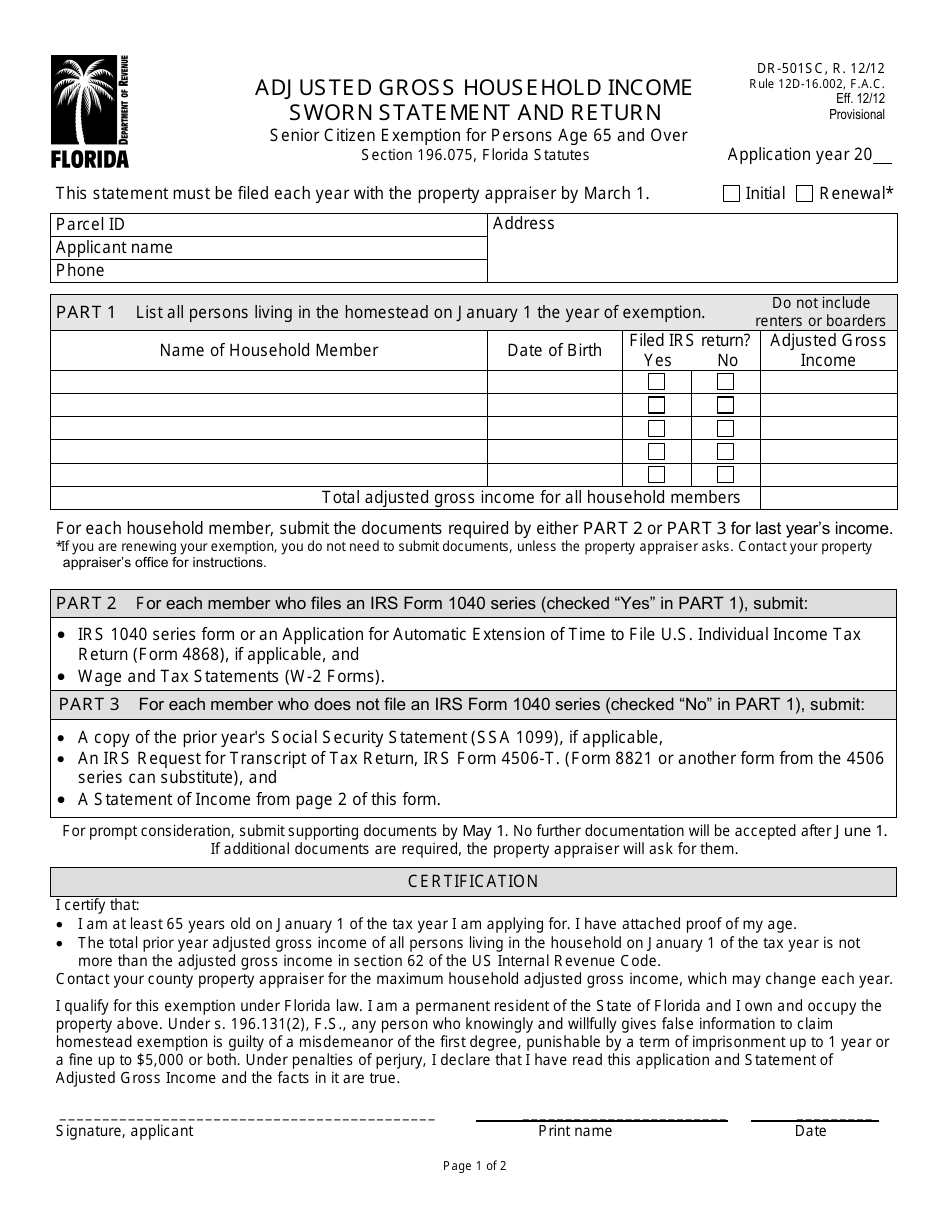

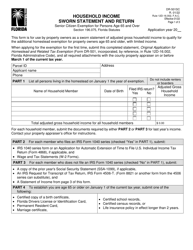

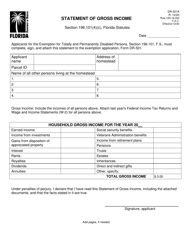

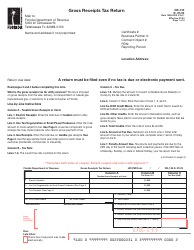

Form DR-501SC Adjusted Gross Household Income Sworn Statement and Return - Florida

What Is Form DR-501SC?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-501SC?

A: Form DR-501SC is a Sworn Statement and Return for the Adjusted Gross Household Income in the state of Florida.

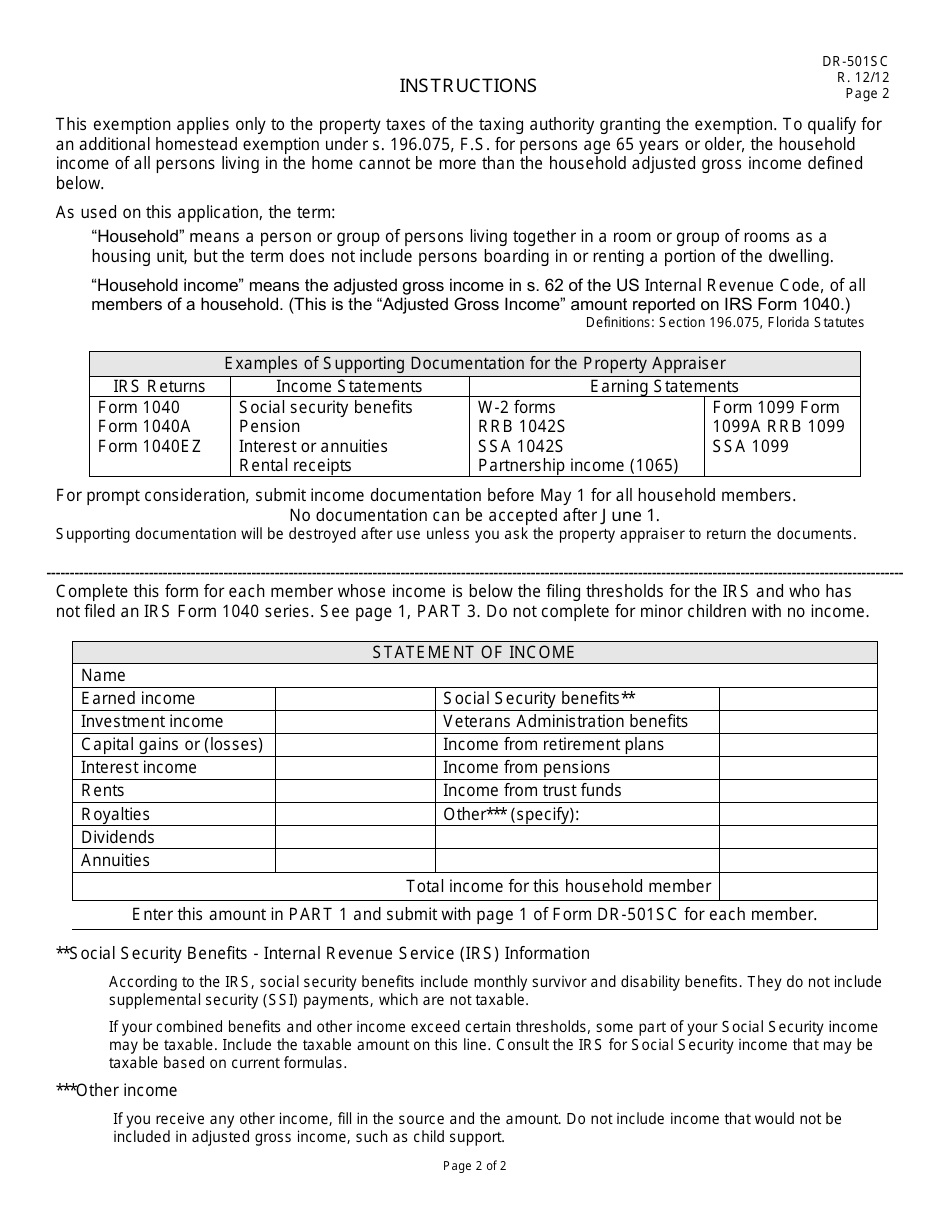

Q: What is Adjusted Gross Household Income?

A: Adjusted Gross Household Income is the total income of all members of a household in Florida after certain deductions and adjustments have been made.

Q: Who needs to file Form DR-501SC?

A: Residents of Florida who are applying for certain property tax exemptions and meet the income threshold need to file Form DR-501SC.

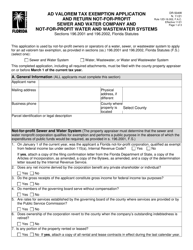

Q: What exemptions require Form DR-501SC?

A: Form DR-501SC is required for exemptions such as the Homestead Exemption and additional exemptions provided by local governments.

Q: When is the deadline to file Form DR-501SC?

A: Form DR-501SC must be filed by March 1st of each year or within 30 days of the mailing of the notice of denial of exemption.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-501SC by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.